There will be over $16 trillion in digital wallet payment transactions by 2028!

This rise in digital wallet transactions is due to technological advancements and digital transformations happening at lightning speed. Also, the market for digital wallets is becoming too competitive with easy access to development tools.

So, to cut through the digital wallet crowd and outshine your competitors, you need to jump into the market with a strategic plan!

A robust digital wallet solution that your customers love to buy without a second thought should be easy to use, cost-efficient, secure, seamless, convenient, omnichannel, and much more. But how to reach there is everything you need to focus on.

You need to form the right strategies to build an effective digital wallet solution. This blog will help you do exactly the same thing.

In this blog post, you will explore;

- The digital wallet market

- Examples of successful digital wallets

- Core strategies to build an effective digital wallet solution

- Process of building the digital wallet mobile app & its cost

So, let’s start by understanding the digital wallet market!

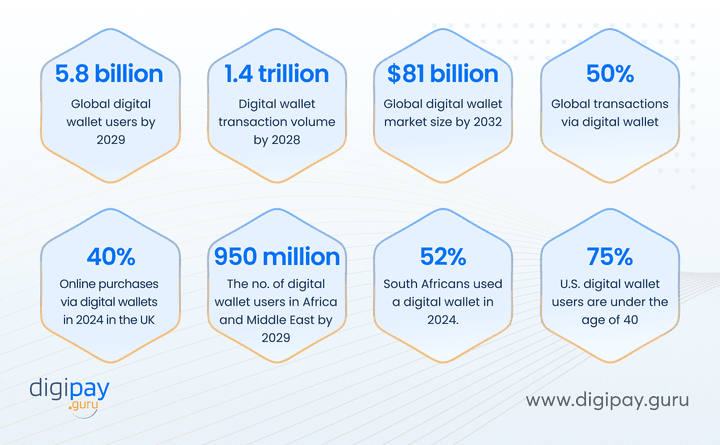

The Digital Wallet Market

The digital wallet market is booming globally. Here are some digital wallet market stats showing its big growth potential!

Examples of Successful Digital Wallets

To further add to the growth potential of digital wallets. Here are some digital wallet examples that have shown tremendous growth and success over the years.

GrabPay

GrabPay is one of Malaysia’s leading eWallet providers. GrabPay enables users to pay for everyday services such as bills, groceries, food items, rides, prepaid reloads, etc.– all within one app.

M-Pesa

M-Pesa is a mobile phone-based money transfer service, payment, and micro-financing service launched in 2007 by Vodafone. It is preferred to make payments across the continent for both banked and unbanked customers with a safe, secure, and affordable way to send and receive money.

PayPal

PayPal is the market leader in payment solutions. Its One Touch software allows you to use your smartphone to make both online and offline payments. The app is available on both Android and iOS devices.

AliPay

Alipay is China’s largest third-party payment digital wallet provider. Alipay enables users to store credit/debit card details to make online and in-store payment transactions using their smartphones.

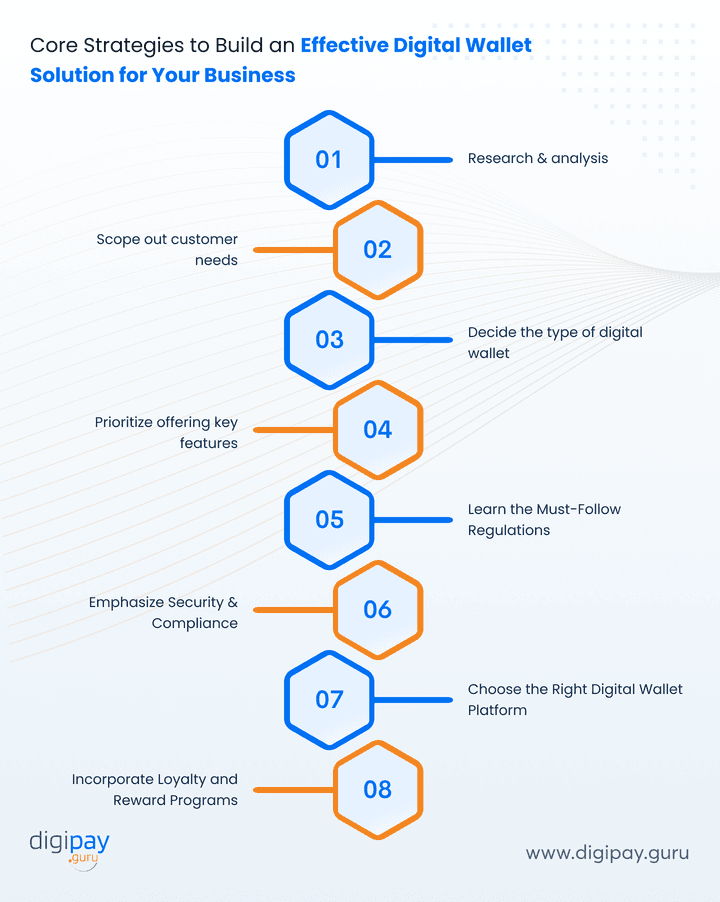

Core Strategies to Build an Effective Digital Wallet Solution for Your Business

Now that you are familiar with the top successful digital wallets, it's pretty sure you want to try building your own digital wallet solution.

