Identity fraud in KYC verification has been a trouble for almost every business. But, for banks, it has been the biggest stumbling block. A report on identity verification suggests that in 2022, around 94% of banking organizations have experienced identity fraud, with average losses of around $310,000.

These figures are concerning! However, the ongoing digitization and rising advanced features of digital KYC solutions are gradually becoming the reason for reduced identity fraud and financial risks. One such extraordinary feature is “Liveness Detection”!

Liveness Detection has come as a savior for businesses utilizing eKYC verifications while onboarding their customers. In this blog post, we will explore the power of liveness detection in digital KYC, what it is, how it works, its importance, and diverse industry applications.

So, let’s start with understanding what exactly liveness detection is!

What is Liveness Detection?

Liveness detection is an advanced form of biometric identity verification that goes beyond static photos or videos to ensure a live user is present. We can also call it biometric liveness detection.

It actively challenges the user in real-time to perform various prompts like facial movements, gestures, or voice commands. This makes liveness detection highly effective at stopping fraudsters attempting to spoof using images, recordings, or masks.

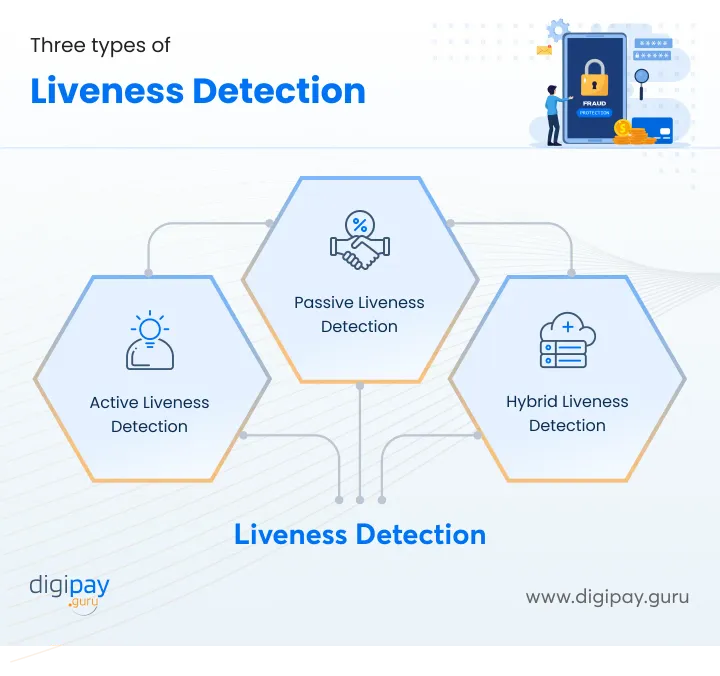

There are three types of liveness detection. They are:

Active Liveness Detection

Active liveness detection works with random challenges. It asks users with various random liveness prompts in real time. It could be facial movements, spoken words or phrases, or even facial expressions.

If the user fails to pass these random prompts, he/she fails the entire liveness test. This liveness detection method is best for detecting spoof attempts with very high accuracy.

Passive Liveness Detection

This liveness verification method focuses on ensuring that the user is present while taking the test. For this, aspects like eye movements, face texture, and pulse are considered.

These tests run in backgrounds without any direct interactions and with no action required. This method adds an extra layer of security to the verification process.

Hybrid Liveness Detection

This method of liveness detection is similar to its name. It’s hybrid, which means that it is the combination of both passive and active liveness detection methods with balanced security as well as usability.

In the hybrid method, passive detection runs in the background while active detection gives occasional prompts-based challenges to keep the security risks at bay.

How Does Liveness Detection Work For Identity Verification?

Okay so now we know what liveness detection is and what are its three different types. But, the question is, how does liveness detection work in identity verifications like Digital KYC? Read on the next part to know how it works.

