One of the hardest parts of running cross-border remittances is not moving the money, but it’s explaining how you do it.

The common hurdles include:

- When a payment arrives, the recipient cannot see which invoice it clears.

- When a family transfer falls short, you struggle to show where the deductions went.

- Your compliance team spends hours checking transactions without enough context.

- On top of that, your customers lose patience, and even regulators demand more transparency.

This is where Electronic Remittance Advice (ERA) matters. ERA is a digital message attached to each payment that explains the “why” behind the transfer. It lists invoice numbers, reasons for payment, deductions, fees, and adjustments in a format that your systems can process instantly.

In a business where trust and speed decide who customers choose, ERA gives your cross-border payments the clarity they have been missing.

In this blog, we will help you see how powerful ERA is. You will explore what it is, how it works, its importance, best practices, and more.

Let’s break it down one by one.

What is Electronic Remittance Advice (ERA)?

At its simplest, Electronic Remittance Advice means a structured message sent along with a payment that tells the receiver what the payment is for. It answers the core questions: who sent the money, how much, why, and what charges were applied.

In financial terms, ERA helps connect a payment to its source record. That could be an invoice, a loan repayment, or a medical claim. This means that, unlike vague transaction references, electronic remittance advice (ERA) delivers a full picture.

Electronic Remittance Advice vs. Paper Remittance Advice

Traditionally, remittance advice was sent on paper by post or fax. Those slips often arrived late, got lost, or contained incomplete information.

And with the automation happening at lightning speed, the financial world has now become real-time. And paper advice creates friction and is not at all a feasible option.

Electronic remittance advice solves this problem by delivering the same information instantly, in a structured, digital format that integrates with banking, ERP, and compliance systems.

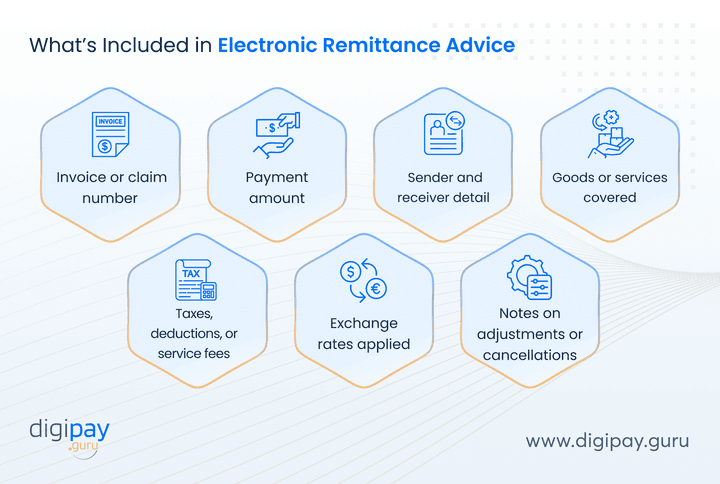

What’s Included in Electronic Remittance Advice?

A typical ERA includes:

- Invoice or claim number

- Payment amount

- Sender and receiver details

- Goods or services covered

- Taxes, deductions, or service fees

- Exchange rates applied

- OR notes on adjustments or cancellations

This structured detail transforms reconciliation in cross-border payments from a guesswork of details into an automated process.

How ERA Works in Financial Transactions

ERA works by linking the payment message with the supporting details needed for reconciliation. When your bank or remittance system processes a transfer, an ERA file is generated and transmitted in parallel.

So, here the message can flow through SWIFT networks, ISO 20022 XML files, or proprietary APIs, depending on your system. On the receiving side, the ERA is ingested directly into the accounting or treasury platform. In it, the finance team sees not just the credit but also the invoice it clears.

How Remittance Advice is Used in Cross-Border Payments (With Examples)

In cross-border payments, money moves across currencies, intermediaries, and regulatory systems, but the details don’t always follow. That gap creates reconciliation delays, unnecessary support queries, and compliance risks.

However, electronic remittance advice (ERA) solves this by attaching structured information to each transfer, so both sender and receiver see the full context.

Here’s how ERA works in real situations you deal with every day:

1. Business-to-Business Supplier Payments

For example, a distributor in Germany pays $200,000 to a manufacturing partner in Nigeria. Without ERA, the Nigerian finance team only sees a credit. And they have to dig through records to link it to the right purchase order. This can be very complex and not so transparent.

With ERA, the payment arrives showing the invoice number, order reference, goods supplied, and deductions. This allows you to reconcile the transaction instantly.

This results in:

- Fewer errors

- Faster reconciliation, and

- Improved supplier relationships

2. Family Remittances

For instance, a worker in the UAE sends $600 home each month to his family in Egypt. Without ERA, the family only sees the final credit amount in the bank/remittance app.

