Quick Summary

International remittances have become quite normal with so many individuals migrating to foreign countries for higher studies or jobs. So, as a bank, if you want to offer successful international remittance services, you need success-yielding features. This blog will take you through these features.

The global remittance flows for 2023 were around $860 billion!

This stat suggests that remittance services are on the rise and so have a great potential to tap into, especially for banks. Why? Because every national or international transaction ultimately passes through the bank.

So, if banks start offering international remittance services as an added service, it will be an added advantage for them. The advantages of more customer attraction, more retained customers, and better customer engagement. This leads to profits and leadership in the market.

But the question is, how can you as a bank leverage these advantages for international remittance success? The answer is “By offering advanced remittance features that customers need badly!”

In this blog post, you will discover the key features of a global money transfer service that can help you gain international remittance success. Let’s get started and explore each feature one by one.

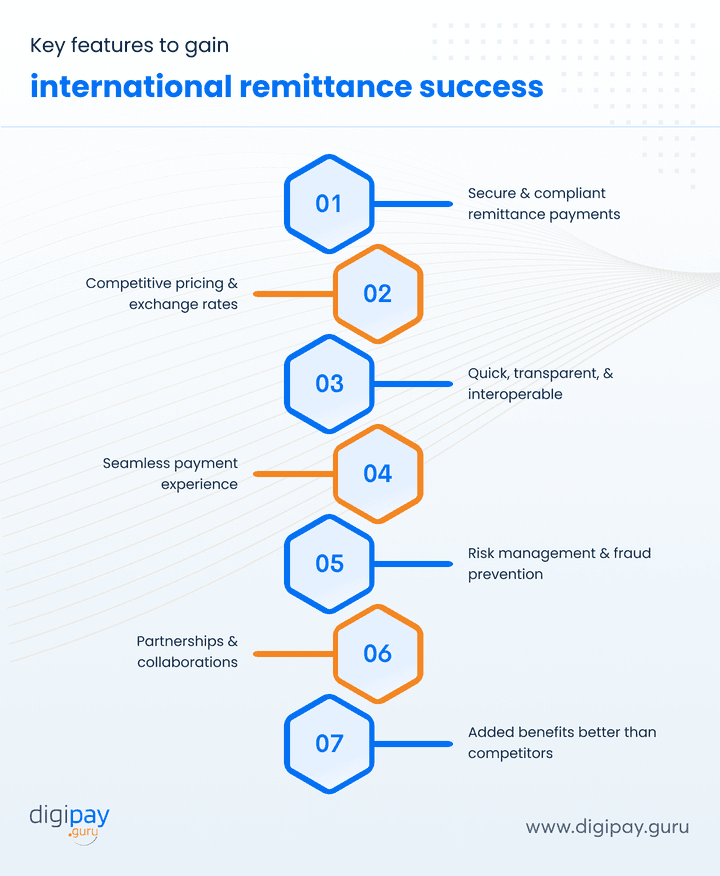

Key features to gain international remittance success

The key features of international money remittance mentioned below can transform your bank into a successful entity for good. Profits, customers, abundance, and growth, all will embrace you in a nick of time, if you make sure to implement these features into your mobile banking system.

The key features are:

Secure and compliant remittance payments

Security and compliance are important factors when there is money movement. And here the money is moving internationally.

Hence, the intensity of robust security and compliance needs is greater here. And non-compliance with security and regulatory standards can lead to;

- Financial losses

- Reputational damage, and

- Regulatory penalties

So, to maintain a high level of security & compliance, you must adhere to international standards & regulations, such as;

- AML screening & KYC standards

- PCI DSS, GDPR, & DSP2

- Strong authentication

- Periodic web PenTesting

- Anomaly detection & prevention

- Advanced encryption algorithm

- Periodic SAST, DAST, SCA scans

- Straightforward authorization rules

Plus, you can collaborate with a fintech offering advanced international money remittance service with robust security & compliance adherence.

Competitive pricing and exchange rates

Customers want affordable services. They can bargain even for a 50-cent extra discount. So, they want competitive pricing and attractive exchange rates in remittance services too.

For that, you can leverage your partnerships or integrate with currency exchange platforms to provide real-time exchange rates. This way, you can ensure that your customers get fair and transparent fees for international remittances

Apart from that, you must clearly communicate fee structures and FX rates to customers. This will enhance transparency and build trust, customer satisfaction, and loyalty.

