Launching or scaling a remittance business is more than just about moving money. It’s about moving fast, securely, and compliantly.

Yet, for many banks and fintechs like yours, developing a remittance platform from scratch can take 6 to 12 months and cost a fortune in infrastructure, engineering, and compliance setup.

And in a market where global remittance flows are surpassing $860 billion in 2025, that kind of delay means losing both time and opportunity.

This is where white-label remittance software comes in. It offers a faster, more efficient way to launch, with built-in compliance, APIs, and integrations designed for instant money transfer operations.

You get all the power of a custom solution, without the development roadblocks or building it from scratch.

In this blog, we’ll explore how a white label remittance platform helps banks and fintechs like yours launch faster, scale smarter, and stay compliant, while focusing on what really matters: growing your business.

Let’s begin by understanding the meaning of this software.

What Is White-Label Remittance Software?

A white-label remittance software is a ready-made digital money transfer engine that you can rebrand and customize to your own business. It’s like having a fully functional fintech stack that is built, tested, and compliant, waiting for your logo and color palette.

These platforms come with API integrations for payments, KYC and AML compliance, multi-currency wallets, and real-time tracking already in place.

This means: You don’t have to start from scratch (like a custom-built solution); instead, you integrate, customize, and launch (like a white-label software).

Let’s look at the quick difference between the two solutions (to make it easy for you):

| Aspect | White-Label Software | Custom-Built Solution |

|---|---|---|

| Time to Launch | 3–6 weeks | 6–12 months |

| Development Cost | Minimal | High |

| Maintenance | Vendor-managed | In-house |

| Compliance | Pre-integrated | Requires setup |

| Scalability | Built-in | Requires planning |

So instead of spending a year on development, you can launch your fintech remittance solution in weeks: ready to handle instant, cross-border, and domestic transfers with minimal risk.

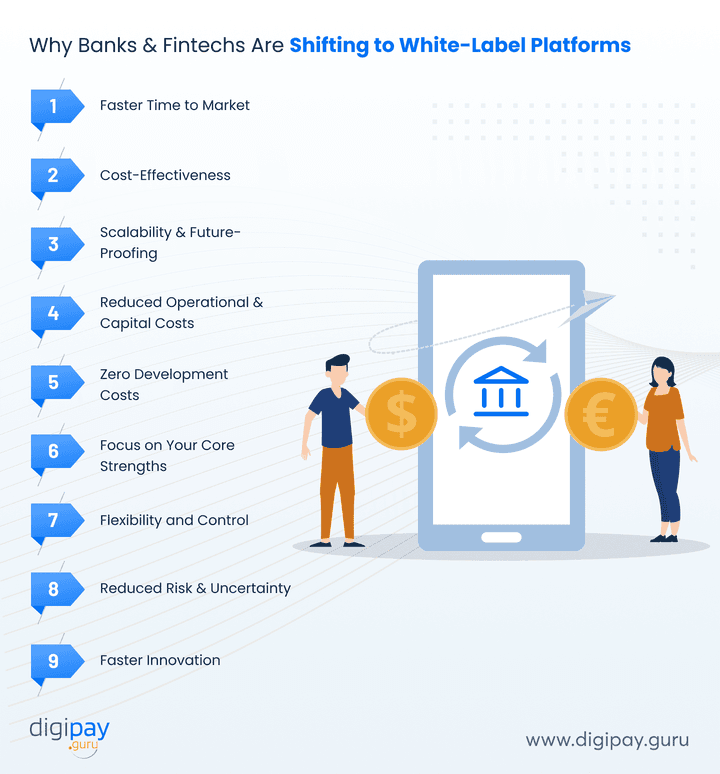

Why Banks & Fintechs Are Shifting to White-Label Platforms

With digital payments growing at record speed, you can’t afford long launch cycles anymore.

Let’s explore why white-label platforms have become the smarter path forward.

