Credit is no longer what it used to be. Traditional credit cards and personal loans feel outdated to modern consumers. Plus, your customers are frustrated with high interest rates, hidden fees, and rigid repayment schedules.

As a business in the financial space, you’re also under pressure to attract younger customers, improve merchant relationships, and compete with agile digital-first players.

This is exactly where Buy Now Pay Later (BNPL) is rewriting the rules of credit.

Customers love it because they can buy what they want now, split the cost into easy installments, and avoid long-term debt. Merchants love it because BNPL users spend more and shop more often.

And for you, the BNPL model offers a chance to increase revenue, capture market share, and build stronger customer loyalty.

In this blog, you’ll learn exactly what BNPL is, how it works, why it’s so popular, and how you can implement it in your business.

Let’s start by understanding what BNPL really means and why it’s reshaping the financial industry.

Understanding Buy Now, Pay Later (BNPL)

Before we dive any further, you need to understand the clear and simple meaning of BNPL. It’s as below:

What is Buy Now, Pay Later (BNPL)?

Buy Now Pay Later (BNPL) is a payment service that lets your customers buy products or services now and pay for them later in easy & scheduled installments.

Unlike traditional credit cards or personal loans, BNPL loans are short-term and often interest-free if customers make their payments on time.

This model works well because it feels simple and transparent to consumers. They know exactly what they’ll pay and when. This transparency is a big reason why BNPL users continue to grow year after year. The best example of BNPL is Amazon Pay Later. Here, the user can buy anything from Amazon and can pay for it later (on a particular date of the next month), or if taken in installments, then the user has to pay EMI every month till the decided period.

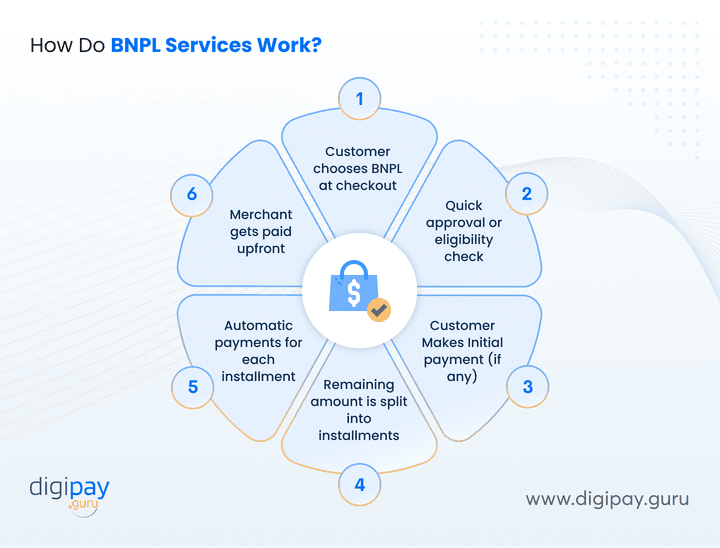

How Do BNPL Services Work?

At its core, BNPL is designed to be simple and frictionless for customers and merchants. Here’s how the process typically works:

-

Step 1: Customer chooses BNPL at checkout: At the point of sale (online or in-store), the customer selects a BNPL option instead of paying the full amount upfront.

-

Step 2: Quick approval or eligibility check: A basic credit check or risk assessment is done instantly to determine if the customer qualifies.

-

Step 3: Initial payment (if any): The customer might pay a small upfront installment or nothing at all, depending on the plan.

-

Step 4: Remaining amount is split into installments: The remaining balance is divided into equal payments over a fixed schedule (e.g., 3, 4, or 6 months).

-

Step 5: Automatic payments: Installments are automatically deducted from the customer’s bank account, debit card, or buy now pay later apps.

-

Step 6: Merchant gets paid upfront: The BNPL provider pays the merchant in full (minus a small processing fee), so the business gets cash flow immediately.

Why does this model work so well?

-

For customers, the experience feels seamless and low-pressure.

