Digital onboarding is now a strategic priority for banks, fintechs, and financial institutions like yours. And your customers expect to open accounts, activate digital wallets, or access payment services without visiting a branch.

At the same time, you must meet strict regulatory standards for identity verification and fraud prevention, especially during eKYC processes.

Yet, many digital onboarding flows still create friction. And when identity checks are slow, confusing, or overly complex, customers don’t wait.

In fact, research shows that up to 40% of consumers abandon the onboarding process in financial services due to friction and lengthy KYC checks.

That’s a real business challenge, not just a user experience issue. Because slow or incomplete verification means lost customers, wasted acquisition spend, and weaker growth.

This is where face recognition in eKYC plays a vital role. It allows you to verify identities quickly and remotely, thereby strengthening both compliance and customer experience without unnecessary delays.

In this blog, you’ll learn how face recognition works within eKYC, where it adds real value, and how it supports secure, scalable digital onboarding for regulated institutions.

Let’s get started with the basics!

What is KYC Verification and eKYC?

Before we talk about face recognition, you need clarity on the foundation. That is, you need to understand what KYC and EKYC are.

Know Your Customer (KYC) is the process financial institutions use to verify a customer’s identity before offering services. It exists to prevent fraud, money laundering, and identity misuse. And regulators expect this process to be consistent, auditable, and risk-aware.

In contrast, traditional KYC relies heavily on physical documents and in-person verification. That approach worked when onboarding volumes were low and customer expectations were different. And it does not scale in a digital-first world.

But, electronic KYC (eKYC) modernises this process. It uses digital documents, biometric eKYC verification, and automated checks to complete identity verification remotely. And for banks and fintechs offering digital wallets or payment services, eKYC is now a practical necessity.

The key differences between traditional KYC and eKYC are:

| Aspect | Traditional KYC | eKYC |

|---|---|---|

| Verification mode | Physical documents | Digital & biometric |

| Customer onboarding | In-person | Remote |

| Processing time | Days | Minutes |

| Scalability | Limited | High |

This shift from physical to digital verification is what enables facial recognition to play a meaningful role.

What is Face Recognition in eKYC?

Face recognition in eKYC is a biometric method used to verify a person’s identity by analysing facial features. It compares a live facial image, usually a selfie, against trusted identity data such as an ID document or an existing biometric record.

This is not the same as simply detecting a face. And it is not just image capture. It is a structured identity verification process.

And modern eKYC face recognition systems use artificial intelligence to:

- Detect a real human face

- Perform liveness checks

- Extract biometric features

- Match those features securely

For digital onboarding, this method offers a rare balance.

- You gain speed without weakening control.

- You reduce fraud risk without adding friction.

That is why facial recognition eKYC has become central to identity verification services used by banks, fintechs, and payment providers like yours.

Why Does Face Recognition Matter for eKYC Identity Verification?

Every onboarding process faces four recurring problems:

-

Identity fraud is getting smarter.

-

Manual checks slow operations.

-

Customers abandon long onboarding journeys.

-

Compliance teams face increasing pressure.

The good news is: Face recognition directly addresses these challenges.

But when you rely only on documents, you leave room for impersonation. And when verification takes too long, your customers leave. Plus, when fraud slips through, costs rise, and trust erodes.

Here’s the real impact of face identity recognition on digital onboarding:

| Metric | Without Face Recognition | With Face Recognition |

|---|---|---|

| Onboarding time | Long | Instant |

| Drop-off rate | High | Low |

| Fraud exposure | Medium | Low |

| Operational cost | High | Reduced |

This is not about technology for its own sake. It is about operational resilience.

Facial Recognition eKYC: Streamlining Digital Customer Onboarding

Digital onboarding succeeds when it feels invisible to the customer and reliable to regulators.

Facial recognition helps you reach that balance.

With facial recognition, your customers can complete identity verification using a simple face scan without the need for a branch visit or any paperwork loop. The process fits naturally into mobile-first experiences.

From an operational perspective, you can reduce dependency on manual review teams. And from a compliance perspective, you gain consistent and auditable verification outcomes.

Impact of Face Recognition on Onboarding Efficiency

It impacts the overall onboarding efficiency of the business. Here’s how:

- Faster account activation for digital wallets

- Higher completion rates across devices

- Reduced human error in identity checks

- Consistent verification across regions

For businesses like yours, which offer digital payment services, these gains compound over time.

How Facial Recognition in eKYC Works

Understanding the process of facial recognition builds trust. So, you should know exactly what happens behind the scenes.

