In today's interconnected world, the movement of money across borders has become a vital aspect of global commerce. As businesses expand their horizons and individuals seek opportunities beyond their homeland, the need for a seamless and secure cross border remittance system has never been more critical.

According to Grand View Research, the market size for global digital remittances was valued at US Dollars 19.65 billion in the year 2022 whereas the global digital remittance transactions were around US Dollars 390 billion in the same year. Additionally, the global digital remittance market size was anticipated to have to grow at a CAGR of 15.6 percent in the forecast period of 2023-2030.

However, navigating the complexities of international remittance can be challenging, both for individuals seeking reliable money transfer services and for MTOs striving to provide efficient remittance services while adhering to stringent regulations.

In this comprehensive guide, we aim to demystify the world of international remittance, providing MTOs with valuable insights and actionable strategies. From understanding the fundamentals of international money transfers to embracing emerging trends, we will explore the intricacies of this dynamic industry.

A quick run-through on International Remittance

International remittance serves as a lifeline for millions of people around the world, enabling financial support across borders and fostering economic resilience. As technology continues to evolve, remittance services are becoming faster, more secure, and increasingly convenient - Sophia Fu, FinTech Consultant, and Remittance Industry Expert

What is an international remittance?

International remittance is the transfer of funds from one country to another, typically to support family members and multinational businesses. It enables individuals to send money to their home countries and cross-border transactions business operating globally.

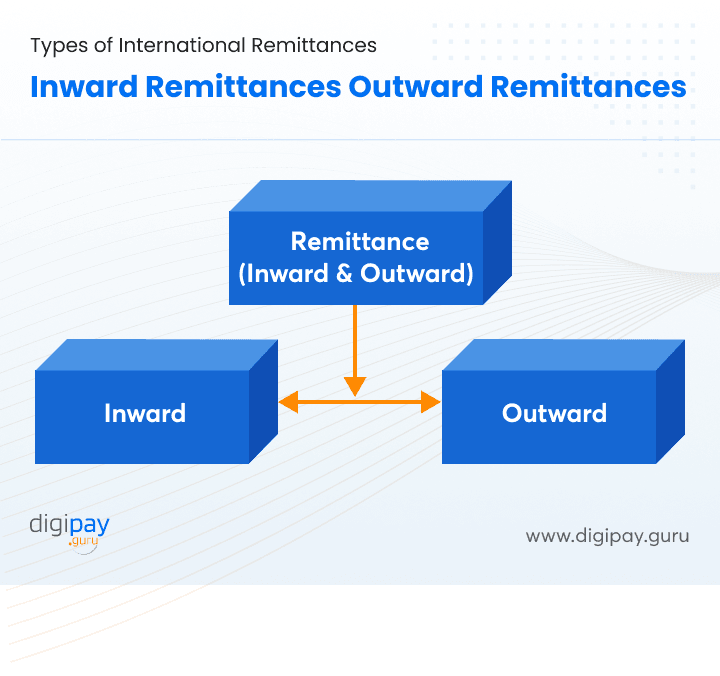

What are the major types of international remittances?

There are basically two major types, but there's also a third type, a combination of 1st two types - they are: Inward, outward, and inward | outward combines

Inward Remittances

Inward remittances refer to funds sent from overseas to a recipient in a particular country. These transfers typically involve individuals or businesses sending money to their family members, friends, or business partners in their home country. For example, a migrant worker sends money earned abroad to their family back home.

Outward Remittances

Outward remittances involve the transfer of funds from a person or business in one country to an individual or entity located in another country. These transactions are initiated by individuals or businesses residing in one country who need to send money abroad. For instance, a student studying abroad receives funds from their home country for living expenses.

Inward and Outward Remittances Combined

This category refers to individuals or businesses that both receive funds from abroad and send money internationally. They engage in two-way remittance transactions. For example, an expatriate worker receives a salary from their employer abroad while also sending money to support their family back in their home country.

All these three types of cross border remittances are very crucial for the customers and so MTOs come into the picture.

MTOs and International Remittances - The most helpful combination

Sophia Fu further adds that, “By leveraging innovative solutions, money transfer operators can bridge the gap between senders and recipients, empowering individuals and communities to thrive in an interconnected global economy."

What are MTOs known for?

MTOs are licensed financial entities that specialize in the transfer of funds on behalf of individuals and businesses. They leverage a network of agents, technology platforms, and banking partnerships to facilitate international money transfers.

Role of MTOs in Facilitating International Remittance

MTOs act as intermediaries, connecting the sender and recipient in the money transfer process. They provide accessible physical locations or digital platforms where customers can initiate money transfers, ensuring convenience and ease of use.

