Why Digital Payments Matter Now

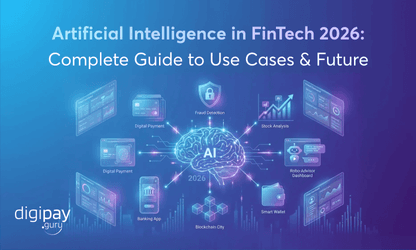

Digital payments are projected to cross $14.7 trillion by 2027, which clearly shows how quickly the world is moving away from cash. And if you're leading digital transformation in a bank, fintech, or financial institution, one thing is clear: “cash is no longer king.

Customers now expect fast, flexible, and secure digital transaction experiences, no matter where they are. Hence, the shift to digital payment systems isn’t just happening; it’s accelerating.

But with every innovation comes a decision: Is now the right time to go digital? What are the real-world benefits of digital payments for your business? And just as importantly, where do the risks lie?

In this blog, we break down the top 10 pros and cons of a digital payment system for you. You'll get a clear picture of how these systems can elevate your services and where caution is required.

In this blog, you will explore:

-

What is a Digital Payment System?

-

Pros and cons of digital payment systems

-

How to find the right balance between them

-

And how can DigiPay.Guru help

Let’s start by understanding what digital payment systems really mean for your business.

What is a Digital Payment System?

Before you dive into the pros and cons of a digital payment system, let’s first have a look at what digital payment systems mean for you.

A digital payment system allows your business to accept and process payments electronically, eliminating the need for physical cash or manual processing. These systems include digital wallets, bank transfers, QR codes, contactless cards, and mobile payment apps like Apple Pay and Google Pay.

If you’re offering digital payments, you're giving your customers the freedom to pay anytime, anywhere, with just a tap or a click. It saves them time, improves accuracy, and builds trust in your brand. Whereas, for you, it opens doors to automation, reduced costs, and faster cash flow.

Whether you’re exploring an online payment system or white-label payment software, the core idea is to enable secure, seamless, and scalable financial transactions.

Ok, now that you have brushed up on our basics, let’s get into the main segment, which is the top 10 pros of the digital payment system. So here it goes!

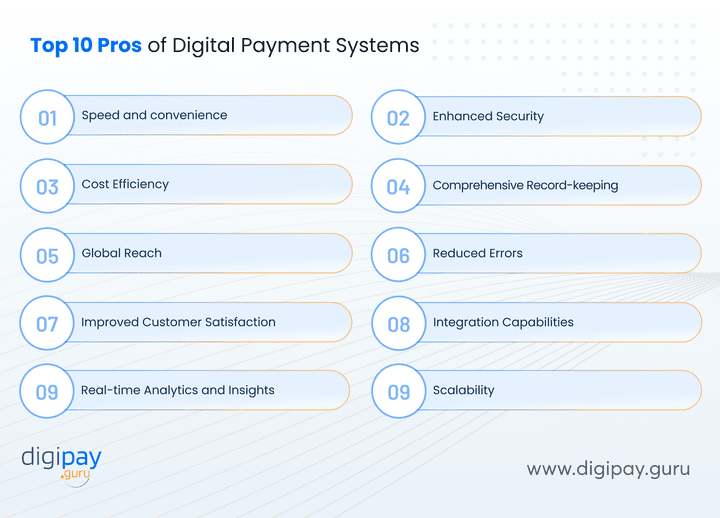

Top 10 Pros of Digital Payment Systems

The best digital payment systems can completely transform how your business handles transactions.

Here are the ten most compelling benefits of a digital payment system for your business.

1. Speed and Convenience

With digital payment software, the delays caused by manual handling or traditional banking hours are eliminated for you and your customers. This is because it processes transactions in real time.

This is a game-changer for financial businesses like you, who are looking to enhance their operational efficiency and meet user expectations for instant payments.

From peer-to-peer transfers to merchant settlements or cross-border payments, digital payment systems offer uninterrupted payment service, 24/7.

Your customers get what they want, when they want it, and you save time in the process.

2. Enhanced Security

With multi-layer security protocols like biometric authentication, tokenization, encryption, and multi-factor verification, digital payment platforms are built to protect sensitive financial data. Unlike traditional systems, you can detect and block fraudulent activity before it escalates.

