In today's interconnected world, the demand for efficient and cost-effective international money transfer services has reached unprecedented levels. With millions of people relying on these services to send funds across borders, money transfer operators (MTOs) and banks face the challenge of meeting customer expectations while navigating complex regulatory landscapes.

Fortunately, the advent of modern International money transfer software has revolutionized the way MTOs and banks operate, offering them a streamlined solution to enhance their operations and drive down costs. This groundbreaking software leverages cutting-edge technology to address the pain points faced by the industry, paving the way for improved efficiency, heightened security, and increased profitability.

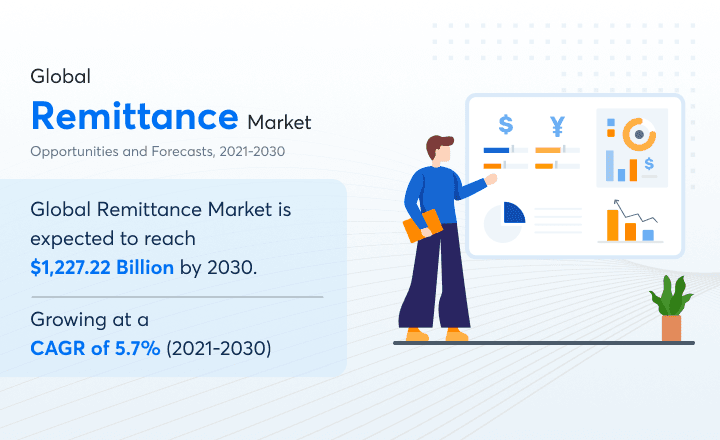

According to recent statistics by Allied Market Research, the global remittance market is projected to surpass $1,227.22 billion by 2030, indicating the significance of embracing innovative cross border payment solutions in the IR space.

In this article, we will delve into the basic understanding of international money transfer software, its key features, challenges faced by MTOs and banks in remittance operations, how to overcome the challenges in international money transfer services, case studies of success stories, and the key factors to consider while choosing a modern international money transfer software, highlighting its potential to transform the operations of MTOs and banks while saving substantial costs.

Also read: Advanced Money Transfer Software in Global Remittance

Understanding modern international money transfer software

To meet the evolving demands of customers, money transfer operators (MTOs) and banks are turning to modern international remittance software. This cutting-edge technology is revolutionizing the way financial institutions manage cross-border transactions, offering instant money transfers, streamlined processes, enhanced security, and cost-saving benefits.

What is modern international remittance software?

Modern international remittance software refers to a comprehensive suite of digital tools and platforms designed to facilitate the seamless & instant money transfer of funds across borders. It leverages advanced technology, including robust encryption, artificial intelligence (AI), and blockchain, to optimize transaction processing, compliance checks, and reporting.

By implementing modern remittance software, MTOs and banks can streamline their operational workflows and the ways to send money internationally. This includes automating manual tasks such as data entry, reconciliation, and transaction processing, leading to increased efficiency and reduced processing times.

Examples of modern international remittance software

Digital payment platforms

Platforms like PayPal, TransferWise, and Venmo are some of the best money transfer apps as they offer user-friendly interfaces and simplified processes for sending and receiving international payments.

Banking software solutions

Leading banking software providers, such as Temenos, Finastra, and FIS, offer comprehensive remittance modules that enable banks to streamline their cross-border payment operations.

Dedicated remittance software providers

Companies like Ripple, Wise (formerly known as TransferWise), and Currencycloud specialize in providing secure and efficient international payment solutions, offering a range of features and integration options.

