The global eKYC market will reach $2792 Billion by 2030!

The above statistic by GlobeNewswire makes sense as the importance of eKYC verification is growing by the day! This is because of the fraudsters and their new ways of attacking and entering the system.

There have been many trends for improving these situations along with the eKYC experience of your customers and business. But what's been cooking up in 2025?

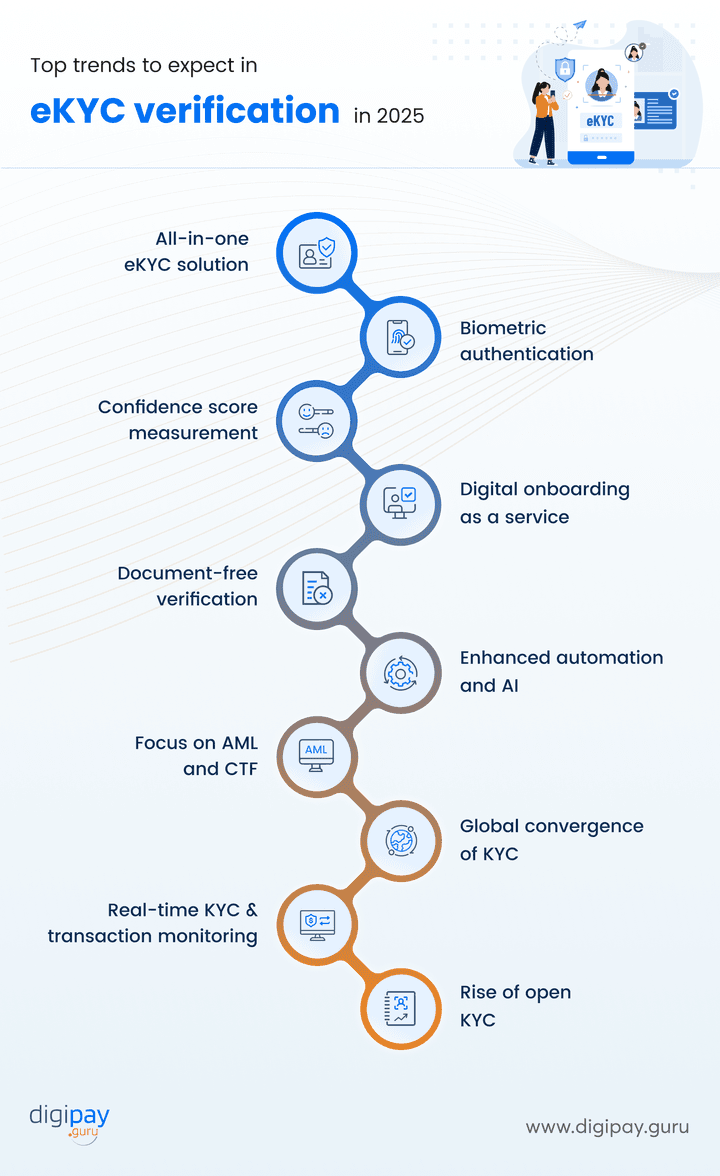

In this blog post, you will explore the latest expected eKYC trends 2025 :

- All-in-one eKYC solution

- Biometric authentication

- Confidence score measurement

- Digital onboarding as a service

- Document-free verification will be the next big thing

- Enhanced automation and AI

- Focus on anti-money laundering (AML) and counter-terrorist financing (CTF)

- Global convergence of KYC standards

- Real-time KYC and transaction monitoring

- Rise of open KYC

- Emphasis on continuous monitoring and re-verification

- Regulatory technology (RegTech) integration

- API-driven KYC solutions

- Voice recognition and natural language processing in KYC

Let’s begin, and explore each trend one by one!

Top trends to expect in eKYC verification in 2025

There are numerous eKYC verification trends that you will see in 2025. But, the key trends that are doing rounds are stated below.

All-in-one eKYC solution

This trend has come to light due to the advanced eKYC solutions emerging into the financial market.

An all-in-one eKYC solution can offer every service needed in an eKYC solution, amalgamated into one unified solution. This means that businesses like yours no longer want to juggle multiple solutions for biometric authentication, AML checks, document verification, and so on.

The services can range from:

- Identity checks

- Face verification

- Fraud detection

- Document verification

- Address verification

- Nationality verification

- Age verification

- AML screening

- Transaction monitoring

- Due diligence

- Two-factor authentication & more

The rise of biometric authentication

Biometric authentication is an essential trend in eKYC as it is the ultimate security feature for ensuring security.

With this feature, you can scan the user’s fingerprint and other physical attributes to ensure that only he can enter his profile.

