The world where payments can be made by zero physical contact was unimaginable a few decades back. The emergence of advanced digital payment technologies has given rise to “contactless payments”.

Contactless payments have become one of the most in-demand payment methods among customers. The latest study predicts that by 2027, almost 99% of smartphones will have contactless payment capabilities. And what’s prevalent in customers, becomes very critical to stay updated with.

In this blog post, you will get insights into the top 7 contactless payment trends for 2024. There are also some bonus trends in payments that you can keep an eye out for when thinking of implementing contactless payments into your business.

So, let’s get started.

Top contactless payment trends in 2024

Contactless payments have become the norm. Handing out cash has gotten limited with so many solutions focused on contactless payments for the convenience and safety it can offer to your customers. But, which contactless payment trends will see a rise in 2024? We will understand them one by one.

Pro Tip:

It’s essential to know the latest contactless trends in payments to help you make informed decisions, innovate, and offer what’s best for your customers and business in the long run.

Tap and pay is emerging strong

Tap and pay is one of the most convenient and easy-to-use contactless payments and hence it's trending among customers. All they need is a smartphone or a card enabled with NFC tech in it.

Also Read: All you need to know about NFC Payments

This also led to the rise of prepaid cards, a preloaded NFC-enabled card for making payments with just one tap on the payment terminal. No need for credit cards or cash. Moreover, the global value of tap and pay transactions via digital wallets is anticipated to rise by over 150% by 2028.

Tap and pay technology provides a fast checkout while enhancing the buying experience. As more stores enable NFC payments, consumer adoption continues growing.

Embedded payments will grab more attention

A study says that the global revenue for embedded payments is expected to exceed USD 59 billion by the year 2027. Embedded payments integrate payment capabilities directly into apps, websites, vehicles, and devices for seamless transactions.

A simple example is a wallet app integrated into the Ola app to enable contactless payments for customers. This is not only convenient for customers but also for the drivers to keep track of their transactions.

More services will likely leverage built-in payments rather than redirect users elsewhere to pay. It facilitates frictionless commerce, creating stickiness between brands and users. Financial institutions can drive engagement by incorporating embedded payment abilities into their own apps and services.

Digital wallet payments will rise

Digital wallets like Apple Pay, Google Pay, and Samsung Pay are gaining popularity for in-store and in-app payments. They allow consumers to pay with their mobile devices rather than use cash or cards.

Advanced digital wallet solutions are convenient & secure and enable rewards integration. As more stores accept contactless payments, digital wallet adoption will rise further. Banks can stay competitive by ensuring their cards integrate with major wallets.

Scan and thru - the retail revolution

The scan and thru solution has become one of the popular contactless payment trends! The main reason is its self-checkout and billing capabilities. A study by NRF mentions that 62% of people find self-checkout systems have improved their overall shopping experience.

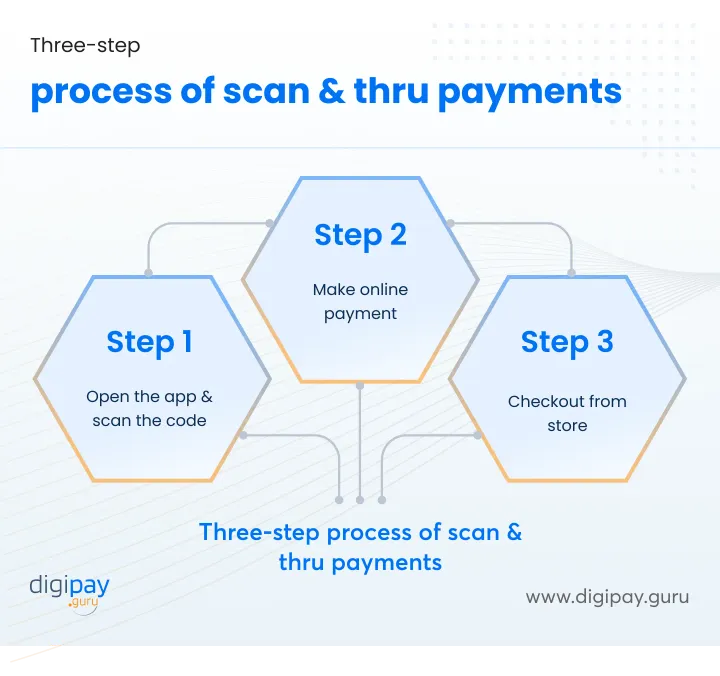

Scan, & thru is important because it simplifies transactions and guarantees a lightning-fast, seamless checkout experience in just three simple steps.

