More than half of Ethiopian adults still do not use a formal bank account, even as mobile-based financial services continue to expand across the country.

That gap explains why mobile money matters to you as a bank leader.

Growth in Ethiopia is no longer limited by demand. It is shaped by reach, cost, and how easily customers can move money in daily life.

While branch-led models struggle to keep pace with these realities. Mobile-first models do not.

Mobile money gives you a practical way to extend services beyond branches, increase transaction frequency, and lower operating costs without compromising control. It also gives you visibility into customer behavior that traditional channels rarely capture.

This is why mobile money in Ethiopia banking has moved from an optional channel to a strategic priority.

In this blog, you will see how Ethiopian banks are using mobile money today, where financial growth is coming from, and what separates short-term launches from sustainable scale.

Let’s begin by understanding the evolution of mobile money in Ethiopia.

Evolution of Mobile Money in Ethiopia

Mobile money in Ethiopia did not grow overnight. It moved through clear stages, each shaping how banks participate today.

Let’s take a glimpse into each of these stages and see the evolution of mobile money in Ethiopia:

| Phase | Market State | Bank Involvement |

|---|---|---|

| Early stage | Telco-dominated wallets | Limited partnerships |

| Expansion | Rapid wallet adoption | API integrations |

| Maturity phase | Ecosystem building | Bank-led wallet strategies |

| Growth phase | Embedded finance & interoperability | Platform & infrastructure investments |

In the early stage, telcos carried the momentum. Their wallets solved access and reach problems. And banks stayed closed but cautious.

During expansion, banks integrated through APIs. That phase helped, but it limited ownership. You could participate, but you could not fully shape the customer journey.

Today, Ethiopia is entering the growth phase. And banks want more than access. They want control, data, and flexibility. This is why bank-led wallets, embedded finance models, and mobile money infrastructure for banks are gaining attention.

This shift explains why mobile money Ethiopia fintech conversations now focus on platforms rather than partnerships.

How Ethiopian Banks Are Using Mobile Money Today

Mobile money is already embedded in Ethiopian banking operations. But how are banks actually using mobile money? The use cases below are practical, measurable, and closely tied to financial outcomes.

Here’s where mobile money delivers immediate value:

| Use Case | Bank Objective | Mobile Money Role |

|---|---|---|

| Retail payments | Volume growth | Wallet transactions |

| SMEs | Retention & float | Merchant acceptance |

| Rural banking | Inclusion | Agent networks |

| Institutions | Scale & transparency | Bulk payments |

-

Retail payments drive transaction frequency. Every wallet payment builds a habit and data. This is how Ethiopian banks' digital payments move beyond sporadic usage.

-

SMEs benefit through merchant acceptance. Wallet-based collections improve liquidity and reduce cash handling risks. For banks, this creates float stability and cross-sell potential.

-

Rural banking depends on agent networks. Branches cannot scale everywhere, but agents can. This is why agent banking in Ethiopia remains a backbone of mobile money success.

-

Institutional flows rely on bulk payments. Salaries, subsidies, and supplier payouts move faster through wallets than traditional rails. Plus, transparency improves, and reconciliation becomes easier.

💡Expert Tip

Financial Growth Impact of Mobile Money for Ethiopian Banks

Mobile money changes the economics of banking. And its impact shows up across acquisition, cost control, and long-term product expansion.

Here’s a glimpse into the impact of mobile money financial growth Ethiopia for traditional banking vs mobile-money-enabled banking:

| Impact Area | Traditional Banking | Mobile-Money-Enabled Banking |

|---|---|---|

| Customer acquisition | Slow, branch-led | Digital & agent-led |

| Transaction volume | Limited | High-frequency |

| Cost per transaction | High | Low |

| Data availability | Low | High |

| Cross-sell potential | Limited | Strong |

What this comparison shows is not a technology shift. It shows a business model shift.

Customer acquisition

Traditional acquisition depends on branch visits, paperwork, and staff availability. That approach limits speed and reach.

Whereas mobile money changes this by enabling digital onboarding and agent-led registration. You can reach customers where they live and work, not only where branches exist.

Transaction volume

Branch-based banking produces low transaction frequency because customers visit only when necessary.

Mobile money reverses this pattern. Wallets support daily use cases such as transfers, bill payments, and merchant purchases.

Higher frequency creates steady fee income and keeps your bank present in customers’ everyday financial decisions.

Cost per transaction

Branch transactions require staff, infrastructure, and physical handling. Each interaction carries a fixed cost.

Mobile money transactions move these activities to digital and agent channels. As volume grows, the marginal cost of each transaction drops. This improves operating efficiency without sacrificing service availability.

Data availability

Traditional channels offer limited insight into customer behavior.

Mobile money generates continuous transaction data across use cases. This data helps you understand spending patterns, liquidity needs, and risk behavior.

Cross-sell potential

When engagement stays low, cross-selling remains difficult. Mobile money keeps customers active. Plus, frequent interaction builds trust and familiarity.