-

They can take home their purchase right away

-

And pay overtime without the feeling of taking on heavy debt

For businesses, there’s no waiting for full payments or worrying about defaults. The BNPL provider assumes the risk and handles collections, which makes it an attractive option for merchants of all sizes. This straightforward process is one of the biggest reasons why BNPL services have become so popular globally.

Now that you know how it works, let’s explore why it’s so appealing to customers and businesses alike.

Key Benefits of BNPL (For All Stakeholders)

The benefits of BNPL are numerous for every stakeholder. Let’s explore them one after another:

For Customers:

-

With BNPL, customers do not require any upfront payment, which makes it easier for them to buy what they need immediately without delay.

-

Transparent and predictable repayment schedules ensure customers know exactly how much they owe and when to pay.

-

Reduced reliance on credit cards, which helps customers avoid high interest rates and revolving credit card debt traps.

For Businesses (merchants):

-

Significant increase in average order value (AOV) as customers feel more comfortable purchasing higher-value items.

-

Improved checkout conversion rates by reducing friction at the point of sale and eliminating cost-related hesitations.

-

Stronger customer loyalty and retention because BNPL creates a convenient and affordable shopping experience that customers appreciate.

For Banks and Fintechs (you):

-

Attract new customer segments, especially younger audiences, who prefer flexible short-term credit options over traditional loans.

-

Unlock new revenue streams through merchant fees, partnerships, and longer-term BNPL loans generating interest income.

-

Gain valuable BNPL data insights, including repayment behaviors, spending patterns, and credit histories for better decision-making.

BNPL Adoption and Suitability

The suitability and adoption of Buy Now Pay Later can come with varied factors. Let’s begin by understanding why it's suitable for modern customers:

Why is the BNPL Model Suitable for Today’s Customers?

Modern customers want more control over how they manage their money. They are cautious about taking on long-term debt and prefer solutions that are simple, transparent, and flexible.

This is why the BNPL model fits perfectly into their lifestyles:

-

Gives instant access without full payment upfront, which makes it easier for customers to purchase products they need right away.

-

Provides clear repayment schedules, which help customers budget better and avoid unexpected charges or hidden fees.

-

Reduces dependency on credit cards, which many customers avoid due to high interest rates and complex terms.

-

Appeals to younger generations, who are more comfortable using digital financial services and prefer short-term, manageable loans.

-

Supports financial confidence, as customers feel empowered to make purchases without overextending their finances.

This suitability is why BNPL usage continues to rise globally, with customers actively seeking merchants and financial institutions that offer these options.

Is BNPL Right for Your Business?

Before you decide to adopt the BNPL model, it’s important to evaluate whether it aligns with your business goals and customer needs.

BNPL is not a one-size-fits-all solution, but when implemented strategically, it can drive growth, improve cash flow, and build stronger relationships with customers.

BNPL is a strong fit if:

-

Your average order value is moderate to high, which makes installments more attractive to customers.

-

You serve digital-first or younger customers who prefer flexible and simple payment options over traditional credit.

-

You want to reduce cart abandonment, as BNPL removes cost-related barriers at checkout.

-

You aim to build repeat purchase behavior, since customers who use BNPL often return to buy again.

-

You’re seeking to expand your customer base, particularly by reaching people who lack access to traditional credit cards or loans.

When these conditions are met, BNPL can become a powerful tool to boost sales and customer satisfaction.

Adoption Trends for BNPL Models Globally

The popularity of the Buy Now, Pay Later (BNPL) model is real, and the numbers prove it. Consumers are adopting BNPL at record levels, and regulators are taking notice. Here’s the latest snapshot:

Global Snapshot

-

BNPL accounted for 5% of global e-commerce payments in 2024, up from 2.9% in 2021, according to the Worldpay Global Payments Report 2025.

-

In-store BNPL usage grew by 30% in 2024 as more merchants integrated BNPL into their point-of-sale (POS) systems (Worldpay GPR 2025).

United States

-

The Consumer Financial Protection Bureau (CFPB) BNPL Report—January 2025 showed that BNPL loan volume has more than doubled in the U.S. since 2021.

-

60% of BNPL users are aged 18–34, making it a favorite among younger consumers (CFPB 2025).

