Worldwide remittance flows reached approximately $958 billion in 2025.

This suggests that due to such high remittance flow, there will be regulatory focus on compliance and monitoring.

And so in money transfer business, compliance is never optional; it's necessary.. Whether you’re a bank expanding remittance corridors, a fintech building a money transfer app, or an MTO managing cross-border payments, one wrong step in compliance can cost you your license, reputation, and customer trust.

The challenge is real: regulators keep raising the bar with:

- Stricter KYC rules

- Tighter AML monitoring, and

- Ever-changing global financial compliance standards

In the middle of all these difficulties, what your customers expect is faster, safer services. Plus, your competitors are pushing innovation at lightning speed. Somewhere in between, you’re left balancing growth with compliance.

Here’s the good news: you don’t have to figure it all out alone.

In this blog, you will get a glimpse into 8 compliance best practices that every money transfer company must follow. These aren’t just checklists; they’re proven strategies that protect your business, keep regulators on your side, and position you as a trusted provider in the international remittance market.

Let’s begin!

What is a Money Transfer Business and Why Compliance Matters?

A money transfer business enables individuals and organizations to send and receive funds locally or across borders. Whether it’s a money transfer app, mobile money transfer service, or a traditional MTO, compliance forms its backbone.

Here’s why compliance matters and is the backbone of the money transfer business:

Because regulators see this industry as high-risk. Without strict fintech regulatory requirements, money transfer services could be exploited for money laundering, terrorism financing, or fraud. That’s why global financial compliance standards like FATF, FinCEN (US), PSD2 (EU), and FCA (UK) exist.

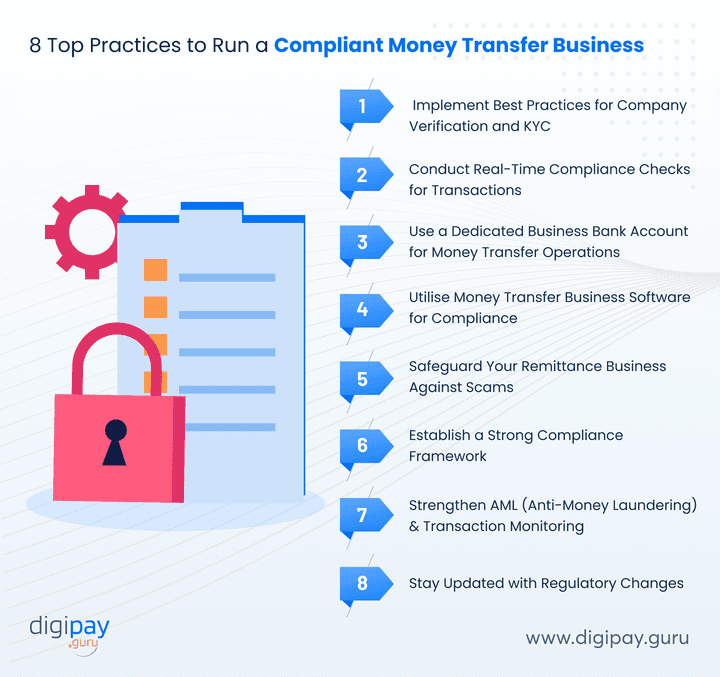

8 Top Practices to Run a Compliant Money Transfer Business

Now that you have seen why compliance is the backbone of any money transfer business.

Let’s now get into the core of the blog: The 8 best practices for compliance.

1. Implement Best Practices for Company Verification and KYC

Every regulator in the world starts with KYC. Hence, Know Your Customer (KYC) is your first shield against fraud, money laundering, and reputational risk.

For a money transfer company like yours, weak KYC isn’t just a gap but an open door for fines and fraud. So, it's necessary to implement the best practices for KYC and verifications without compromise.

Why KYC matters:

-

It proves to regulators that you know who you are dealing with.

-

It protects your customers from identity theft and financial loss.

-

It strengthens your brand as a trusted money transfer business.

Best practices for KYC compliance:

The top best practices you can follow for KYC and verification compliance are:

-

Use multi-layer verification like documents, biometrics, and address checks. This becomes hard to breach for fraudsters.

-

Automate with eKYC solutions to onboard customers instantly while staying compliant.

-

Re-verify periodically to prevent dormant accounts from becoming fraud channels.

Tip: Think beyond compliance. Strong KYC builds customer trust, and in financial services, trust is priceless.

2. Conduct Real-Time Compliance Checks for Transactions

Transactions in current times move in seconds (they are very fast), but compliance risks travel just as fast with them (even fraudsters are becoming smarter).

Moreover, manual reviews are too slow and leave dangerous blind spots for compliance and security breaches. That’s why real-time compliance checks are the need of the hour.

What this means for you:

-

Every payment must be screened against sanction lists and politically exposed persons (PEPs).

