Let’s face it—remittance has changed. The way people send and receive money across borders is evolving fast. The days of slow, expensive, and paperwork-heavy transfers are fading. And they should.

Your customers are living in a digital-first world. They shop online, hail rides with a tap, and pay their bills with a thumbprint. So when it comes to sending money abroad, they expect the same speed and simplicity. Anything less feels outdated.

But traditional payment systems haven’t kept up with it. SWIFT transfers, bank wires, and manual compliance checks are too old and complex. They frustrate users and slow your growth.

That’s where alternative payment methods (APMs) come in. They’re not just a convenience but a competitive edge. For your remittance business, APMs open up new markets, reduce costs, and meet the high expectations of today’s mobile-savvy customers.

If you're not offering APM, you're falling behind your competitors.

In this blog, let’s uncover what APMs are, how they’re transforming cross-border payments, and why forward-looking remittance services providers are going all in.

Let’s begin by understanding alternative payment methods in remittance.

What Are Alternative Payment Methods in Remittance?

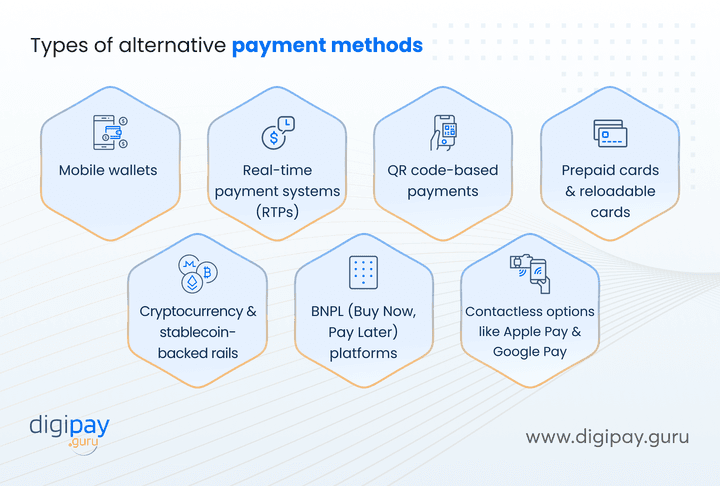

Alternative payment methods (APMs) refer to any non-traditional ways of sending or receiving money. It is beyond the usual mix of credit cards, bank transfers, and wire systems like SWIFT. In the remittance space, APMs are designed to be faster, more inclusive, and optimized for the digital economy.

Some of the alternative payment methods examples that are used in cross-border remittance include

-

Mobile wallets (e.g., M-Pesa, GCash)

-

Real-time payment systems (RTPs)

-

QR code-based payments

-

Prepaid cards and reloadable cards

-

Cryptocurrency and stablecoin-backed rails

-

BNPL (Buy Now, Pay Later) platforms

-

Contactless options like Apple Pay and Google Pay

These payment methods offer speed, cost-efficiency, and accessibility—especially in regions where traditional banking infrastructure is limited or nonexistent.

In contrast, traditional payment methods like SWIFT and bank wires are

-

Dependent on multiple intermediaries

-

Often take 2–5 business days, and

-

Incur high FX fees and compliance costs

All in all, it can be said that APMs are so good that traditional cross-border payment methods don’t stand a chance to survive the market of today’s customers.

Market Trends You Can’t Ignore (Which Makes APMs a Must-Have)

Don’t just take our word for it. The numbers speak volumes.

-

According to the GSMA Mobile Money Report 2025, over 2.1 billion mobile money accounts are now active globally.

-

The value of international money transfers through mobile wallets alone has skyrocketed. That’s a 28% increase year-over-year in wallet-based cross-border transactions.

-

Another stat to watch: 60% of consumers in emerging markets now prefer digital remittance options over traditional methods.

-

Millennials and Gen Z account for more than 50% of global remittance senders, and they demand intuitive, app-based solutions.

Here’s why this matters:

-

Users demand speed, simplicity, and cost-efficiency.

-

Smartphone penetration in Asia, Africa, and Latin America is fueling mobile-based remittance.

-

These digital-first users don’t want to stand in queues. They want control at their fingertips.

This shift in behavior is forcing the industry to rethink how money transfers should work. If your remittance payment solutions don’t support APMs, you’re ignoring what your customers want.

Why Traditional Remittance Methods Are No Longer Enough

The remittance industry may be familiar with traditional methods—but familiarity doesn’t equal fitness for today’s market. Before we explore how APMs change the game, let’s look at what’s broken in the systems most institutions still rely on.