Read More: Strategies to reduce remittance costs for providers and customers

Quick, transparent, and interoperable

You can deliver quick, transparent, and interoperable cross border remittance services. Here’s how:

Quick:

Implement cutting-edge technologies or partner with fintech which allows you to offer real-time or near-instant international money transfer services.

This results in;

- Enhanced customer experience

- Minimized risks of delayed transactions (currency fluctuations & missed deadlines)

Transparent:

Keep your customers informed about their remittance status at every step by providing real-time transaction tracking & notification features.

By doing so, you will create a transparent path for your customers that will give them a sense of confidence and reliability in your banking services.

Interoperable:

Enable your system to integrate with all the necessary platforms (also called interoperable), to cater to diverse customer preferences & facilitate seamless transactions.

The platforms to integrate include;

- Various payment channels

- Digital wallets

- Mobile money services

- Money transfer operators & more

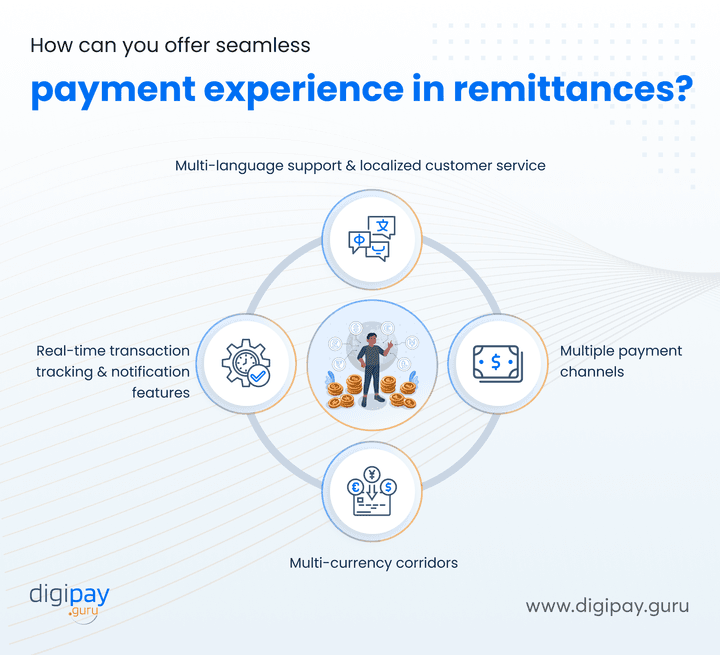

Seamless payment experience

To attract more customers and keep them coming back, you must ensure a seamless payment experience. Here’s how you can do it:

Multiple payment channels

Offering varied payment channels can cater to diverse customer preferences. This means attracting more customers.

The payment channels can be;

- Online platforms

- Mobile applications, and

- In-branch services

Multi-currency corridors

To expand your reach globally, you can expand the no. of currency corridors supported by your services.

Real-time transaction tracking and notification features

Customers appreciate transparency and visibility when it comes to their international remittances.

Implementing real-time transaction tracking and notification features allows your customers to monitor the status of their transactions at every step.

Multi-language support and localized customer service

As you (bank) expand your international remittance services globally, it's essential to offer multi-language support and localized customer service.

By communicating with customers in their preferred languages and catering to cultural nuances, you can foster a sense of familiarity and trust. This ultimately leads to increased customer satisfaction and loyalty.

Risk management and fraud prevention

You must implement advanced fraud detection and monitoring systems to mitigate risks in international remittances & safeguard both you and your customers.

These risks include;

- Money laundering

- Terrorist financing, and

- Cyber threats

Plus, leveraging AI and ML technologies can significantly enhance fraud prevention capabilities in cross-border transactions.

These technologies strengthen your defenses against financial crimes, by;

- Analyzing transaction patterns

- Identifying anomalies, and

- Flagging suspicious activities in real-time

Moreover, with adherence to the CDD & KYC process, you can ensure thorough scrutiny of customer identities and transactions.

This scrutiny;

- Reduces the risk of fraudulent activities, and

- Enhances overall remittance security

Partnerships & collaborations

Strategic partnerships and collaborations are essential for you to gain competitive edge and achieve international remittance success. The partnerships include;

Fintech companies and money transfer operators (MTOs)

Fintech or MTO partnership offers you;

- Advanced technologies

- Innovative cross border payment solutions, and

- Extensive agent networks.

This partnership allows your banks to offer international remittance services that are;

- Faster

- More secure, and

- Cost-effective

Read more: Effective and cost-efficient cross-border payment solution to elevate your business.

Local or regional partners

Collaborating with local or regional partners can help gain a deeper understanding of specific markets and cultural nuances.

