The United Arab Emirates has become one of the most dynamic fintech hubs in the world. Once known mainly for its oil wealth and skyscrapers, the UAE is now making global headlines for something different: fintech innovation.

According to a 2026 report by Globenewswire, the UAE fintech market is projected to grow from $2.97 billion in 2024 to $6.42 billion by 2030, at a CAGR of 13.8%. This growth reflects the UAE government’s strategic focus on building a digital economy, backed by proactive regulation from the Central Bank of the UAE (CBUAE) and innovation-driven hubs like DIFC and ADGM.

For businesses like yours, this is a signal to adapt, collaborate, and lead MENA’s digital finance transformation.

In this blog, we’ll explore fintech in the UAE market landscape, its key growth drivers, and the leading players shaping the region’s digital finance future.

Let’s begin with a glimpse into the UAE fintech market.

The UAE Fintech Market: A Region on the Rise

The UAE has become the epicenter of fintech in the MENA region, driven by government vision, world-class infrastructure, and a culture of innovation.

The UAE government has placed financial technology at the center of its Digital Economy Strategy, which aims to double the digital sector’s contribution to GDP by 2031.

Plus, initiatives like Smart Dubai, Digital Dirham, and the CBUAE’s FinTech Strategy 2026 show the country’s intent not to follow fintech trends 2026 but to set them.

Moreover, the regulatory parties like the Central Bank of the UAE (CBUAE), the Dubai International Financial Centre (DIFC), and the Abu Dhabi Global Market (ADGM) have created frameworks that make the UAE one of the most fintech-friendly regulatory landscapes in the MENA and the Globe.

The UAE’s fintech landscape today includes:

-

250+ active fintech startups in sectors like payments, lending, and wealth tech.

-

Over 60% of UAE consumers use at least one digital banking or payment app.

-

A rapidly growing cashless economy in the UAE, with card and mobile payments leading everyday transactions.

In simple words, fintech isn’t the future in the UAE; it’s the present.

Fintech Hubs Powering Innovation in the UAE

The UAE’s fintech success didn’t happen by chance. It’s been built on a foundation of purposeful ecosystems.

There are varied fintech hubs that power advanced innovation in the UAE.

The key fintech hubs include:

| Fintech Hub | Location | Core Focus | Key Programs/Initiatives |

|---|---|---|---|

| Dubai International Financial Centre (DIFC) | Dubai | Global fintech hub, open banking, wealth tech | FinTech Hive, Innovation Hub |

| Abu Dhabi Global Market (ADGM) | Abu Dhabi | Regulatory innovation, sustainable finance | RegLab, digital asset regulation |

| Hub71 | Abu Dhabi | Startup accelerator and venture hub | Fintech partnerships, VC funding programs |

| Sharjah Research Technology Park (SRTIP) | Sharjah | Blockchain, R&D, startup incubation | Fintech testbeds and academic partnerships |

Each of these fintech hubs acts like a sandbox for financial institutions and fintech startups to test, launch, and scale safely within clear guidelines.

Banks and fintechs like yours can benefit from these hubs by gaining:

- Fast-track regulatory approvals

- Partnership access

- And venture support

That’s why global names like Revolut, Stripe, DigiPay.Guru, and Rapyd have either entered or are eyeing the UAE as their MENA launchpad.

Know more - DigiPay.Guru at MENA Fintech Festival 2024 in Qatar: Recap

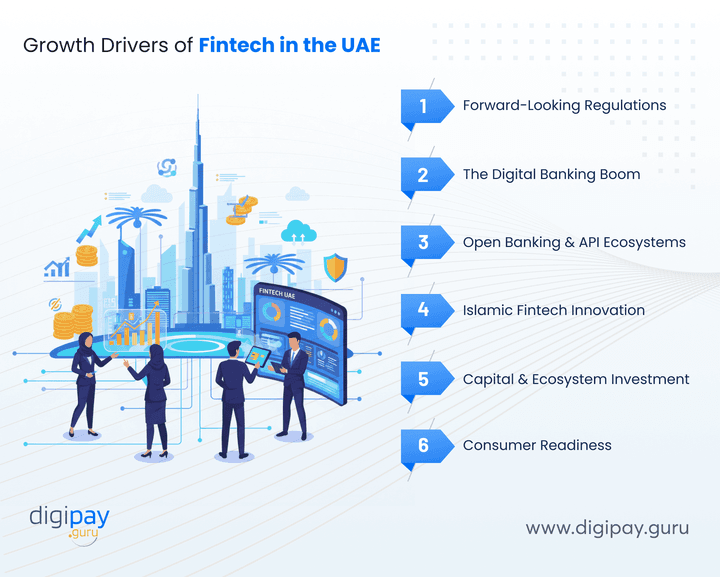

Growth Drivers of Fintech in the UAE

The rise of fintech companies in the UAE is no accident. It’s the result of multiple forces converging, such as policy, technology, investment, and consumer behavior.