Faster Time to Market

In remittance, speed is everything. And every delay in entering the market is a missed market opportunity.

White-label remittance platforms eliminate the long development cycles: you plug in, configure, and go live. And with API-based remittance systems, your platform connects to multiple corridors, wallets, and partners in a few weeks, and not quarters.

Plus, you get faster ROI, faster scaling, and a quicker route to your customers’ trust.

Cost-Effectiveness

Developing your own cross-border payment software sounds empowering until you see the bill. Engineering, compliance, and infrastructure costs can run into hundreds of thousands.

And a white-label fintech solution cuts that dramatically. Here you pay for what’s proven and ready, not endless testing.

Here’s how it helps in cost reduction compared to the traditional in-house development:

| Cost Component | White-Label | In-House Development |

|---|---|---|

| Initial Setup | Low | High |

| Maintenance | Included | Separate team |

| Compliance Updates | Automatic | Manual |

| ROI Timeline | 3–6 months | 12–18 months |

So, the math is simple: Launch remittance business faster while saving on time, talent, and technology.

That’s a win-win equation for any bank or fintech.

Scalability and Future-Proofing

A successful remittance business doesn’t stay small for long. You’ll expand corridors, currencies, & user volumes, and your platform must grow with you.

White-label platforms are built with cloud-based remittance infrastructure, which allows for instant scalability without downtime. Whether you add 10,000 users or open a new corridor in Africa, the platform adjusts automatically.

It’s like having a future-proof digital backbone that scales as you grow.

Reduced Operational and Capital Costs

With traditional development, you’d spend on infrastructure, servers, compliance teams, and 24/7 support.

But with white-label remittance solutions, your vendor handles the heavy lifting, such as hosting, monitoring, and updates.

This converts your capital expense (CapEx) into operational expense (OpEx), thereby freeing your budget for marketing, partnerships, and innovation.

Zero Development Costs

You don’t have to go through a cumbersome process of months of design and testing.

A white-label money transfer platform comes pre-tested and pre-verified. This means that you don’t write a single line of code; instead, you deploy a proven framework and focus on growth.

That’s how banks and fintechs like yours can cut down their go-live timelines from 12 months to 4–6 weeks.

Focus on Your Core Strengths

You’re not in the business of writing code; you’re in the business of moving money. So why waste time in custom development?

White-label solutions let you concentrate on customer acquisition, corridor expansion, and compliance partnerships with speed and ease of launch, while the technology hums quietly in the background.

Flexibility and Control

Unlike rigid and traditional custom software, white-label systems give you complete control. You own the brand, the user experience, and customer data.

Plus, you can customize everything from the UX design to service modules while ensuring your customers see your brand, not your vendor’s.

Reduced Risk and Uncertainty

Building a system from scratch comes with risks like bugs, compliance gaps, and deployment issues.

White-label platforms remove that uncertainty. They’re already tested across multiple regions and currencies with compliant remittance technology built in.

Faster Innovation

Fintech moves fast, and innovation can’t wait for the next development cycle.

With white-label global remittance solutions, new features arrive via continuous updates: from AI-driven fraud checks to biometric KYC.

Let’s understand how white-label outperforms the traditional system:

| Innovation Area | Traditional System | White-Label Platform |

|---|---|---|

| Product Updates | Manual release | Automatic versioning |

| Feature Add-ons | Limited | Plug-and-play modules |

| AI Integration | Requires dev work | Built-in APIs |

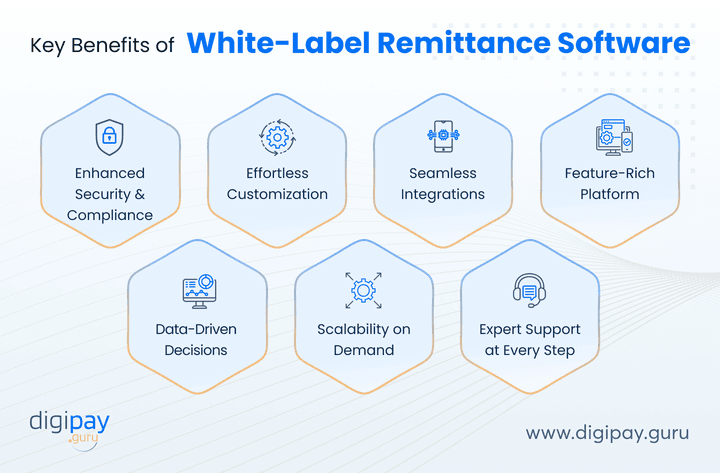

Key Benefits of White-Label Remittance Software

A white-label remittance platform gives banks and fintechs like yours a faster, smarter, and more cost-efficient way to go live, without starting from zero.

Here are the key benefits that make it a preferred choice for global payment leaders.

Security & Compliance Made Simple: Built-in KYC & AML frameworks, PCI DSS certification, and encrypted transactions ensure your operations stay fully compliant and risk-free.

Effortless Customization: Rebrand the platform with your logo, colors, and user experience while offering a seamless journey that feels uniquely yours.

Seamless Integrations: Connect instantly with core banking, wallets, and FX providers using API-based remittance systems. These integrations save months of development work and deliver a unified experience across channels.

Feature-Rich Platform: Access everything from multi-currency digital wallets, cross-border transfers, analytics, to agent management and real-time FX updates, all under one roof

Data-Driven Decisions: Get detailed analytics and transaction insights to make faster, smarter, and more informed business decisions.

Scalability on Demand: Easily expand corridors, currencies, and transaction volumes with a cloud-based remittance infrastructure that grows as you do.

Expert Support at Every Step: Receive dedicated onboarding, technical, and compliance support from specialists who understand remittance operations inside out.

Why Choose DigiPay.Guru’s White-Label Remittance Software for Your Business

When speed, scalability, and security matter, DigiPay.Guru delivers.

Our white-label remittance software empowers banks and fintechs like yours to launch faster, stay compliant, and scale globally without losing control or quality.

The key capabilities of our solution include:

Advanced Functionality for Trust and Transparency

DigiPay.Guru offers full visibility into every transaction. From sender to receiver, you can track transfers in real time. Plus, our secure money transfer software ensures data transparency across your ecosystem, thereby building trust among users, regulators, and partners alike.

Agility and Innovation at Your Fingertips

Our platform gives you the agility to pivot and scale quickly. With modular architecture and plug-and-play APIs, you can launch new corridors or add services in days.

Also, continuous updates keep you ahead with no downtime and disruption problems.

Scalability and Security You Can Rely On

Whether you process a thousand or a million transactions, DigiPay.Guru’s cloud-based remittance infrastructure scales seamlessly.

Plus, we’re PCI-SSF and ISO certified, which ensures every transaction is secure, encrypted, and compliant.

Future-Proof Technology for Smarter Remittances

Our tech stack evolves with you. As regulations, currencies, and payment methods change, your platform stays future-ready to support crypto, open banking (or any other new tech), and new API standards.

Compliance Expertise to Simplify Your Journey

Navigating global compliance is complex. But DigiPay.Guru simplifies it with built-in AML and KYC frameworks, ready for 40+ corridors. And we also handle the legal updates, so you can focus on business growth.

A Strong Partner Ecosystem for Greater Opportunities

Partnerships power remittance success. DigiPay.Guru integrates seamlessly with leading FX providers, payout networks, and payment gateways, while helping you expand reach and liquidity faster.

Continuous Improvement for a Cutting-Edge Experience

Fintech never stands still, and neither do we. Our continuous release cycle ensures your platform is always optimized for speed, UX, and compliance while keeping you ahead of the curve.

Dedicated Support for a Trusted Partnership

DigiPay.Guru is your long-term fintech partner. Our dedicated onboarding and success teams help you deploy, train staff, and grow your customer base without friction.

