“In Ghana today, users don’t ask if digital payments work.

They know it does.”

This shift has changed everything.

According to the Bank of Ghana, mobile money transactions in Ghana reached a total value of GH¢3.01 trillion in 2024, indicating a significant increase in the nation's use of digital payments. Payments are no longer innovation—they’re expectation. And when expectations aren’t met, users leave quietly.

Fintech in Ghana is entering a make-or-break phase. Payments are mainstream, user patience is shrinking, and regulators are more involved than ever. This creates massive upside—but only for fintechs built for local scale.

This fast-growing, increasingly unforgiving Ghana’s fintech market is growing highly competitive. Success now depends less on launching new features and more on building reliable, compliant, and locally aligned financial infrastructure that can scale with demand.

But growth has exposed friction too—fragmented payment rails, rising fraud risks, regulatory complexity, and trust-sensitive users who don’t tolerate failed transactions or unclear experiences.

This is the real inflection point for fintech in Ghana.

The next phase is not for those who launch first - but those who build reliable, compliant, and scalable systems that match how Ghanaians users actually transact.

What this guide covers:

-

The current state of fintech in Ghana

-

Top fintech trends shaping Ghana’s digital payments

-

Real fintech challenges in Ghana founders face

-

High-growth fintech opportunities in Ghana

-

What to look for in Ghana payment solutions & partners

If you’re building, or investing in fintech in Ghana, this isn’t a market to watch—it is one to design for.

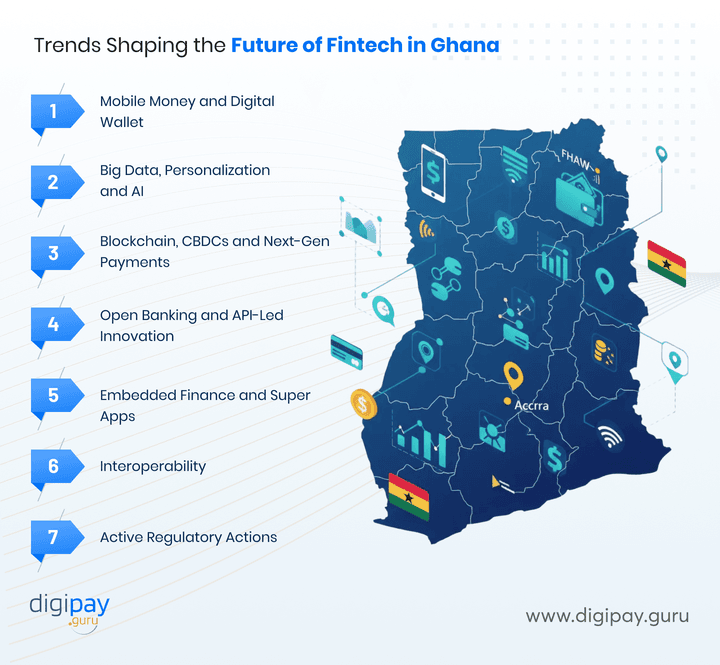

Emerging Top 7 Trends Shaping the Future of Fintech in Ghana

The next phase of fintech growth in Ghana will be defined by how platforms evolve beyond payments into full financial services ecosystems.

Why It Matters - These trends define where the future of fintech in Ghana is heading ranging from mobile money dominance to API-driven ecosystems.

💡Expert Tip

1. Mobile Money and Digital Wallet Expansion

Digital wallet solutions in Ghana are moving beyond P2P transfers into micro-loans, savings products, insurance, and investment access. Wallets are becoming financial hubs rather than single-use tools. Turning Ghana’s economy into a growth market with technology.

2. Big Data, Personalization and AI in Fintech in Ghana

Fintechs are increasingly using AI-driven fraud detection, alternative credit scoring, and personalized financial recommendations. These tools help platforms manage risk while expanding access to underserved users.

| Trend | Description | Example / Impact |

|---|---|---|

| Digital Wallet Adoption | Rising use of mobile wallets & apps | MTN Mobile Money, Vodafone Cash |

| Embedded Finance | Financial tools integrated into apps | E-commerce checkout wallets |

| AI & LLMs in Finance | Smarter risk assessment & chat support | Automated KYC, fraud detection |

| Blockchain & Crypto Interest | Growing blockchain communities | NFT markets, crypto savings |

| Open Banking | APIs connecting banks & fintechs | Data sharing for lending products |

| Interoperability | Seamless payments across banks, wallets, and payment service providers. | GhIPSS enabled wallet-to-bank transfers, QR payments |

| Active Regulatory actions | Increased regulatory oversight | Bank of Ghana licensing, KYC/AML enforcement |

This table summarizes the fintech trends in Ghana and their impact in the category.

3. Blockchain, CBDCs and Next-Gen Payments

Ghana’s e-Cedi pilot signals growing interest in central bank digital currencies and blockchain-based infrastructure. While adoption is still evolving, these technologies could improve transparency, reduce settlement times, and enable programmable payments.

