By 2028, digital prepaid card transactions are projected to hit $3.98 trillion!

This isn’t just explosive growth, it’s a clear signal: prepaid cards are becoming the future of business payments.

Many businesses today are looking for alternatives to credit cards and traditional bank accounts. They want prepaid cards that can be used by employees, departments, or even for bulk disbursements to vendors or end users.

As a financial business, you’re in a strong position to meet this demand. By launching prepaid card programs for your business customers, you help them simplify financial operations while opening new revenue streams for your own business.

However, every solution comes with some pros and cons. And it's essential to understand them before you start offering prepaid card for business.

In this blog, you’ll get a strategic look at the pros and cons of issuing prepaid cards to businesses, so you can decide whether it fits your strategy.

By the end, you’ll have clarity on whether prepaid fits your roadmap, and if it does, how to do it right.

Let’s begin with the basics!

What Are Prepaid Cards for Businesses?

Prepaid cards for businesses are payment cards that are preloaded with a set amount of funds. These cards aren't linked to a credit line or traditional business bank account.

Businesses use them for controlled spending, vendor payments, employee perks, or team-based budgeting.

Unlike credit or debit cards, prepaid cards offer:

-

No credit checks

-

No interest charges

-

No direct linkage to a company’s operating account

As an issuer, you’re not just offering a payment tool; you’re delivering a prepaid business checking account alternative with built-in controls.

Why Financial Institutions Are Issuing Prepaid Cards to Businesses

Businesses today are under pressure to modernize how they manage and move money. And they want tools that are faster, simpler, and built for control.

That’s where prepaid cards come in.

As a bank, fintech, or financial institution, you can offer prepaid card programs that help businesses:

-

Distribute business prepaid cards for employees with pre-set spending limits

-

Manage project-based budgets or department-level spending

-

Disburse funds instantly to vendors, freelancers, or service partners

-

Avoid the overhead of traditional credit or account-based products

From your side, as the issuer, the benefits are just as strong:

-

Lower compliance and risk exposure compared to credit cards

-

New revenue streams via interchange, program fees, and partnerships

-

Quick deployment through modern APIs and white-label portals

-

Stronger business relationships by embedding financial tools into your clients’ workflows

Offering prepaid cards isn’t just about payments, it’s about enabling better money movement for modern businesses.

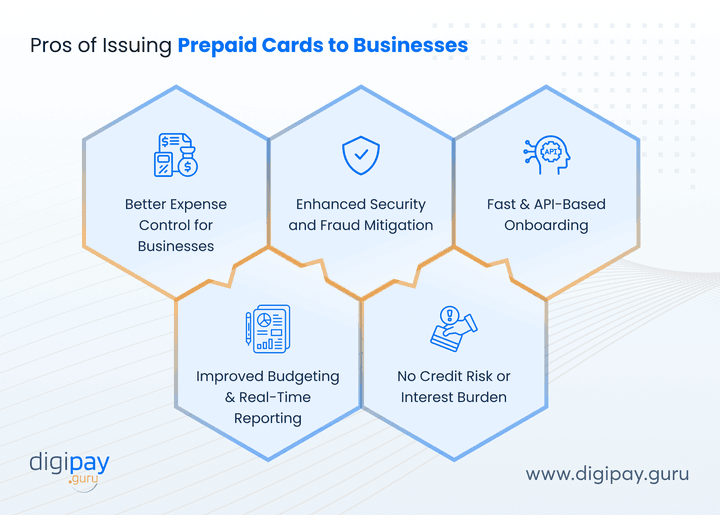

Pros of Issuing Prepaid Cards to Businesses

When done right, prepaid card programs offer clear & scalable advantages for both your business and the businesses you serve.

Here's what makes them so effective:

Better Expense Control for Businesses

Your business customers want tighter control over company spending, especially across teams or departments, or for any other purpose. And prepaid cards give them a clean way to manage budgets without the risk of overspending.

With prepaid company cards, businesses can:

-

Set individual or team-based spending limits

-

Allocate budgets for projects or events, and

-

Prevent overdrafts or misuse automatically

Improved Budgeting & Real-Time Reporting

Businesses expect transparency and real-time insights into where money goes. And prepaid cards bring clarity without the complexity of traditional banking tools, with clear admin dashboards.

With the right platform, you can enable:

-

Live transaction tracking at the card or user level

-

Instant balance and usage notifications, and

-

Detailed monthly or custom spending reports

Enhanced Security and Fraud Mitigation

Security matters more than ever, especially when multiple people handle payments after prepaid cards are issued to them (be it employees or end users, they are in bulk).

Prepaid cards add a built-in layer of control for your business customers and help you reduce exposure.

It also comes with advanced features like tokenization, biometrics, multi-factor authentication, and more.

