The prepaid card industry is booming. With its pre-loading capabilities, ease of payment, and extraordinary rewards and loyalty features, it has already started taking center stage in many industries.

According to a study by Juniper Research, the global market for prepaid cards was valued at $ 3.5 trillion in 2023 and was predicted to rise to $ 6.7 trillion by 2028. This stat indicates a market growth of a whopping 92% in the period 2023-2028.

As more people adopt prepaid cards for purchases and payments, businesses offering these services need to stay ahead of consumer demand and ever-changing technology. So, the question arises, what does the future hold for prepaid card solutions? How will it be a plus point for the business?

Read this blog to get an insight into the top predictions for prepaid card solution in 2026 and beyond. Let’s begin!

Widespread acceptance of prepaid card solution

Prepaid cards’ acceptance has grown rapidly among both digital and brick-and-mortar businesses over the past few years. This prepaid card market trend is expected to continue with more businesses embracing prepaid card solutions as a convenient and secure payment method.

There are a few key drivers of this widespread adoption:

Growing retailer adoption

An increasing number of online and in-store retailers are integrating prepaid card services into their payment ecosystems. Big players like Amazon and Walmart already offer prepaid cards, and we expect more specialized retailers to follow the lead by 2026 to capture this growing market. You as a financial business can offer prepaid card solutions to them.

Prepaid card solutions for travel expansion

Prepaid travel cards are gaining popularity internationally thanks to better exchange rates and cardholder security compared to cash or standard credit cards. Offering multi-currency prepaid cards can help your business attract global travelers and businesses seeking seamless cross-border payments.

Loyalty building with gift cards

Businesses are leveraging prepaid gift cards as a tool to drive customer loyalty and engagement. The ability to integrate loyalty programs with digital prepaid cards ensures a seamless customer experience while encouraging repeat purchases and increasing brand engagement.

With such exceptional benefits, it can be predicted that significantly more businesses will explore prepaid card loyalty programs in 2026 and the coming years.

Advanced prepaid card security

The global digital payments market will reach $20.37tn in 2026. With these rising numbers, prepaid card solution providers are prioritizing advanced security capabilities that protect cardholders against emerging payment threats while allowing convenient account access.

Cutting-edge technologies will shape fraud prevention and monitoring as one of the prepaid card trends 2026.

Chip technology reduces fraud

Over 60% of cards issued in the United States will transition to EMV chip technology by the end of 2026, which generates unique data for each transaction to prevent counterfeitfraud. Alongside encryption and tokenization, chip cards significantly reduce in-person payment fraud. Hence, prepaid card solutions are considered the most secure ones for implementing into the business!

Remote locking capability

Prepaid card service providers will implement mobile-based card locking and unlocking features. This will allow customers to secure accounts when security threats arise and instantly unfreeze them after they subside. Giving cardholders more real-time cards strengthens security for prepaid card users.

EMV and tokenization to reduce fraud

Combined with EMV microchips, tokenization makes data stealing impossible for fraudsters and criminals even if they infiltrate merchant systems. As a prepaid card solutions provider, implementing these security measures will make your financial offerings more attractive to businesses and end users.

Hence, there will be a significant boost in the EMV-chipped prepaid card solutions to offer an extra level of proven security.

Advanced biometric authentication for secure transactions

When it comes to virtual prepaid cards, fingerprint and facial recognition for prepaid cards in the mobile wallet are strictly implemented. Over 80% of smartphones are equipped with biometric sensors.

Plus, fingerprint scanning, facial recognition, and biometric verification ensure that only authorized users access accounts thereby reducing fraud risks significantly. So, prepaid card solution providers will increasingly integrate biometric authentication and verification.

Integration with mobile wallets

Mobile wallet solutions have become instrumental in the payment ecosystem. The current prepaid card market helps us to predict that prepaid card issuers will focus heavily on deep mobile wallet integrations to align with evolving consumer preferences for all-in-one money management.

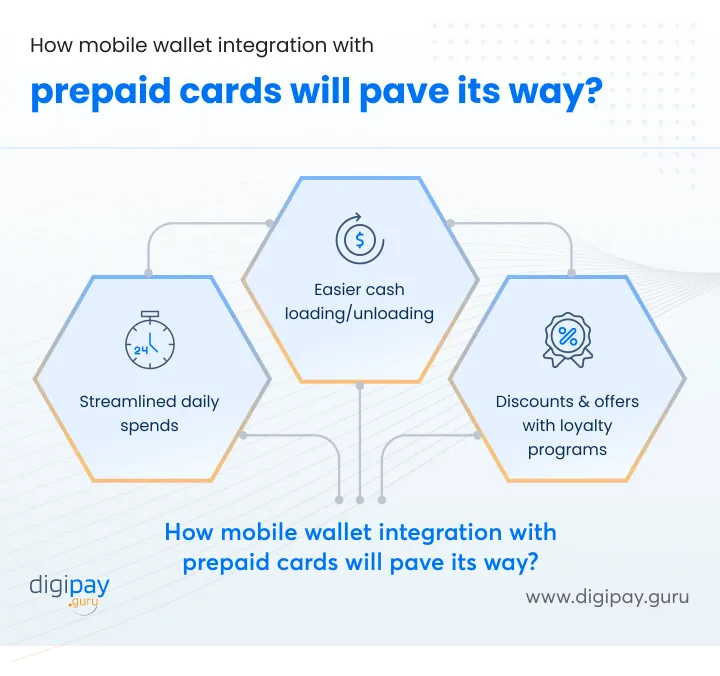

Streamlining everyday spend

Fast forward to 2026, users are now able to add their prepaid card details to their mobile wallet. Customers now want prepaid card services that integrate seamlessly with digital wallets for daily spending. You can enhance user experience by offering prepaid financial products that support mobile-based transactions.