4. Open Banking and API-Led Innovation

APIs are enabling bank-fintech collaboration, third-party integrations, and faster product launches. Open, modular architectures are becoming essential for scaling across services and partners.

5. Embedded Finance and Super Apps

Financial services are increasingly embedded into non-financial platforms—commerce, logistics, agribusiness, and digital marketplaces—meeting users where they already transact.

6. Interoperability

A solution to the fragmentation problem of Ghana is interoperability. Connecting the isolated systems into one smooth financial infrastructure that works for the betterment of the country. Real-time cross-border transfers across African currencies are now available thanks to the Pan-African Payment and Settlement System (PAPSS).

Fintech payment platform providers like Digipay Guru are bridging the gaps by offering smart APIs and payment platforms that bring disparate ecosystems together.

By 2030, Africa's financial system should function more like the EU's single payment area, where interoperability will be a prerequisite rather than a competitive advantage.

7. Special Mention - Active Regulatory Actions

Ghanainan government is playing an active role in sculpting the digital economy. With new Ghana Startup and Innovation bill the government aims to strengthen the startup culture, attracting more investors. This creates a fertile environment for better digital structure and fintech compliance in Ghana.

With these trends leading Ghana’s digital structure there are still users who are living in the rural areas where internet availability is a question. This is among one of the challenges that Ghana is facing.

Key Challenges Affecting the Growth of Fintech in Ghana

The rising trends are showing possibilities but there are some substantial obstacles in fintech growth of Ghana. For founders to scale in Ghana they must address these fintech challenges in Ghana as early as possible.

Why It Matters - These challenges are why many fintechs struggle to scale—not because demand is low, but because execution is hard._

| Challenge | Business Impact | Effort to Address | Why This Matters in Ghana |

|---|---|---|---|

| Cybersecurity & Fraud | Very High | High | -High mobile money volumes attract SIM-swap fraud, social engineering, and account takeovers.The Bank of Ghana expects strong fraud monitoring. Weak controls can trigger wallet suspensions or partner scrutiny. |

| Regulatory Complexity & Compliance | Very High | Very High | Fintechs must comply with Bank of Ghana licensing, AML/CFT guidelines, transaction limits, and reporting mandates. Delays in approval or non-compliance can halt launches entirely. |

| Infrastructure & Connectivity Gaps | Medium–High | Medium | While Accra and Kumasi are well-served, rural regions face network instability and device limitations. Failed or delayed transactions impact user confidence, especially for mobile money–dependent users outside urban centers. |

| Trust & User Experience | High | Medium | Ghanaian users are quick to abandon platforms after failed payments. With many wallet options available, switching costs are low. Reliability and transparency directly affect retention. |

| Interoperability & Settlement Delays | High | Medium–High | Despite GhIPSS progress, interoperability across banks, wallets, and PSPs still introduces settlement delays and reconciliation complexity. This impacts merchant payouts and SME cash flow. |

Cybersecurity & Fraud

With growing digital transactions, fraud is not just increasing—it is getting smarter. Account takeovers, social engineering scams, and mobile money fraud are common realities in high-volume ecosystems like Ghana.

Basic security checks are no longer enough. Founders need real-time monitoring, tokenization, behavioral risk scoring, and automated fraud responses built into the system. Without these controls, fraud losses and chargebacks don’t just hurt revenue—they quietly strike at user trust.

Founder Shared Challenge- Fraud crept in quietly

One payments founder shared that fraud didn’t spike overnight, it crept up slowly. By the time alerts were raised, chargebacks had already impacted their settlement cycle. The lesson came fast: fraud prevention needs to run in real time, not in weekly reports.

Regulatory Complexity & Compliance Costs

Ghana’s fintech ecosystem is well regulated and that’s a good thing. But all the good things come with their share of complexities. Licensing timelines, ongoing reporting, KYC/AML requirements, and transaction monitoring can slow launches if they’re not planned early.

Compliance isn’t a box you tick once; it evolves as your product grows. Founders who push compliance down the roadmap often end up paying for it later through delays, rework, or regulatory pressure.

Real life Anecdote – Delayed Launch

A startup preparing to launch a wallet feature assumed compliance could be “handled post-MVP.” The product was ready—but approvals weren’t. What should have been a soft launch stretched into months, forcing engineering and legal teams back to the drawing board.

Infrastructure & Digital Literacy Gaps

Urban fintech users enjoy stable connectivity and smartphone access, but that’s not the full picture. In rural and semi-urban areas, network reliability, device limitations, and varying levels of digital literacy still shape how people experience financial products.

So if you’re expanding beyond major cities, your product needs to work in low-bandwidth conditions, guide users clearly, and support assisted onboarding.

Adoption depends as much on usability as it does on technology in Ghana fintech market.

