Quick Summary

Face verification has become an essential feature of eKYC solutions, leveraged for the identity verification process. It effectively prevents fraud and fastens the customer onboarding process. But, what exactly is face verification in an eKYC solution and how does that work for fast and secure identity verification? This blog will give you answers to all these questions. Happy reading!

The facial recognition market will reach around $19.3 billion by 2032!

This prediction shows the increase in the significance of secure biometric authentications like face verification at a global level.

Face verification is utilized in the identity verification process when the KYC is performed. Hence, it's a big and essential feature of modern eKYC solutions. You can benefit the most from the face verification feature, as it will make the customer onboarding process fast, secure, and seamless.

Wondering, what's so special about face verification?

Read this blog to learn

- What face verification is

- How it works

- How it makes the identity verification process fast and secure

- How DigiPay.Guru can help in achieving this

Let's buckle down and start with what face verification is!

What is face verification?

Face verification is a biometric face recognition technique that compares a person's live facial selfie-based image or video capture. This process ensures that the individual presenting the image/video is the legitimate owner, not an impersonator.

Facial verification is a critical component of eKYC solutions, enabling businesses to comply with regulatory requirements while providing a frictionless and secure customer onboarding experience.

How does the face verification process work?

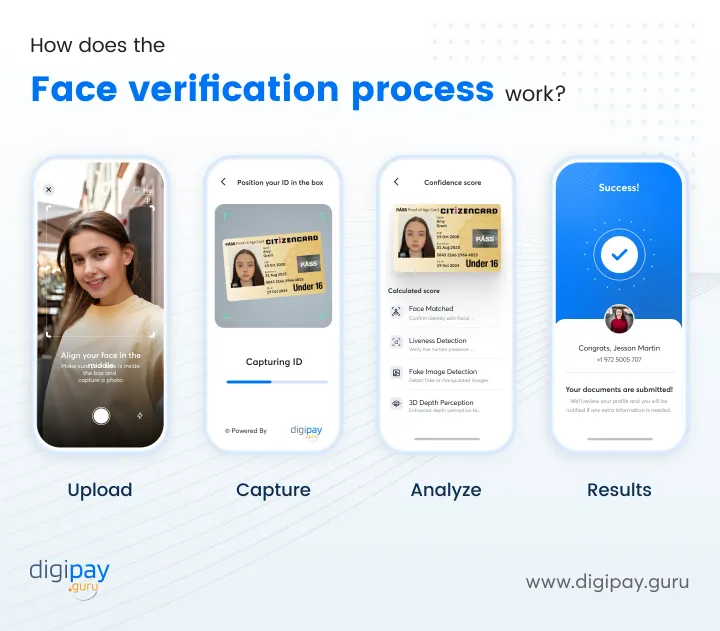

Now that you know what face verification is, let’s explore how this process works. It is a simple identity verification check using camera captures. Here’s how to verify identity in face verification:

Step 1: Upload

The user uploads a government-issued identity document into the system

Step 2: Capture

The user captures a live selfie image or video with their front camera

Step 3: Analyze

The system analyzes the captured image/video with its advanced AI algorithms to see if it matches the ID document of the user

Step 4: Results

The verification results appear on their screen with approve or reject within a few seconds

The process is quick and simple yet very effective in preventing fraud while onboarding the customers into your system.

Now, let’s understand exactly how this feature makes the identity verification process fast and secure in eKYC.

What makes face verification a fast and secure process of eKYC?

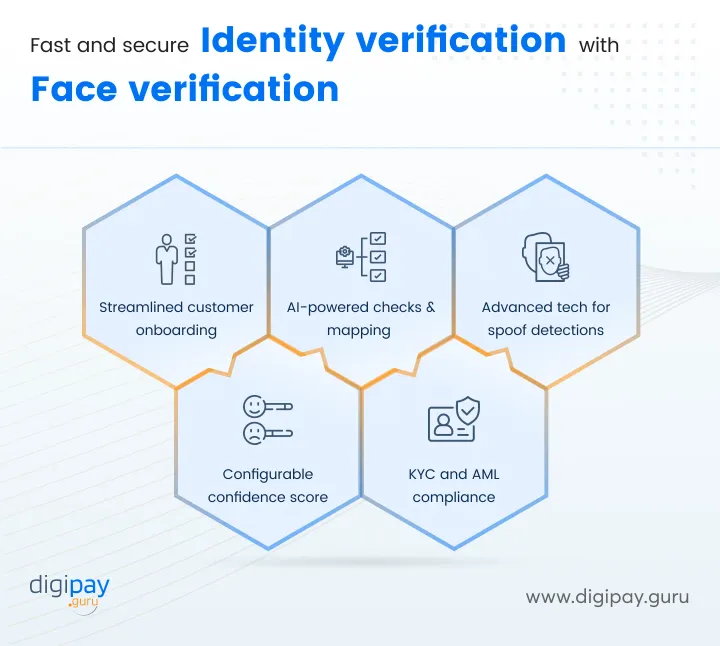

Streamlined customer onboarding

Face verification automates the verification of identities with AI algorithms. This significantly reduces the time and effort required for customer onboarding.