This creates natural opportunities to introduce savings, credit, insurance, or merchant services at the right moment, rather than pushing products blindly.

Strategic Models Ethiopian Banks Are Adopting

Banks in Ethiopia follow different paths depending on size, ambition, and technical readiness. And each model carries trade-offs.

Here are the mobile money strategy models Ethiopian banks are adopting for Ethiopian banking digital transformation:

| Model | Strengths | Challenges | When It Works Best |

|---|---|---|---|

| Bank-owned wallet | Control & branding | Heavy infra burden | Large national banks |

| Telco partnership | Fast distribution | Limited ownership | Rapid expansion |

| Fintech infrastructure | Speed + compliance | Vendor dependency | Scale-focused banks |

| Embedded finance | Distribution reach | Complex integrations | Ecosystem plays |

Bank-owned wallet model

This model gives you full control over branding, customer data, and product direction.Plus, it works well for large banks with strong internal technology teams and long investment horizons.

Growth is steady but requires sustained capital and technical discipline.

Telco partnership model

Partnering with a telco allows fast market entry and immediate access to large user bases. Distribution improves quickly, especially in rural areas. However, ownership remains limited.

So, product flexibility, pricing control, and customer data access depend on the partner. This model suits banks that prioritize reach over long-term platform control.

Fintech infrastructure model

This approach balances speed and control. You use one of the specialized fintech platforms for African banks to power mobile money while retaining regulatory oversight and customer ownership. Plus, integration happens through APIs rather than deep system rebuilds.

This model suits banks focused on scale, operational efficiency, and faster time to market without taking on full infrastructure risk.

Embedded finance model

Embedded finance extends banking services into external ecosystems such as merchants, platforms, or service providers. But growth depends on partnerships rather than direct customer acquisition.

While distribution expands, integrations become more complex. This model works best when a bank already has strong platform capabilities and governance frameworks in place.

💡Expert Tip

Challenges Ethiopian Banks Face in Mobile Money Expansion

Mobile money growth brings operational pressure. Ignoring these challenges leads to stalled adoption.

The key barriers to scale include:

| Challenge | Business Impact | Why It Matters |

|---|---|---|

| Compliance | Delayed launches | Licensing & audits |

| Fraud | Revenue & trust loss | High transaction volumes |

| Interoperability | Fragmentation | User experience |

| Legacy systems | Slow innovation | High IT cost |

| Connectivity | Failed transactions | Rural dependency |

Why These Challenges Slow Mobile Money Scale:

Regulatory compliance

Mobile money operates under close regulatory oversight. Any gap in KYC, reporting, or audit readiness can delay launches and limit expansion. Banks must balance speed with strict compliance expectations.

Fraud risk

As transaction volume grows, fraud attempts increase. Weak controls erode customer trust quickly. And preventing losses requires real-time monitoring, limits, and clear escalation processes.

Interoperability gaps

Disconnected systems frustrate users and restrict usage. When wallets cannot interact smoothly with banks, billers, or merchants, adoption slows, and value remains limited.

Legacy system constraints

Older core systems were not built for high-volume digital transactions. Integrations become slow and expensive, thereby reducing the bank’s ability to innovate quickly.

Connectivity limitations

Rural areas face network instability. And failed transactions damage confidence. Mobile money platforms must handle retries, offline tolerance, and delayed confirmations reliably.

Read more - Mobile money and FinTech success stories of Africa

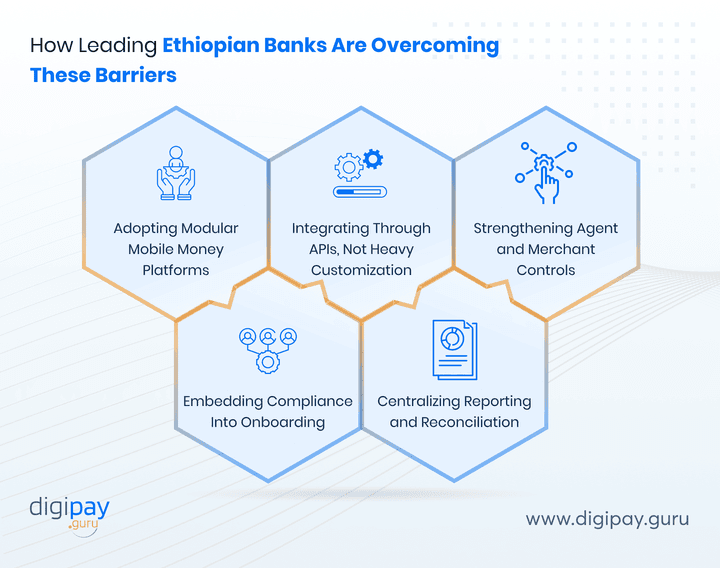

How Leading Ethiopian Banks Are Overcoming These Barriers

Banks that scale mobile money successfully do not try to fix everything at once. They focus on removing operational friction step by step. The emphasis stays on control, reliability, and long-term flexibility rather than speed alone.

