“When you design a payment product, every choice you make has long-term impact.”

The payment method you support influences how fast merchants onboard, how customers pay, and how easily you scale across regions.

Tap and Pay & QR code payments are often grouped under contactless payment methods. On the surface, they appear to solve the same problem.

In practice, they behave very differently. Each method comes with its own cost structure, infrastructure needs, security model, and adoption pattern.

If you are a financial business, choosing between Tap and Pay vs QR payment is not a branding decision. It is a business decision. And the wrong choice can slow expansion, increase operational costs, and limit where & how your payment product works.

So, this guide is written to help you make that choice with clarity. You will see how NFC vs QR code payment compares across speed, security, deployment effort, and market suitability.

You will also learn when it makes sense to support one method, when to support both, and how to plan that rollout without reworking your entire payment infrastructure.

Let’s begin!

What Is Tap and Pay (NFC Payments)?

Tap and Pay is built on NFC payments technology. It allows users to complete transactions by tapping a card or mobile device on a compatible terminal.

From a technical perspective:

-

Tap and Pay relies on tokenization.

-

Sensitive card data is replaced with a secure token.

-

The actual card number never reaches the merchant.

This significantly reduces fraud exposure and simplifies compliance.

Plus, tap and pay technology excels in environments where speed and consistency matter. Supermarkets, transit systems, fuel stations, and large retail chains depend on it because checkout time directly affects revenue.

However, NFC payments come with dependencies.

-

You need certified POS devices, scheme approvals, and secure hardware environments.

-

Deployment takes time, and costs are higher.

For institutions with established card infrastructure, this tradeoff makes sense. But, for early-stage or emerging markets, it can slow growth.

Expert Tip💡

What Is QR Code Payment?

A QR payment is a contactless digital transaction where you scan a Quick Response (QR) code with the user's smartphone's camera or a payment app to pay for goods and services.

It is linked directly to a merchant's account for instant fund transfers, while eliminating the need for cash or cards.

QR code payments follow a simpler model:

-

A merchant displays a QR code.

-

The customer scans it using a mobile app or digital wallet.

-

The transaction completes through backend authorization.

And the biggest advantage of QR code payments is accessibility. Moreover, merchants do not need expensive hardware; a printed code or screen display is enough. This makes QR payments ideal for rapid deployment.

QR payment systems thrive in wallet-centric ecosystems. They work especially well in emerging markets, agent networks, and micro-merchant environments where cost sensitivity is high.

The tradeoff is experience friction.

-

Scanning, confirming, and authenticating takes longer than a tap.

-

Security also depends heavily on how well the wallet application is designed.

QR payments are not inherently risky. But poor implementation can create risk.

Tap and Pay vs QR Payment: Core Differences

Before deciding between the two payment methods, you need to understand how these methods differ at an operational level. The key differences are:

| Feature | Tap and Pay (NFC) | QR Payment |

|---|---|---|

| Hardware Required | NFC-enabled POS | Printed or digital QR |

| Transaction Speed | Very fast | Fast, scan-dependent |

| Cost for Merchants | High | Low |

| Internet Dependency | Low | High |

| User Experience | Seamless | Slight friction |

| Scalability | Hardware dependent | Easily scalable |

| Best for | Developed markets | Emerging markets |

This comparison highlights a simple truth: Tap and Pay optimizes speed. QR payments optimize reach.

So, your choice depends on which constraint matters most at your current stage of operation.

Security Comparison: Which Is Safer?

Payment security is an essential aspect when you are choosing a payment method for your payment app. And security decisions are rarely emotional. They are mostly regulatory, reputational, and financial.

Here’s a quick comparison between the Tap and Pay + QR payment from the security pov:

| Security Aspect | Tap and Pay | QR Payment |

|---|---|---|

| Tokenization | Yes | Limited |

| Card Data Exposure | None | Depends on implementation |

| Fraud Risk | Very low | Medium if poorly implemented |

| Compliance | PCI-DSS, EMV | PCI plus app controls |

At first glance, Tap and Pay appears more secure. That impression is largely correct, but the reason matters.

Tap and Pay is built on NFC payments standards that have matured over decades.

And tokenization ensures that sensitive card data never reaches the merchant or the POS terminal. Even if a transaction is intercepted, the data is useless outside that single payment.

This architecture significantly reduces fraud risk and explains why Tap and Pay is widely accepted by regulators and card schemes.

On the other hand, QR code payments follow a different security model. The QR code itself does not carry sensitive data. The real security responsibility shifts to the digital wallet or payment app. So, strong authentication, dynamic QR codes, encrypted communication, and backend risk checks determine how safe the transaction is.

However, problems arise when QR payments are implemented poorly. Static QR codes, weak user authentication, or limited transaction monitoring create opportunities for fraud.