Process of International Money Transfers

Customer Initiation

The sender visits an MTO's branch or uses their online platform to initiate a money transfer. They provide necessary details such as the recipient's information, the amount to be sent, and the destination country.

Verification and Compliance

MTOs follow strict verification processes to comply with Anti-Money Laundering (AML) and Know-your-customer (KYC) regulations. This step ensures the legitimacy of the transaction and prevents fraudulent activities.

Fund Collection

The sender provides the funds to the MTO, either in cash or through electronic payment methods, depending on the MTO's available options.

Fund Transfer

MTOs utilize their established network of banking partners or correspondent relationships to facilitate the transfer of funds to the recipient's country.

Payout to the Recipient

Once the funds reach the recipient's country, the MTO arranges for the payout, which can be collected by the recipient through various channels such as cash pick-up locations, bank accounts, mobile wallets, or prepaid cards.

How can MTOs be helpful for international remittance aka international money transfer?

Money transfer operators (MTOs) play a crucial role in facilitating cross border remittance, which is the process of sending money from one country to another. Here's how MTOs help in international remittance:

Accessibility

MTOs provide a convenient and accessible way for individuals to send and receive money internationally. They have a widespread network of branches, agents, or online platforms that make it easy for people to initiate remittance transactions.

Currency Exchange

MTOs handle currency exchange between the sender's and recipient's countries. When you send money internationally, MTOs convert the funds from the sender's currency to the recipient's currency. This allows the recipient to receive the money in their local currency, eliminating the need for them to handle the exchange themselves.

Speed and Efficiency

MTOs offer fast and efficient cross border remittance services. Depending on the MTO and the chosen transfer method, funds can be transferred within minutes or a few business days. This enables timely access to funds, which is crucial for meeting financial obligations or emergencies.

Security and Trust

MTOs prioritize the security of remittance transactions. They implement various measures to protect customer information and ensure that funds are transferred securely. Reputable MTOs comply with strict regulations and anti-money laundering measures, enhancing trust and reliability in the cross border remittance process.

Service Options

MTOs provide different service options to cater to diverse customer needs. These options include cash pick-up at agent locations, bank deposits, mobile wallet transfers, or direct transfers to recipient bank accounts. By offering multiple delivery methods, MTOs accommodate the preferences and requirements of both senders and recipients.

Financial Inclusion

MTOs contribute to financial inclusion by providing cross border remittance services to unbanked or underbanked individuals. They bridge the gap between formal financial systems and those who may not have access to traditional banking services, enabling them to receive and manage funds securely.

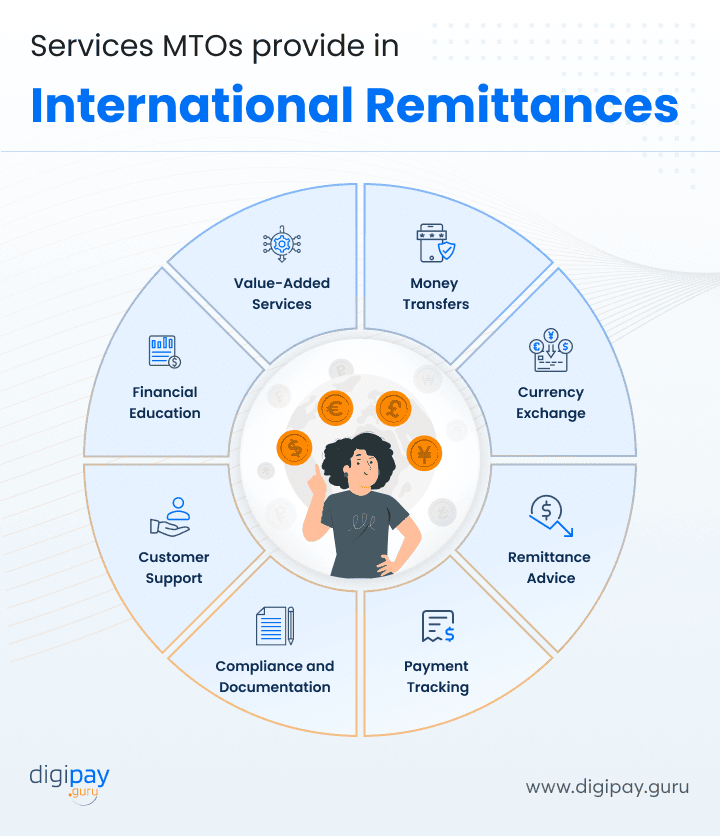

What services can MTOs provide in International Remittances?

