With digitalization, digital payments are increasing rapidly, resulting in a widespread adaptation of the current digital environment. One such adaptation is the rise of virtual cards.

Verification of Identity has become a must for every business. The fraud and security risks have increased so much over the years, that we can’t go without verification. And in today's rapidly evolving digital landscape, businesses face the critical challenge of maintaining robust security measures while ensuring a seamless customer experience.

Businesses are constantly seeking ways to streamline their processes, enhance security, and deliver seamless experiences to their customers. One critical aspect that plays a pivotal role in achieving these goals is the implementation of electronic Know Your Customer (eKYC) solutions.

Did you know that by 2030, the global eKYC market is projected to reach a staggering $2792 billion, with a compound annual growth rate (CAGR) of 21.55%?

The above statistics make it clear that businesses across industries are recognizing the immense potential of eKYC solutions to revolutionize their operations. And so implementing them into your business would be a smarter move.

In this blog post, we are going to explore the basics of eKYC solutions, how it works, their benefits, key components, implementing eKYC solutions, and the best practices for eKYC implementation.

What is eKYC and How Does it Work?

What is eKYC?

“eKYC, or electronic Know Your Customer, refers to the digital verification process that businesses use to confirm the identities of their customers..”

Imagine you want to open a new bank account. In the past, you would have to visit a bank branch, fill out numerous forms, provide KYC documents, and wait for the verification process to be completed manually. With eKYC, the entire process can be accomplished online, saving time and offering a convenient experience for both the customer and the business.

How does it work?

-

The eKYC process typically involves collecting personal information and supporting documents from the customer, which may include government-issued identification cards, passports, or other relevant documents.

-

The customer's information is then electronically validated and verified against trusted databases or sources, such as government records or credit bureaus.

-

To initiate the eKYC process, a customer usually needs to provide their personal information through an online application or a mobile app.

-

The collected data is securely transmitted to the service provider, who then performs the necessary identity checks using automated systems or manual review processes.

Why Does Your Business Need an eKYC Solution - Key Benefits

In the ever-evolving digital era, businesses must adapt to the changing landscape to stay competitive and secure. When it comes to verifying customer identities, traditional manual processes are no longer sufficient. This is where implementing an electronic Know Your Customer (eKYC) solution becomes essential.

Let's explore the key advantages of KYC viz. eKYC Solution for your business

Efficiency and Effectiveness of Process

-

Streamlined Onboarding: It automates the eKYC verification process, reducing manual effort and paperwork, and thereby speeding up customer onboarding.

-

Real-time Results: With eKYC, verification happens in real-time, enabling swift decision-making and reducing wait times for customers.

Improved Customer Experience

-

Convenience and Accessibility: By allowing customers to verify their identities remotely, eKYC eliminates the need for in-person visits or sending physical documents, resulting in a frictionless and hassle-free experience.

-

Seamless Digital Journey: Implementing eKYC ensures a smooth transition from online application to account activation, enhancing customer satisfaction and loyalty.

Reduced Risk of Fraud

-

Enhanced Security: One of the key benefits of eKYC is that eKYC solutions employ advanced technologies, such as biometrics and document verification, to ensure the authenticity of customer identities, minimizing the risk of fraudulent activities.

-

Compliance with Regulations: Implementing eKYC helps businesses meet regulatory requirements, ensuring adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations.

Reduced Caseload

-

Automation and Scalability: eKYC solutions automate the verification process, allowing businesses to handle a larger volume of customers without increasing staffing requirements.

-

Time and Cost Savings: By eliminating manual processes and paperwork, eKYC reduces operational costs and frees up resources, enabling businesses to focus on core activities.

Data-driven Insights

eKYC solutions provide valuable data and insights on customer demographics and behavior, helping businesses make informed decisions and tailor their services accordingly.

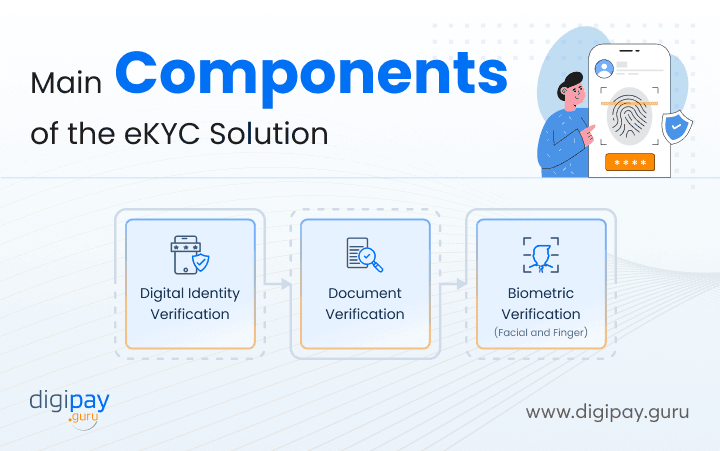

Key Components of the eKYC Solution

When it comes to implementing an electronic Know Your Customer (eKYC) solution, understanding its key components is crucial. These components work together to ensure secure and efficient eKYC verification.

Let's explore the essential elements of an eKYC solution in a simple and user-friendly manner.

Digital Identity Verification

-

Biometrics: Advanced biometric technologies such as facial recognition, fingerprint scanning, and iris scanning are employed to verify the authenticity of an individual's identity.

-

One-Time Passwords (OTPs): Secure OTPs are used to authenticate customers during the eKYC verification process, providing an additional layer of security.

Document Verification

-

Document Types: eKYC solutions utilize various identification documents, including passports, driver's licenses, and national identification cards, to establish the identity of customers.

-

Validation and Authentication: The system validates and authenticates the submitted documents by cross-referencing them with trusted databases, performing optical character recognition (OCR) checks, and detecting any signs of tampering or forgery.