But before you do that. Stop for a while! Don’t just enter the market in haste. You need to get your vision, mission, and strategies straight. But don't worry, you do not have to decide it all on your own!

This section will tell you just the right strategies you need to incorporate to build a digital wallet solution.

Research & Analysis

Market research and competitor analysis are essential digital wallet strategies before you begin building a digital wallet solution. During this process, you must decide for which industry you will design an app, who your target audience will be, and what type of digital wallet you will offer to your audience.

What features & functionality do you want to incorporate, and who will your competition be? This market research will assist you in conceptualizing your application and deciding how to differentiate it from the competitors.

Scope Out the Detailed Overview of Your Customer Requirements

You should be well aware of your customers and their needs. And for that, it is crucial to conduct thorough research and analysis. This helps you gain a comprehensive understanding of your target customers' needs, preferences, and pain points.

By gathering insights into their financial habits, preferences, and expectations, you can tailor your digital wallet solution to meet their specific requirements to ensure a seamless and user-friendly experience.

Decide on the Type of Wallet You Will Offer

Before you consider developing a digital wallet, you must first determine the type of digital wallet you will provide to your target audience. There are three types of digital wallets, each of which differs from the others in terms of payment methods.

Let’s take a closer look at each of them separately:

Closed-loop wallets: Designed for specific ecosystems or platforms, these wallets are limited to specific merchants or services.

Examples: Starbucks App, Walmart Pay, Disney MagicMobile, and more.

Semi-closed loop wallets: These wallets offer more flexibility and allow users to store funds from various sources and make purchases within a specific network or ecosystem.

Examples: Zelle Pay, Citrus, Paytm, FreeCharge, Oxygen, etc.

Open-loop wallets: These wallets provide users with the freedom to store various currencies and make purchases across multiple platforms and merchants.

Examples: Apple Pay, Google Pay, and more.

Prioritize Offering Key Features

One of the core strategies is to know the difference between core and non-core features. And prioritize offering all the key features your customer wants and that your competitors are also offering. Just remember to stay one step ahead of your competitors.

Here are a few essential functionalities to incorporate while developing your finance-based application:

P2P/P2M/P2A/P2G

The wallet should be capable of transferring funds to friends/relatives, merchants, agents, or government disbursements.

Top-Up and Utility Bill Payments

Top-up and bill payment services allow consumers to electronically top up their prepaid service accounts and pay bills for their postpaid accounts, like mobile, fixed line, and DTH.

NFC/QR/Biometric Payments

Users should have access to pay through multiple options based on available resources, like QR codes, NFC payments, biometrics, etc.

Loyalty & Rewards

Loyalty and rewards based customer engagement are highly recommended to meet the changing goals of service providers like:

- Facing increasing competition

- Changing technology

- And attracting more consumers

Bulk Payments

The bulk disbursement option facilitates the disbursement of funds to multiple users in a single go. It can be useful in disbursing grants, salaries, subsidies, etc.

Split Payments

Consumers can split their bills between two or more customers by entering the number of customers and the total bill amount that they’re supposed to pay.

For each transaction, an invoice will be generated that the consumers can view and download from their mobile application.

Auto Reconciliation Manager

Mobile money systems are usually integrated with third-party systems like billing systems, banks, payment gateways, etc. All this, at the end of the day, results in numerous tasks to reconcile the transactions happening with various systems.

It is a laborious task that requires a lot of manpower from the operator side. So the system must have:

-

An automatic periodic reconciliation feature

-

Trust account reconciliation with a partner bank

-

System e-value & biller’s reconciliation, and

-

Bank-to-wallet and wallet-to-bank reconciliations

Financing Analysis

This feature enables customers to track their spending which encourages consumers to better manage their expenditures and set spending limits.

Learn About the Regulations That Your Mobile Wallet Technology Must Follow

The financial industry is heavily regulated. So, digital wallet solutions must adhere to various compliance and regulatory requirements.

Stay informed about the latest regulations and guidelines governing digital payments, data privacy, AML, and KYC protocols. Collaborate with legal experts and regulatory bodies to ensure your digital wallet solution meets all necessary standards.

Emphasize Top-Notch Security Standards and Compliance

Security is crucial in the digital wallet solution as it involves handling sensitive financial data and transactions.

To protect your customers' information and maintain their trust, implement robust security measures, such as:

- Multi-factor authentication

- Encryption

- Tokenization

- Biometrics and more

Plus, ensure compliance with industry standards like the PCI DSS, AML, and GDPR to maintain a secure and trustworthy digital wallet ecosystem.