Biometric payments - security at the center

The contactless biometric technologies market is expected to grow to $53.15 billion at a global level by 2032. A contactless payment with biometrics goes like this: A user’s physical features like iris, and facial features are used for biometric authentication and the payment is done through just that one scan.

This contactless payment trend’s methods are very accurate with zero chance of fraud or identity theft, making biometric payments the most secure contactless payment option. And so it's a great one to look to implement in your business this year.

Read More: Biometric technology - Enhancing security in digital payments

Contactless wearable devices

The contactless wearable devices became more prevalent for the need for a contactless, secure, and more convenient payment method after contactless prepaid cards were widely accepted.

Today, contactless wearable devices have become more than that. It's like a status quo for the GenZer having smartwatches on their wrists and seamlessly making payments with it.

Voice-based smart payments

The global market for voice-based payment technology is expected to reach $18.2 billion by 2031. Voice-activated virtual assistants like Siri, Alexa, and Google Assistant enable hands-free payments. Users can make purchases simply by speaking requests.

The volume of smart speakers is expected to reach 335.7 million by 2028. As smart speaker adoption grows, voice-based payments will also rise in popularity for their convenience. Voice payments allow multitasking and assist those with disabilities. Financial institutions can be early adopters of enabling vocal transactions via virtual assistants.

Bonus contactless payment trends to consider in 2024

The above top 7 contactless trends in payments, if adopted into your fintech business, can make a big difference in your customer retention, experience, and overall profitability. Moreover, some additional contactless payment trends can help you grow your business further.

Let’s uncover them!

Growth in contactless QR payments

The latest report on QR payments by Deloitte says that businesses can enable QR code payments by partnering with third-party providers like Venmo or by developing an in-house digital wallet solution with a QR code payment feature.

Quick Response code payments are emerging as a popular contactless payment option. Financial institutions worldwide should take note of QR payment growth as consumer expectations evolve.

QR codes provide a seamless, touch-free payment experience by scanning a code via a smartphone camera thereby offering:

- High convenience factor for both merchants and shoppers

- Allows simpler integration for small vendors vs dedicated POS hardware

- Useful for payments in high-traffic areas like subways and events

Increase in contactless payment limits

With contactless payments on the rise, transaction limits are increasing to accommodate more significant purchases. Banks must adapt by raising capped amounts for contactless debit/credit transactions.

Why?

- Pandemic has accelerated contactless payment adoption at POS

- Consumers expect tap-and-go convenience for bigger ticket items

- Retailers raising or eliminating payment limits to satisfy customer demand

- Higher limits reduce cash usage and lines at checkout

- Opportunity for banks to become the primary payment method via limit increases

Smartphones becoming POS terminals

One of the prominent contactless payment trends is that smartphones can now act as mobile point-of-sale (POS) terminals. This contactless payment solution also called the mPos solution for accepting payments anywhere. Financial institutions should build mobile POS capabilities into their apps.

- Mobile POS allows pop-up shops, delivery agents, and remote vendors to accept contactless payments

- Provides convenience over dedicated POS hardware like terminals and registers

- Enables small businesses to quickly establish a digital presence

- Large market opportunity as mobile POS adoption grows globally

- Banks can attract merchants by integrating NFC payments, QR, and smart POS functionality into apps

Conclusion

These contactless payment trends are the most prevalent in the world of digital payments. From tap-and-pay technology payments, digital wallets, and embedded payments, to voice-based smart payments, any payment mode added to your business will surely yield profits and growth.

Moreover, contactless payment trends like QR payments and mobile POS payments will add convenience for your customers, making them a must-have option for 2024.

How DigiPay.Guru can help? DigiPay.Guru is a world-class fintech solution provider that offers advanced contactless payment solutions in its digital wallet solution. From QR code payments to NFC payments, USSD, wearables, and more, we focus on making your lives easier with cashless and contactless payments.

We also offer prepaid card management software where you can issue and manage prepaid cards for your customers in a contactless and smart way. And an M-POS solution where you can utilize your smartphone device as a contactless payment terminal to accept payments. This is very seamless and affordable.