Biometric authentication, including facial recognition and fingerprint scanning, is increasingly used in eKYC to enhance security and accuracy. These technologies reduce the risk of identity fraud by verifying unique physical traits

Plus, the advanced form of biometric authentication is liveness detection. This feature captures live selfie videos/images and cross-checks customer identities in a near real-time manner.

Hence, biometric verifications are considered the best feature of an eKYC solution. And are leveraged by many successful businesses.

Confidence score measurement

The confidence score is an adjustable mechanism that allows businesses like yours to determine what level of accuracy they need in the KYC verification process.

For example;

- You set the confidence score to 80.

- The face verification matches the user’s face with his ID to almost 80%.

- His profile will pass and the user will be onboarded into your platform.

This feature gives you a free hand to ensure your customer’s onboarding experience is smooth and effective. Plus, your business does not end up onboarding fake identities due to spoofs.

It’s an eKYC trend in 2025 for a reason!

Digital onboarding as a service

SaaS versions of eKYC software solutions can make it easy for even small business owners to have a tight secure digital onboarding in their platform.This version of eKYC solution is also called eKYC-as-a-Service.

Digital onboarding as a service is an affordable and effective cloud-based solution. Here;

- You pay only for what you use (no. of transactions)

- Launch faster into the market

- Access cutting-edge technology at less cost

This trend makes the eKYC process affordable and accessible to every business that needs secure customer onboarding.

Document-free verification will be the next big thing

Document-free verification is a dream for both your customers and your business. And this trend being here is proof that it's possible.

Various features offered by e-KYC solution providers offer document-free verification in one way or another.

For example, face verification recognizes user identity with facial features.

Another instance is; global database verifications like AML screening that can automatically verify user identity through AI checks against global databases.

So, this trend is here to stay!

Enhanced automation & integration of artificial intelligence in eKYC processes

The top eKYC solutions today focus on automation. The reason is how fast, secure, and seamless it makes the identity verification process.

And with the emergence of AI in eKYC equation the automated identity verification processes have become even more filtered and of better quality.

AI with automation can automate;

- Document & face scans

- Data extraction (OCR technology)

- Identity checks against global databases

Plus, machine learning algorithms will detect anomalies, suspicious transactions, and fraud attempts in real time.

The major benefits of AI-powered eKYC implementation are;

- Real-time verifications

- Reduced spoof attacks

- Reduced manual processes

- Minimized associated costs

- Improved customer experience

- Automated compliance checks

- Advanced detection & fraud prevention technologies

Focus on anti-money laundering (AML) and counter-terrorist financing (CTF)

In 2025, the majority of the business would focus on AML and CTF to make their businesses extremely secure & reliable.

AML and CTF efforts are possible by leveraging artificial intelligence and analytics where you can identify even the most complex fraud attacks and suspicious activities.

This way, you will be able to combat every fraud risk or security breach coming your way. Also, keep your business & customers safe and boost customer satisfaction at all times.

Bottom line: Expect AI-driven behavioral analysis to flag high-risk transactions and prevent illegal activities before they occur.

Global convergence of KYC standards

Imagine a scenario where KYC standards are similar in every corner of the world. Unimaginable right?

The current KYC standards vary greatly across different rеgions. This can create confusion, inconsistеnciеs, and inеfficiеnciеs in operating across bordеrs.

2025 will see a growing momentum towards global convеrgеncе of KYC standards to shape the future of еKYC the right way.

What’s the point of this global convergence? This trend;

- Promotes consistent customer experiences

- Streamlines cross-border transactions, and

- Facilitates international business operations

To make this convergence possible, international organizations & regulatory bodies are working together. They aim to establish common standards and guidelines for eKYC verification.

Global initiativеs likе thе Financial Stability Board (FSB) KYC Principlеs and thе Intеrnational Organization for Standardization (ISO) 20022 arе driving thе convеrgеncе of KYC standards.

This convergence will enhance regulatory compliance in eKYC and encourage greater collaboration & data sharing.

Real-time KYC and transaction monitoring

While keeping security at the center stage, real-time KYC and transaction monitoring will be a bigger trend in eKYC verification.

Real-time KYC allows you to offer near-instant customer onboarding and identity verification, which boosts trust and loyalty in your business. Plus, it cuts down the wait of many days for KYC verification.

Moreover, transaction monitoring detects suspicious activity from the very beginning & during the transaction. This takes foolproof security to another level leaving no chance of breaches.

So, both the factors combined act as a gold mine.

Rise of open KYC

The concept of open KYC is gaining momentum in the digital times! It allows the sharing of verified customer data among multiple companies.

The aim of this trend is:

- Reduce duplication

- Minimize customer friction, and

- Build a seamless onboarding experience

This is a customer-centric approach where users no longer have to provide the same document multiple times on multiple platforms.

With secure API-driven KYC solutions, you can share verified customer identities across platforms, which redcuces the redundant verifications and improves user experience.