The key growth drivers of fintech innovation in the UAE are:

1. Forward-Looking Regulations

The CBUAE, DIFC, and ADGM have built one of the most progressive regulatory landscapes in the MENA region.

Their sandboxes and reglabs help startups test innovations without the risk of non-compliance.

This regulatory clarity attracts banks, NBFCs, and fintechs to build next-gen payment systems confidently.

2. The Digital Banking Boom

Neo-banks like Wio Bank and YAP have proven that digital banking in the UAE can be both compliant and customer-first.

And their success signals an ecosystem shift where consumers prefer mobile-first, personalized, and fee-transparent financial services.

3. Open Banking and API Ecosystems

The UAE is among the first in MENA to actively promote open banking. It’s changing how financial institutions operate by encouraging collaboration instead of competition.

Plus, APIs now drive everything from lending to loyalty.

4. Islamic Fintech Innovation

Sharia-compliant solutions are booming in the fintech space. From digital Islamic savings accounts to halal lending apps, Islamic fintech is becoming a global export category with the UAE at the center of fintech.

5. Capital and Ecosystem Investment

UAE fintech investment reached about $2.2 billion by mid-2026, which has become a key opportunity for businesses like yours to notice.

Plus, the government’s 100% foreign ownership policy, startup visas, and accelerators like Hub71 have fueled a pipeline of fintech innovation.

6. Consumer Readiness

With smartphone penetration at 100% and internet usage above 99%, UAE consumers are digital-first. This demand pushes banks and fintechs to innovate faster in areas like contactless payments, eWallets, and mobile money.

Technology Trends Shaping the UAE Fintech Landscape

Technology isn’t just supporting fintech in the UAE; it’s driving its reinvention. The key trends that are shaping the UAE’s innovative fintech landscape are:

| Trend | Impact on Fintechs | Impact on Financial Institutions | Example Use Case |

|---|---|---|---|

| Open Banking & APIs | Enables partnerships and embedded finance | Drives innovation and service personalization | Instant account-to-account transfers |

| Cloud-Native Architecture | Scalable fintech deployment | Lowers IT costs and boosts agility | API-based payment platforms |

| AI & Analytics | Enhances fraud detection and credit scoring | Improves compliance & customer insights | Smart KYC and risk monitoring |

| Islamic Fintech Solutions | Unlocks untapped ethical finance markets | Aligns products with Sharia laws | Halal lending platforms |

| Crypto-to-Fiat Conversions | Supports regulated digital assets | Adds diversification to banking revenue | Crypto-powered cross-border remittance |

Let’s understand each of these trends in brief:

Open Banking and APIs

Open banking in the UAE is rapidly becoming the foundation of collaboration between banks and fintechs.

APIs are helping you move beyond traditional silos by securely sharing customer data (with consent) to deliver personalized lending, payments, and wealth solutions.

This shift empowers banks like you to stay relevant in a digital-first world while enabling fintechs to scale faster through partnerships instead of competition.

Cloud-Native Architecture

Legacy systems once slowed down innovation. Now, cloud-native platforms are helping fintechs deploy new digital services within weeks, not months.

For banks and financial institutions like yours, this approach means better scalability, resilience, and lower infrastructure costs.

The rise of API-based payment solutions and modular eWallet platforms is proof that UAE fintech is moving toward agile, future-ready infrastructure.

AI and Data Analytics

Artificial Intelligence is the brain behind smarter decision-making in the UAE financial technology ecosystem.

- Banks are using AI-driven analytics for fraud prevention, transaction monitoring, and credit scoring.

- Fintechs leverage these insights to design personalized financial experiences, thereby improving both compliance and customer satisfaction.

Islamic Fintech Solutions

The UAE’s commitment to Sharia-compliant finance is opening new doors for innovation.

Fintechs like you are now developing Islamic digital banking platforms, savings products, and investment tools that blend ethical finance with convenience.