These issues are not inherent to QR payments. But they are the result of shortcuts in design.

From a risk perspective, the question is not “Is QR less secure?” The real question is “How strong is your wallet and transaction control layer?”

Expert Insight💡

Cost and Infrastructure Considerations

Cost and infrastructure decisions often determine whether a payment rollout succeeds or stalls. This is where many otherwise strong payment strategies lose momentum.

When you compare Tap and Pay and QR payments, the difference is not just about transaction fees.

It is about how quickly you can deploy, how far you can reach, and how much operational overhead you can sustain over time.

| Cost Factor | Tap and Pay | QR Payment |

|---|---|---|

| POS Setup | Expensive | Minimal |

| Maintenance | Medium | Low |

| Deployment Time | Slow | Fast |

| Rural Suitability | Low | High |

From where we see now, Tap and Pay looks a bit more costly, right?

Well, it is because Tap and Pay requires certified POS hardware. That means procurement, installation, certification, and ongoing maintenance. For large merchants in urban areas, this cost is acceptable and often expected. But for smaller merchants or distributed networks, it becomes a bottleneck.

And in case of QR payments…..

QR payments remove most of that friction. A printed QR code or a simple digital display is enough to accept payments. This allows you to onboard merchants in days rather than months. It also makes QR payments far more practical for rural and semi-urban regions, where POS penetration remains limited.

Maintenance costs also differ significantly between the two methods. NFC infrastructure depends on hardware upkeep and periodic upgrades. Whereas QR payment systems shift maintenance to the software layer, which scales more efficiently and costs less to operate.

From an infrastructure standpoint, this creates a clear pattern: Tap and Pay favors stability and high throughput. QR payments favor speed, reach, and cost efficiency.

Expert Tip💡

User Adoption and Market Trends

Understanding how people are actually using contactless payment methods is critical before you make strategic technology choices.

Below is the table showing how both Tap and Pay and QR code payments are being adopted around the world.

| Region | Preferred Method |

|---|---|

| Europe / US | Tap and Pay |

| Africa | QR + Mobile Wallet |

| Asia | QR Dominant |

| LATAM | Hybrid |

The trends that reflect broader shifts in payment behavior:

-

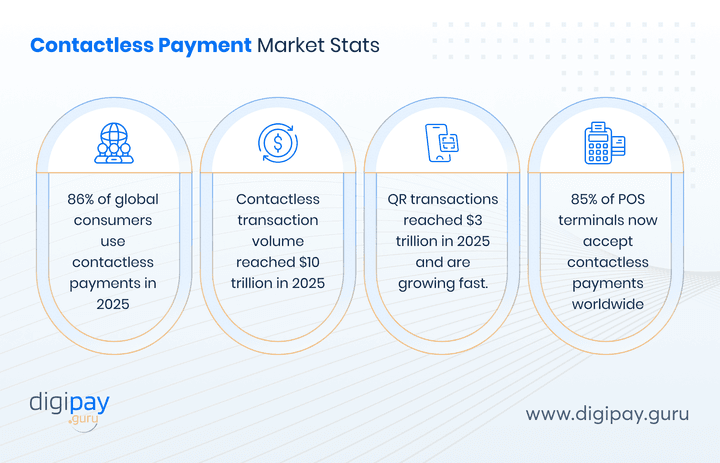

Contactless adoption is now mainstream: A recent 2025 global snapshot shows that 86% of consumers use contactless payment methods such as Tap and Pay or mobile wallets at least occasionally as of 2025.

-

Contactless payments are expected to grow explosively: Market analysts estimate that the total value of contactless transactions globally could reach $8 trillion by 2029, driven strongly by QR code systems in emerging markets.

-

Contactless transactions are becoming the default: Global forecasts suggest that contactless payment values (combining NFC and other tech) have doubled in the next five years and reach close to $10 trillion as of 2025, mainly powered by mobile wallet adoption.

-

QR payment adoption is massive in Asia: In China alone, QR code payment usage is deeply embedded in commerce, with billions of users scanning codes daily.

-

POS terminals are catching up worldwide: Approximately 85% of all point-of-sale terminals globally now accept contactless payments, whether NFC, QR, or wallet-based taps.

These signals tell a clear story.

Contactless is no longer experimental. It is the baseline strategy for digital payment acceptance across regions, and the method you choose affects how quickly your customers adopt your services.

When Should You Choose Tap and Pay?