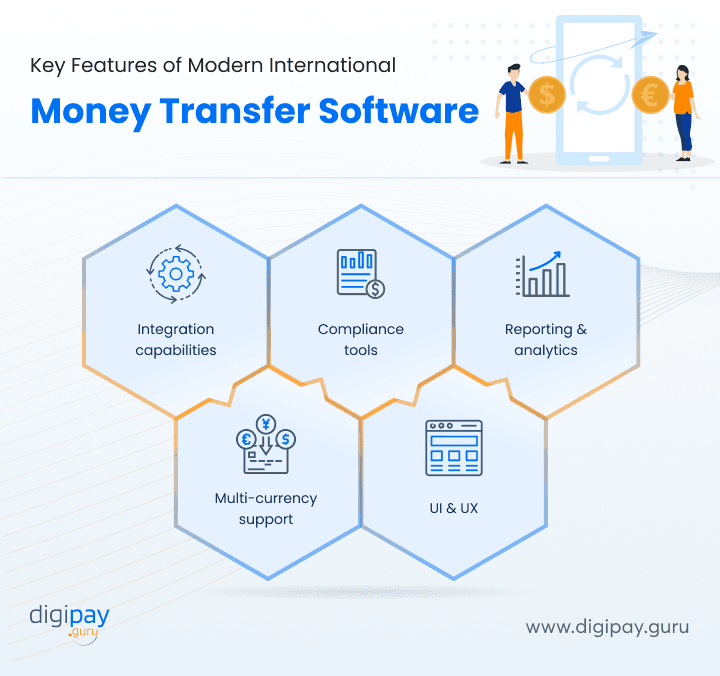

Key Features of Modern International Money Transfer Software

Modern international money transfer software offers a range of powerful features that enable money transfer operators (MTOs) and banks to streamline their operations, enhance compliance, and deliver an exceptional customer experience. These features include

Integration capabilities

Modern remittance software seamlessly integrates with existing systems and infrastructure, allowing MTOs and banks to leverage their current technology investments. This enables a smooth transition and minimizes disruption during implementation.

Compliance management tools

To navigate complex regulatory landscapes, modern international payment solutions incorporate compliance management tools. These tools automate identity verification, risk assessments, and anti-money laundering (AML) checks, ensuring adherence to legal requirements and reducing the risk of fraudulent transactions.

Robust reporting and analytics

Advanced reporting and analytics functionalities provide real-time insights into transaction volumes, revenue streams, and customer behavior. This empowers MTOs and banks to make data-driven decisions, identify trends, and optimize their business strategies.

Multi-currency support and FX rate optimization

Modern remittance software provides smoother international money transfer for businesses as it accommodates multiple currencies, enabling smooth transfers across borders. Additionally, it includes features to optimize foreign exchange (FX) rates and fees, ensuring competitive pricing and maximizing value for customers.

User-friendly interface and customer experience enhancements

Intuitive and user-friendly interfaces are key features of modern remittance software. These interfaces simplify the user experience for both staff and customers, allowing for easy navigation, quick transactions, and self-service options. By fostering greater customer satisfaction, we create a positive experience that paves the way for repeated business engagements.

Challenges Faced by MTOs and Banks in Remittance Operations

In the dynamic landscape of international remittance operations, money transfer operators (MTOs) and banks encounter a multitude of challenges that can hinder their efficiency, profitability, and customer satisfaction.

Regulatory Compliance

MTOs and banks face stringent regulatory frameworks that vary across jurisdictions. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is crucial but requires significant resources and expertise to ensure adherence.

High Transaction Costs

The cost associated with international money transfers, including fees, foreign exchange rates, and intermediary charges, can be a barrier for customers. MTOs and banks need to strike a balance between offering competitive pricing and maintaining profitability.

Security & Fraud Risks

The risk of fraudulent transactions, data breaches, and cyber attacks is a constant concern for MTOs and banks. Robust security measures, such as encryption, authentication protocols, and fraud detection systems, must be in place to protect sensitive customer data and funds.

Limited Access to Financial Services

In some regions, individuals and businesses face limited access to formal financial services, making it challenging for MTOs and banks to reach underserved populations. Overcoming regulatory barriers and establishing partnerships with local entities can help expand financial inclusion.

Technological Infrastructure

Outdated or inadequate technological infrastructure can impede the efficiency of remittance operations. MTOs and banks need robust software systems, reliable connectivity, and scalable platforms to handle the increasing volume of transactions securely.

