Trust is the real currency in the remittance world. Your customers send money with urgency, and they expect it to reach the right hands without delays or uncertainty. And regulators expect the same level of clarity.

According to the World Bank, more than $860 billion moved through global remittances last year, which makes the sector an attractive target for fraud, identity theft, and other financial crimes.

This is why strong AML, KYC, and overall remittance compliance practices matter now more than ever.

When compliance is weak, fraud and security risks grow. And when processes are slow, customers lose confidence. Plus, when regulations shift often with little warning, your business must be ready.

As a business running remittance operations, you have to deal with increasing expectations around customer verification, transaction monitoring, and cross-border remittance compliance.

This blog breaks down these requirements in simple, practical terms. You will understand the challenges, the technology reshaping compliance, and the steps that help you build long-term trust in every corridor you operate in.

Let’s begin with understanding the compliance backbone of the remittance industry.

Understanding the Compliance Backbone of the Remittance Industry

Your remittance business runs on thin margins and high expectations. And compliance protects you from financial crime, money laundering risks, and operational errors that can break trust overnight.

So it's important to understand that when regulators tighten money transfer regulations, they are not trying to make life difficult. They are trying to protect the ecosystem you operate in.

AML screening, identity verification, onboarding verification, and transaction monitoring are your shield. They help you reduce fraud, stay ahead of threats, and earn the confidence of your customers and global partners.

This is because trust grows when compliance feels reliable. It fades when compliance feels reactive. That is why understanding AML and KYC at a deeper level is essential.

Understanding AML in Remittances

AML plays a central role in safeguarding every remittance transaction. Also, cross-border transfers move fast, and that speed creates opportunities for misuse.

Criminals often try to hide illegal funds inside legitimate money flows, especially in high-volume corridors. As your business grows, exposure to these risks grows too.

You can’t rely on manual checks to manage this level of complexity. You need systems that detect unusual patterns early and support your team with clear, accurate signals.

Strong AML controls help you maintain trust with customers, regulators, and partners across every market you operate in.

What is AML (Anti-Money Laundering) and Why It Matters

AML, or Anti-Money Laundering, refers to the policies and tools that prevent criminals from using your remittance channels for illegal activity.

It matters because weak AML creates real consequences:

-

Fraud goes unnoticed

-

Suspicious transactions slip through

-

Regulators intervene, and

-

Customers lose confidence

And effective AML in remittances gives you visibility across every transfer. It keeps you aligned with money transfer regulations, FATF guidelines, and cross-border remittance compliance standards. It also helps you expand into new corridors with fewer regulatory hurdles.

When AML is strong, trust follows. And when trust grows, your business grows.

Below is a simple view of the AML risks you should watch closely.

Common AML Risks in Remittances

These patterns appear every day in real remittance operations. You might have seen some yourself.

Some common AML risks and how they can be detected are listed below.

Common AML Risks vs Detection Methods

| AML Risk | How It Appears in Remittances | Detection Method | Technology Used |

|---|---|---|---|

| Structuring | Multiple small transfers | Pattern monitoring | AI and ML risk scoring |

| Fraudulent Accounts | Fake IDs or SIM farms | Identity checks | eKYC and facial matching |

| Suspicious Corridors | High-risk countries | Geo-risk checks | Watchlist and sanctions screening |

Structuring is one of the oldest tricks in the book. Fraudsters break down a large amount into many small transfers to avoid detection. The right transaction monitoring tool detects patterns your team would miss manually.

Fraudulent accounts have increased due to low-cost digital identities. Identity verification and biometric checks give you the upper hand.

Suspicious corridors require constant updates, especially when PEP and sanctions lists change overnight.

AML is a moving target, which is why your tools must move faster than your risks.

Understanding KYC in Remittances

KYC shapes the trust you build at the very first step of a remittance journey. It confirms who your users are, protects your platform from misuse, and helps you meet regulatory expectations across corridors.

So, when KYC is consistent, your compliance foundation becomes strong. And when it is weak, risks slip through unnoticed.

What is KYC and Why is it Critical

KYC stands for Know Your Customer. It verifies the identity of both senders and receivers before any money moves.

It protects your platform from:

- Impersonation

- Mule accounts

- Synthetic or stolen identities

It is crucial because:

- KYC in remittances creates accountability

- It ensures that the person using your platform is legitimate

- It also supports stronger AML controls by giving you clear identity data for transaction monitoring and risk scoring.