Here’s how face recognition in eKYC works:

| Metric | Without Face Recognition | With Face Recognition |

|---|---|---|

| Onboarding time | Long | Instant |

| Drop-off rate | High | Low |

| Fraud exposure | Medium | Low |

| Operational cost | High | Reduced |

Each of these steps serves a specific purpose:

- Face detection ensures the image contains a valid face.

- Liveness checks confirm the presence of a real person, not a photo or video replay.

- Feature extraction converts facial characteristics into a secure biometric template.

- And matching compares that template against verified identity data.

This layered approach is what makes eKYC face verification reliable at scale.

Main Applications of Face Recognition in eKYC

Face recognition is not limited to onboarding alone. You can use it across multiple identity touchpoints:

- Digital wallet registration

- Payment account creation

- Re-KYC and periodic verification

- High-risk transaction confirmation

- Account recovery and access control

For businesses like yours that manage digital wallets, face recognition strengthens identity assurance throughout the customer lifecycle.

Read More: Face verification: Fast & safe identity verification process

Advantages of Using Facial Recognition in eKYC

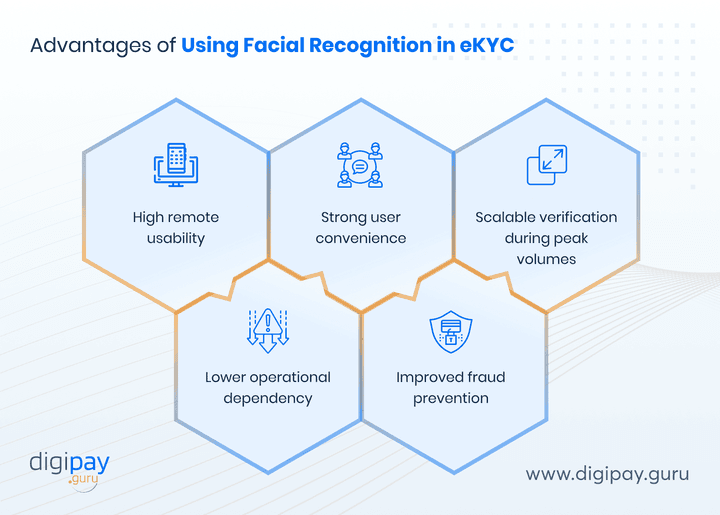

The benefits of facial recognition extend beyond speed. Face-based eKYC offers essential advantages like:

High Remote Usability: Facial recognition allows you to verify customer identities entirely online using standard devices. This supports remote onboarding without branch visits or specialised hardware.

Strong User Convenience: Customers complete eKYC through a simple face scan instead of multiple document uploads. This reduces effort and makes the eKYC verification process easier to complete.

Scalable Verification During Peak Volumes: Face-based eKYC automates identity checks even during high onboarding demand. This way, you can handle large volumes without compromising verification speed or accuracy.

Lower Operational Dependency: Automated facial recognition reduces reliance on manual verification teams. This helps you control operational costs while maintaining consistent identity checks.

Improved Fraud Prevention: Liveness detection and biometric matching ensure a real person is present during verification. This reduces the risk of impersonation and identity fraud.

Unlike hardware-dependent biometrics, facial authentication works on standard consumer devices. That matters when you operate across regions with varied infrastructure.

Face Recognition vs Other Biometric Technologies for KYC

Choosing the right biometric method is a strategic decision. Here’s a quick comparison between the top biometric technologies and face recognition:

| Criteria | Face Recognition | Fingerprint | Iris Scan |

|---|---|---|---|

| Remote usability | High | Low | Medium |

| User convenience | High | Medium | Low |

| Scalability | High | Medium | Low |

| Hardware dependency | Low | High | High |

In all, face recognition stands out because it supports remote onboarding at scale. That is why it fits naturally into digital onboarding solutions for banks and fintechs like yours.

Challenges of Using Face Recognition in eKYC

No technology is without challenges. And ignoring them can weaken credibility.

The common concerns using face recognition in eKYC include:

- Spoofing attempts using photos or videos

- Bias and accuracy across demographics

- Data privacy and biometric storage

- Regulatory scrutiny

These challenges are real. But they are also solvable.

Strong liveness detection, AI-driven verification, and privacy-first architecture address most risks effectively.

Is Face Recognition Secure for eKYC Processes?

Security of face recognition depends on the implementation process. Modern AI face recognition systems combine advanced security features like:

- Active and passive liveness detection

- Multi-layer verification checks

- Encrypted biometric storage

- Audit-ready verification logs

When deployed correctly, face recognition reduces fraud exposure while supporting compliance requirements. It strengthens, not weakens, your identity verification system.