Exchange Rate Fluctuations

Currency exchange rates are subject to constant fluctuations, which can affect the cost and value of international money transfers. MTOs and banks must employ strategies to optimize foreign exchange rates and minimize the impact of volatility.

Customer Experience

Providing a seamless and positive customer experience is essential in the competitive remittance market. MTOs and banks need user-friendly interfaces, efficient transaction processes, and responsive customer support to meet customer expectations.

Market Competition

The remittance industry is highly competitive, with numerous players vying for market share. MTOs and banks need to differentiate themselves by offering innovative cross border payment solutions, competitive pricing, and value-added features to attract and retain customers.

Cross-Border Regulations

Cross-border regulations, including restrictions on capital flows and varying compliance requirements, pose challenges for MTOs and banks. Staying updated on evolving regulations and maintaining strong relationships with regulatory bodies is crucial.

How can modern international money transfer software help overcome these challenges?

In the face of numerous challenges encountered by money transfer operators (MTOs) and banks in the remittance industry, modern international money transfer software emerges as a powerful solution to overcome these obstacles. These solutions are:

Automation and Efficiency

Modern money transfer software streamlines transaction processing by automating manual tasks. This includes automating data entry, reconciliation, and transaction verification, reducing processing times, and increasing overall efficiency.

Additionally, compliance checks and reporting can be automated, ensuring adherence to regulatory requirements without the need for manual intervention.

Enhanced Security and Fraud Prevention

Advanced security features embedded in modern money transfer software protect sensitive customer information and funds. These features include encryption protocols, multi-factor authentication, and robust data privacy measures.

Real-time monitoring and alerts enable MTOs and banks to proactively detect and mitigate potential security breaches and fraudulent activities.

Enhance security & prevent fraud with DigiPay.Guru’s secure digital payment solution

Cost Reduction and Operational Savings

By minimizing manual processes and human error, modern money transfer software reduces operational costs. Automated workflows and streamlined processes eliminate the need for labor-intensive tasks, freeing up resources for other critical business functions.

Additionally, the software optimizes foreign exchange (FX) rates and fees, ensuring competitive pricing and maximizing value for customers.

Case Studies: Successful Implementation of Modern International Money Transfer Software by MTOs and Banks

Now that we know the effective benefits of Modern International Money Transfer Software for MTOs and banks. Let’s explore some case studies showing the successful implementation of the IR software:

TransferWise

TransferWise, now known as Wise, is a prominent MTO that revolutionized the remittance industry with its digital platform. By leveraging modern international money transfer software, TransferWise transformed the user experience by offering transparent fees, competitive exchange rates, and fast transaction processing for near instant money transfer.

The implementation of their software enabled them to operate with greater efficiency, significantly reducing costs and providing a seamless cross-border money transfer experience to millions of customers worldwide.

Western Union

Western Union, a long-established leader in the remittance industry, has embraced modern international money transfer software to enhance its services. Through the implementation of cutting-edge technology, Western Union improved transaction speed, security, and compliance.

The software enabled them to automate processes, reducing manual errors and optimizing operational efficiency. As a result, Western Union has maintained its position as a trusted provider of international money transfer services, catering to a diverse range of customer needs.

BBVA

BBVA, a renowned global bank, integrated modern international money transfer software into its operations to improve cross-border payment solutions and its services. The software provided BBVA with real-time monitoring capabilities, enabling proactive risk management and fraud prevention.

With enhanced transaction visibility and advanced analytics, BBVA gained valuable insights into customer behavior and market trends, enabling them to refine their strategies and deliver personalized services.

Moreover, the implementation of modern international money transfer software made so many fintech one of the most competitive international money transfer companies thereby ensuring a seamless and secure experience for their customers.

Read More: How FinTechs are transforming international remittance?