As the issuer, you can offer:

-

Instant card freezing or reissuing

-

Rule-based fraud alerts and thresholds, and

-

Virtual card generation for secure online use

No Credit Risk or Interest Burden

Offering credit means taking on risk like credit default risk, interest risk, margin pressure, or regulatory burden.

With prepaid cards, you can skip that altogether. You can avoid underwriting headaches, and businesses (your customers) don’t need a strong credit score to qualify.

This makes it easier to serve:

-

Thin-file or newly registered businesses

-

Companies that want to limit borrowing exposure, and

-

Clients that need faster approvals with lower documentation

Fast & API-Based Onboarding

Speed matters in payments and onboarding, especially for fintechs and digital-first banks. With modern infrastructure, you can launch prepaid programs for businesses without building from scratch.

With API-first prepaid card issuance and management software, you can offer:

-

Seamless KYB workflows and onboarding flows

-

White-label business portals with your branding, and

-

Fully programmatic card issuing and management

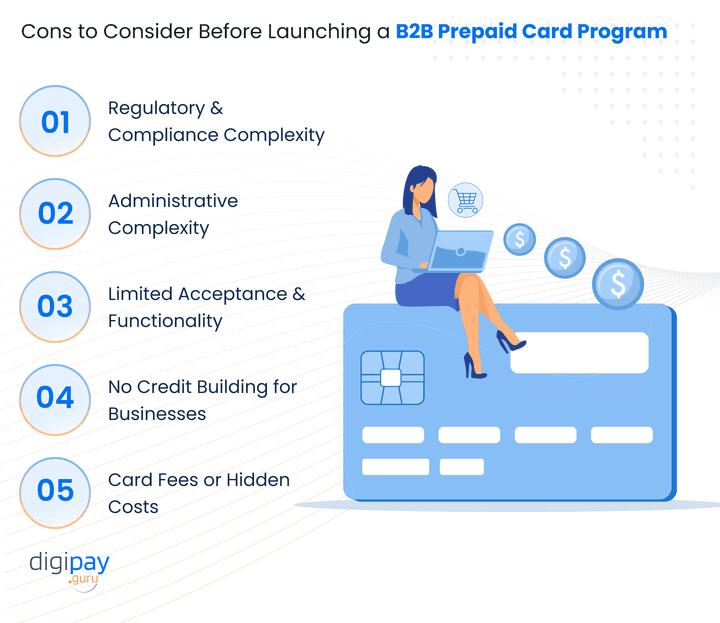

Cons to Consider Before Launching a B2B Prepaid Card Program

Of course, no solution is perfect. So, before you roll out a prepaid card program, it’s important to understand the operational and compliance challenges that come with it.

The cons to keep in mind are:

Regulatory & Compliance Complexity

Unlike consumer KYC, onboarding businesses requires much deeper due diligence. You’re responsible for verifying that each business entity and its owners meet all applicable regulations.

Key regulatory requirements include:

-

Collecting incorporation documents

-

Verifying beneficial owners, and

-

Ensuring AML and local compliance

Administrative Complexity

Managing cards across multiple users, departments, or locations can quickly get messy. And without automation and smart controls, this becomes a resource drain.

Typical admin challenges include:

-

Assigning and adjusting spend limits by role

-

Handling card reissues, closures, and disputes

-

And managing multi-card programs for complex organizations

Limited Acceptance & Functionality

Some prepaid cards don’t offer full network coverage or capabilities. That can lead to confusion or failed transactions for your business clients.

Limitations you need to watch for:

-

Restricted ATM withdrawals

-

Incompatibility with recurring billing, and

-

Limited international acceptance

No Credit Building for Businesses

While prepaid cards simplify access, they don’t help businesses build a credit profile. That may be a deal-breaker for companies that want to grow or borrow in the future.

So, you need to keep in mind that it:

-

Has no contribution to business credit scores

-

Doesn’t substitute credit lines for scaling, and

-

Some businesses may expect both options

Card Fees or Hidden Costs

If your prepaid card program has unclear or excessive fees, businesses may lose trust or stop using the service. Because transparency is not just best practice, it’s a competitive advantage for your business if you want your customers to stay loyal.

Fees that can affect adoption:

-

Monthly service or inactivity charges

-

Load and withdrawal fees, and

-

Foreign transaction or cross-border charges

Use Cases: When Prepaid Makes Strategic Sense for Issuers

Not every business segment needs prepaid cards, but for many, they’re a perfect fit.

Here are use cases where issuing prepaid cards makes strategic and commercial sense for your business :

Corporate Expense Programs

Large businesses want tighter spend control across departments, teams, and projects. And prepaid cards help them eliminate reimbursement processes and enforce policy-level budgets.

Common corporate use cases include:

-

Departmental and travel expense cards

-

Event- or project-specific budgets, and

-

Issuing cards to remote teams or field staff

Logistics and Delivery Companies

Fleets need to manage daily fuel, travel, and operational costs, often across hundreds of drivers or agents. Prepaid cards reduce cash handling and improve accountability.