But with ERA, they see the sender’s name, purpose (“monthly support”), transfer fee, FX rate applied, and net amount received.

Impact: Customers understand every deduction, which builds long-term trust in formal remittance channels.

3. Healthcare & Insurance Settlements

Let’s say a Canadian insurance company settles a $5,000 claim with a hospital in Mexico.

Without ERA, the hospital only sees a payment with no explanation or data linked to it.

But, with ERA for businesses like yours, the payment details for this settlement show the patient ID, claim reference, billed amount, covered amount, and deductions.

Impact: The hospital matches payments with patient files quickly, while avoiding compliance issues and billing disputes.

4. Payroll Across Borders

Say, for example, a logistics company in the UK pays salaries for staff across Kenya, Ghana, and Tanzania. Without ERA, local teams only see net payments credited in the employee accounts.

But with ERA, each of the money transfers lists employee IDs, gross salary, tax withheld, and net pay.

This results in:

- Payroll is transparent across countries

- Audits are easier, and

- Employees trust the process

Together, these scenarios show how electronic remittance advice in cross-border payments transforms uncertainty into clarity. Whether you’re serving businesses, families, or institutions, ERA makes transactions faster to reconcile, safer to process, and easier to explain to customers and regulators.

Why ERA Matters for Banks, Fintechs, and Remittance Businesses

Electronic Remittance Advice (ERA) is not just extra data attached to payments. It directly impacts how your business runs, how compliant you remain, and how much trust you build with customers.

Here’s what it means for you:

Banks

Banks handle high volumes of cross-border payments where reconciliation and compliance are constant challenges. So, if you are a bank, ERA helps by:

- Automating reconciliation: Payments arrive with invoice numbers and references, thereby cutting hours of manual work.

- Strengthening compliance: Every transfer is tied to a clear purpose, while supporting AML and regulatory checks.

- Reducing exceptions: Cleaner data means fewer payment errors or disputes with corporate clients.

Fintechs

For fintechs, speed and transparency drive customer adoption. So, if you are a fintech, ERA gives you:

- Seamless integrations: Connects easily with accounting systems, ERPs, and wallets.

- Customer transparency: Your users see why, how, when, and from where they received or sent money, with charges explained upfront.

- Market differentiation: Offering ERA builds trust and sets your platform apart from competitors.

Remittance Providers

In remittance, customer trust is your strongest currency. So, if you are a remittance business, ERA strengthens customer trust by:

- Clearer communication: Families and businesses instantly see fees, FX rates, and net amounts in your remittance app.

- Lower support costs: Fewer “where did my money go?” calls to your team as they get clear on everything about the transaction.

- Regulatory advantage: Structured data makes it easier to comply with tightening cross-border rules.

Whether you’re a bank, a fintech, or a remittance provider, ERA delivers the same outcome: faster operations, easier compliance, and stronger customer loyalty.

Industry Standards and Global Adoption

ERA adoption is tied to the global move toward ISO 20022 messaging standards. This framework ensures payment messages carry structured data that all systems can read.

- Regions like Europe and Asia are pushing for ISO 20022 compliance across banks and payment systems.

- In Africa, where mobile money is dominant, ERA integrated with wallets can bring even greater transparency.

- For banks and fintechs like yours, being early adopters means staying ahead of regulators and customer expectations.

Common Remittance Advice Codes

When money moves across borders, it can get quite difficult to find the relevant details about the money transfer. That’s why remittance advice codes exist.

Remittance advice codes act as short signals that explain what happened to a payment. Instead of forcing your finance team to decode vague notes or chase down missing context, these codes provide a standardized reason that systems can read & people can understand.

For example, when an invoice is mismatched or a transfer is held for compliance, the ERA message doesn’t just say “error.” It delivers a code that tells your team exactly what went wrong. This precision makes reconciliation faster and reduces the risk of misreporting.

Here are some common codes you’ll see in an Electronic Remittance Advice (ERA):

| Code | Meaning |

|---|---|

| FX01 | Foreign exchange rate applied |

| TX02 | Tax or service fee deducted |

| D03 | Duplicate payment detected |

| PND04 | Payment pending verification |

| INV05 | Invoice number mismatch |

| CXL06 | Payment canceled due to compliance issues |

Why These Codes Matter to You

- For banks: These advice codes cut exception-handling time by giving reconciliation teams clear reasons for mismatches.

- For fintechs: They allow automated ERA processing, which means your platform can flag and resolve issues instantly.

- For remittance providers: odes reduce customer confusion. Families and businesses see exactly why amounts differ from expectations.

In short, remittance advice codes turn unclear payments into clear messages. They bring structure where there was ambiguity, which makes your international remittance operations more reliable and easier to scale.