Choose The Right Digital Wallet Platform

Selecting the appropriate digital wallet platform and technology stack is crucial for building a scalable, robust, and future-proof solution.

Consider factors such as:

- Cross-platform compatibility

- Integration capabilities

- Scalability & flexibility

- API-driven efficiency

- Security & compliance features

To make your idea a reality, you can collaborate with a digital wallet solution provider that can assist you in reaching your goal.

Incorporate Loyalty and Reward Programs

You want users to not just sign up, but stick around. Introduce cashback, reward points, tiered loyalty, and referral bonuses into your digital wallet.

A digital wallet without rewards is like a coffee without caffeine. It may look the same, but it won’t keep them coming back.

Process of Building the Digital Wallet Mobile App

Once the strategy is set, it’s time to build. Here’s the development journey broken down into 5 phases.

Design and Prototype Phase

The digital wallet development process starts with design and a prototype. You must concisely describe the design format and provide it to your design partner.

You must create a complete project review and establish the key objectives & target audience.

Plus, among other things, you need to:

-

Outline the features you intend to implement

-

Explain your product’s visual concept, and

-

Include your recommendations for prohibitions

Mobile Wallet App Development Phase

After the completion of designing, you will have a virtual version of the wallet that users will probably value. Now, it is indeed the time to begin developing a digital wallet.

The end aim of this process is to develop a live digital payment app with all the features that were decided upon during the research phase.

App Testing Phase

During development, programmers perform a test suite on the digital wallet software solution to determine if specific features are functioning as planned. Nevertheless, during the formal testing process, developers must evaluate the entire program for functionality and user experience.

App Launch & Promotion Phase

After the completion of the digital wallet app development and testing process, now is the time to launch your digital wallet solution. To make your app live on the app stores, you must first pass through a few guidelines set by Google Play and the App Store.

Additionally, the server side should be connected to the app and switched to a development site.

And once the app is released to the market, it’s time to think about the promotion. However, the development of a marketing plan should begin long before the app is made available to end customers.

Plus, you can utilize social media marketing, content marketing, and sponsored ads, along with word-of-mouth marketing, for your app promotion.

Ongoing Maintenance Phase

Once the application is on the app stores, it’s your responsibility to maintain it. You must keep your app updated by accommodating the latest operating system features, fixing minor issues/bugs, and simplifying the user experience. Plus, to be successful, you must update your app regularly.

Determining the Cost of Developing a Digital Wallet App

The cost varies significantly based on the app's complexity, features, platform requirements, and the development team's expertise. Here are some factors that may affect the cost.

-

More features in digital wallet solutions, like multi-currency support, loyalty programs, and personal finance management, increase complexity and cost.

-

A well-designed, intuitive user interface requires investing in professional UI/UX design services, which adds to the cost.

-

Integrating with payment gateways, financial institutions, and third-party services involves additional development effort and potential licensing fees.

-

Implementing robust security, encryption, tokenization, and regulatory compliance adds to the development cost but is crucial.

-

The expertise, experience, and location of the development team significantly impact the overall cost. Plus, the ongoing maintenance, updates, and support should be factored into the total cost for long-term success.

How DigiPay.Guru Can Help?

DigiPay.Guru is a leading digital wallet solution provider offering everything you need, from convenience, security, and multiple payment options, to all the key features that make it a customer and future centric app

Our whitelabel digital wallet solution can help you to:

-

Attract, retain, & increase customer satisfaction.

-

Generate new revenue streams

-

Multiply the customer base

-

Minimize overall costs

Plus, the digital wallet solution by DigiPay.Guru comes with fewer risks and fewer licensing requirements. Plus, it does not require to pre-load funds.

FAQ's

A strong digital wallet app must include user onboarding with KYC, peer-to-peer payments, debit card linking, bill payments, push notifications, transaction history, and multi-factor authentication. These features ensure usability, trust, and frequent engagement.

Security is non-negotiable. A breach can destroy user trust and attract regulatory penalties. Top-notch security measures are the foundation of any credible digital wallet solution, not just an added bonus.

Vital measures include end-to-end encryption, biometric authentication, fraud detection systems, and role-based access control. These protect user data, prevent unauthorized access, and ensure compliance with security standards.

Digital wallets must align with local and international compliance standards such as PCI-DSS, GDPR, and central bank regulations. Staying compliant helps you avoid fines and ensures long-term scalability in new markets.

Keep the design clean and navigation intuitive. Use smart onboarding, real-time transaction updates, and responsive support. Adding loyalty programs like cashback or rewards can also boost retention.

Aside from basic payment features, essential components are user-friendly KYC, QR code payments, loyalty modules, push notifications, and real-time analytics. These elevate the app from usable to indispensable.

DigiPay.Guru offers a white-label digital wallet solution built for banks, fintechs, and financial institutions. It includes fast deployment, omnichannel access, built-in loyalty programs, real-time analytics, and full regulatory compliance to help you go live with confidence and in no time.