-

High-risk corridors need special monitoring with smart thresholds.

-

Real-time systems stop suspicious payments before they go through which avoids costly clawbacks for you.

How to implement real-time compliance best practices effectively:

-

Deploy AML compliance software that integrates with your core system.

-

Set automated alerts for unusual transaction volumes or velocity.

-

Keep sanction lists and global databases updated daily.

Pro insight: Real-time compliance doesn’t just prevent fraud; it keeps you in regulators’ good books. This makes license renewals smoother for your business (as the regulators already trust you).

3. Use a Dedicated Business Bank Account for Money Transfer Operations

Mixing personal and business funds may sound insignificant at first glance, but in compliance, it’s a red flag. And regulators expect money transfer operators to maintain complete transparency in financial flows.

Why this matters:

-

A dedicated business bank account makes audits cleaner.

-

It signals professionalism and operational maturity.

-

It helps secure trust from partner banks, which are often cautious with fintechs or businesses like yours.

Best practices to implement a dedicated business bank account for MTOs you partner with:

-

Maintain one account per jurisdiction for clarity.

-

Keep records of all settlements and reconciliations.

-

Build a relationship with a compliance-aware banking partner who understands money transfer services.

A business bank account is like the foundation stone without which your compliance structure can fall apart.

4. Utilise Money Transfer Business Software for Compliance

Spreadsheets and manual logs are not the ideal way to maintain compliance in remittances now. This is because regulators want real-time, automated, and auditable compliance. This is where money transfer business software becomes your competitive advantage.

Benefits of compliance-driven money transfer software:

-

Automated KYC, AML, and sanctions screening.

-

End-to-end reporting that regulators can audit instantly.

-

Fraud detection through AI-driven anomaly checks.

5. Safeguard Your Remittance Business Against Scams

With innovations in tech becoming common, even fraudsters innovate faster than ever. If you run a money transfer company, scams are not a question of if, but when.

Common types of scams in the remittance and payment industry include:

-

Phishing: Fake money transfer apps or sites mimicking yours.

-

Mule accounts: Fraudsters laundering money through unsuspecting users.

-

Synthetic IDs: Identities built from stolen fragments of personal data to breach your system.

How to protect your business these scams:

-

Educate your customers with alerts and FAQs about scam prevention.

-

Train your compliance staff regularly around the latest and common scams going on in the market. This is essential because the fraud tactics evolve every quarter.

-

Deploy fintech fraud prevention tools that flag anomalies and suspicious activities before damage is done.

Remember: Compliance scams in remittances don’t just cost you money; they cost you trust of both the regulators and your customers.. And in a money transfer business, trust is your strongest currency.

6. Establish a Strong Compliance Framework

Compliance has become more than a checklist that is necessary to run your business. Hence, it needs a structured framework to work.

Without a structured framework, even the best tools will fail.

Here’s what a compliance framework looks like:

-

Clear policies on onboarding, monitoring, reporting, and escalation.

-

Documented procedures for every compliance step.

-

Regular reviews and internal audits to ensure alignment with regulations.

The best practices you can follow to establish a strong compliance framework:

-

Appoint a dedicated compliance officer with authority and resources.

-

Train staff continuously, not just once a year, and

-

Encourage a compliance-first mindset across all departments.

This framework is your blueprint. It keeps your money transfer business steady even when regulations shift.

7. Strengthen AML (Anti-Money Laundering) & Transaction Monitoring

AML guidelines for money transfer companies like yours are strict for a reason. It’s because criminals love exploiting global remittance channels.

Here’s why AML is critical:

-

Protects your license from suspension or cancellation.

-

Detects suspicious flows that could expose your business to legal risks.

-

Meets global financial compliance standards demanded by regulators and partners.

Here are the best practices to strengthen AML and transaction monitoring:

-

Deploy AI-driven systems to track patterns like structuring or unusual velocity.

-

Flag large cash deposits, rapid transfers, or high-risk country corridors.

-

File Suspicious Activity Reports (SARs) immediately to remain compliant.

In short: Strong AML doesn’t just protect you. It makes your money transfer company attractive to global partners looking for safe corridors.

8. Stay Updated with Regulatory Changes

The only constant in compliance are regulatory changes. The regulations keep on evolving so yesterday’s rules won’t protect you tomorrow. And staying on top of these regulatory standards is a must.

Here are the key global regulations to watch in the current remittance market:

-

PSD2 (EU): Stronger authentication and data security.

-

FATF (Global): Updated AML/CFT guidelines.

-

FinCEN (US) & FCA (UK): Heightened scrutiny on digital-first fintechs.

And here’s why continuous adaptation is key:

-

Prevents costly disruptions in your operations.

-

It keeps your money transfer business license secure.

-

Allows you to expand confidently into new markets.