Money transfer operators (MTOs) provide various services to their customers in cross border remittance. These services are designed to facilitate the smooth transfer of funds across borders. Here are some common services offered by MTOs:

Money Transfers

The core service offered by MTOs is the transfer of funds from one location to another. MTOs facilitate the secure and efficient transfer of money on behalf of customers, ensuring that funds reach the intended recipients on time.

Currency Exchange

MTOs often provide currency exchange services, allowing customers to convert their funds from one currency to another. This service is particularly useful for customers who need to send money in a different currency than their own or for recipients who prefer to receive funds in their local currency.

Remittance Advice

MTOs offer remittance advice or receipts to both senders and recipients as proof of the transaction. These documents provide details such as the amount transferred, the exchange rate, the transaction reference number, and other relevant information. Remittance advice helps in tracking and verifying transactions.

Payment Tracking

MTOs enable customers to track the status of their remittance transactions. Through online platforms or customer service channels, customers can check the progress of their transfers, ensuring transparency and peace of mind.

Compliance and Documentation

MTOs assist customers in meeting regulatory requirements by verifying customer identities, conducting anti-money laundering (AML) and know-your-customer (KYC) checks, and ensuring compliance with local and international financial regulations. MTOs also handle necessary documentation, such as transaction records and reporting, to adhere to legal and regulatory standards.

Customer Support

MTOs provide customer support services to address customer queries, and concerns, and assist in the cross border remittance process. This can include assistance with transaction inquiries, account setup, and general guidance on using MTO services.

Financial Education

Some MTOs offer financial education and literacy programs to empower their customers with knowledge about financial management, budgeting, and making informed decisions regarding their cross border remittance. These educational initiatives aim to enhance financial well-being and improve financial inclusion.

Value-Added Services

MTOs may offer additional services to enhance the customer experience and provide added value. This can include services such as mobile top-ups, bill payments, and loyalty programs, allowing customers to access a broader range of financial services through the MTO platform.

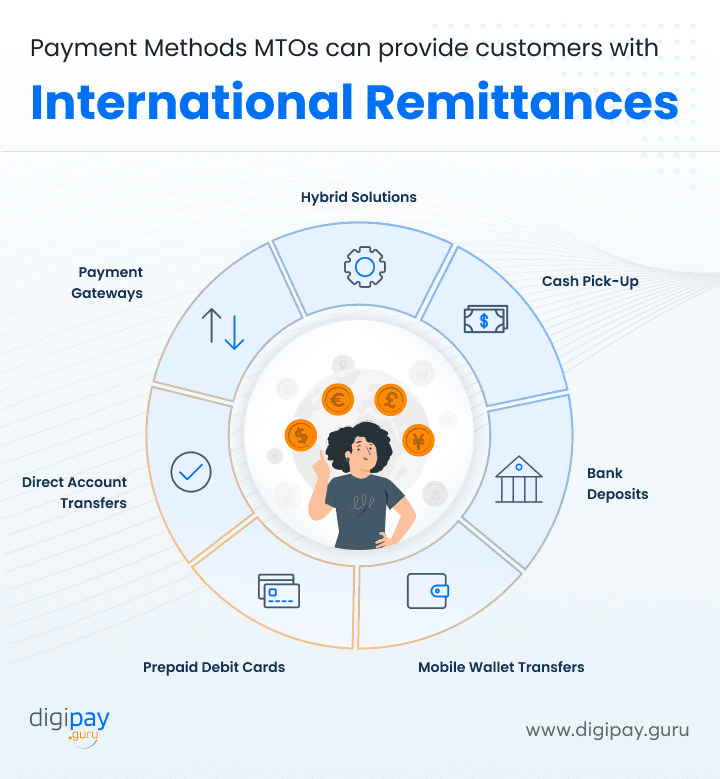

Different Payment Methods MTOs can provide customers with international remittance

Money transfer operators (MTOs) offer various payment methods to provide customers with flexibility and convenience for cross border remittance solution. Here are some common payment methods that MTOs can provide:

Cash Pick-Up

Customers can send money through an MTO and the recipient can collect the funds in cash from a designated agent location. This method is suitable when the recipient does not have a bank account or prefers to receive funds in cash.

Bank Deposits

MTOs can facilitate direct transfers to the recipient's bank account in the destination country. The sender provides the necessary banking details, and the funds are deposited into the recipient's account. Bank deposits are convenient for recipients who have a bank account and prefer the funds to be directly credited to their accounts.

