Launch Faster, Stay Compliant, and Scale Smarter in Ghana’s Digital Economy

DigiPay.Guru empowers financial institutions across Ghana to deliver scalable, compliant, and secure fintech solutions that meet the country’s evolving digital finance needs. Our modular, white-label platform enables you to launch e-wallets, cross-border remittances, prepaid cards, and merchant acquiring services in record time.

With API-first integration, regulatory alignment, and multi-channel interoperability, we help you connect with banks, mobile money operators, and agents. Accelerate your journey toward a cashless economy with DigiPay.Guru’s digital payment solutions, built to transform financial inclusion and strengthen Ghana’s fintech ecosystem.

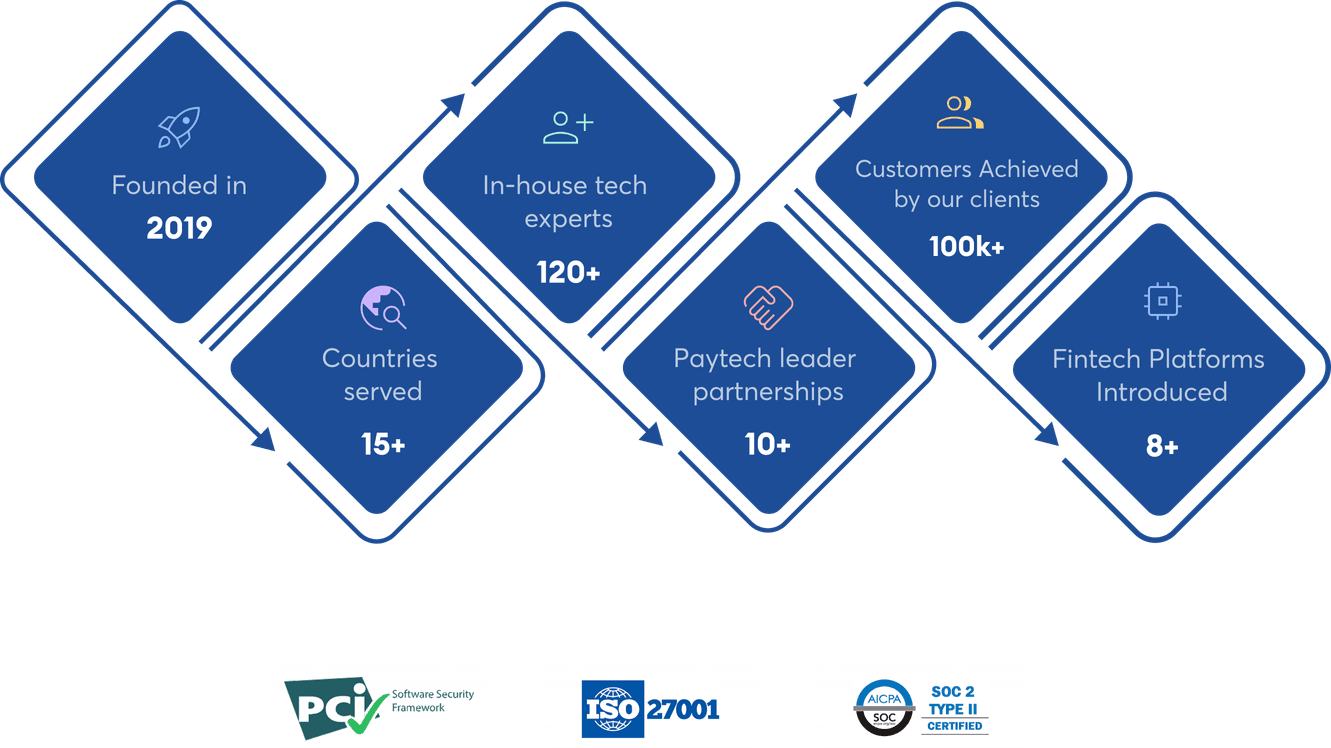

Our foundation and growth

Ghana: One of Africa’s Fastest-Growing Fintech Markets

Over 55% of Ghana’s adults actively use mobile money, while digital transactions exceed 100 billion GHS annually, thereby reflecting a massive shift toward cashless adoption.