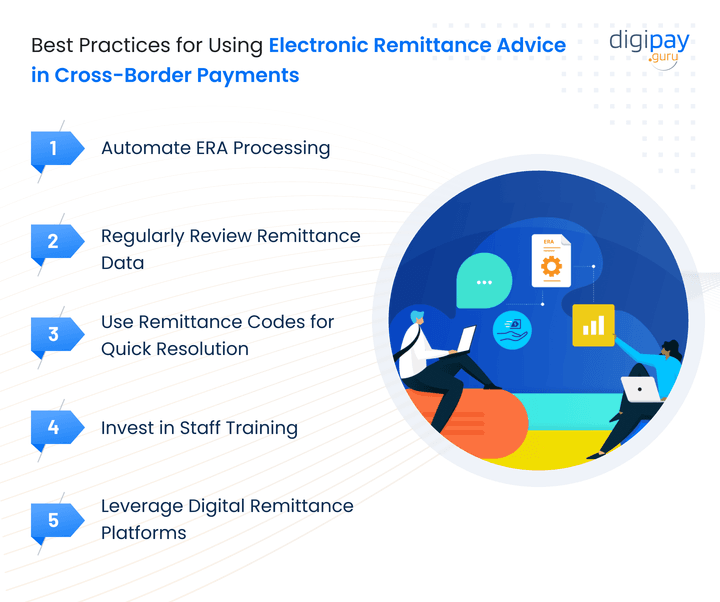

Best Practices for Using Electronic Remittance Advice in Cross-Border Payments

Implementing electronic remittance advice (ERA) can unlock its full value by offering faster reconciliation, stronger compliance, and higher customer trust. But for that, you need a clear plan.

Here are five best practices to guide your adoption:

Automate ERA Processing

Don’t leave reconciliation to manual matching of payment data, and with the received amount.

You should integrate ERA directly into your core banking, ERP, or remittance systems. Because automation ensures every payment is paired with the right invoice or reference. This cuts down errors and speeds up settlement cycles.

Regularly Review Remittance Data

Set up dashboards or scheduled reports to monitor ERA feeds. Additionally, spotting anomalies like repeated codes for failed or duplicate payments helps you fix issues before they snowball into costly disputes or compliance breaches.

Use Remittance Codes for Quick Resolution

Train your operations teams to act on standardized ERA codes (like FX01 for exchange rates or INV05 for invoice mismatches). This allows faster troubleshooting, shorter support calls, and higher accuracy in clearing exceptions.

Invest in Staff Training

Even the best systems fail if your people aren’t confident using them. Provide training on reading and applying ERA data in day-to-day operations. This is because when teams understand the codes and fields, they can resolve queries without escalation.

Leverage Digital Remittance Platforms

Modern cross-border platforms, such as those built by DigiPay.Guru, come with ERA support baked in.

So, partnering with a specialized provider helps you:

- Roll out ERA across multiple corridors

- Keep pace with ISO 20022, and

- Deliver transparency to your customers from day one

With these practices in place, ERA stops being just another compliance requirement and becomes a driver of efficiency, trust, and growth in your cross-border business.

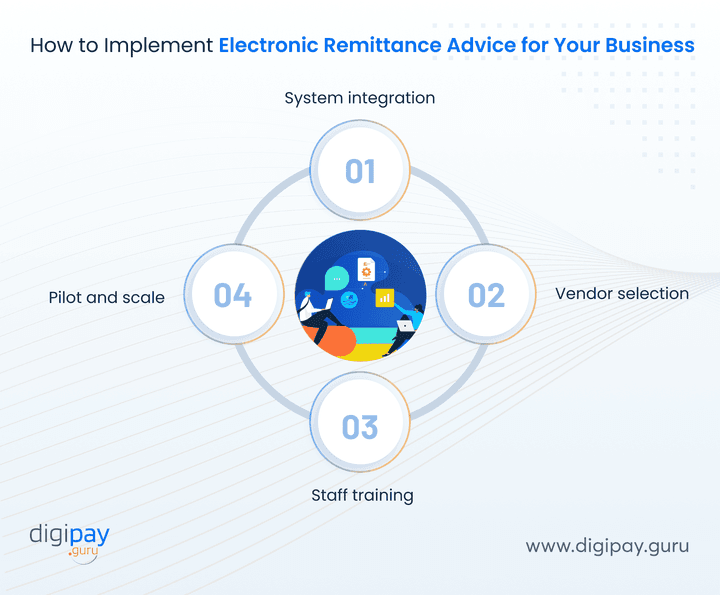

How to Implement Electronic Remittance Advice for Your Business

Implementation of ERA for your remittance business is as simple as a walk in the park. Here’s how you can approach it:

- System integration: Ensure your core banking or fintech platform supports ISO 20022 or ERA-compatible formats.