As the saying goes: “An ounce of prevention is worth a pound of cure.” Hence, staying ahead of compliance trends saves both your money and reputation.

Conclusion

Compliance is not just about avoiding fines or ticking regulatory boxes. For any money transfer business, it’s the foundation of trust, growth, and long-term survival.

And when you build strong KYC processes, monitor transactions in real time, safeguard against fraud, and stay aligned with global standards, you don’t just stay compliant but you also strengthen your reputation and unlock new opportunities.

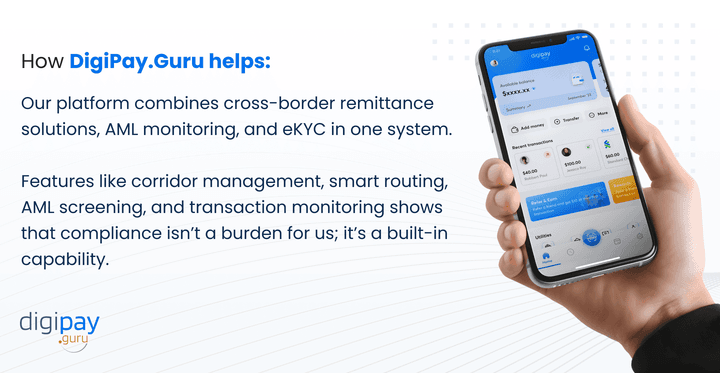

For remittance businesses like yours, compliance can feel like a heavy burden. However, with the right approach and the right technology, it becomes a competitive advantage. That’s where DigiPay.Guru comes in.

Our international money transfer software is built with compliance at its core. It integrates eKYC, AML monitoring, fraud detection, and regulatory reporting into one powerful platform.

Plus, we help you stay ahead of compliance challenges so you can focus on scaling your money transfer services, expanding into new corridors, and building customer trust worldwide.

Ready to simplify compliance and grow with confidence? DigiPay.Guru is your trusted partner.

FAQs

A money transfer business enables individuals or organizations to send and receive funds locally or across borders.

It works by collecting funds from a sender, transferring them through a secure channel often via banks, payment service providers, or fintech platforms and delivering them to the recipient.

Modern money transfer companies use digital wallets, APIs, and mobile money transfer systems to make this process faster, cheaper, and more transparent.

Compliance ensures that your money transfer company operates legally and ethically. Plus, regulators require strict KYC, AML, and fraud prevention practices to stop financial crimes like money laundering and terrorism financing.

Non-compliance can lead to fines, frozen accounts, reputational damage, or even loss of your license. Compliance also builds trust with customers, banks, and partners, essential for scaling cross-border remittance services.

The required licenses depend on the jurisdiction where you operate. Generally, you need:

- A money transfer business license or equivalent (from the central bank or financial regulator).

- Registration as an MSB (Money Services Business) in countries like the US.

- AML/CFT compliance approvals as part of licensing.

- In some regions, additional permits for cross-border transactions.

A strong money transfer business plan with compliance policies, risk management, and capital adequacy is usually part of the approval process.

Fraud prevention requires a multi-layered approach:

- Strong onboarding: Verify users with eKYC, biometrics, and address checks.

- Transaction monitoring: Use AI-driven software to flag unusual patterns.

- Customer education: Inform users about phishing, fake apps, and mule accounts.

- Internal training: Keep staff updated on emerging scam tactics.

Using fintech fraud prevention tools not only protects revenue but also protects customer trust, which is your most valuable asset.

AML compliance requires proactive monitoring and reporting. To stay compliant, you should:

- Implement real-time AML compliance software that screens against sanction and PEP lists.

- Set clear rules for detecting unusual behavior (structuring, high-velocity transfers, cross-border risks).

- File Suspicious Activity Reports (SARs) with regulators on time.

- Train staff regularly on AML guidelines for money transfer companies.

Strong AML practices not only meet global financial compliance standards but also secure your license and reputation.

Compliance today is impossible without automation. Money transfer business software ensures:

- Real-time KYC and AML checks.

- Automatic reporting for regulators.

- Fraud detection using AI.

- Corridor management for global remittances.

Platforms like DigiPay.Guru integrate compliance directly into operations, so compliance isn’t a manual burden but is built into the system.

Failing compliance checks can trigger serious consequences:

- Heavy fines and penalties from regulators.

- Frozen bank accounts or blocked transactions.

- Loss of your money transfer business license.

- Long-term reputational damage that discourages partners and customers.

In short: non-compliance doesn’t just slow you down. It can shut your business down.

Instant payment compliance checks happen in real time, often within milliseconds of a transaction. The system screens the payment against sanction lists, AML rules, and transaction thresholds before it settles. If the transaction is suspicious, it’s flagged or blocked immediately.

This protects money transfer companies like yours from fraud and regulatory violations while ensuring legitimate transfers remain fast and seamless.