total transaction value in the digital payments market in 2025

mobile money customers growth in 2025

of all financial transactions in Ghana are digital payments

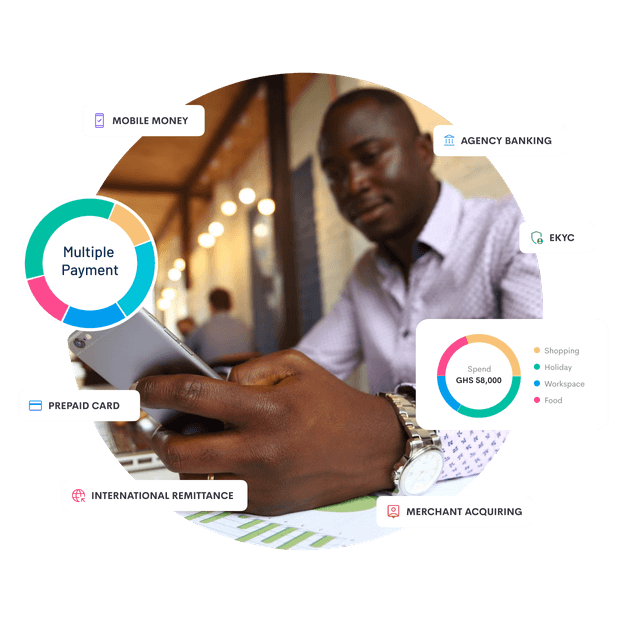

One Platform. Every Digital Financial Service You Need in Ghana.

DigiPay.Guru helps financial institutions, fintechs, and telcos in Ghana build, launch, and scale digital financial services, covering wallets, remittances, cards, and eKYC, while staying fully compliant.

eWallet Solution in Ghana

Launch secure & interoperable digital wallets that enable seamless P2P transfers, bill payments, and merchant transactions while ensuring Bank of Ghana compliance and financial inclusion across Ghana.

- Seamless peer-to-peer and merchant payments

- Interoperable with GhIPSS and MNO systems

- Promotes inclusion and customer loyalty

International Remittance Solution in Ghana

Offer compliant international money transfers from and to Ghana with automated routing, competitive FX rates, and AML safeguards, supporting cross-border remittance and diaspora inclusion.

- Compliant with Bank of Ghana & AML/CFT regulations

- Supports multiple payout channels (wallet, bank, cash)

- Strengthens diaspora remittance flows

Prepaid Card Solution in Ghana

Issue and manage virtual or physical prepaid cards that support cashless payments, enhance customer convenience, and comply with Bank of Ghana’s digital payment framework.

- Card issuance and management modules

- Multi-currency and corporate options

- Promotes inclusion and youth adoption

Merchant Acquiring Solution in Ghana

Enable merchants across Ghana to accept POS, QR, and tap-to-phone payments with real-time settlement, simplified operations, and compliance with Ghana’s electronic payment standards

- POS, QR, and tap-to-phone acceptance

- Real-time reporting and reconciliation

- Grows SME and retail transaction networks

eKYC Solution in Ghana

Digitize customer onboarding with biometric verification, document scanning, and AML checks to ensure secure, compliant, and seamless identity verification for banks and fintechs in Ghana.

- Fast, secure onboarding with AML safeguards

- Face and ID verification modules

- Fully compliant with KYC/AML policies

Agency Banking Solution in Ghana

Expand your reach through agent-led cash-in, cash-out, and bill payment services that promote inclusion, financial accessibility, and efficiency across urban and rural Ghana.

- Supports agent-led cash-in/cash-out

- Enhances rural and semi-urban access

- Scalable and regulation-ready platform

Why DigiPay.Guru Is the Go-To Fintech Partner for Ghana’s Financial Institutions

With DigiPay.Guru, you gain more than technology, you gain a digital payment partner committed to your growth, compliance, and long-term digital success in Ghana’s financial ecosystem.

Empower Your Institution to Lead Ghana’s Cashless Future With DigiPay.Guru

Schedule Your Strategy Call

Frequently asked questions

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.