As cyber threats grow, modern digital payment solutions give you a powerful shield while ensuring compliance with PCI-DSS and other standards. This strengthens trust among users and reduces exposure to financial as well as reputational risk.

3. Cost Efficiency

By automating manual workflows and eliminating physical touchpoints, digital payment solutions reduce overhead across departments. You save a lot on paper trails, teller queues, and the labor-intensive reconciliation process.

Plus, with a white-label digital payment system, you can avoid high development costs while still owning your infrastructure. Over time, these cost savings compound and free up resources for growth, innovation, and customer experience improvements.

4. Comprehensive Record-keeping

You no longer need to dig through spreadsheets or paper trails. With digital payment systems offering built-in record-keeping you can track and log every digital transaction automatically.

Whether you need to pull up payment histories, customer statements, or regulatory reports, everything is stored in real-time and accessible with a few clicks. This level of transparency simplifies compliance, strengthens internal audits, and keeps your operations future-ready.

5. Global Reach

Digital payment systems break down geographic barriers for your business. You can serve customers across the globe without setting up physical branches. You can accept payments in multiple currencies through your platforms.

Plus, you can expand to new markets, offer tailored services in different regions, reduce the cost of cross-border transfers, and scale faster.

6. Reduced Errors

Manual transactions are prone to mistakes like typos, miscounts, or lost documentation. Digital payment systems eliminate these risks with system-driven validation and automation.

Plus, payment gateways ensure that each transaction is complete and accurate before processing. This reduces rework, customer complaints, and financial discrepancies.

Over time, fewer errors mean better trust, lower operational costs, and a cleaner audit trail.

7. Improved Customer Satisfaction

All your customers expect fast and flexible payments. With robust digital payment software, you can give them exactly what they want. Seamless, uninterrupted, fast, and secure digital payment services.

A smooth, secure experience builds loyalty and increases repeat usage. And when your backend works flawlessly, your brand becomes known for reliability. This gives you a critical edge in competitive financial markets.

8. Integration Capabilities

Modern digital payment software is built for interoperability. You can seamlessly integrate payment functionality into your banking apps, merchant platforms, or ERP systems using APIs and SDKs.

This ensures consistent performance across channels while reducing development time. For your business, this means:

-

Faster launches

-

More robust offerings, and

-

Greater control over customer journeys

The best thing is, you can achieve all this without the headache of rebuilding your core infrastructure.

9. Real-time Analytics and Insights

Data is gold in financial services, and digital payment systems deliver it in real time. You can track every transaction, identify trends, and spot anomalies instantly. This empowers you to make informed decisions on pricing, product improvements, and fraud prevention.

Whether you're optimizing user experience or preparing compliance reports, the ability to access accurate, up-to-the-minute insights is a major strategic advantage.

10. Scalability

You don’t need to rebuild your infrastructure as you grow. Digital payment systems scale effortlessly—whether you’re handling 1,000 or 100,000 transactions per day. You can handle increasing transaction volumes without sacrificing speed or security.

And with white label payment software, your infrastructure is ready to adapt as your business evolves. It’s a future-proof foundation for long-term success in the digital economy.

The cons of the digital payment system

Even though digital payments are transforming the way you operate, they’re not without risks. Knowing these downsides helps you prepare better and avoid potential disruptions.

Here are six drawbacks every business should consider.

1. Security concerns

Digital payment systems are prime targets for cyber threats. Payment fraud, phishing attacks, and data breaches can expose sensitive financial details.

Without proper encryption, fraud detection, and compliance controls, your business may face data breaches and financial loss. Regular audits and PCI DSS compliance also help strengthen your payment security posture.

2. Technical glitches

A few seconds of system downtime can cost you loss of trust, customers, and revenue.

Imagine you're processing hundreds of real-time cross-border payments during peak hours, and your system crashes due to server overload.

To prevent this, you should invest in cloud-based infrastructure with automatic failover, real-time monitoring, and round-the-clock support to ensure maximum uptime. Plus, choosing stable, well-supported platforms with strong SLAs helps minimize such risks.

Pro tip: Choosing a white-label payment solution shifts the tech burden to experts, which helps you avoid costly glitches and system downtimes.

3. Digital divide

Not all users are digitally ready. Digital payments still exclude many users in rural or less tech-savvy regions.

In regions of Africa and Southeast Asia, the lack of digital infrastructure keeps many from using digital payment platforms.