Customers can complete the verification process remotely & within seconds using their mobile device. This eliminates the need for in-person interactions or lengthy manual KYC processes.

This streamlined approach enhances the overall customer experience and enables you to onboard new customers quickly and efficiently.

AI-powered checks and mapping

Face verification leverages cutting-edge AI algorithms to perform accurate and reliable facial comparisons.

These algorithms can detect minute details and variations in facial features to ensure a high degree of accuracy in matching the live facial capture with the ID document photo.

Additionally, AI-powered mapping techniques can extract and analyze specific facial features and further enhance the verification process's reliability.

Advanced tech for detecting spoofs fast

Face verification offers advanced technologies that detect spoofs instantly. The spoof-detecting technologies include liveness detection, 3D mask attack detection, presentation attack detection, bypass detection, and many more.

Let’s understand how they help in fraud detection and offer a secure ID verification process:

1. Liveness detection

Liveness detection technology ensures that the facial capture is from a live person and not a static image, video replay, or other forms of presentation attacks.

This is typically achieved by capturing live biometric data and analyzing subtle facial movements, micro-expressions, eye blinking patterns, and gestures, or by prompting the user to perform specific actions during the capture process.

2. 3D mask attack detection

Sophisticated algorithms can detect and prevent 3D mask attacks, where a physical 3D model of a face is used to bypass the verification process. This includes 3D masks made of silicone, latex, plastic, cloth, and more.

The facial authentication algorithms analyze various facial depth and texture patterns to identify and reject such attempts and spoof attacks.

3. Presentation attack detection

Presentation attack detection (PAD) technologies can identify and mitigate various types of presentation attacks, such as printed photos, 2D printed photos, cut-out paper masks, & hi-res digital photos/videos, or other forms of impersonation attempts.

PAD algorithms analyze various cues and patterns to distinguish between genuine and fabricated facial presentations.

4. Bypass attack detection

Facial verification also employs techniques to detect and prevent bypass attacks. Where an attacker attempts to bypass the verification process by exploiting vulnerabilities or flaws in the system.

It automatically identifies spoof attacks that are aimed to bypass the camera, such as pre-recorded, synthetic, and deep fake videos.

The technologies incorporated in face verification continuously monitor and analyze the verification process for any anomalies or suspicious activities.

Configurable confidence score

Face verification often provides configurable confidence scores. It allows businesses to adjust the level of strictness or leniency. This is typically based on their specific risk tolerance and compliance requirements.

Higher confidence scores indicate a higher degree of certainty in the ID verification process while lower scores may warrant additional checks or manual review.

Compliance with KYC and AML standards

Face verification is designed to comply with various regulatory frameworks, such as KYC and AML regulations.

By accurately verifying identities and detecting fraudulent activities, it helps you meet your compliance obligations and mitigate the risks associated with financial crimes and illegal activities.

With the above-mentioned benefits and features, the face verification feature of the Digital KYC solution guarantees that your facial identification process remains fast and secure.

How DigiPay.Guru can help?

DigiPay.Guru is a leading eKYC solution provider in the fintech space. Our eKYC solution ensures fast, reliable, and secure identity verification while onboarding your customers.

From us, you get a robust eKYC solution with AI-driven advanced features. One of the most significant features you get is ‘face verification’.

It offers advanced security features like:

- Liveness detection

- 3D mask attack detection

- Presentation attack detection

- Bypass attack detection

- Configurable confidence score

- Near passive user action

- User guidance and feedback to help end-users complete liveness checks quickly.

- Accessibility compliance like WCAG 2.1 for colored screens

- And more

Oh, by the way, our eKYC solution is available in two models:license and SaaS. You can opt for a version that suits your current business requirements.

Conclusion

eKYC solution is foolproof due to face verification! Face verification makes the identity verification process simple, fast, and secure with its advanced technology and features. Face verification identifies users and detects suspicious activities and spoofs in just seconds. It makes face verification a must-have feature in an eKYC solution.

So, if you are a bank or a business looking for a secure and reliable eKYC solution, look for a solution with face verification. And if you find an eKYC solution with an advanced feature of face verification then you found the best eKYC solution.

With eKYC implementation into your system, you can experience seamless customer onboarding, advanced fraud detection, and robust KYC and AML compliance.