Cash loading or unloading made easier

Partnerships with digital fintech solution providerwill allow seamless transfers between prepaid card accounts and mobile wallets. Customers will be able to deposit and withdraw cash from wallet balances to cards with minimal clicks for easy liquidity access.

Loyalty and discount bundling

In 2026, there is a possibility of branded mobile wallets linking their loyalty programs, offers, and discounts with prepaid cards to offer engaging incentives to the users. Customers would only need to tap once to redeem points or coupons while making purchases with prepaid cards or mobile wallets linked to them.

Mobile wallet solutions for customer loyalty and reward program

Support from consumer shifts

Evolving user preferences and demographics will further propel prepaid card management system adoption over the next few years. Prepaid card solution providers that understand these consumer shifts can develop tailored products that align with the emerging needs of small and large businesses.

Move from cash to prepaid

The consumers first shifted from cash to cards and then cards to digital payments and now to contactless payments and digital payments together. That's the reason why prepaid cards came into the picture - digital prepaid cards as well as physical ones. Customers only want more convenience and security than their previous methods of payment.

And prepaid card software does full justice to their evolving behaviors. It offers security, convenience, and budgeting control. However, till 2022 there were still 59% of cash payments. So, in the future, we can expect that this number will further reduce with the advent of prepaid card solutions.

Unbanked segment adoption

Globally, around 1.4 billion adults are unbanked. Prepaid cards give the underbanked an affordable and accessible financial tool without credit checks. This facilitates more of them to opt for prepaid cards. So, it can be predicted that in the coming year, a large portion of the unbanked and underbanked population will actively use prepaid cards according to BusinessWire.

Millennial user growth

The majority of Millennials are attracted to these prepaid payment options because of the discounts & offers attached to them. This shows a high chance that the millennial users of digital prepaid cards will grow significantly.

Also, features like P2P transfers, mobile app controls, and real-time notifications appeal to millennial convenience and engagement preferences.

Favorable market trends

Certain developing macro conditions actively support prepaid card market growth trajectories as the prepaid card trends 2026 and beyond. Prepaid card solution providers should consider these trends when projecting market expansion.

Expanding urbanization

Urban migration escalates globally as over 70% of the world’s population will inhabit cities by 2030. Urban citizens are more tech-quipped and modern. Hence, the adoption of cashless payments and prepaid cards in urban areas is already more than the rural. And with the increasing urban population, the adoption will also increase.

Retailer-branded prepaid cards

Retail giants from Starbucks to Amazon are launching branded prepaid products which allows customers to shop within their ecosystems. These create sticky, closed-loop environments that benefit the business. Plus, it increases brand visibility, working capital, and active users. So, the growth of such prepaid cards might increase in 2026.

Prepaid-as-a-Service white label solutions on the rise

As a financial business, the need for white-label prepaid solutions is increasing now! You can stay ahead by offering businesses fully customizable prepaid card programs tailored to their customers' needs.

The impact of 5G on prepaid card solutions

The latest trend that has come into the picture is 5G. With prepaid card solutions and 5G blended in it the payments are transformed. Here’s how:

Faster transaction processing

5G technology will speed up transactions, which will make prepaid cards more efficient for both consumers and businesses. Plus, real-time payments will become the standard.

Enhanced mobile banking experiences

With 5G, mobile banking and prepaid card management will see improved connectivity, better security, and smoother user experiences.

Real-time notifications and alerts

Instant transaction alerts and balance updates will give customers more control over their spending. This will enhance trust and transparency.

What other industries might see a rise in prepaid card solutions?

There are several other industries other than financial services where prepaid card solutions are rising:

The growing role of prepaid cards in remittances and international transactions

Prepaid cards are increasingly favored for remittances due to their convenience, security, and speed for cross-border transactions. So, banks and fintech startups are focusing on this sector.

Bringing banking services to remote and rural areas

Many remote areas lack access to traditional banking services. Prepaid cards offer financial inclusion for these communities by bringing banking services to rural and remote areas. Plus, financial institutions are leveraging prepaid payment solutions for bridging the gap in underserved regions.

Government

Many governments already use prepaid cards to offer various services to their country's citizens. 2026 will see a rise in government agencies using prepaid card platforms to manage payment cards for various purposes, such as government benefits or employee expense cards. Toll, parking, and fuel can also be managed over here.

How DigiPay.Guru can help stay ahead of the industry?

DigiPay.Guru offers prepaid card management software that facilitates businesses to offer prepaid cards to their customers. These prepaid card platforms are secure, efficient, NFC-enabled, and fast.

Our prepaid card solutions come with capabilities that enhance customer loyalty with loyalty programs, boost working capital, and increase brand visibility. We also offer multiple currency options, multiple payment options, and robust security.

Moreover, we offer both, physical and virtual prepaid cards for extensive usage and convenience to the customers. Many businesses are already leveraging the power of our solutions. Now, it's your turn!

Conclusion

Prepaid cards are the tomorrow of payments! And 2026 looks as promising and beyond as 2024. As we look ahead at the future of the prepaid card industry, the landscape is filled with tremendous growth opportunities as consumer adoption accelerates globally.

Prepaid cards are rapidly becoming a trusted, indispensable payment tool for all user segments regardless of bank account ownership or income levels.

With DigiPay.Guru’s future-ready prepaid card solution, businesses like you can thrive in the dynamic world of payments and become the leaders of their industry while keeping their customers retained and happy.