Offering a hybrid mix of traditional and digital payment methods ensures inclusivity and better service reach across diverse user groups.

4. Transaction fees

Digital payments might reduce your operational costs, but they often come with hidden costs. Every transaction you process through gateways or card networks includes fees like interchange, processing, or cross-border charges.

These costs can impact your margins, especially on high-volume, low-ticket transactions. It's important to evaluate fee structures and negotiate terms that align with your business model.

5. Over-reliance on technology

The convenience of digital systems can become a dependency. If the internet goes down, or a power failure hits, your operations come to a halt.

A real example: In India, a regional fintech provider saw a 2-hour blackout in services due to a DNS issue. Merchants couldn’t receive payments, and transactions piled up. The fix? Backup systems, offline support tools, and failover infrastructure are crucial for business continuity.

6. Fraud and scams

Cybercriminals are getting more creative with payment fraud. From social engineering to fake apps, your customers are constantly at risk.

To avoid such fraud and scams, you have to educate your customers through SMS/email alerts, verify app downloads through official stores, and use AI-based fraud detection to flag suspicious behavior in real time.

Despite strong security, social engineering and phishing scams are on the rise. Customers may still fall prey to fake links or spoofed apps. Continuous user education, anti-fraud alerts, and proactive fraud monitoring help reduce exposure and strengthen trust in your platform.

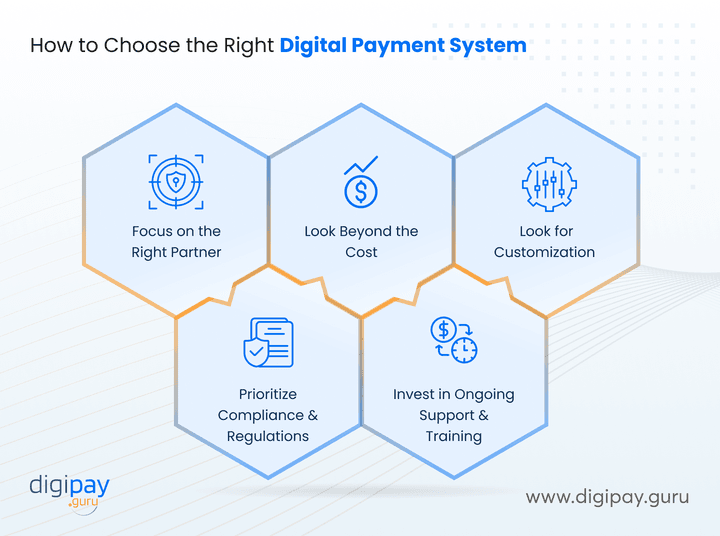

How to Find the Right Balance for Your Business

Yes, digital payment systems come with challenges. But the trick is knowing how to manage them smartly. Weighing the pros and cons of digital payment systems helps you build a smarter, more resilient operation. Here’s how to get it right.

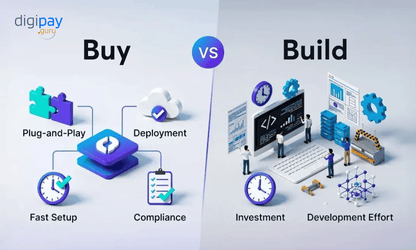

1. Focus on the Right Partner

Choosing the right digital payment solution provider is half the battle won. You need a provider who understands your industry, offers scalable tech, and ensures compliance.

For example, if you're a fintech focused on cross-border payments, look for partners offering multi-currency support, FX optimization, and regional compliance. Avoid one-size-fits-all vendors—they might limit your growth. Always assess your partner for uptime, support, integration options, and regulatory knowledge.

2. Look Beyond the Cost

Low cost doesn’t always mean high value. Many businesses fall into the trap of choosing providers based on transaction fees alone. But ignoring factors like tech reliability, fraud protection, customer experience, and settlement time can cost you more in the long run.

Investing in the right digital payment software upfront avoids costly migrations and disruptions down the line.

3. Customize Your Offering

No two businesses are the same, so why should your payment system be? Whether you're a fintech platform or a digital bank, tailor your payment flow to match customer behavior and operational needs.

A white-label digital payment system lets you tailor experiences, workflows, and branding.

Delivering personalized journeys not only enhances user satisfaction but also strengthens your competitive positioning in a crowded financial market.