These partnerships can facilitate;

- Better market reach

- Customer acquisition, and

- The development of region-based tailored remittance solutions

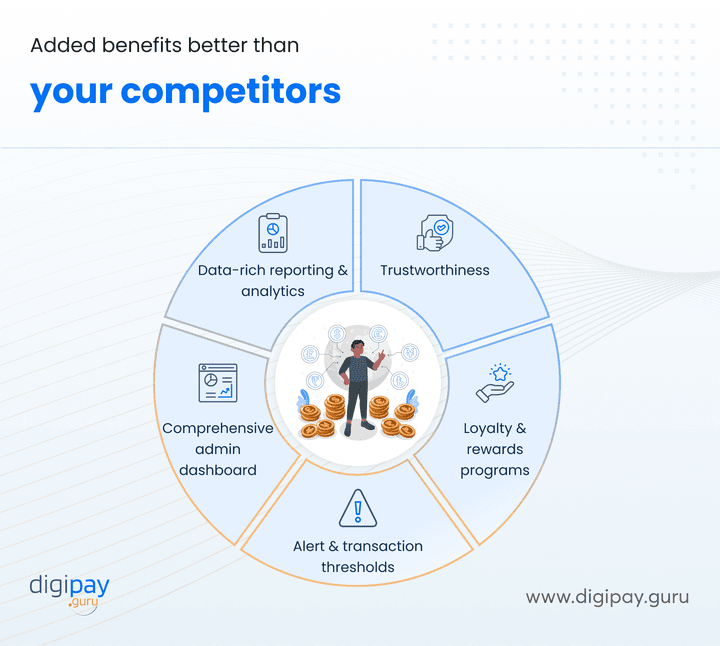

Added benefits compared to competitors

To survive and thrive in the financial market, you must differentiate yourself by offering added benefits that set you apart from your competitors.

Here are some key added benefits that give you a competitive edge and your customers an over-the-top experience;

Trustworthiness

You must offer services that inculcate trust among your customers.

For that, you can offer;

- Reliable services

- Robust security, and

- Have a proven track record of best experience

Loyalty and rewards programs

One powerful strategy for you to retain new customers and attract new customers in the global remittance market is Loyalty and reward programs.

These programs offer incentives like;

- Discounted fees

- Cashbacks, or

- Reward points

These incentives boost long-term customer loyalty and encourage repeat business.

Alert and transaction thresholds

Provide your customers with the ability to set alerts and transaction thresholds. This can enhance their sense of control & security.

By allowing customers to customize notification preferences and set limits on remittance amounts, you can demonstrate your commitment to customer convenience and risk management.

Comprehensive admin dashboard

Offering a comprehensive admin dashboard can be a valuable added benefit as it is an advanced remittance feature.

This dashboard can provide;

- Real-time visibility into transaction details

- Streamlined reconciliation processes, and

- Enable efficient reporting and analysis.

Data-rich reporting and analytics

Leveraging data-rich reporting and analytics can provide you with valuable insights into your customers' remittance behavior, preferences, and pain points.

By analyzing this data, you can

- Make informed decisions

- Optimize your services, and

- Deliver personalized experiences

How DigiPay.Guru can help?

To gain international remittance success, you need a robust international remittance software that offers all the above features and more. DigiPay.Guru’s cross border remittance solution offers just the solution you need to succeed.

With our end to end payment solutions, we strive to empower your bank and related finance businesses with our best-in-class remittance software & its advanced features.

It is a solution designed to make your business shine and customers satisfied with advanced capabilities like;

Secure and reliable

With DigiPay.guru, you can follow security standards and advanced features to ensure safe & trusted transactions for your customers.

Scale effectively

Seamlessly expand your operations & handle rising transaction volumes with our highly scalable infrastructure (it also can be customized and tailored to your brand needs).

Plug & play integrations

Easily integrate our solution into your existing systems and workflows without the need for tech expertise.

The DigiPay.Guru Bonus:

We also offer cloud based solutions to remittance businesses irrespective of the size. The aim is to make your international remittance services fast, secure, and reliable.

- Cost-efficient services

- Pay as you scale

- No hidden costs

Conclusion

By integrating these advanced features into your international remittance services, you can attract more customers, retain them longer, and significantly boost your bank’s market position.

With DigiPay.Guru’s international remittance solution, you can enhance your remittance services with secure, quick, and transparent transactions, along with competitive rates and added benefits. This will set you apart from the competition.

Don’t miss out on this golden opportunity. Remarkable success is waiting for you!