Your users no longer ask, “Do you accept mobile payments?” They expect it.

From tap-to-pay at grocery stores to cross-border transfers through eWallet apps, they have become the heartbeat of daily transactions. And if you're in financial services offering business, that shift isn’t happening around you. It’s happening to you.

By 2026, 5.2 billion people will be using eWallets. That’s a 53% global surge. But more importantly, it’s a signal that the financial brands that win are those that adapt fast.

Whether you're building for the underbanked, modernizing your ecosystem, or launching new revenue streams, a white-label eWallet solution gives you the speed, security, and scalability to compete.

In this blog, you'll explore:

-

Tangible benefits of e‑wallet solutions for your business

-

What leaders like PayPal and Google Pay are doing right

-

A step-by-step business eWallet integration plan

-

Real-world examples and future-ready insights

Let’s turn your eWallet from an idea into a competitive advantage.

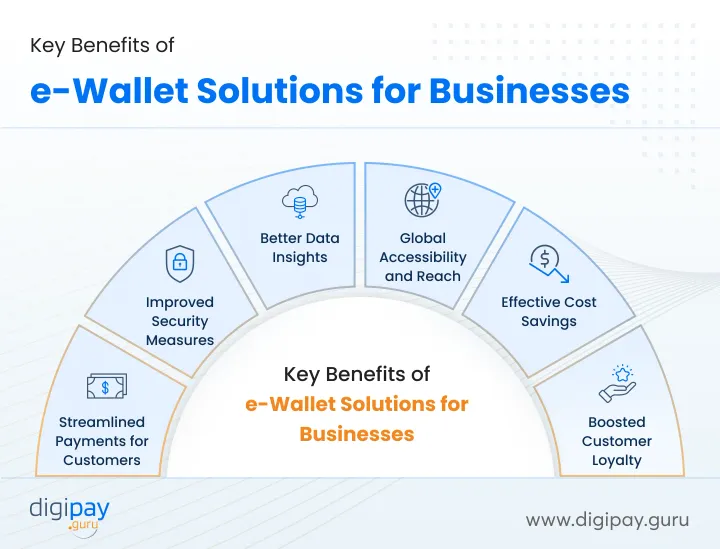

Key Benefits of White-Label eWallet Solutions for Your Businesses

Many leading financial service providers are adopting eWallet payment options due to the benefits they offer. Some of the key benefits of e‑wallets that make them an essential part of the business are

Streamlined Payments for Customers

Integrating eWallet checkout eliminates payment friction that frustrates customers. When you offer a business eWallet app, you're giving users what they already want: seamless, one-tap transactions. From QR code scans to tap-to-pay, the frictionless UX keeps customers coming back.

Improved Security Measures

Secure e‑wallet systems are built with advanced encryption, tokenization, biometric authentication, and more to protect financial data shared with merchants.

This way, customers can feel confident that their payment information remains safe from compromise or misuse. This builds their trust in your business, which in turn makes e-wallet the right choice for you.

Better Data Insights

eWallet adoption enables you to collect real-time transaction data. You can generate valuable data and insights on consumer behavior and patterns. Knowing the spending and buying patterns means sharper personalization, better credit profiling, and smarter cross-selling.

Global Accessibility and Reach

As eWallets are digital, they allow even every size of business to easily expand their customer base and sales worldwide. There are no geographic barriers to using mobile wallet payments.

And cross-border payments, multi-currency wallets, and digital onboarding allow you to reach users across markets, especially in underbanked regions.

Effective Cost Savings

Businesses that integrate eWallet payments can cut down costs associated with cash handling, physical cards, and in-person customer service. Plus, it brings substantial savings on transaction fees and payment processing costs compared to traditional methods.

Lower fees mean improved profit margins on sales. And bringing more and more customers to adopt eWallet use results in ongoing savings.

Boosted Customer Loyalty

You can add loyalty rewards, cashback offers, and gamified incentives inside your wallet platform. This way, eWallet apps offer a smooth & secure eWallet payment experience. This builds satisfaction and loyalty with customers.

Plus, when checkout is easy and their data is safe, customers are more likely to purchase again.

Some Successful eWallet Solutions

The best business eWallets aren't just successful because of branding. They're strategically designed, continuously optimized, and seamlessly integrated into people's lives.

Some of the successful e-wallet solutions are

PayPal - The Pioneer

PayPal pioneered eWallet adoption and remains a global leader. It enables users to securely connect their bank accounts, cards, or devices to make fast payments online or in-store.

PayPal allows easy P2P transfers and provides robust fraud protection and purchase guarantees for extra security. For businesses, PayPal offers accessible merchant plans, analytics, and tools that turn transactions into lasting relationships.