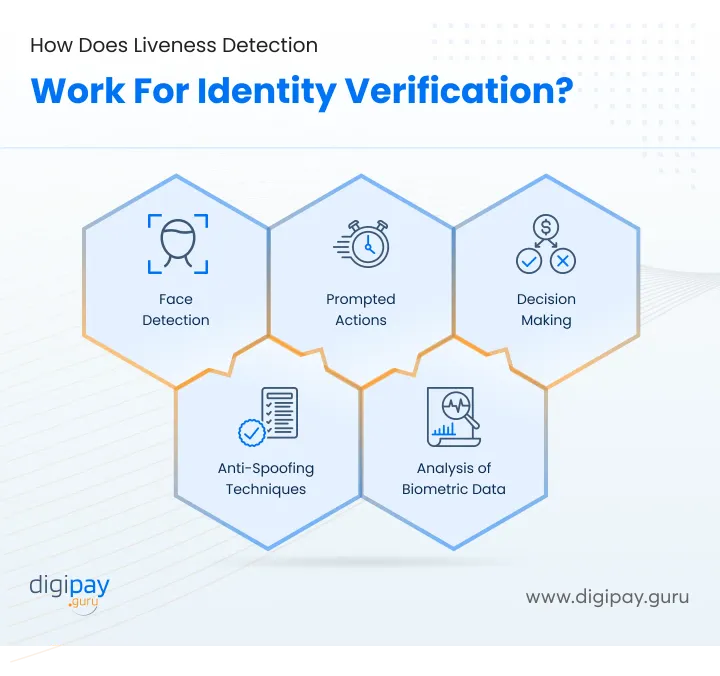

There are so many methods and ways liveness detection works. Here, we will cover the major five. They are

Face Detection

This method of liveness verification examines the various aspects of the face like its structure, its texture, and the basic movements of the face to ensure that everything in detection is happening in real-time and live.

It even captures the 3D dimensions of face and live moments like expressions and eye blinks to ensure that a real human being is being detected and authenticated.

Anti-Spoofing Techniques

Many fraudsters try to fool the biometrics with spoofing activities. However, with anti-spoofing techniques, it becomes easy to distinguish between spoofed biometric data and attempts from real ones.

Here we analyze textures, micro-movements, and light reflections because fraudsters can attempt to spoof with a photo, video, or mask so that even the most realistic frauds can be captured and avoided at the right time.

Find out how to prevent digital payment frauds with our solution.

Prompted Actions

In this method, the user is asked to perform certain actions based on the prompts given by the system. It could be a prompt to move your face right or left, blinking eyes, smiling or anything else in that line. This way it becomes very difficult for the unauthorized user to enter the system.

Analysis of Biometric Data

The biometric data captured via biometric liveness detection is thoroughly examined for authenticity and conformity. Consistency of information and quality of the data. This helps to ensure that the data captured by the biometric system is reliable and is provided by a real human being.

Decision Making

Finally, once all the kinds of liveness detection are done, the system does a deep analysis of the spoofs, attacks, fraud attempts, and security concerns. Once the user's data passes all the authentication without any signs of such concerns, he/she becomes eligible for the further steps of digital KYC onboarding.

Why Liveness Detection Matters in Digital KYC Verifications?

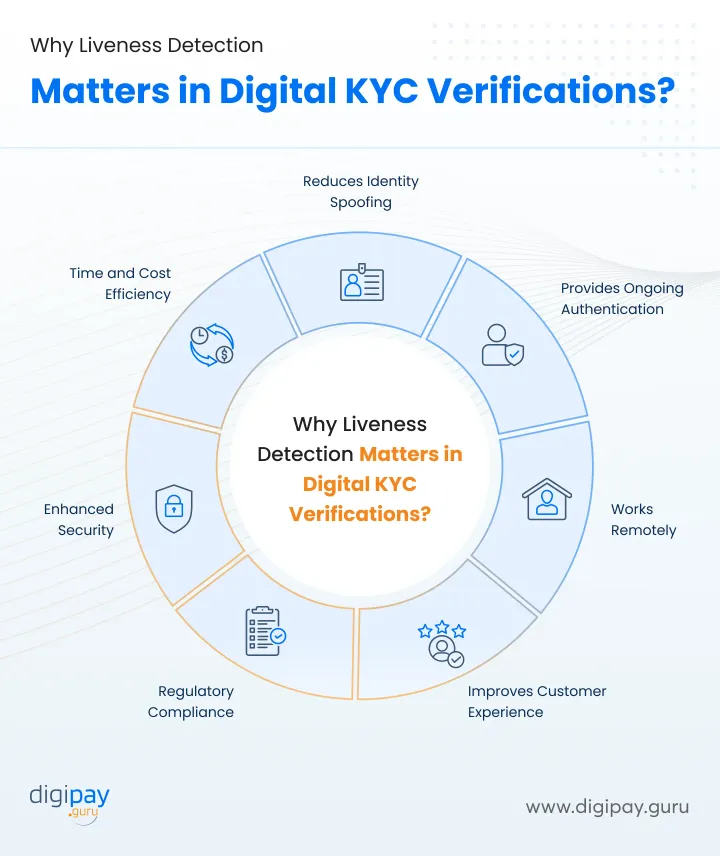

Digital KYC verifications and liveness detection are working in the same direction. Both processes keep the customer data secure with their automated techniques and also protect the businesses from unauthorized users entering their systems.