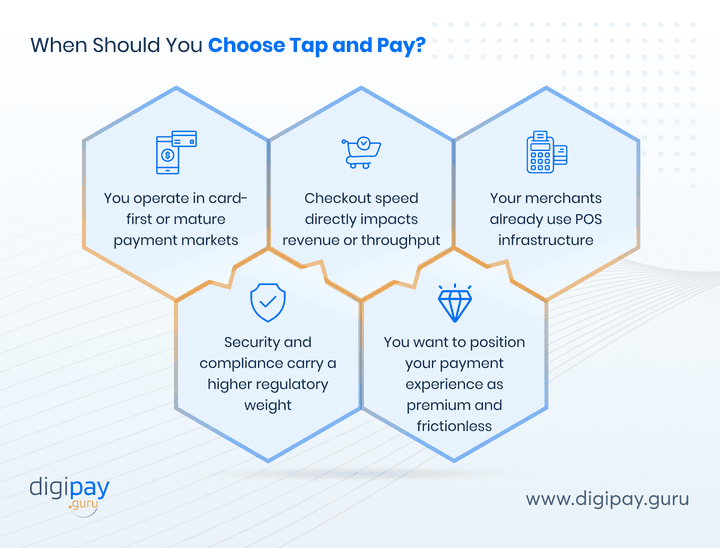

Tap and Pay is the right choice when your priority is speed, consistency, and trust at scale. It works best in environments where payments must feel effortless, and failure is not an option.

You should strongly consider Tap and Pay if:

-

You operate in card-first or mature payment marketsIn regions where cards and mobile wallets are already the default, Tap and Pay aligns with existing user habits and expectations.

-

Checkout speed directly impacts revenue or throughputHigh-traffic environments such as supermarkets, transit systems, fuel stations, and quick-service retail benefit from near-instant NFC transactions.

-

Your merchants already use POS infrastructureIf NFC-enabled POS terminals are common in your network, Tap and Pay adds value without introducing operational friction.

-

Security and compliance carry a higher regulatory weightTap and Pay benefits from EMV standards and tokenization by default, which simplifies compliance discussions with regulators and card schemes.

-

You want to position your payment experience as premium and frictionlessA tap-based flow reduces steps, minimizes user effort, and signals a mature, trusted payment ecosystem.

From a strategic perspective, Tap and Pay is less about rapid expansion and more about operational excellence. It delivers predictable performance, lower fraud exposure, and a polished customer experience.

Expert Insight💡

When Should You Choose QR Payments?

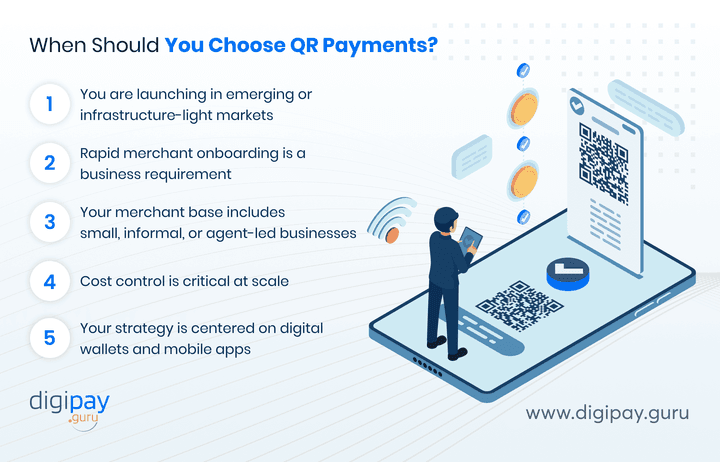

QR payments are the right choice when your priority is reach, speed of deployment, and cost efficiency. They work best when you need to scale quickly across diverse merchant environments without heavy infrastructure investment.

You should strongly consider QR payments if:

-

You are launching in emerging or infrastructure-light markets - In regions where POS penetration is low, QR payments allow you to enable merchant acceptance using nothing more than a printed code or a mobile screen.

-

Rapid merchant onboarding is a business requirement - QR payments shorten onboarding cycles from months to days, thereby helping you grow your acceptance network without operational bottlenecks.

-

Your merchant base includes small, informal, or agent-led businesses - Micro-merchants, agents, and rural sellers benefit from QR payments because they eliminate hardware costs and technical complexity.

-

Cost control is critical at scale - QR payments reduce upfront investment, ongoing maintenance, and replacement costs, while making them ideal for high-volume merchant expansion.

-

Your strategy is centered on digital wallets and mobile apps - QR payments integrate naturally with mobile wallets, enabling peer-to-peer payments, merchant acceptance, and value-added services within a single app experience.

From a strategic perspective, QR payments are less about perfection at checkout and more about distribution and inclusion. They allow you to enter new markets quickly, test use cases, and build transaction volume before investing in heavier infrastructure.

Expert Insight💡

Tap and Pay vs QR: Decision Framework

Now that you know the core differences between Tap and Pay & QR payment methods, it is time to finalize which one suits your business.

Use this framework to guide practical decisions.

| Your Requirement | Best Choice |

|---|---|

| Low setup cost | QR Payment |

| Fast checkout | Tap and Pay |

| Rural reach | QR Payment |

| High security | Tap and Pay |

| Instant scaling | QR Payment |

This framework is not meant to crown a winner. It is meant to help you sequence your payment strategy correctly.