Apple Pay: Seamless Mobile Transactions

Apple Pay is one of the best eWallet solutions, seamlessly built into Apple devices like iPhones, iPads, and Apple Watches. Users add their cards and authenticate payments using Face ID or Touch ID.

It supports fast, encrypted transactions in stores, apps, and online. With Apple Pay Cash, users can also send peer-to-peer payments, which makes it both secure and versatile.

Google Pay: Payments on Android

Google Pay is one of the best eWallet solutions for Android users. It offers seamless, contactless payments via smartphones and tablets. It allows users to store card details securely and pay in-store with a tap.

Online merchants can integrate Google Pay easily via its API. The app also supports peer-to-peer transfers, which makes it a versatile and globally trusted eWallet option.

Implementing eWallet Solutions into Your Business

If you're serious about launching or improving your mobile wallet offering, follow a roadmap that actually works.

Here's how forward-thinking businesses are implementing e‑wallet in business.

Assess Your Business Needs and Define Your Use Case

Start by asking, what's the core problem you're solving with an eWallet? Are you aiming to improve financial inclusion, drive customer loyalty, or streamline P2P payments?

Grounding your strategy in a specific use case ensures your solution fits real customer behavior. With a clear purpose, you avoid bloated features and build something users actually need—and trust.

Choose the Right eWallet Provider

Choosing a provider isn’t just about ticking boxes. Look for one that offers proven scalability, enterprise-grade security, and support beyond launch. Evaluate their roadmap, track record, and how well they understand your sector.

A reliable partner will help you move faster, avoid costly missteps, and deliver a solution that grows with your business.

Choose the Right White-label Partner

Your ideal provider should offer a customizable eWallet platform with modular architecture, regulatory compliance, and rapid go-to-market capability. This is where a partner like DigiPay.Guru adds serious value with its advanced white‑label e‑wallet solution.

Customize Branding and UX Flows

Your wallet's design is about trust, adoption, and daily usage. Tailor the interface to reflect your brand, simplify every tap, and guide users through intuitive onboarding.

A clean, responsive UX builds credibility instantly. And a great design makes your wallet feel native to your customer’s life, unlike another clunky add-on they have to tolerate.

Integrating With Your Existing Systems

A puzzle piece that should fit perfectly. That's how eWallet integration should feel. Make sure your chosen solution harmonizes with your current ewallet payment systems, whether digital or physical.

Your eWallet should easily integrate with your core banking systems, CRM, KYC engine, and payment gateway. A frictionless transition ensures your staff and customers feel at ease from the beginning.

Educate Your Customers

Don’t assume users will explore. Educate your customers through the mediums they frequently use, such as social media, emails, or even informative blog posts. Guide them with walkthroughs, launch campaigns, and simple "how it works" journeys.

Illustrate the advantages, from smoother transactions to enhanced security, painting a picture of a brighter future with eWallets. The more they understand it, the more they’ll use it.

Train Your Staff

Empower your workforce for a smooth transition. Comprehensive training sessions are non-negotiable. Equip your team with the know-how to guide customers and troubleshoot technical problems if needed.

With proper training, the staff will be confident enough in handling the new ewallet payment system, reflected in their customer interactions.

Test and Optimize

Rigorous testing under diverse scenarios can discover potential glitches or bugs in the system, which can help you fine-tune the user experience for a flawless eWallet experience for customers.

Pilot Testing With a Limited Audience

Start small and smart. Launch your eWallet with a limited user group to uncover friction points and gather real feedback. This approach helps validate your assumptions, refine the UX, and ensure system stability before scaling.

Monitor Metrics and Iterate New Features

Launching your eWallet is just the start. Track adoption, transaction volume, and drop-off points to see what’s working and what’s not. Use real user behavior to inform updates. Don’t chase trends; double down on features your audience values.

Continuous improvement based on live metrics keeps your wallet relevant, user-friendly, and ahead of competitors.

Real-world Implementation Case Studies

Successfully integrating e-wallet solutions can transform customer payment experiences and business operations. Examining use cases across industries provides valuable insights for implementation.

Some key real‑world e‑wallet use cases include

Retail Industry Transformation

Major retailers like Starbucks and Walmart have adopted white-label e wallet solutions to great success. Starbucks saw mobile payments surge in popularity after launching its own branded e-wallet app. With it, customers can pre-order, collect rewards, and earn free products all through the app.

Similarly, Walmart Pay reduced checkout times significantly for in-store shoppers who linked cards for contactless tap payments. In short, retailers experience faster transactions, lower processing fees, and branded engagement with advanced eWallet solutions.

Seamless e-commerce Transactions

Online merchants integrating PayPal, Apple Pay, Google Pay, and other branded e-wallets into their checkout flows remove friction for customers. And shoppers can securely check out quickly without repeatedly entering card information.