United Kingdom & Europe

-

The UK Government and FCA announced that BNPL providers will be regulated by the Financial Conduct Authority (FCA) by July 2026. Providers will be required to conduct affordability checks and register under FCA oversight.

-

This change will improve consumer protection and encourage responsible lending practices.

Africa

-

The GSMA State of the Industry Report on Mobile Money 2025 highlights 500 million+ active mobile money users, which makes Africa a huge growth market for BNPL.

-

Countries like Kenya, Nigeria, and South Africa are seeing demand surge as BNPL helps unbanked customers access short-term credit through mobile wallets.

Implementing BNPL in Your Business

Knowing BNPL was the easy part. The main thing is implementing BNPL in your business. Let’s start by getting to know the 5 key ways to adopt Pay Later Apps in your business.

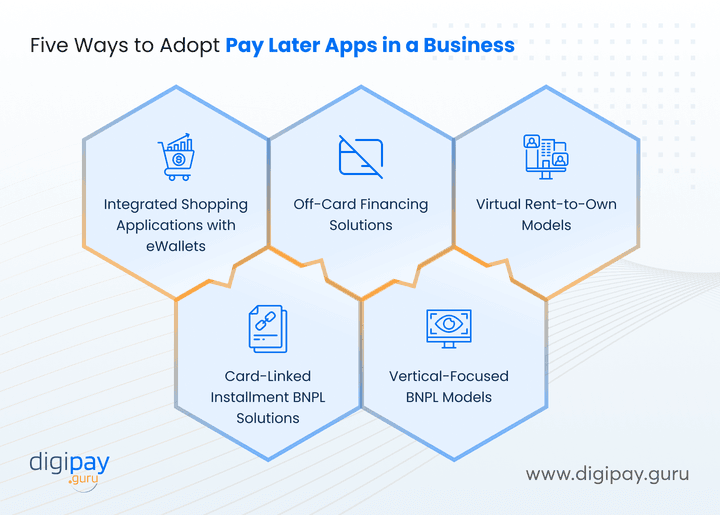

Five Ways to Adopt Pay Later Apps in a Business

There’s no single way to implement the Buy Now, Pay Later (BNPL) model. Depending on your customer base, product mix, and industry, you can choose from several approaches.

Here are five effective ways to integrate pay later apps into your business:

1. Integrated Shopping Applications with eWallets

You can embed BNPL directly into your existing eWallet or mobile banking app. Because customers see the BNPL option during checkout and choose to split payments instantly.

Why this works:

-

It creates a seamless experience for customers already using your app for payments.

-

You gain control over the customer journey and can build stronger engagement.

-

You can cross-sell other financial products within the same ecosystem.

2. Off-Card Financing Solutions

Off-card BNPL solutions work outside traditional credit card or debit card rails. This means that customers link their bank accounts or mobile wallets, and the BNPL provider manages repayments directly.

Why this works:

-

It’s a good option for unbanked or underbanked customers who don’t have credit cards.

-

Reduces dependency on card networks, thereby lowering processing costs.

-

Provides greater flexibility in designing repayment schedules.

3. Virtual Rent-to-Own Models

This model is popular for high-value products such as electronics, appliances, or furniture.

Here, customers can take the product home immediately and pay in installments. But, if they default, the item may be reclaimed, similar to traditional rent-to-own arrangements.

Why this works:

-

Attracts customers who need big-ticket items but don’t have enough upfront funds.

-

Mitigates your risk by tying repayments to the product’s ownership.

-

Increases conversion rates for expensive purchases.

4. Card-Linked Installment BNPL Solutions

With this approach, customers use their existing debit or credit cards at checkout, and the payment is automatically split into installments by the BNPL provider.

Why this works:

-

Easy for customers to adopt because it uses their existing payment method.

-

Requires minimal setup for merchants, as it leverages card networks.

-

Builds trust since customers are already familiar with their card issuers.

5. Vertical-Focused BNPL Models

This model customizes BNPL offerings for specific industries such as travel, healthcare, education, or automotive. For instance, a healthcare BNPL plan could allow patients to split the cost of medical procedures over time.