In logistics, prepaid cards can be used for:

-

Fuel and maintenance spending

-

Route-based per diem payouts, and

-

Instant reimbursement for delivery issues

Gig Platforms and Freelance Ecosystems

Platforms that work with freelancers, creators, or gig workers need real-time disbursement tools. Prepaid cards solve this by letting workers access funds instantly.

Ideal for:

-

Daily or weekly payout programs

-

Reducing dependency on external bank accounts

-

And offering loyalty or incentive bonuses

Project-Based or Seasonal Businesses

Companies that operate in cycles like construction, events, or consulting need tools to handle temporary teams and short-term budgets.

Prepaid cards are a flexible fit for:

-

Temporary workers or contractors

-

Budget allocation per site or client, and

-

Scaling operations without setting up full accounts

NGOs, Government Agencies & Public Sector

Disbursement at scale demands security, traceability, and speed, whether for stipends, grants, or aid. Prepaid cards meet all three requirements without needing bank infrastructure.

Great for:

-

Welfare programs and cash transfers

-

Education or training stipends, and

-

Emergency or crisis fund distribution

How DigiPay.Guru Enables Prepaid Card Issuance to Businesses

Whether you're launching your first prepaid program or scaling an existing one, DigiPay.Guru gives you everything you need to go live fast, with zero operational guesswork.

Here’s how:

Virtual & Physical Card Issuance: Your business clients want flexible card options tailored to their needs. DigiPay.Guru lets you offer both physical prepaid corporate cards for employees and virtual cards for secure, one-time or online use.

Corporate Account Management: Managing a business with multiple cardholders doesn’t have to be complex. Our system gives you the tools to assign user roles, enforce spend policies, and keep everything organized in one place.

Real-Time Reporting & Controls: Business clients expect full visibility into their transactions. And we give you real-time data, alerts, and customizable reports to keep finance teams in control and confident.

Embedded Onboarding: Our onboarding module automates business verification, document collection, and account setup, ready to embed into your own digital workflows.

Regulatory-Ready Infrastructure: From AML to PCI DSS, our platform is designed to help you stay compliant from day one, across multiple markets and business types.

Conclusion

If you’re serving businesses, issuing prepaid cards is a strategic opportunity for you.

Prepaid cards offer speed, spend control, and scalability that traditional banking tools often can’t. For financial businesses like yours, they open the door to new revenue streams, deeper client relationships, and stronger product differentiation.

But that doesn’t mean it’s plug-and-play. So, you’ll need the right tech stack, compliance foundation, and go-to-market clarity to opt for it.

That’s where DigiPay.Guru comes in.

We offer an advanced prepaid card issuance and management solution. This solution helps banks, fintechs, and financial institutions launch, manage, and scale prepaid card programs tailored for businesses without the operational overhead. From onboarding to reporting to compliance, we’ve built it all so you don’t have to.

Ready to build your prepaid card program for businesses? Let’s talk.

FAQ's

A prepaid card for businesses is a payment card preloaded with funds, not connected to a credit line or business checking account. Financial institutions issue them to businesses, who then use them to manage employee expenses, vendor payments, or corporate disbursements.

Yes. Businesses can use prepaid cards to streamline expense management, distribute budgets to teams, and handle one-off or recurring payments. They’re flexible tools that don’t require credit checks or interest management, which makes them ideal for controlled business spending.

Any business or organization that wants more control over how funds are spent can benefit. This includes corporates, SMEs, NGOs, logistics companies, and gig platforms. And issuers also benefit through increased revenue, stronger client relationships, and reduced credit risk.

Issuing prepaid cards to employees helps businesses manage and monitor spending in real time. It reduces the need for reimbursements, prevents overspending, and gives finance teams full visibility into where and how money is used.

Most prepaid cards operate on global networks like Mastercard or Visa, meaning they’re accepted almost anywhere these networks are supported. However, acceptance may be limited for some high-value or recurring transactions, depending on the card’s settings.

Prepaid cards offer control, flexibility, and security. Businesses can:

Set spend limits per user or department

Track transactions in real time

Eliminate overspending and manual reimbursements

Reduce exposure to fraud

Some limitations include:

-

No credit building for the business

-

Possible fees (e.g., monthly, foreign transaction)

-

Restrictions on certain types of payments (like recurring subscriptions)

These can be mitigated with the right platform and clear fee structures.

DigiPay.Guru helps you launch and scale prepaid card programs for businesses quickly and securely. Our platform offers card issuance, corporate account management, real-time reporting, and built-in compliance, all through a white-label & API-ready system.

Industries with high-volume, decentralized, or time-sensitive payment needs benefit the most. This includes:

Logistics and fleet management

Gig economy platforms

Government and NGO disbursement programs

Construction and project-based businesses

Enterprise companies managing employee spend at scale