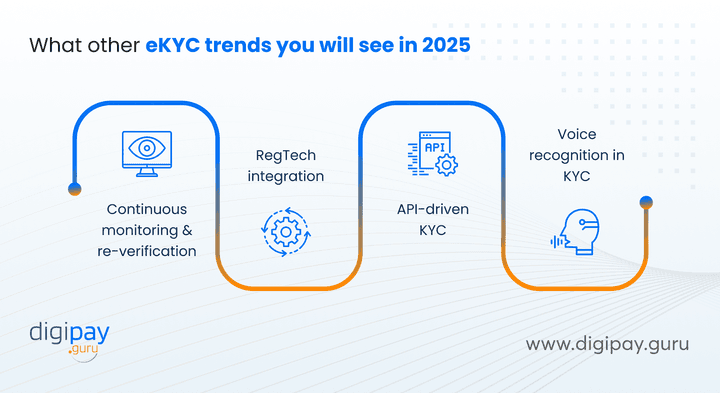

Bonus trends

Well, all the above trends are doing rounds in the world. There are certain other eKYC trends that will be doing amazing in 2025 and you must implement them. These eKYC future trends are:

Emphasis on continuous monitoring & re-verification

KYC is not a one-time process. Financial institutions must continuously monitor user activity to detect fraud, prevent AML risks, and ensure compliance.

In 2025, AI-powered re-verification systems will conduct real-time identity checks, behavioral analysis, and transaction monitoring to maintain security.

Regulatory technology (RegTech) integration

RegTech is reshaping compliance. Automated regulatory reporting, AI-driven risk assessment, and blockchain in identity verification will make compliance easier and more efficient.

More institutions will invest in RegTech solutions to reduce compliance costs and improve fraud prevention.

API-driven KYC solutions

KYC should not be a bottleneck. API-driven KYC solutions will allow businesses to integrate seamless identity verification systems into their existing platforms.

This will enhance customer experience, improve security, and speed up onboarding.

Voice recognition & natural language processing in KYC

Biometric authentication is evolving beyond facial recognition. Voice recognition and NLP (Natural Language Processing) will add an extra layer of security in eKYC implementation.

This will make fraud detection stronger, ensuring that only legitimate users can access financial services.

How can DigiPay.Guru help in shaping the future of eKYC?

DigiPay.Guru provides a robust eKYC verification solution that aims to make customer onboarding streamlined, efficient, and secure for your business.

To make your KYC verification process quick, secure, reliable, and cost-effective, we offer smart KYC solutions that include document verification, face verification, address verification, AML screening and biometric authentication.

We strive to provide:

- API-driven efficiency

- Enhanced security

- Faster onboardings

- Cost reductions

- Competitive advantage

- Improved regulatory compliance

Conclusion

These identity verification trends will shape eKYC in 2025. If your business focuses on at least one of these trends with full dedication, you are likely to taste success in the long run.

So, without a second thought, give your business a chance to be future-ready and offer your customers everything latest and in line with the 2025 KYC trends.

Besides, you can also opt for an eKYC solution that already focuses on all or majority of these trends - just like DigiPay.Guru. And enjoy the seamless verification & onboarding experience.

FAQ's

In 2025, eKYC will be driven by AI-powered automation, biometric authentication, and document-free verification. Financial institutions will move towards all-in-one eKYC solutions that integrate fraud detection, AML compliance, and real-time monitoring. Confidence score measurement and continuous KYC monitoring will also gain momentum. This will ensure better risk management and security.

eKYC streamlines customer onboarding, fraud prevention, and regulatory compliance. It reduces manual verification efforts, enhances security, and ensures faster user verification. You can benefit from cost savings, improved user experience, and stronger compliance with AML and CTF regulations.

AI enhances identity verification by analyzing biometric data, behavioral patterns, and risk scores. It detects deepfake fraud, synthetic identities, and suspicious activities in real time. AI-powered facial recognition, liveness detection, and anomaly detection make eKYC faster, more accurate, and highly secure.

Blockchain ensures tamper-proof identity verification by creating a decentralized and immutable record of customer data. It enables secure KYC data sharing between financial institutions, which reduces duplicate verifications and improves compliance. This enhances transparency, security, and efficiency in eKYC processes.

Passwords and OTPs are no longer enough to prevent fraud. Facial recognition, fingerprint scanning, iris detection, and voice recognition provide stronger security and a seamless onboarding experience. AI-driven biometric authentication ensures only legitimate users can access financial services, which reduces identity fraud.

Yes, automation will significantly reduce manual KYC processes. AI-powered verification, real-time transaction monitoring, and API-driven KYC solutions will handle data validation, fraud detection, and compliance checks automatically. This will speed up onboarding, lower costs, and minimize human errors in eKYC.