Mobile Wallet Transfers

MTOs can offer transfers to mobile wallets, which are digital wallets linked to a mobile phone number. The recipient can access the transferred funds through their mobile wallet and use them for various purposes such as mobile money payments, mobile top-ups, or transfers to other individuals.

Prepaid Debit Cards

MTOs may issue prepaid debit cards that can be loaded with remittance funds. These cards can be used by recipients for purchases, ATM withdrawals, and online transactions, providing them with a convenient and secure way to access their funds.

Direct Account Transfers

MTOs can enable direct transfers to the recipient's bank account in their home country. This method is suitable for customers who have a bank account and prefer the funds to be credited directly to their account without the need for cash pick-up or mobile wallet access.

Payment Gateways

MTOs can integrate with online payment gateways, allowing customers to initiate cross border remittance transactions and make payments using credit cards, debit cards, or online banking systems. This provides customers with the convenience of making mobile money payments directly through their preferred digital payment methods.

Hybrid Solutions

Some MTOs offer hybrid solutions where customers have multiple options to receive funds. For example, recipients may have the choice to receive funds through cash pick-up, bank deposit, or mobile wallet transfer, depending on their preferences and local availability.

Note: “MTOs can manage rates in international remittance by monitoring exchange rate fluctuations, analyzing market conditions, and adjusting their rates accordingly to stay competitive, optimize revenue, and meet customer expectations.”

Regulations and Compliance are important!

Regulatory compliance is not only a legal obligation for MTOs but also a crucial element in building trust and credibility within the remittance industry. Regulations should be in place to combat money laundering, terrorist financing, fraud, and other illicit activities.

Compliance with regulations ensures the integrity of the financial system and safeguards customers' funds and personal information.

The Regulatory Landscape for MTOs

MTOs must navigate a complex web of international, national, and regional regulations that vary across jurisdictions. Regulatory bodies, such as central banks and financial supervisory authorities, impose rules and guidelines to govern MTO operations.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

- AML regulations require MTOs to implement robust cross border remittance solution to prevent money laundering and the financing of illegal activities.

- KYC regulations mandate MTOs to verify the identity of customers, assess the risk profile of transactions, and maintain comprehensive records.

Collaboration with Regulatory Authorities

MTOs work closely with regulatory authorities, providing regular reports and updates on their operations. Collaboration fosters a transparent and cooperative environment, ensuring regulatory compliance and maintaining the trust of customers and partners.

Emerging Trends in International Remittance

The world of cross border remittance is rapidly evolving, driven by technological advancements and changing consumer preferences. Money Transfer Operators (MTOs) must stay ahead of the curve to meet the demands of a digital-first era and capitalize on emerging trends.

Digital Transformation

- Digital transformation has revolutionized the remittance industry, enabling MTOs to provide seamless, user-friendly online platforms and mobile applications for mobile money payment transfers.

- Customers now have the convenience of initiating transfers anytime, anywhere, and enjoying faster processing times.

Blockchain Technology

- Blockchain technology holds immense promise for international remittance, offering enhanced security, transparency, and cost efficiency.

- Blockchain-based solutions can streamline the cross border remittance solution and its process, eliminating intermediaries and reducing transaction costs, while ensuring traceability and immutability.

Mobile Money

- The widespread adoption of mobile technology has given rise to mobile money solutions, transforming the way individuals send and receive funds internationally.

- Mobile wallets and payment apps allow users to store, send, and receive money directly from their smartphones, providing financial inclusion to unbanked populations.

Integration of Artificial Intelligence (AI)

AI-powered tools and algorithms can enhance compliance processes, fraud detection, and customer service in the remittance industry. MTOs can leverage AI to automate customer identity verification, analyze transaction patterns for risk assessment, and provide personalized user experiences.

Expansion of Peer-to-Peer (P2P) Transfers

P2P transfers are gaining popularity, allowing individuals to send money directly to recipients without the need for traditional financial institutions or intermediaries. MTOs can explore partnerships or develop their own P2P platforms to cater to the growing demand for seamless and cost-effective money transfers.

Conclusion

In this comprehensive guide, we have demystified the world of cross border remittance solutions, providing MTOs with valuable insights into the intricate workings of the industry.

From understanding international remittance to exploring the operations of MTOs, navigating regulations and compliance, and embracing emerging trends, we have covered key aspects that shape the success of MTOs.

As you strive to excel in the remittance landscape, consider partnering with DigiPay.Guru, a leading cross border remittance solution provider. With our secure, efficient, and user-friendly platform, you can enhance your services and offer seamless money transfer experiences to your customers.