Here’s how leading banks in Ethiopia are overcoming these barriers:

Adopting Modular Mobile Money Platforms

Instead of rebuilding core systems, banks use modular platforms that sit alongside existing infrastructure. This approach reduces risk and allows features to be added without disrupting daily operations.

Integrating Through APIs, Not Heavy Customization

API-based integration helps banks connect mobile money with core banking, billers, and partners. It shortens implementation time and makes future upgrades easier to manage.

Strengthening Agent and Merchant Controls

Banks invest in clear commission structures, limits, and role-based access. This keeps agent networks stable and merchant acceptance predictable, even as transaction volume grows.

Embedding Compliance Into Onboarding

KYC and AML checks are built directly into onboarding flows. This reduces manual intervention and ensures regulatory alignment from the first transaction.

Centralizing Reporting and Reconciliation

Unified dashboards and reports give operations and finance teams better visibility. Plus, reconciliation becomes faster, and exceptions are easier to resolve before they escalate.

How DigiPay.Guru Supports Mobile-Money-Led Bank Growth

At DigiPay.Guru, the focus stays on infrastructure that works in real banking environments.

You get an advanced mobile money solution designed for banks, fintechs, and financial institutions that need reliability at scale.

The platform offers:

-

API-first fintech infrastructure that integrates with your existing systems

-

Wallet and payment orchestration for smooth transaction flows

-

Unified mobile money and bank rails to avoid fragmentation

-

Compliance-ready architecture built for regulated markets

-

Modular expansion so you grow without disruption

This way, you stay in control, move at fintech speed, and meet regulatory expectations without compromise.

This approach aligns with how Ethiopian banks are building for long-term financial growth.

Conclusion

Mobile money has become part of everyday financial activity across Ethiopia. For banks, the opportunity now lies in how well this activity is structured, governed, and scaled.

And growth does not come from launching a wallet alone. It comes from building systems that support frequent transactions, reliable agent networks, and clear operational control.

Banks that approach mobile money with long-term intent gain more than digital reach. They improve cost efficiency, strengthen customer engagement, and create a foundation for future products such as credit, savings, and merchant services. This way, the focus stays on steady progress, not rapid experimentation.

At DigiPay.Guru, we help banks and financial institutions that want to offer mobile money services without disrupting existing operations. Our advanced mobile money solution is designed to support regulatory requirements, real-world banking workflows, and scalable growth.

If you are evaluating how mobile money fits into your bank’s next phase, our team can help you assess the right approach.

FAQs

Banks use mobile money to extend services beyond branches and capture high-frequency transactions. Common uses include wallet-based transfers, merchant payments, bill payments, bulk payouts, and agent-led cash-in and cash-out services. Many banks also use mobile money as a digital layer for onboarding and customer engagement.

Mobile money helps you reach customers faster and serve them at a lower cost. It also keeps your bank present in daily payments, not only in occasional branch visits. That daily relevance supports retention, deposit stability, and future product growth.

Growth comes from three levers: higher transaction volume, lower servicing cost, and stronger customer insight. More digital transactions increase fee-based income and improve float movement. Better data helps you design credit, savings, and merchant products with fewer assumptions.

Yes. Many banks launch bank-led mobile wallets in Ethiopia to control branding, customer experience, and data ownership. The key decision is whether you build from scratch or use a proven platform that integrates with your existing core and channels.

The biggest challenges are compliance readiness, fraud and dispute control, interoperability gaps, and integration with legacy systems. Operational reliability also matters, especially in agent liquidity management, reconciliation, and handling failed or delayed transactions.

Mobile money reduces reliance on branches by using digital onboarding and agent networks. It helps customers access basic services like deposits, transfers, bill payments, and merchant payments closer to where they live. Inclusion improves when services are simple, reliable, and available in rural areas.

Fintech infrastructure gives you a faster path to launch and scale without rebuilding your core systems. It supports modular features, API integrations, and operational controls that banks need for real-world scale. It also helps you upgrade capabilities over time, instead of doing one large transformation project.

Secure scaling starts with strong onboarding controls, transaction limits, role-based access, and audit trails. You also need real-time monitoring, clear exception handling, and consistent reconciliation reporting. Security is not one feature. It is a set of controls that must work together across users, agents, merchants, and admins.

For SMEs, mobile money improves collections and reduces cash-handling risk. It supports faster payments, clearer transaction records, and easier reconciliation. For banks, SMEs become more visible financially, which supports merchant services, working capital offers, and deeper retention.

DigiPay.Guru provides an advanced mobile money solution that helps banks offer mobile money services with control and scalability. You get a platform designed for regulated environments, with modular capabilities for wallets, agents, merchants, reporting, and integrations.

If you want to evaluate the best rollout model for your bank, DigiPay.Guru’s team can guide you through scope, architecture, and a practical go-live plan.