Types of KYC for Remittance Providers

You work with different risk levels across different customers and corridors. That is why you need multiple KYC layers:

| Type of KYC | Purpose |

|---|---|

| Basic KYC | Standard identity checks for low-risk users |

| Customer Due Diligence (CDD) | Deeper checks for medium-risk profiles |

| Enhanced Due Diligence (EDD) | Required when you deal with high-risk customers, high-value transfers, or flagged behaviors |

| Remote / Digital Onboarding | Online verification using biometrics, OCR, and liveness checks for faster onboarding |

Each layer helps you balance compliance, customer experience, and operational efficiency.

Traditional KYC vs Digital KYC (eKYC)

The digital version of KYC, called “eKYC,” has totally changed the scenario of onboarding for remittance users. Now it's fast, secure, and more accurate than ever.

Below is a simple comparison of traditional vs. digital KYC:

| Feature | Traditional KYC | Digital KYC (eKYC) |

|---|---|---|

| Onboarding Speed | Slow and manual | Instant and automated |

| Accuracy | Manual errors possible | AI-verified accuracy |

| Fraud Risk | High | Low due to biometrics |

| Cost | High operational cost | Low cost per user |

| User Experience | In-branch only | Remote and mobile-friendly |

Digital KYC is not just efficient; it's safer. Plus, it uses biometrics, OCR extraction, liveness detection, and document verification that outperforms manual review.

And customers choose the provider that makes onboarding fast and secure. In this competitive space, you should want to be that provider.

Global Regulatory Landscape for Remittance Providers

Regulations shape how you operate across different markets. They influence your onboarding standards, your AML controls, and your reporting responsibilities.

As your business expands into new corridors, regulatory clarity becomes essential. It helps you stay compliant, avoid penalties, and maintain trust with partners and customers.

Why Regulations Matter for Trust

Regulations exist to protect everyone in the remittance ecosystem. They set the rules that safeguard consumers, ensure fair practices, and reduce financial crime.

As a remittance provider, you work with multiple authorities across the world. Some of these include:

-

FATF

-

FINTRAC

-

Local central banks

-

CBUAE

-

European AMLD regulators

-

FinCEN

You build trust when your systems align with these requirements. That alignment shows you take compliance seriously, which strengthens your credibility across all corridors.

Regional Compliance Requirements

Different regions come with different expectations. Understanding these variations helps you prepare for audits, avoid regulatory delays, and maintain a consistent approach to cross-border remittance compliance.

Here is a simplified view of remittance compliance requirements by region

| Region | Main Authority | Mandatory Checks | Complexity Level |

|---|---|---|---|

| USA | FinCEN | AML, KYC, SAR | High |

| EU | AMLD | KYC, CDD, EDD | Medium |

| UAE | CBUAE | eKYC, AML screening | Medium |

| Africa | Local Central Banks | ID checks, AML | Variable |

Key Compliance Challenges in the Remittance Industry

Compliance in remittances looks simple on paper, but the real challenges appear when you manage high volumes, multiple corridors, and different regulatory expectations.

These challenges slow operations, increase risk, and often impact your customer experience. Here are the compliance challenges in remittance industry providers struggle with the most.

Challenge 1: Fragmented Cross-Border Regulations

Each corridor follows different rules, formats, and reporting standards. And your team must track these variations continuously to avoid errors. This makes scaling into new markets slower and more resource-intensive.

Challenge 2: Manual Compliance Processes

Manual reviews delay onboarding and increase the chance of human error. Small inconsistencies across documents often slip through unnoticed. Over time, these gaps create compliance friction and operational stress.

Challenge 3: High False Positives in AML Screening

Legacy monitoring systems often flag harmless transactions as risky. Plus, your team spends time reviewing alerts that do not need attention. This reduces efficiency and leaves less room to spot real threats.

Challenge 4: Inconsistent Identity Data Across Markets

Some regions lack unified ID systems or digital verification tools. This makes customer verification harder and slows KYC accuracy. And mismatched records increase the chance of onboarding fraud.

Challenge 5: Rapidly Evolving Fraud Techniques

Fraudsters adapt faster than most compliance teams can respond. Plus, deepfakes, synthetic identities, and social engineering are rising. So, you need tools that evolve at the same pace to stay ahead.

Challenge 6: Pressure to Reduce Onboarding Friction

Your customers expect fast approval, but regulators expect thorough checks. So, balancing speed and compliance becomes a daily struggle for operators. If either side suffers, user trust or regulatory trust takes a hit.

Challenge 7: Operational Costs Linked to Compliance

Compliance tools, audits, and manual workflows increase operational expenses. And smaller remittance providers often feel this burden the most. Automation helps, but many still rely on outdated systems.