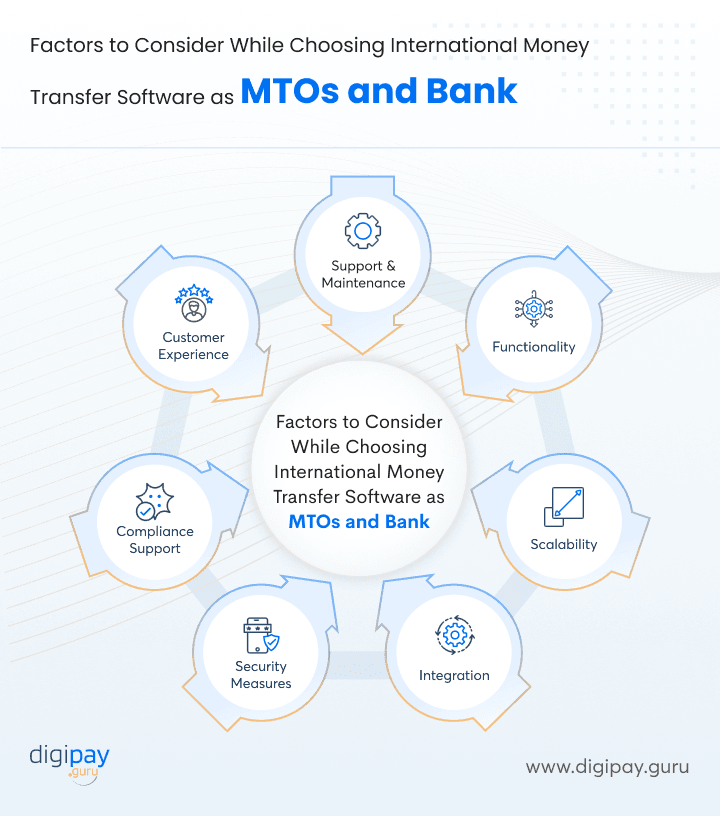

Factors to Consider While Choosing International Money Transfer Software as MTOs and Bank

Selecting the right international money transfer services and software is crucial for money transfer operators (MTOs) and banks seeking to streamline their operations, enhance customer experience, and stay competitive in the remittance industry. When evaluating potential international payment solutions, several key factors should be taken into consideration. They are:

Functionality

The chosen software should offer a comprehensive set of features that address the specific requirements of MTOs and banks. This includes transaction processing, compliance management, reporting and analytics, multi-currency support, and user-friendly interfaces.

Scalability

As the business grows, the software should have the capability to scale accordingly. It should be able to handle increasing transaction volumes and accommodate additional functionalities without compromising performance or security.

Integration Capabilities

Seamless integration with existing systems and infrastructure is crucial for a smooth transition and efficient operations. The software should be compatible with various platforms, enabling data exchange and interoperability with other applications.

Security Measures

Robust security features are paramount in the remittance industry. The software should employ advanced encryption protocols, authentication mechanisms, and data privacy measures to protect sensitive customer information and prevent unauthorized access.

Compliance and Regulatory Support

Compliance with regulatory requirements is of utmost importance. The software should have built-in compliance management tools that automate identity verification, anti-money laundering (AML) checks, and know-your-customer (KYC) processes. It should also provide support for staying up-to-date with evolving regulations.

Customer Experience

The software should prioritize a seamless and user-friendly customer experience. It should offer intuitive interfaces, quick transaction processing, and self-service ways to send money internationally, thereby enhancing customer satisfaction and loyalty.

Technical Support and Maintenance

A reliable software provider should provide international money transfer services that offer prompt technical support and regular maintenance to address any issues or updates. This ensures the smooth operation of the software and minimizes downtime.

Conclusion

Choosing the right international money transfer software is a crucial decision for money transfer operators (MTOs) and banks. By considering factors such as functionality, scalability, integration capabilities, security measures, compliance support, customer experience, and technical assistance, financial institutions can make informed choices that drive operational efficiency and cost savings.

We at DigiPay.Guru strive to provide advanced international money transfer services, designed specifically to streamline your business operations and significantly reduce costs. Opting for our advanced mobile payment solution empowers MTOs and banks to enhance their services, mitigate challenges, and deliver a seamless customer experience.