Biometric Verification (Facial and Finger)

-

Facial Recognition: Facial recognition technology analyzes unique facial features to verify an individual's identity. It compares the person's live image or a photo captured during the eKYC process with the photo on their identification document.

-

Fingerprint Scanning: Fingerprint biometrics are captured and compared against existing records to confirm the person's identity. This method provides a high level of accuracy and reliability. This eKYC solution is very popular among digital payment solutions for better payment authentication before payments.

Read more: How can biometric technology drive ease & security in digital payments

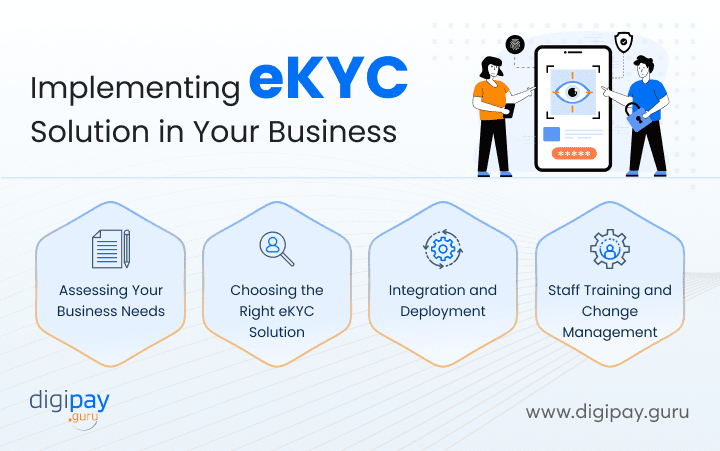

Implementing eKYC Solution in Your Business

In the quest for enhanced security, streamlined operations, and improved customer experiences, businesses are increasingly turning to utilize the benefits of eKYC solutions. However, successfully implementing an eKYC solution requires careful planning and execution.

Let's explore the key steps involved in integrating eKYC into your business seamlessly.

Assessing Your Business Needs

-

Identify Pain Points: Evaluate your current identity verification processes and pinpoint the pain points, bottlenecks, and challenges that an eKYC solution can address.

-

Compliance Requirements: Understand the specific regulatory and legal requirements relevant to your industry to ensure your eKYC solution aligns with compliance standards.

Choosing the Right eKYC Solution

-

Research Solution Providers: Conduct thorough research and explore different eKYC solution providers, considering factors such as reputation, reliability, scalability, and compatibility with your existing systems.

-

Features and Integration: Evaluate the features, functionalities, and integration capabilities of the eKyc solution providers can provide, ensuring they meet your specific business needs.

Integration and Deployment

-

Plan the Integration Process: Create a comprehensive integration plan, considering factors such as data migration, system compatibility, and potential disruptions to existing workflows.

-

Collaborate with IT Team: Work closely with your IT team or eKyc solution providers to seamlessly integrate the eKYC solution into your existing infrastructure while minimizing any operational disruptions.

Staff Training and Change Management

-

Training Employees: Provide thorough training to your staff members involved in the eKYC process, ensuring they are well-versed in using the solution and understand the benefits of eKYC.

-

Change Management Strategies: Implement change management strategies to ensure the smooth adoption of the new eKYC solution, including clear communication, addressing concerns, and providing ongoing support.

Best Practices for Successful eKYC Implementation

Implementing an electronic Know Your Customer (eKYC) solution is a significant step towards enhancing security, streamlining operations, and ensuring compliance. To ensure a successful eKYC implementation, it is essential to follow best practices that promote efficiency, transparency, and data protection.

Let's explore these best practices in a simple and user-friendly manner.

Clear Communication with Customers

-

Informative and Transparent: Clearly communicate the eKYC process to customers, explaining its purpose, benefits, and the data required for eKYC verification. Address any concerns or questions they may have to build trust and confidence.

-

User-Friendly Experience: Design the eKYC process to be intuitive and user-friendly, ensuring a seamless customer experience. Provide step-by-step instructions and offer support channels for assistance, if needed.

Data Security and Privacy

-

Compliance with Regulations: Adhere to data protection regulations such as the General Data Protection Regulation (GDPR) or any industry-specific guidelines. Safeguard customer data and ensure its confidentiality, integrity, and availability.

-

Encryption and Secure Storage: Utilize strong encryption protocols to protect sensitive customer information both in transit and at rest. Implement secure storage practices and access controls to prevent unauthorized access.

Regular Audits and Monitoring

-

Periodic Audits: Conduct regular audits of the eKYC system to assess its accuracy, reliability, and compliance. Identify and rectify any potential vulnerabilities or weaknesses in the process.

-

Fraud Detection and Monitoring: Implement robust monitoring mechanisms to detect and prevent fraudulent activities. Monitor for suspicious patterns, unusual behavior, or discrepancies in the eKYC process.

Continuous Improvements and Updates

-

Stay Updated: Keep abreast of evolving regulations, industry trends, and advancements in eKYC technology. Continuously evaluate and update your eKYC solution to align with the latest standards and best practices.

-

User Feedback and Iteration: Gather feedback from users and stakeholders to identify areas for improvement. Regularly refine and optimize the eKYC process based on feedback and changing business needs.

Conclusion

Implementing an electronic Know Your Customer (eKYC) solution is no longer just an option; it is a necessity for businesses seeking enhanced security, streamlined processes, and improved customer experiences. By embracing the power of eKYC, you can unlock a world of benefits, including increased efficiency, reduced fraud risks, and compliance with regulatory requirements.

As you embark on your eKYC journey, remember that choosing the right solution is crucial. With DigiPay.Guru’s industry-leading eKYC solution, you can rest assured that your business will thrive in a secure and compliant environment.