Industry Insights: How Businesses Benefit from Face Recognition eKYC

Face recognition in eKYC delivers measurable value across industries where secure and scalable identity verification is essential.

While the use cases differ, the underlying benefits remain consistent: faster onboarding, lower fraud risk, and improved operational efficiency.

Here are industry-wise benefits from face recognition in eKYC:

| Industry | Business Benefit |

|---|---|

| Banking | Faster account opening |

| Fintech platforms | Reduced fraud |

| Insurance | Instant policy issuance |

| Payments | Secure onboarding |

Beyond these outcomes, varied businesses also see broader operational improvements:

- Banks reduce onboarding timelines while meeting strict KYC requirements without increasing manual reviews.

- Fintech platforms strengthen identity verification during rapid user growth, while helping control fraud at scale.

- Insurance providers verify customer identities instantly, thereby enabling faster policy activation and better customer experience.

- Payment companies secure digital wallet onboarding while maintaining compliance across high transaction volumes.

By adopting face recognition eKYC, financial businesses like yours improve both compliance confidence and customer conversion without adding friction to digital onboarding.

Real-World Use Cases of Facial Recognition eKYC

Facial recognition eKYC is widely used in industries where fast, secure, and remote identity verification is critical. It supports digital onboarding without increasing compliance risk or operational overhead.

Common real-world use cases include:

- Banks use facial recognition to onboard customers remotely while meeting KYC requirements for account opening and digital wallet activation.

- Fintech platforms apply face-based eKYC to verify users quickly during app sign-ups, reducing identity fraud and improving onboarding completion rates.

- Payment service providers rely on facial verification to secure wallet registrations and prevent unauthorised access to payment services.

- Insurance companies use facial recognition to verify policyholders digitally, enabling faster policy issuance and claims processing.

Across these use cases, facial recognition strengthens identity assurance, reduces manual checks, and supports scalable digital growth, especially in high-volume onboarding environments.

How DigiPay.Guru Helps with Facial Recognition eKYC

DigiPay.Guru offers an end-to-end eKYC solution designed for banks, fintechs, and financial institutions offering digital wallets and payment services.

With our solution, you get:

- AI-powered face recognition with liveness detection

- Configurable eKYC workflows aligned with regulations

- Secure biometric handling and audit readiness

- Seamless integration into digital wallet onboarding

- Scalability across regions and customer volumes

This way, the focus stays on secure identity verification that supports long-term digital growth.

Conclusion

Face recognition has become a practical requirement in modern eKYC. As digital wallets, payment services, and remote onboarding continue to grow, you need identity verification methods that balance speed, security, and regulatory compliance.

And relying on manual or document-heavy processes alone often leads to delays, higher costs, and customer drop-offs. Plus, the industry research shows that up to 40% of users abandon digital onboarding when identity verification feels slow or complicated, making efficient eKYC critical for growth.

Facial recognition addresses this challenge by enabling real-time, remote identity verification while strengthening fraud controls. When combined with liveness detection and audit-ready workflows, it supports both customer experience and compliance expectations.

To implement this effectively, the technology partner matters. The good news is: DigiPay.Guru offers an advanced eKYC solution with AI-powered face recognition designed for banks, fintechs, and financial institutions like yours.

It helps you onboard customers securely, scale digital wallet adoption, and meet regulatory requirements without adding friction to the user journey.

FAQs

Face recognition in eKYC is a biometric method that verifies a customer’s identity using facial features. It enables remote identity verification through a live face scan during digital onboarding.

KYC relies on physical documents and in-person verification, while eKYC uses digital documents and biometric checks. eKYC allows faster, remote, and more scalable identity verification.

The system captures a live facial image, performs liveness detection, and matches biometric data against verified identity records. This confirms that the person is genuine and present.

Accuracy depends on the AI models, image quality, and liveness detection used. When implemented correctly, face recognition delivers high accuracy suitable for regulated environments.

Yes, when combined with liveness detection, encrypted data handling, and audit trails. These controls help meet security and compliance requirements in financial services.

Liveness detection confirms that a real person is present during verification. It blocks spoofing attempts using photos, videos, or pre-recorded images.

For remote and large-scale onboarding, face recognition is more practical. It works on standard devices and does not require specialised hardware.

Banking, fintech, payments, and insurance lead adoption. These industries rely on secure, high-volume digital onboarding and strong identity verification controls.