High Fees and Hidden Costs

Legacy systems rely on intermediaries. That means fees pile up fast—FX margins, bank charges, and hidden transaction costs. According to the World Bank, the average global remittance fee is still over 6%. APMs help cut this drastically.

Slow Processing Times

A SWIFT transfer can take 2–5 days. That’s an eternity when someone needs to send money home for an emergency. APMs complete transactions in seconds or minutes.

Limited Accessibility in Emerging Markets

In many countries, users don’t even have a bank account. But they have a phone. APMs let you reach them where they are—digitally and instantly.

Compliance and Friction in Older Systems

Traditional setups often struggle with real-time KYC/AML requirements. APMs come with embedded identity and fraud controls that simplify regulatory compliance.

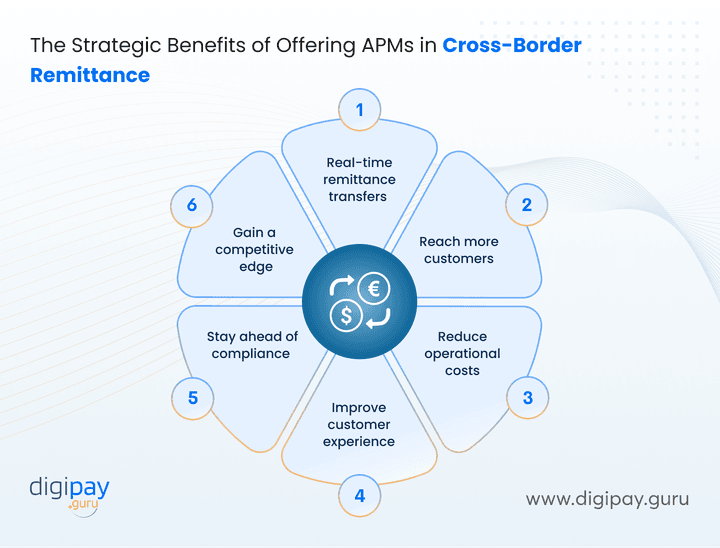

The Strategic Benefits of Offering APMs in Cross-Border Remittance

If you’re in the remittance space today, speed and reach are only part of the equation. What your customers really want is control. Control over how they send, how much they pay, and how fast it lands. That’s where alternative payment methods (APMs) give your business a serious edge.

Below are six key benefits that make APMs a smart strategic move for your remittance offering.

1. Send and receive money instantly

Alternative payment methods like mobile wallets and real-time payment rails reduce settlement times from days to minutes. This way customers can send money during lunch and have it received before the next meeting. That immediacy isn’t just a perk—it’s now expected.

Read More - International Money Transfer Dominates the Digital Landscape

2. Reach more customers across regions

Over 1.4 billion adults globally remain unbanked. But many of them still use mobile wallets and prepaid solutions daily (either directly or via agents). Hence, supporting APMs means you can extend your remittance services to high-growth markets in Africa, Southeast Asia, and Latin America as well without needing branches or banking infrastructure.

3. Cut down your costs

When you bypass intermediaries, you eliminate layers of fees. Alternative payment methods (APMs) reduce dependency on SWIFT and correspondent networks. This streamlines operations and lowers your cost per transaction.

Some providers report savings of up to 35% after switching to wallet-based payouts.

4. Improve the user experience

Modern customers expect clarity, choice, and convenience when making cross-border payments. Offering alternative payment options like Apple Pay, Google Pay, or QR-based payments creates a better experience. An experience that increases satisfaction and drives repeat usage. Customers stick with platforms that let them pay their way.

5. Stay ahead of compliance

Many APM platforms are built with eKYC, AML tracking, and transaction transparency built in. This reduces onboarding time and lowers risk, especially when operating across multiple jurisdictions.

6. Gain a competitive edge

When customers compare remittance service providers: speed, fees, and UX matter most. By integrating APMs, you position yourself ahead of legacy players that still rely on outdated systems. In crowded markets, alternative payment methods help you stand out not just today, but long-term.

Competitor Landscape: What Other Leaders Are Doing

You’re not the only one thinking about transforming your remittance operations. Some of the most successful global players have already made the shift. And they’re setting new benchmarks for the rest of the industry.

Here’s what forward-thinking companies are doing differently, and why it matters for your business.

Wise

Wise built its global money transfer reputation on one promise: speed without the bank. They use local payment rails and digital wallets to settle cross-border payments in near real-time. By bypassing legacy infrastructure, they’ve cut costs and delivered transparency. And customers love them for it.