Why this works:

-

Addresses industry-specific pain points, thereby increasing adoption.

-

Helps businesses differentiate themselves with tailored solutions.

-

Can be co-branded with industry partners for stronger market penetration.

-

These five approaches give you the flexibility to choose the BNPL strategy that aligns with your customer base and business goals.

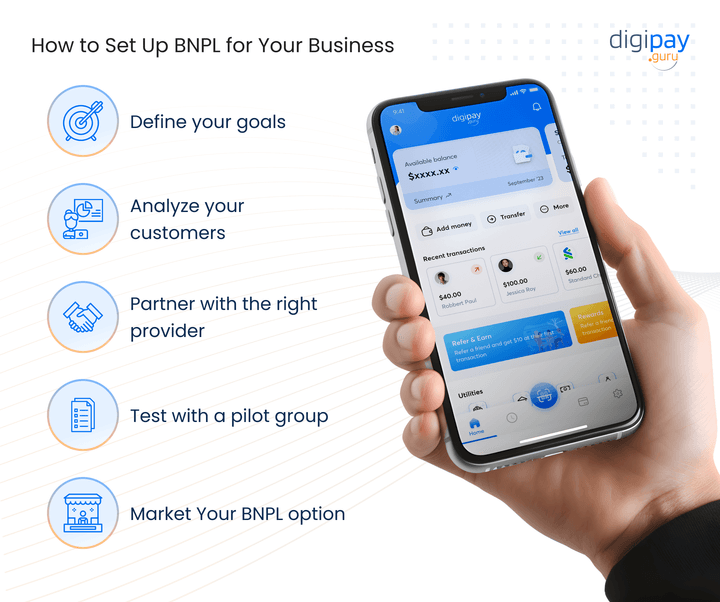

How to Set Up BNPL for Your Business (Step-by-Step)

Getting started with the BNPL model doesn’t have to be overwhelming.

Follow these steps to set up a pay-later option that fits your business goals, keeps customers happy, and stays compliant with regulations.

1. Define your goals: Are you focused on higher sales, better customer loyalty, or new customer acquisition?

2. Analyze your customers: Are they comfortable with digital payments? What’s their credit history?

3.Partner with the right provider: Look for scalability and compliance.

4. Test with a pilot group: Start small, monitor repayment trends, and fine-tune your risk models.

5. Roll out widely: Market your BNPL option heavily to merchants and customers.

Regulatory and Compliance Issues

Before you launch a BNPL solution, it’s critical to understand the legal and regulatory requirements that govern this model in your market.

Are There Regulatory Roadblocks to Implementing BNPL Software?

The BNPL space is under increasing regulatory scrutiny. Authorities like the Consumer Financial Protection Bureau (CFPB) in the US and the FCA in the UK are focusing on:

-

Transparent disclosures

-

Strong affordability checks, and

-

Reporting missed payments to credit reporting bureaus

The Sum and Substance of the BNPL Regulatory Landscape

The regulatory environment for the Buy Now, Pay Later (BNPL) model is evolving rapidly across the globe. Authorities are introducing measures to ensure customers don’t take on unmanageable debt and that providers operate responsibly.

Here’s what you need to know:

-

Affordability checks are now standard: Most regulators require BNPL providers to assess whether a customer can realistically repay before approving loans.

-

Clear disclosures are mandatory: Customers must understand repayment terms, late fees, and any potential impact on their credit score.

-

Credit bureau reporting is growing: Missed and on-time payments are increasingly reported to credit bureaus, directly affecting credit reports and FICO scores.

-

Licensing is required in several markets: Countries like Australia and the UK are mandating BNPL providers to hold credit licenses and join formal complaint schemes.

Bottom line: if you’re adopting BNPL, compliance must be a priority. Not only does it protect your customers, but it also strengthens trust in your brand and avoids legal complications down the road.

How DigiPay.Guru Can Help You Launch BNPL Successfully

At DigiPay.Guru, we help banks, fintechs, and financial institutions launch BNPL solutions fast, without compromising on compliance or user experience.

Here’s how we can support you:

-

Speed to market: Pre-built integrations with merchant POS systems, eWallets, and mobile money networks.