Each aspect reflects a real-world constraint that banks and fintechs face when launching or expanding contactless payment methods.

Instead of asking, “Which technology is better?”This framework helps you ask a more useful question: “Which technology fits our current stage?”

-

If your primary constraint is cost or speed to market, QR payments give you faster results with fewer dependencies. They allow you to onboard merchants quickly, test use cases, and expand reach without heavy upfront investment.

-

If your constraint is checkout speed or transaction reliability, Tap and Pay becomes the stronger choice. NFC-based payments reduce friction at the point of sale and perform consistently in high-volume environments.

-

For rural reach and inclusion, QR payments clearly outperform. They remove the need for POS hardware and enable acceptance in locations where traditional infrastructure is limited.

-

For security-sensitive use cases, Tap and Pay offers built-in advantages through tokenization and EMV compliance. This simplifies conversations with regulators, schemes, and enterprise merchants.

-

For rapid scaling across new geographies, QR payments are easier to replicate. They depend more on software than hardware, which makes multi-country rollout faster and more predictable.

Expert Insight💡

How DigiPay.Guru Enables Both Tap and QR Payments

You should not lock yourself into a single method.

DigiPay.Guru offers an advanced digital payment solution that enables both Tap and Pay and QR payments through prepaid cards and mobile wallet solutions.

With DigiPay.Guru, you can:

-

Launch QR payments quickly via mobile money and wallet platforms

-

Enable Tap and Pay using NFC-enabled prepaid cards (issue to your customers)

-

Manage merchants through a unified system, and

-

Expand across regions without rebuilding infrastructure

This modular approach lets you grow in phases while staying future-ready.

Conclusion

Choosing between Tap and Pay and QR payments is not about following what others are doing. It is about understanding your market, your merchants, and your long-term payment strategy.

Tap and Pay works best where speed, consistency, and established infrastructure already exist. And QR payments perform better when reach, cost efficiency, and fast deployment matter more.

In many cases, the most practical approach is not choosing one over the other, but deciding which to introduce first and where each fits.

What matters most is flexibility.

-

Payment ecosystems evolve

-

Customer behavior changes

-

Regulations tighten, and

-

Your technology should adapt without forcing a complete rebuild

This is where a modular platform makes a difference. DigiPay.Guru helps banks, fintechs, and financial institutions enable both Tap and Pay and QR payments through secure prepaid card and digital wallet solutions. You can launch, scale, and adjust based on real market needs.

So, if you are evaluating your next move, our expert team is ready to help you plan it with clarity and confidence.

FAQs

QR payments are easier and faster to deploy for a new fintech product. They require minimal hardware, rely on mobile apps or digital wallets, and allow merchant onboarding within days. Whereas Tap and Pay requires certified POS infrastructure and scheme approvals, which increases deployment time and cost.

Yes. A well-designed digital wallet can support both Tap and Pay and QR payments. QR payments are usually enabled through in-app scanning, while Tap and Pay is delivered through NFC-enabled prepaid or virtual cards. Supporting both improves flexibility and future readiness.

QR payments are better suited for emerging markets like Africa. They work well in low-infrastructure environments, support mobile-first users, and allow rapid merchant expansion without POS hardware. Tap and Pay can be introduced later in urban or premium segments.

Tap and Pay follows EMV and PCI-DSS standards with built-in tokenization. QR payments must meet PCI-DSS and local regulatory requirements through strong app security, KYC, AML screening, and transaction monitoring. Both can meet compliance expectations when implemented correctly.

QR payments are generally more cost-effective for merchants. They eliminate the need for POS hardware and reduce maintenance costs. Tap and Pay involves a higher upfront investment but may be justified for high-volume or enterprise merchants.

Tap and Pay typically delivers higher success rates in stable POS environments due to fast processing and offline tolerance. QR payment success depends on network availability, app performance, and user interaction, but it performs well when the wallet infrastructure is strong.

Limited offline QR payment models exist, but they require strict controls and reconciliation mechanisms. Most QR payments rely on real-time connectivity to ensure security and accuracy, especially for regulated financial environments.

QR payments scale faster across countries because they depend mainly on software and local regulations, not hardware availability. Tap and Pay scaling is slower due to POS certification, hardware readiness, and scheme alignment in each market.

Tap and Pay offers a faster, more seamless checkout experience. QR payments involve more steps but provide flexibility and accessibility. The best experience comes from offering both, allowing users to choose based on context.

Yes. Fintechs can add or switch payment methods if their platform is modular. Starting with QR payments and adding Tap and Pay later is a common and effective strategy when using a flexible digital wallet or prepaid card infrastructure.