Remitly

Remitly targets a mobile-native audience. Their app-first approach, combined with digital onboarding, live transaction tracking, and wallet integrations, makes them a preferred choice for younger senders. They're not just moving money—they're designing seamless user journeys.

Western Union

Even the oldest names in the business are adapting. Western Union is now embracing fintech partnerships to roll out wallet-based payouts, QR-driven interfaces, and API-powered integrations across Asia and Africa. They’re evolving with the market instead of resisting it.

What does this mean for you?

It means the window to wait and see is closing. The leaders are already on the next wave—and your customers are watching. If you want to stay relevant and competitive, now’s the time to act.

Use Case Snapshots: APMs in Action

Let’s make this real. The benefits of APMs aren’t just theoretical—they’re already being realized across the globe. Banks, fintechs, and digital remittance service providers are using APMs to unlock speed, expand reach, and improve customer experience.

Here are three real-world examples showing how APMs are driving measurable impact.

Nigeria: Wallet Transfers for Rural Communities

Paga, a leading Nigerian fintech, has helped millions send and receive money instantly through mobile wallets.

By bypassing banks and working with local merchants as agents, they’ve created an ecosystem that supports fast, secure wallet-based remittances—even in rural villages. This has opened access for unbanked users while reducing overhead for the provider.

UAE: Crypto-Powered Cross-Border Settlement

A UAE-based digital bank now enables cross-border transfers using regulated stablecoins. Funds are sent via blockchain and converted to local fiat instantly at the receiving end through licensed crypto-to-fiat gateways.

The result? Instant delivery, better FX rates, and complete traceability without the usual correspondent banking delays.

Philippines: Inbound Remittance via Digital Wallets

GCash, one of the top e-wallets in the Philippines, partners with global remittance providers like MoneyGram and Western Union to allow users to receive funds directly in their digital wallets.

The experience is seamless—funds arrive within minutes, no branch visit needed. This has become especially critical for migrant families relying on quick, reliable transfers.

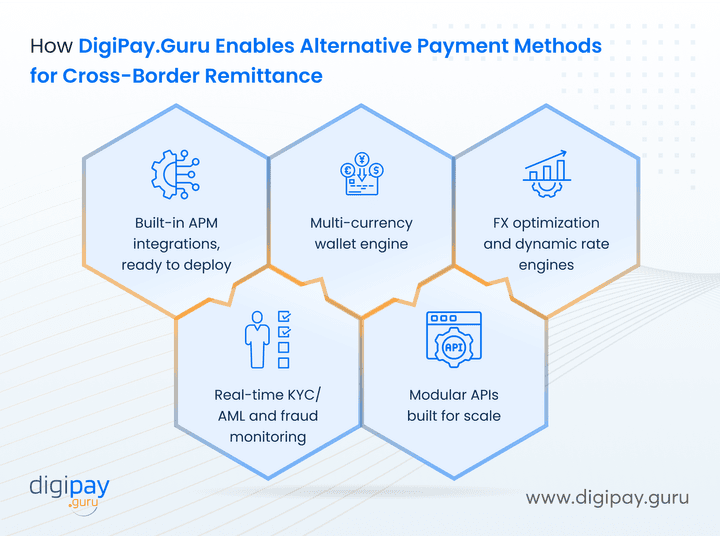

How DigiPay.Guru Enables Alternative Payment Methods for Cross-Border Remittance

If you're ready to offer faster, more accessible, and lower-cost remittance services, DigiPay.Guru is your ideal technology partner. We don’t just provide the building blocks—we help you construct a modern, scalable, and regulation-ready remittance infrastructure.

Here’s how we do it:

If you're ready to offer faster, more accessible, and lower-cost remittance services, DigiPay.Guru is your ideal technology partner. We don’t just provide the building blocks—we help you construct a modern, scalable, and regulation-ready remittance infrastructure.

Here’s how we do it:

1. Built-in APM integrations, ready to deploy

We support a wide range of alternative payment methods, from mobile wallets to prepaid cards to contactless platforms like Apple Pay and Google Pay. With our plug-and-play model, you can go live with new payment rails in record time. No long dev cycles, no operational chaos.

2. Multi-currency wallet engine

Let your users store, convert, and transfer funds in multiple currencies with ease. This gives them more control, while your operations benefit from streamlined FX management and real-time balance updates.

3. FX optimization and dynamic rate engines

Our platform intelligently sources the best conversion rates, which reduces overhead for your business and improves payout accuracy for your customers.