Data shows lower cart abandonment when e-wallets are offered. Square integrated Apple Pay and Google Pay into its online store builder, which lets merchants accept mobile wallet payments easily.

The future of White Label eWallet Solutions

The eWallet revolution has only just begun. As more businesses adopt mobile and digital wallet technology, we can expect to see exciting innovations that further optimize and secure the payment experience.

Let’s see what the potential future for e-wallet solutions looks like.

Mainstream Adoption is Inevitable

With over 5 billion digital wallet users projected by 2026. This is not a fringe movement. It’s a macro shift.

For consumers, the convenience and ease of eWallet solutions are incredibly appealing. As more retailers integrate the ability to pay with a quick tap or click, customer expectations will make eWallet usage completely mainstream. Soon, pulling out a physical wallet to pay will feel outdated.

Advancing Security through Biometrics

Secure eWallet systems are getting smarter. eWallets will utilize advanced biometric authentication like fingerprint, facial, or even voice recognition for seamless, highly secure identification. This takes mobile payments to the next level, with authorization requiring a person's unique biological traits.

Evolution of Cryptocurrency Wallets

Blockchain-based cryptocurrency wallet solutions will emerge, which will allow decentralized digital currency transactions. Paying via crypto wallets provides enhanced security, global accessibility of funds, and innovative features like smart contracts.

Proprietary Wallets for Brand Loyalty

More retailers will develop branded, customizable e-wallet solutions that integrate directly with their own payment systems. Features like free delivery for wallet users and targeted promotions will drive consumer engagement.

Connecting All Your Accounts

The most innovative eWallets will link credit/debit cards, bank accounts, loyalty programs, coupons, and more, all in one place. This creates an integrated payment hub customized to each user.

Want to implement a bespoke ewallet solution into your business?

You don’t need to build everything from the ground up. You just need a reliable partner that knows how to move fast and scale smart.

At DigiPay.Guru, we’ve built a powerful, white-label eWallet platform designed for banks, fintechs, and financial institutions like yours. From multi-currency payments to expense tracking, top-ups, loyalty rewards, and agent-based onboarding, we cover everything under one roof.

Our solution is modular, scalable, secure, compliant, and fully customizable. That means you launch faster, serve better, and grow without roadblocks. Whether you're targeting new geographies, boosting customer retention, or enabling seamless mobile wallet payments, we’re here to help you do it right.

FAQ's

KA white-label eWallet solution is a fully developed eWallet platform that businesses can rebrand and customize as their own. Instead of building from scratch, you get a ready-made foundation, complete with features like payments, P2P transfers, loyalty, and more, tailored to your brand, use case, and user journey. It saves time, reduces cost, and accelerates your go-to-market strategy.

eWallets are no longer optional. They’re expected. Whether you're a bank, fintech, or enterprise, offering a seamless, secure digital payment experience builds trust, increases retention, and expands your reach. With more than 5 billion digital wallet users projected by 2026, businesses not offering eWallets risks falling behind as customer behavior shifts toward mobile-first, contactless, and app-based financial interactions.

When implemented correctly, modern eWallet solutions are extremely secure. They use encryption, tokenization, biometric authentication (Face ID, fingerprint), and real-time fraud monitoring to protect users and transactions. A well-built solution also follows global compliance standards like PCI DSS, GDPR, and local KYC/AML requirements, which makes it as secure as, or more secure than, traditional payment methods.

Yes. Customization is one of the biggest strengths of white-label eWallet platforms. Whether you’re in banking, retail, travel, telecom, or logistics, you can tailor workflows, features, UI, and integrations to match your specific use case. For example, a bank may prioritize P2P transfers and KYC, while a retailer may focus on loyalty rewards and QR payments.

Building from scratch is resource-intensive and time-consuming. A white-label eWallet gives you a head start with pre-built infrastructure, tested features, and faster deployment. You save months (or years) on development, reduce cost, and avoid technical debt. Plus, a good white-label provider ensures scalability, compliance, and post-launch support, so you focus on growth, not maintenance.

Core features to look for include multi-currency support, P2P transfers and merchant payments, KYC/AML and compliance tools, loyalty rewards, cashback and bill payments, admin dashboards and real-time analytics, biometric login and fraud prevention, API-based integration with core systems, and more.

The more modular and customizable the platform, the better it can grow with your needs.

Implementation timelines vary based on complexity, but with the right provider, you can launch a fully functional eWallet in as little as 8–12 weeks (with DigiPay.Guru). That includes branding, feature configuration, compliance integration, and initial rollout. Choosing a provider with ready APIs, industry experience, and onboarding support can drastically speed up your time to market.