Real life anecdote – Poor Connectivity Issues

One fintech noticed strong signup numbers outside Accra but poor transaction completion. The issue wasn’t pricing or demand. It was timeouts on low-bandwidth networks. A simplified flow and retry logic significantly improved success rates within few weeks.

Trust & User Experience

In financial services, trust is everything—and it’s easy to lose. A failed payment, a delayed settlement, or a confusing refund flow can be enough for users to walk away. Ghanaian consumers now expect digital payments to be fast, clear, and dependable.

Founders who invest in reliable infrastructure, transparent communication, and responsive support don’t just retain users - they earn long-term loyalty in a highly competitive market.

Real life anecdote – Trust lost

A merchant-focused platform saw churn increase after payout delays—although funds arrived eventually. Once they added proactive status updates and clear settlement timelines, support tickets dropped and retention stabilized. Sometimes, clarity matters as much as speed.

Strategic Fintech Opportunities in Ghana for Growth

For founders who understand the landscape, Ghana offers multiple high-impact growth paths.These fintech opportunities in Ghana pave the way for a stable mobile money ecosystem.

Financial Inclusion for the Unbanked

Large segments of the population remain underbanked. Fintechs that design mobile-first, low-cost, and compliant solutions can unlock significant scale.

Cross-Border Remittances & Trade

Then there is cross border remittance Lower-cost, faster remittance and trade settlement solutions remain in high demand—especially for SMEs and diaspora-driven flows.

Partnerships between Bank–Fintech

Collaboration with banks can accelerate distribution, licensing, and trust while enabling innovation on modern tech stacks.

Agri-Fintech & Rural Solutions

Agriculture remains a major economic driver. Digital payments, credit, and insurance tailored for rural and agricultural users represent a major opportunity.

SME Digital Adoption

POS systems, QR payments, and integrated payment-plus-analytics solutions help small businesses formalize and grow.

What High-Performing Fintechs in Ghana are Getting Right?

In Ghana’s fintech market, speed alone isn’t enough. Founders need technology partners who understand local payment behavior, regulation, and scale realities from day one.

The right partner must support mobile money–first ecosystems, local settlement timelines, and interoperability requirements—without forcing fintechs into rigid global templates. Payments in Ghana are not failing because of low demand – they are failing because of infrastructure not built for the market.

Compliance and security also need to be built in, not bolted on. KYC, AML, transaction monitoring, and tokenization should operate quietly in the background, so teams can focus on growth instead of firefighting audits.

Finally, Ghanaian fintechs need partners who scale with them supporting new products, and markets without costly rework. In a fast-moving ecosystem, flexibility is not a “nice-to-have” thing. It is survival.

How Digipay Guru Enables that Execution?

Digipay Guru is designed for fintechs operating in complex, high-growth markets like Ghana. Our API-first, white-label payment infrastructure helps teams launch faster, operate securely, and scale with confidence.

Through a single integration, fintechs can unify mobile money, bank transfers, cards, and local payment rails. All of this while reducing fragmentation and improving transaction success rates.

Our modular platform supports wallets, marketplaces, payouts, collections, and embedded finance so fintechs in Ghana can expand without rebuilding their payments stack. As regulations and market needs evolve, the infrastructure evolves with them.

For founders and investors, this means less time managing payment complexity and more time building products that Ghana’s digital economy actually needs.

Is Ghana Right for Your Fintech?

You can self-check whether the fintech in Ghana works for you or not? Here is a checklist to give you more clarity -

-

Do you support mobile money–first flows?

-

Can your infra handle GhIPSS & PAPSS?

-

Is compliance embedded, not manual?

-

Can your UX survive low bandwidth?

Ghana’s fintech story isn’t about who launches fastest – it is about who builds for trust, scale, and local reality.

The next decade belongs to fintechs designed for Ghana, not adapted to it.

FAQs

Fintech growth in Ghana is driven by widespread mobile money usage, rising smartphone adoption, SME digitization, and national payment infrastructure like GhIPSS.

Ghana’s mobile money market processes over GH¢1.2 trillion annually, making it one of Africa’s most active digital payment ecosystems.

Key challenges include regulatory compliance, fraud risk, fragmented payment systems, infrastructure gaps, and maintaining user trust at scale.

Startups ensure compliance by engaging early with the Bank of Ghana and embedding KYC, AML, and transaction monitoring into their payment infrastructure.

AI and LLMs improve fraud detection, automate KYC, enhance credit scoring, and enable faster customer support for fintech platforms.

High-demand solutions include mobile wallets, merchant payments, SME POS and QR systems, digital lending, and remittance platforms.

Yes. Ghana offers strong mobile money adoption, growing digital demand, and a structured regulatory environment for fintech launches.

Fintechs scale securely by using API-first platforms with built-in security, compliance automation, and support for local payment rails.

Technology partners provide compliant infrastructure, local payment expertise, and scalable systems that reduce risk and time-to-market.

DigipayGuru offers API-first, white-label payment infrastructure that unifies mobile money, banks, and local rails with built-in compliance.