This growing sub-sector supports the UAE’s goal to become a global hub for Islamic fintech, aligning perfectly with the cultural and financial fabric of the region.

Crypto-to-Fiat Conversions

With the UAE positioning itself as a regulated digital asset hub, crypto-to-fiat innovation is on the rise.

Licensed exchanges and fintechs are enabling instant, compliant crypto payments and cross-border remittances.

For financial institutions like yours, this opens new revenue streams and partnerships while ensuring full compliance with CBUAE and ADGM frameworks.

Key Top Fintech Companies Driving Innovation in the UAE

The country’s fintech space is now packed with innovators shaping every layer of financial services, from neobanking and remittance to API infrastructure and investment platforms.

The key fintech companies driving fintech innovation in the UAE currently are:

| Company | Headquarters | Core Offering | Founded | Why It Matters |

|---|---|---|---|---|

| YAP | Dubai | Digital banking & money management | 2019 | Among the first neobanks in the UAE |

| Wio Bank | Abu Dhabi | Cloud-native SME banking | 2020 | First licensed neobank under ADGM |

| NymCard | Dubai | Card issuing & payment APIs | 2017 | Powers regional fintech cards |

| Sarwa | Dubai | Robo-advisory & wealth tech | 2016 | Simplifies investing for retail users |

| NOW Money | Dubai | Payroll & eWallet for low-income workers | 2016 | Promotes financial inclusion |

| Baraka | Dubai | Retail investing app | 2020 | Encourages youth financial literacy |

These players show that UAE financial technology isn’t just about payments. It’s about creating access, inclusion, and transparency in every financial interaction.

And from these companies, you can gauge that with opportunity, the competition is also wide in the UAE. So, it's now the time to tap into it.

The Regulatory Landscape

The UAE Central Bank fintech regulations are among the most forward-thinking globally. Here’s how:

The CBUAE Fintech Strategy 2026 focuses on:

- Promoting safe innovation via sandboxes.

- Establishing clear guidelines for digital banking and payment services.

- Plus, encouraging AI adoption for risk management and compliance.

The DIFC and ADGM also offer:

- Separate licensing for crowdfunding

- Digital asset custody

- And payment solutions

This enables fintechs like yours to enter the market confidently.

So, when you look at the regulatory landscape of the UAE, it's clear and simple. And this clarity matters especially for banks and NBFCs exploring cross-border partnerships.

The UAE’s unified regulatory framework ensures interoperability, data protection, and compliance. This is exactly what enterprises need to scale securely.

How DigiPay.Guru Supports Fintech Development in the UAE

Launching a fintech product in a regulated market isn’t easy. But with the right partner, it becomes achievable.

DigiPay.Guru empowers fintechs, banks, and financial institutions like yours to build and launch secure, compliant, and market-ready digital payment ecosystems in the UAE.

Here’s what gives DigiPay.Guru an edge over other payment solution providers:

| Factor | Why It Matters | DigiPay.Guru's Edge |

|---|---|---|

| Regulatory Understanding | Ensures smooth entry & compliance | Experience with UAE Central Bank, DIFC, and ADGM regulations |

| Proven Architecture | Delivers scalability & reliability | Cloud-native microservices powering high-volume transactions |

| Local Integration Expertise | Enables regional interoperability | APIs connected with the UAE’s core banking & payment systems |

| Product-Level Thinking | Accelerates innovation | Pre-built modules for eWallets, prepaid cards, and agent banking |

| Time-to-Market Advantage | Reduces launch delays | White-label platforms ready for rapid deployment (launch in as little as 90 days) |

With DigiPay.Guru, you don’t just build fintech products, you build business impact.

Whether it’s digital banking, cross-border remittance, or eWallet solutions, our digital payment solutions help you go to market faster, stay compliant, and scale confidently.

The Road Ahead: The UAE Fintech Map 2026 and Beyond

The UAE is shaping up to be the financial innovation capital of the Middle East.

By 2026, expect three major shifts:

- Open finance will become mainstream, where APIs will drive collaboration, not just integration.

- AI and data analytics will move from back-office tools to front-line decision engines.

- Cross-border interoperability will connect the UAE to the broader MENA fintech network.

With MENA fintech growth projected to hit $10 billion by 2030, the UAE stands as its strategic focus: powered by vision, regulation, and relentless innovation.

Conclusion

The UAE fintech market stands as a global example of how vision, policy, and innovation can move in perfect sync.

With the UAE government’s focus on digital transformation, supportive frameworks from the Central Bank, and the rise of agile fintech companies, the country has built more than an ecosystem of momentum.