DigiPay.Guru Advantage:

Let’s look at DigiPay.Guru’s edge against the traditional/custom solution provider:

| Capability | Traditional Solution | DigiPay.Guru Advantage |

|---|---|---|

| Global Compliance | Limited | 40+ country-ready |

| Integration | Manual APIs | Plug-and-play SDKs |

| Support | Ticket-based | Dedicated team |

| Product Innovation | Slow | Continuous release cycle |

Conclusion

The remittance landscape is evolving faster than ever. According to the World Bank, global remittance flows reached over $860 billion in 2024, which reflects how vital speed, transparency, and reliability have become in cross-border payments.

For banks and fintechs, the challenge isn’t just launching a remittance service. It’s launching one that’s secure, compliant, and future-ready.

That’s exactly where white-label remittance software bridges the gap. It helps you go live in weeks, not months, while staying aligned with global standards and customer expectations.

At DigiPay.Guru, we empower banks and fintechs like yours with an end-to-end white-label remittance platform that combines speed, security, and scalability.

From built-in KYC and AML compliance to real-time API integrations and multi-corridor support, our solution is designed to help you innovate confidently and expand effortlessly.

Ready to move faster in the remittance space? Partner with DigiPay.Guru and turn your cross-border payment goals into global success stories.

FAQs

White-label remittance software is a ready-to-use, customizable digital money transfer platform that lets you launch your own branded remittance business without developing it from scratch. It includes built-in APIs, compliance modules, and payment integrations to start operating instantly.

White-label remittance software for banks and fintechs eliminates months of development and testing. With pre-built infrastructure, APIs, and compliance frameworks, banks and fintechs can go live in just a few weeks instead of 6–12 months.

Look for multi-currency support, KYC/AML compliance, API integrations, real-time transaction tracking, scalability, analytics, and agent management. These ensure your remittance business is secure, compliant, and easy to expand.

Yes. Leading platforms like DigiPay.Guru’s are PCI SSF-certified and include pre-integrated AML and KYC modules, encryption protocols, and audit trails to ensure end-to-end transaction security and compliance with global standards.

The key benefits of using white-label software are: You save time, cost, and effort. Plus, white-label solutions are pre-tested, compliant, and scalable, which helps you launch quickly while focusing on growth instead of technology development.

Absolutely. You can customize everything from logo, colors, interface, and even feature modules to reflect your brand identity while maintaining your operational control and customer ownership.

Yes. DigiPay.Guru’s platform supports both cross-border and domestic transfers with multi-currency wallets, instant payouts, and corridor management to help you expand globally with ease.

It’s built on a cloud-based infrastructure that scales automatically with transaction volume and corridor expansion. Whether you’re processing thousands or millions of transfers, performance remains seamless.

DigiPay.Guru integrates KYC, AML, FATF, and GDPR-compliant modules directly into the system. The platform automatically updates to reflect regulatory changes, which keeps your operations compliant worldwide.

Yes. The platform offers API-based integrations for core banking, wallets, FX providers, and payment gateways, thereby allowing seamless connection with your existing ecosystem.

Pricing depends on your scale, features, and integration needs. However, it’s far more cost-effective than in-house development, with significantly lower upfront costs and faster ROI..

You get dedicated onboarding assistance, 24/7 technical support, and a customer success team that ensures your platform runs smoothly and continuously improves with new updates.

Yes. DigiPay.Guru’s modular design allows you to easily add new services such as bill payments, airtime top-ups, and merchant payments as your business expands.

It provides faster transactions, transparent tracking, and reliable service through a secure money transfer platform. And custom branding ensures your customers enjoy a seamless, trusted experience under your brand name.

Getting started is simple: book a demo with the DigiPay.Guru team. They’ll guide you through the platform, customization options, and integration process to help you launch quickly and confidently.