-

Risk and compliance: Advanced credit scoring models, KYC, and fraud detection tools.

-

Flexible models: Offer BNPL loans, card-linked installments, or rent-to-own models.

-

Data and insights: Get access to rich BNPL data to refine your credit decision-making and understand your customers better.

-

Global expertise: Whether you’re in Africa, the US, or the Middle East, our platform adapts to your regulatory and market context.

Conclusion

The Buy Now, Pay Later (BNPL) model has already proven its more than a passing trend. Customers love the flexibility, merchants enjoy higher sales and better retention, and financial institutions gain access to new revenue streams and customer segments.

Now, picture your business 12 months from today. You’ve implemented a compliant BNPL solution, merchants are thriving with higher conversions, and customers trust your brand for giving them smarter ways to pay. Competitors are still trying to catch up, while you’ve already established yourself as a market leader in this growing space.

That’s the opportunity BNPL brings. And the window to act is now.

If you’re ready to capture this momentum, DigiPay.Guru can help you launch BNPL quickly, safely, and at scale. Our platform is built for banks, fintechs, and financial institutions that want to deliver flexible credit with robust compliance and risk management.

Act now! Choose DigiPay.Guru. And let’s design a BNPL solution that drives growth for your business while giving customers the experience they want.

FAQ's

BNPL is a short-term financing model that lets customers purchase a product or service and pay for it over time in fixed installments, often with zero interest if payments are made on time. It provides flexibility at checkout and helps increase customer affordability without relying on traditional credit cards.

At checkout, a customer selects BNPL as the payment option. The purchase amount is split into equal payments over a specified number of weeks or months. The customer either pays a portion upfront or nothing, and the rest is automatically debited on schedule. The merchant receives payment immediately (minus a fee), and the BNPL provider handles repayments and risk management.

BNPL boosts conversion rates, average order values, and customer loyalty. Customers enjoy instant access to products without upfront payment or revolving debt. Businesses gain revenue faster, while BNPL providers earn through fees or interest. It’s a win for all parties when done responsibly.

Retail, electronics, fashion, healthcare, travel, and education are among the top-performing categories. These industries deal with higher-ticket items where customers appreciate the flexibility of splitting costs into smaller, more manageable payments.

With the right provider, you can go live in as little as 8–12 weeks. Platforms like DigiPay.Guru offer pre-built integrations, making the process faster without compromising on compliance or risk management.

BNPL is a great fit if you sell mid- to high-value products, serve digital-savvy customers, or operate in sectors like retail, travel, healthcare, or education. It’s also ideal for financial institutions aiming to onboard new users, drive financial inclusion, and offer more flexible credit alternatives.

You can adopt BNPL in five key ways:

Embedded in eWallet apps

Off-card financing via direct bank or mobile money

Virtual rent-to-own models

Card-linked installments

Industry-specific (e.g., healthcare, education)

Each approach serves different customer needs and business types.

BLook for a provider that offers:

Fast, API-ready integration

Built-in affordability checks and KYC

Regulatory compliance by region

Support for multiple payment rails (cards, bank, mobile money)

Analytics, reporting, and merchant tools

Choose one that aligns with your market, risk appetite, and growth goals.

Follow these steps: Define your product goals and customer segments.

Partner with a compliant BNPL platform.

Set credit policies and repayment terms.

Launch a pilot program and gather data.

Scale up with automated workflows, risk monitoring, and performance tracking.

The right partner makes the setup smoother and faster.

DigiPay.Guru offers a plug-and-play BNPL platform built for banks, fintechs, and financial institutions. We provide:

Fast deployment (API-ready)

Configurable repayment plans and risk scoring

Multi-channel integration (eWallet, POS, online)

Full compliance with regional rules

Real-time analytics and merchant dashboards

Whether you're launching in Africa, Asia, or the Middle East, we help you go live confidently, with scalable, secure infrastructure.

If customers pay on time, BNPL usually doesn’t hurt their credit score. However, many providers now report missed payments to credit bureaus, which can negatively impact credit histories. On-time payments can even help improve scores as credit scoring models start including BNPL data.