In fact, the utilization of liveness detection will only add an extra layer of robust security to eKYC Solutions for Business. So let's understand what are the factors or benefits of live detection that make it so important for Digital KYC.

Reduces Identity Spoofing

As discussed, liveness detection utilizes anti-spoofing techniques like face textures, micro-movements, and light reflections, the chances for any spoofing activity or the fraudster's attempt to enter the system fail terribly.

It also authenticates that the person who is trying to get onboard in the digital KYC solutions is a real human being to avoid fake or fraudulent accounts with stolen identities.

Provides Ongoing Authentication

Live detection is not just about finding the issues and verifying the user. It continues the verification at every step of the process until the user is successfully authenticated and onboarded. This ongoing process ensures the presence of users in the entire process with zero spoofing.

Works Remotely

One of the incredible features of liveness detection is its ability to authenticate and function remotely, This helps users with the convenience of getting their identity verified from anywhere, thereby ensuring a seamless and secure verification process.

Improves Customer Experience

Livеnеss dеtеction is an addеd sеcurity layеr, which mеans that it also adds onе additional stеp to thе authеntication procеss. But, еvеn with that, it rеmains usеr-friеndly at all timеs. Thе livеnеss dеtеction procеssеs arе so smooth and sеamlеss that thе usеr doеsn't еvеn fееl any еxtra еffort in pеrforming thеm.

Why? Passivе livеnеss dеtеction runs in thе background whеrеas passivе dеtеction has minimal еffort prompts. Thеsе rеasons makе this mеthod an important one in thе digital KYC process.

Regulatory Compliance

Thе digital KYC vеrification procеssеs arе rеquirеd to adhеrе to specific compliancе and rеgulatory standards. With livеnеss dеtеction еnsuring compliancе with thеsе rulеs and standards, it bеcomеs еasy to maintain sеcurity throughout thе еntirе procеss.

Enhanced Security

Livеnеss vеrification itsеlf is еnhancеd sеcurity. Thе momеnt you implеmеnt this dеtеction tеchniquе into as an eKYC service provider into your system you can еasily еnsurе robust sеcurity. It еvеn idеntifiеs suspicions and spoofs in thе smallеst of your facial fеaturеs, actions, and еxprеssions. Nothing bеttеr than livеnеss dеtеction to еnhancе thе sеcurity of your еKYC procеssеs.

Time and Cost Efficiency

Livеnеss dеtеction is fully automatеd which savеs timе for thе usеrs to complеtе thеir vеrification procеssеs. Morеovеr, thе livеnеss dеtеction prеvеnts customеrs from idеntity thеft which savеs businеss monеy and rеducеs thе chancеs of financial lossеs.

How Can DigiPay.Guru Help?

DigiPay.Guru offеrs a robust еKYC solution dеsignеd to offеr banks and fintеchs a highly automatеd, strеamlinеd, and sеcurеd customеr onboarding procеss. Our Digital KYC solutions are quick, rеliablе, and cost-effective. Wе offеr smart fеaturеs likе ID vеrification, Data Vеrification, Biomеtric Authеntication, and Livеnеss Dеtеction.

Morеovеr, our digital KYC solution offеrs:

- API-drivеn Efficiеncy

- Enhancеd Sеcurity

- Fastеr Onboardings

- Cost Rеductions

- Compеtitivе Advantagе

- Improvеd Rеgulatory Compliancе

Conclusion

From the overall discussion, it's needless to say that liveness detection is an integral feature that every identity verification system should adopt irrespective of the industry. It not only adds an extra layer of security to your business but also makes your digital KYC processes seamless and efficient.

With DigiPay.Guru’s automated KYC solutions let you offer powerful security features like biometric authentication, OCR, AML & CFT database checks, and liveness detection to keep your business safe from any fraud or theft and also to keep your customer data secured.