PS: If you have felt any of these pain points, you are not alone. These challenges are universal across remittance services.

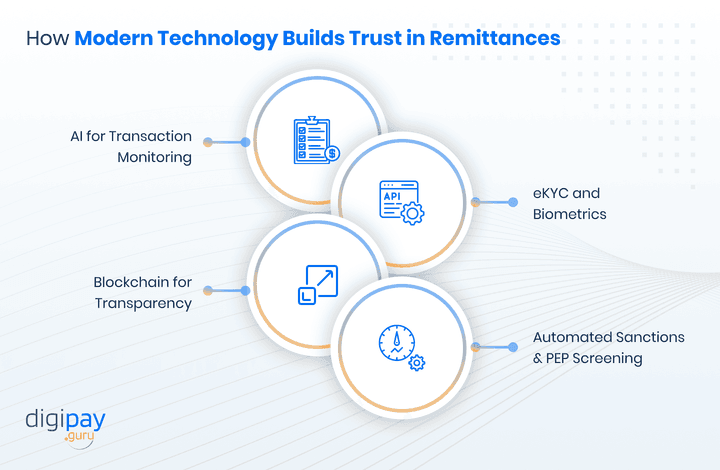

How Modern Technology Builds Trust in Remittances

Technology simplifies compliance. It transforms reactive compliance into predictive compliance. And with it, you detect threats before they become losses.

Technology like AI, automation, biometrics, and blockchain creates reliable systems that build trust for both regulators and customers.

Let’s break down how to build trust in remittances with each technology:

AI for Transaction Monitoring

AI detects unusual patterns faster than manual systems. It spots hidden correlations between transfers, senders, and corridors. It also reduces false positives by learning from behavior.

This way, you stay ahead of risks with less operational strain.

eKYC and Biometrics

eKYC and biometrics processes like facial matching, document verification, and liveness detection protect you from identity spoofing and deepfakes. This is vital when mobile onboarding becomes the default experience.

This way, your users trust your platform when they know you take identity seriously.

Blockchain for Transparency

Blockchain supports the traceability of transactions. With its decentralized approach, it creates an audit trail that regulators trust. Even if you do not use blockchain today, understanding its role helps you prepare for future requirements.

Automated Sanctions and PEP Screening

Sanctions and PEP screening lists change frequently. And manual updates lead to gaps. Whereas automation reduces human dependency and ensures real-time protection.

You cannot afford outdated lists when compliance rules shift daily.

Modern Tools vs Traditional Compliance

To understand the importance of modern technology and tools in compliance. Let’s look at a quick comparison of modern tools and traditional ones for compliance:

| Technology | Benefit | Impact on Trust | Adoption Cost |

|---|---|---|---|

| AI-based AML | Real-time monitoring | High | Medium |

| eKYC | Faster onboarding | High | Low |

| Blockchain | Traceability | Medium | Medium |

| Manual Verification | Low accuracy | Low | High |

Bottomline: Modern systems reduce operational load, improve accuracy, and help you strengthen trust at scale.

A Practical Compliance Framework for Remittance Providers

Here is a simple compliance framework you can apply immediately:

-

Adopt risk-based onboarding

-

Use tiered KYC (CDD → EDD)

-

Deploy real-time AML screening

-

Monitor high-risk corridors separately

-

Automate transaction monitoring

-

Maintain audit trails for regulators

-

Train your teams regularly on new threats

In short: Consistency builds trust. Strong frameworks eliminate weak gaps.

Best Practices to Strengthen Trust and Remittance Compliance

You can apply the best practices mentioned below to strengthen trust in remittance compliance, without restructuring your entire ecosystem:

-

Use AI to prioritize alerts that matter.

-

Maintain corridor-specific risk rules.

-

Reduce false positives with behavioral analytics.

-

Communicate security measures clearly to customers.

-

Use digital KYC for money transfer to reduce friction.

-

Update sanctions lists in real time.

-

Keep regulators informed with clean audit reports.

Because when compliance improves, trust follows. When trust improves, growth follows.

How DigiPay.Guru Supports Compliance for Remittance Providers

Compliance becomes far more manageable when your technology works in your favour.

DigiPay.Guru’s international remittance solution is built to help remittance providers meet regulatory expectations without slowing customer experience or increasing operational load.

Every component of the platform strengthens AML, KYC, and cross-border compliance in a structured and predictable way.

Here is how DigiPay.Guru strengthens compliance across your entire remittance workflow:

-

Digital KYC and biometric verification to validate customer identities instantly and reduce manual checks.