4. Real-time KYC/AML and fraud monitoring

You’ll meet compliance requirements in every market with built-in eKYC, sanctions screening, and transaction monitoring. This helps you stay secure and audit-ready from day one.

5. Modular APIs built for scale

Our solution integrates with your existing systems and can be customized for different markets or use cases. Whether you’re a digital-first fintech or a traditional bank expanding into digital remittance, our tech flexes with your strategy.

Results? Clients have seen up to a 45% reduction in transaction turnaround time and a 30% drop in customer support tickets just by switching to our APM-powered solution.

With DigiPay.Guru, you're not just adopting new tools. You're enabling a faster, more future-ready remittance business that’s built for where the market is going.

Conclusion

If you’re leading remittance innovation, the message is clear. APMs are no longer optional. The shift toward faster, mobile-first, and inclusive payment systems is already underway, and customer expectations have moved with it.

Here’s what to remember:

-

Traditional methods like SWIFT and bank wires are too slow, too costly, and too rigid for today’s remittance demands.

-

Alternative payment methods help you deliver real-time, low-cost, and user-friendly experiences that scale globally.

-

APMs unlock access to high-growth markets, support unbanked users, and reduce operational complexity.

-

Regulatory readiness and built-in compliance features make APMs a smarter, safer choice.

-

The industry’s top players are already there. And if you want to stay competitive and relevant, you need to evolve your offering.

That’s where DigiPay.Guru comes in.

Our international remittance solution helps you integrate APMs seamlessly, serve wider geographies, and deliver experiences your customers expect. Whether you're modernizing legacy systems or launching a new digital product, we provide the tech foundation to help you lead with confidence.

FAQ's

Alternative payment methods (APMs) in remittance refer to non-traditional ways of sending or receiving money across borders without relying on bank wires, credit cards, or SWIFT. These include mobile wallets, real-time payment rails, prepaid cards, QR code payments, cryptocurrencies, and contactless systems like Apple Pay and Google Pay.

They’re designed to make international money transfers faster, more inclusive, and more cost-effective, especially in regions with limited access to traditional banking.

Remittance businesses should adopt APMs to stay competitive, reduce costs, and meet evolving customer expectations. APMs enable real-time transfers, lower transaction fees by bypassing intermediaries, and offer broader access in emerging markets.

They also allow providers to deliver seamless digital experiences. Something today’s mobile-first users expect. In short, APMs aren’t just an upgrade; they’re a strategic necessity for long-term growth .

APMs benefit cross-border transfers in several ways:

-

Faster settlement: Transactions complete in minutes, not days.

-

Lower fees: Fewer intermediaries mean reduced FX and processing costs.

-

Expanded reach: Serve unbanked and underbanked populations via mobile and digital wallets.

-

Improved transparency: Real-time updates and digital records create better customer trust and audit readiness.

-

Regulatory agility: Many APM platforms come with built-in KYC/AML compliance tools.

For remittance providers, this means better margins, happier customers, and faster global scale.

While APMs bring innovation, they also require careful management. Key risks include:

-

Regulatory compliance: Varying laws across borders may require custom checks.

-

Fraud and identity theft: Mobile-first platforms must ensure robust KYC and fraud prevention systems.

-

Technology dependencies: Downtime, system compatibility, and API failures can impact transaction reliability.

-

Volatility (for crypto rails): Using blockchain-backed assets like stablecoins requires monitoring of price stability and liquidity.

Partnering with a secure, compliant technology provider can mitigate most of these challenges.

Several regions are ahead in APM adoption for remittance:

-

Kenya: M-Pesa has revolutionized mobile wallet-based transfers, becoming the blueprint for APM success.

-

India: UPI and Paytm have enabled real-time domestic and inbound remittances at scale.

-

Philippines: GCash and Coins.ph offer fast inbound remittance via digital wallets.

-

UAE: Digital banks and crypto-regulated platforms are pushing innovation in blockchain-based remittance.

-

Nigeria: Wallet-based ecosystems like Paga have brought financial access to rural, unbanked populations.

These countries combine regulatory support with high mobile penetration, making them prime use cases.

APMs break down barriers to financial access. They allow users without bank accounts—especially in rural or underserved areas—to receive and use funds digitally. With mobile phones and e-wallets, people can send, receive, store, and spend money securely, even without traditional financial infrastructure.

For remittance providers, this opens new markets and helps bridge the global financial divide while aligning with financial inclusion goals set by regulators and development agencies.