4. Prioritize Compliance and Regulations

Compliance is non-negotiable in digital finance. Regulatory frameworks vary by region, and failing to align with them can cost you fines and your reputation. Make sure your payment setup supports KYC, AML, GDPR, PCI-DSS, or local standards.

You can partner with legal experts or fintech consultants to stay updated. A proactive compliance approach builds trust and future-proofs your business.

Choose a platform that simplifies compliance and adapts to regional rules as you grow into new markets.

5. Invest in Ongoing Support and Training

A robust system means nothing if your team doesn’t know how to use it or respond to issues. So train your support, compliance, and tech teams regularly. Ensure your provider offers 24/7 help, clear documentation, and platform stability.

In fast-moving sectors like fintech, downtime or confusion can mean lost revenue. Ongoing enablement ensures adoption, faster issue resolution, and smoother scaling over time

DigiPay.Guru’s Approach to Maximizing Pros and Mitigating Cons

At DigiPay.Guru, we help you deliver digital payment services that are fast, secure, scalable and intuitive. Here’s how:

Innovative White-Label Solutions: Our white label payment solution helps you launch digital wallets, remittance services, merchant acquiring, prepaid cards, and more under your own brand. We make scaling simple, fast, and affordable.

Risk Management: Security is built into our foundation. We offer AI-powered fraud monitoring, biometric logins, compliance dashboards, and transaction-level risk scoring to protect your users and data.

Customer-Centric Focus: We prioritize UX. Our platforms offer smooth onboarding, multi-language support, and personalized interfaces. This ensures higher adoption and retention rates.

End-to-End Compliance: From KYC and AML to PCI-DSS, we help you stay audit-ready across all markets. Our digital payment software evolves with regulations.

Explore our official PCI DSS listing to see how we help businesses stay secure and compliant

Modular, Scalable Architecture: Whether you're launching in one region or ten, our modular platform lets you deploy fast, iterate quickly, and grow with confidence.

Dedicated Support and Training: Our teams provide full technical guidance, training, and post-launch support. You get 24/7 assistance, so you never go it alone.

Conclusion

Digital payment systems are transforming the financial landscape. From speed and convenience to global reach and analytics, the benefits of digital payment systems are powerful. But security concerns, user education, and tech dependencies need careful handling.

At DigiPay.Guru, we help your business go beyond just accepting digital payments. We build customized ecosystems with our white label digital payment system that’s secure, scalable, and future-ready.

Ready to offer smarter, faster, and more secure digital payments? Let’s build your next-gen payment solution together.

FAQ's

A digital payment system enables businesses and consumers to send or receive money electronically — eliminating the need for cash. These systems work through secure payment gateways, APIs, mobile wallets, and card networks, enabling instant, traceable transactions. They support multiple use cases, including P2P transfers, bill payments, merchant payments, and cross-border remittances.

Yes — especially if speed, cost-efficiency, and scalability are priorities. White-label digital payment solutions let banks and fintechs launch branded platforms quickly without long development cycles. You retain control over branding and user experience while ensuring regulatory compliance and backend scalability — without the overhead of in-house development.

Modern digital payment platforms like DigiPay.Guru use bank-grade security, including:

- Tokenization and encryption

- Biometric authentication

- AI-based fraud detection

- Compliance with PCI-DSS, GDPR, and AML standards

These security layers help prevent fraud, reduce data exposure, and build trust with users.

When selecting a provider, evaluate:

- Industry expertise and domain focus

- Regulatory knowledge

- Integration capabilities (APIs, SDKs)

- Modular architecture and scalability

- Post-launch support and training

- Uptime SLAs and fee structure

Choose a long-term partner, not just a vendor.

Absolutely. DigiPay.Guru’s digital payment platform offers seamless API integrations with:

- Core banking systems

- Mobile banking apps

- CRMs and ERPs

- eKYC and compliance tools

This ensures a unified user experience and smooth internal operations — no need to rebuild your tech stack.

DigiPay.Guru delivers a fully customizable, white-label digital payment ecosystem designed for banks, fintechs, and financial institutions. Key differentiators include:

- Faster time to market

- Modular solutions like eWallets, merchant acquiring, cross-border payments, and eKYC

- End-to-end compliance support

- AI-powered fraud protection

- 24/7 support and onboarding assistance

We help you launch fast, scale securely, and grow confidently.