- Vendor selection: Choose a technology provider that specializes in cross-border remittance solutions.

- Staff training: Bring your finance and compliance teams up to speed on ERA workflows.

- Pilot and scale: Start with high-volume corridors like Europe → North Africa or US→ Mexico, then expand globally.

At DigiPay.Guru, we design remittance platforms with ERA built in. That means you can adopt ERA without re-inventing your tech stack.

Challenges and Considerations for ERA Implementation

Adopting electronic remittance advice (ERA) in cross-border payments delivers major benefits, but it also comes with hurdles you need to plan for.

Here are the key challenges to keep in mind:

- Legacy banking and remittance systems may not support ERA or ISO 20022 formats.

- Not all corridors have adopted standardized ERA messaging, creating gaps in coverage.

- Integration with core systems, ERPs, or apps can involve significant upfront costs.

- Regional regulations differ, requiring customization of ERA formats per market.

- Staff need training to interpret ERA codes and use them effectively in daily operations.

Read more: Top Bank Remittance Challenges & How to Solve Them

The Future of ERA in Cross-Border Payments

Cross-border payments are moving toward faster speeds, richer data, and stricter compliance. In that landscape, ERA will become a core requirement.

And businesses that prepare early will gain smoother operations and stronger customer trust. Here’s what the future looks like:

- Real-time payments with ERA: As instant cross-border transfers grow, ERA will deliver payment details in real time, not hours or days later.

- Global ISO 20022 adoption: With more countries mandating ISO 20022, ERA will become the default standard for financial messaging.

- Data-rich transactions: ERAs will carry more structured fields (like compliance tags, FX breakdowns, and invoice metadata) for deeper automation.

- Integration with digital wallets: ERA will move beyond banks and into wallets, giving consumers the same level of transparency businesses already expect.

- AI-driven reconciliation: Future systems will use ERA data combined with AI to predict errors, flag risks, and auto-resolve disputes.

- Regulatory enforcement: Regulators will increasingly demand ERA as proof of transparency, especially in high-risk corridors.

Conclusion

In international remittance, your business can fail if you can’t provide proper details for the money transfers. Why? Because your customers won’t be able to trust you or feel at peace about their funds. That’s the gap electronic remittance advice (ERA) fills. It makes every transfer clear by showing the invoice, the purpose, the fees, and the final amount.

For remittance service providing businesses like yours, ERA is what speeds up reconciliation, reduces customer complaints, and keeps regulators satisfied. More importantly, it shows your customers that you value transparency and that builds trust.

The choice is simple: without ERA, cross-border payments remain a guessing game. With ERA, every transaction is clear and transparent.

At DigiPay.Guru, we’ve built international remittance solutions with ERA at the core. Plus, our platform helps you handle high-volume corridors, simplify reconciliation, and meet global compliance standards with ease.

If you want your remittance service to run faster and earn customer trust, DigiPay.Guru can help you get there.

FAQs

For a remittance provider like yours, the purpose of Electronic Remittance Advice (ERA) is to make every cross-border transfer transparent. It explains why the money was sent, what fees or FX rates applied, and which invoice or reference it belongs to. This saves your operations team time and gives your customers the clarity they expect.

ERA improves your remittance service by attaching structured details to each transaction. Instead of leaving customers confused about charges or compliance teams chasing missing information, you deliver payments with a full explanation. That means faster reconciliation, fewer complaints, and more trust in your brand.

Yes. ERA follows international standards like ISO 20022, so sensitive payment data moves securely across banks, wallets, and remittance networks. For your business, that means you can provide detailed payment information without risking data security.

As a remittance provider, ERA simplifies your reporting by automatically linking each transfer to its purpose. Your finance and compliance teams don’t need to manually match credits to invoices. This improves accuracy in your books, reduces audit stress, and ensures you stay regulator-ready.

Yes. ERA isn’t only for big banks. Even smaller remittance providers benefit by offering clear, transparent receipts. Many modern remittance platforms (like DigiPay.Guru’s) include ERA as a built-in feature, so you can start without heavy infrastructure costs.

While ERA is used in banking, healthcare, and trade, the biggest impact is in international remittances. Providers like you gain the most because ERA helps manage high-volume corridors, improves compliance in regulated markets, and creates customer trust in competitive remittance channels.

Most remittance disputes happen when receivers don’t understand why the final amount is lower. With ERA, you show the full breakdown: sender, purpose, deductions, FX rates, and net received. This clarity reduces complaints, lowers support tickets, and protects your reputation.

Often, yes. ERA can be integrated into your current remittance platform. Solutions like DigiPay.Guru’s international remittance system is modular, meaning you don’t need to replace your entire provider setup to deliver ERA to your customers.