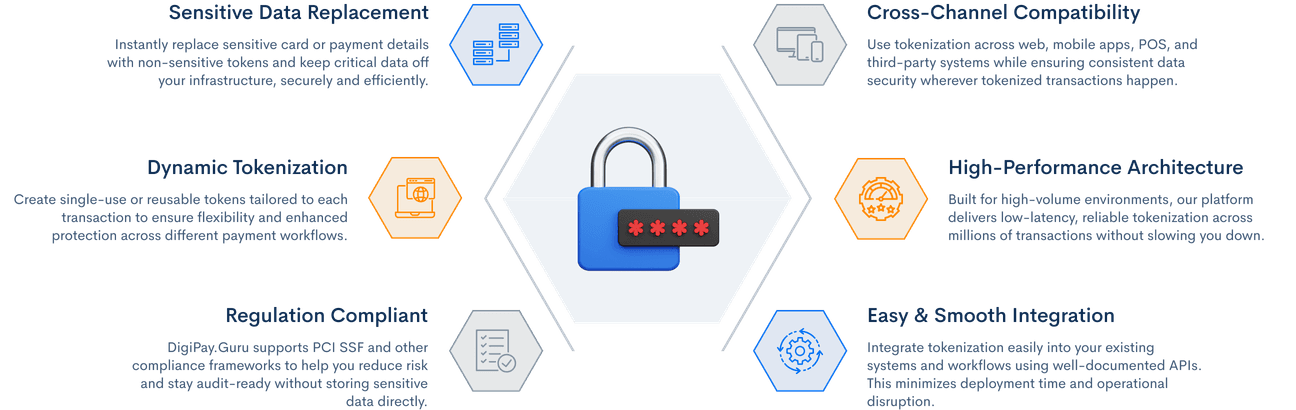

Essential Features That Power Secure Payment Processing with Tokenization

Why Leading Fintechs and Banks Choose Tokenization by DigiPay.Guru

Ready to Secure Your Payment Data with Tokenization?

Book a Demo With an Expert

Frequently asked questions

Our solution supports tokenization of card details, bank info, account identifiers, and other custom sensitive data per your use case.

Not necessarily. In fact, using tokenization can reduce your PCI DSS scope significantly, as sensitive data never touches your infrastructure directly.

Absolutely. Our solution is designed to support clients who run payment gateways and want to extend secure tokenization to their merchants.

Both. You can integrate via API or use our managed service. No sensitive data ever touches your infrastructure.

Tokens are completely useless on their own. Without the underlying context and mapping system, intercepted tokens hold no exploitable value, which keeps transactions safe.

Yes. You have full flexibility to generate dynamic, single-use, or reusable tokens based on your business logic, security policies, or compliance needs.

Most clients go live in a matter of weeks with our guided support and streamlined integration docs.

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.