-

Real-time sanctions and PEP screening using updated global watchlists to prevent restricted users from entering your ecosystem.

-

AI-powered transaction monitoring that analyses behavioural patterns and flags unusual activity with clear, actionable insights.

-

Corridor-specific compliance rules that help you adapt to regional regulations without restructuring your system.

-

Automated regulatory reporting and audit-ready logs that simplify documentation for regulators and partners.

-

Modular compliance APIs that integrate seamlessly with your existing systems, enabling smooth adoption without operational disruption.

These capabilities work together to give you a secure and compliant foundation for global money movement.

Conclusion

Trust is the foundation of every successful remittance business. Your customers expect their money to move safely, and regulators expect every transaction to meet clear compliance standards.

With global remittances crossing $860 billion last year, the responsibility to protect users from fraud, identity misuse, and financial crime has never been greater. Strong AML, KYC, and ongoing monitoring give you the structure you need to operate confidently across borders.

Also, compliance is not a one-time task. It evolves with new regulations, emerging risks, and growing customer expectations. When your processes stay consistent, your reputation strengthens, and your growth opportunities expand.

A reliable compliance framework helps you build long-term trust with every partner and every corridor you serve.

If you want to modernise your operations without increasing complexity, DigiPay.Guru helps you move forward with clarity.

Our international remittance solution brings automated KYC, real-time AML screening, secure transaction monitoring, and corridor-ready compliance under one platform, so you can scale safely and serve your customers with confidence.

FAQs

AML (Anti-Money Laundering) is the rules, processes, and tools you use to stop criminals from moving illicit funds through your remittance channels. It matters because weak AML exposes you to fraud, regulatory action, lost reputation, and frozen corridors. Strong AML protects customers, partners, and your ability to operate across borders.

KYC (Know Your Customer) is the process of verifying sender and receiver identities before you process transfers. It prevents impersonation, mule accounts, and synthetic identities. Good KYC reduces risk and makes your transaction monitoring more accurate.

You must implement AML screening, KYC onboarding, transaction monitoring, sanctions and PEP screening, suspicious activity reporting, recordkeeping, and risk-based policies. These requirements vary by jurisdiction, so you also need corridor-specific controls and audit-ready logs.

Digital KYC automates identity checks with OCR, document verification, liveness detection, and biometric matching. It also speeds onboarding, cuts manual errors, and lowers costs per user while improving fraud resistance and user experience.

Common pain points include fragmented cross-border rules, manual processes, high false positives, inconsistent ID data across markets, and evolving fraud methods. Balancing fast onboarding with thorough checks is also a constant challenge.

AI refines transaction monitoring by spotting subtle patterns and reducing false alerts. It improves identity verification accuracy, powers risk scoring, and helps you prioritize real threats so your team focuses on cases that matter.

Penalties range from fines and remediation orders to loss of licenses or access to banking corridors. Reputational harm and business disruption often cost more in the long run than the fines themselves.

You use automated screening tools that match customers and transactions against updated sanctions, watchlists, and PEP databases. Real-time list updates and fuzzy matching reduce misses and false positives.

CDD (Customer Due Diligence) is standard verification for normal-risk customers. EDD (Enhanced Due Diligence) is a deeper investigation for high-risk customers, high-value transfers, or flagged corridors and requires more information and ongoing monitoring.

Be transparent about safety measures, speed up secure onboarding with digital KYC, and resolve disputes quickly. Communicate what you do to protect users and show audit-ready compliance to partners and regulators.

Key tools include eKYC platforms, AI/ML transaction monitoring, sanctions and PEP screening, tokenization, secure audit logs, and corridor-specific rule engines. Modular APIs let you add capabilities without a full rebuild.

Yes. Digitization closes manual gaps, improves identity verification, and enables real-time monitoring. It doesn’t eliminate fraud, but it makes detection faster and response more effective.

FATF sets global standards and guidance for AML/CFT that countries adopt into local rules. Following FATF principles helps you design risk-based controls that are acceptable to regulators worldwide.

Use cloud and API-based compliance services, adopt tiered KYC, outsource heavy screening to specialists, and automate reporting. Start with high-impact, low-cost controls (digital KYC, sanctions screening, basic transaction rules) and scale from there.

DigiPay.Guru provides modular, API-driven tools for digital KYC, real-time AML and sanctions screening, AI transaction monitoring, corridor-specific compliance rules, and audit-ready reporting. You get a compliant, scalable platform that reduces manual work and speeds secure onboarding.