For financial businesses like yours, this moment is pivotal. The UAE’s progress shows that collaboration, compliance, and customer-centric design are the real cornerstones of fintech success.

At DigiPay.Guru, we help you turn that momentum into measurable results.

Our digital payment solutions: eWallet, international remittance, agency banking, prepaid card solutions, and more, empower you to launch fast, stay compliant, and scale confidently in the UAE’s ever-evolving fintech landscape.

FAQs

The UAE’s fintech boom is driven by a mix of strong government vision, clear regulation, and high digital adoption.

Plus, the Central Bank of the UAE (CBUAE) and innovation zones like DIFC and ADGM have created a supportive environment where new ideas can be tested safely.

The UAE has three major fintech hubs: DIFC in Dubai, ADGM in Abu Dhabi, and Hub71, also in Abu Dhabi.

- Each plays a different but connected role.

- DIFC focuses on open banking and global partnerships

- ADGM supports regulatory innovation and sustainable finance

- Hub71 helps early-stage fintech startups with mentorship and funding.

Together, they make the UAE one of the easiest places to build and scale a fintech business in the region.

Some of the most active fintech players include YAP, Wio Bank, NymCard, Sarwa, and NOW Money.

YAP and Wio are leading digital banking innovation; NymCard powers card issuance infrastructure; Sarwa makes investing simple; and NOW Money focuses on financial inclusion.

What’s exciting is how these companies are partnering with banks and NBFCs, thereby proving that collaboration is shaping the future of fintech in the UAE.

Open banking is creating a bridge between banks and fintechs. By sharing data securely through APIs, institutions like yours can offer more personalized products, faster transactions, and smoother onboarding experiences.

Islamic fintech is one of the UAE’s strongest growth areas. Customers want digital products that align with Sharia principles, and fintechs are stepping up to offer halal investing, digital savings, and payment platforms that respect ethical finance.

For banks and financial institutions, it’s a huge opportunity to reach new audiences across the MENA and Southeast Asia regions.

The biggest forces shaping the UAE’s fintech future are open banking APIs, AI and analytics, blockchain, and cloud-native platforms.

- AI helps improve fraud detection and credit scoring

- APIs make financial products more interconnected

- And blockchain supports transparent and faster cross-border transactions

These technologies are giving both banks and fintechs the agility to deliver secure, data-driven, and customer-centric financial services.

The CBUAE, DIFC, and ADGM have designed fintech-friendly frameworks that make innovation easier and safer.

Startups can use sandbox programs to test products without full licensing upfront, while established players get clarity on rules for payments, eKYC, AML, and data privacy.

This “regulate-to-enable” mindset ensures fintechs can move fast without cutting corners on compliance or trust.

Because in fintech, the stakes are high. A partner with local and technical experience understands the UAE’s compliance laws, integration needs, and banking landscape.

Working with an inexperienced vendor can lead to delays, compliance errors, or integration challenges that cost time and reputation.

That’s why experienced providers like DigiPay.Guru matters; we know the regional ecosystem and help you launch confidently from day one.

The UAE’s fintech sector is heading toward deeper integration and smarter experiences.

- Expect more focus on AI-driven personalization, cross-border payments, and open finance.

- Banks will collaborate even more with fintechs to offer products built around convenience and trust.

By 2030, the UAE will likely serve as the regional fintech hub for MENA by exporting its frameworks, innovations, and digital models to neighboring economies.

Foreign fintechs can enter through DIFC or ADGM, both offer clear licensing paths and regulatory sandboxes.

Partnering with local banks or a fintech technology provider is often the fastest route to market since it simplifies compliance and integration.

Working with a regional expert like DigiPay.Guru helps international players localize their operations, align with UAE regulations, and launch faster without reinventing their technology stack.

Because collaboration is now a growth strategy, not a risk.

Fintechs bring speed, creativity, and digital-first thinking, while banks bring trust, scale, and regulatory experience. Together, they deliver products customers actually want: from instant payments to seamless onboarding.

At DigiPay.Guru, we help you turn fintech ideas into real, scalable solutions.

Our platform supports digital wallets, prepaid cards, agent banking, and remittance systems, all built to meet CBUAE and DIFC standards.

We combine local expertise, strong compliance frameworks, and modular technology. So whether you’re a bank or a fintech, you can launch faster, scale smarter, and stay compliant in the UAE’s fast-moving fintech market.