Digital wallets are becoming a preferred way for people to pay, save, and manage money worldwide.

In fact, recent industry research shows that digital wallets now account for over 50% of global ecommerce transactions, and adoption continues to rise across both developed and emerging markets.

This shift is creating new expectations for speed, intelligence, convenience, and security in financial services.

And as you plan your product roadmap for the coming years, digital wallet innovation will play a central role.

This is because the industry is moving toward smarter systems powered by:

-

Predictive analytics

-

Stronger biometric authentication

-

Open banking connectivity, and

-

Support for digital assets

Plus, your customers are looking for clearer insights, smoother cross-border transactions, and experiences that work across devices and channels without friction.

This blog highlights 10 digital wallet trends 2026 that will shape the future, along with their impact on banks and financial businesses like yours.

You will get a clear view of what is changing, why it matters, and how you can prepare your digital wallet strategy for the next phase of growth.

Let's look at each trend one by one!

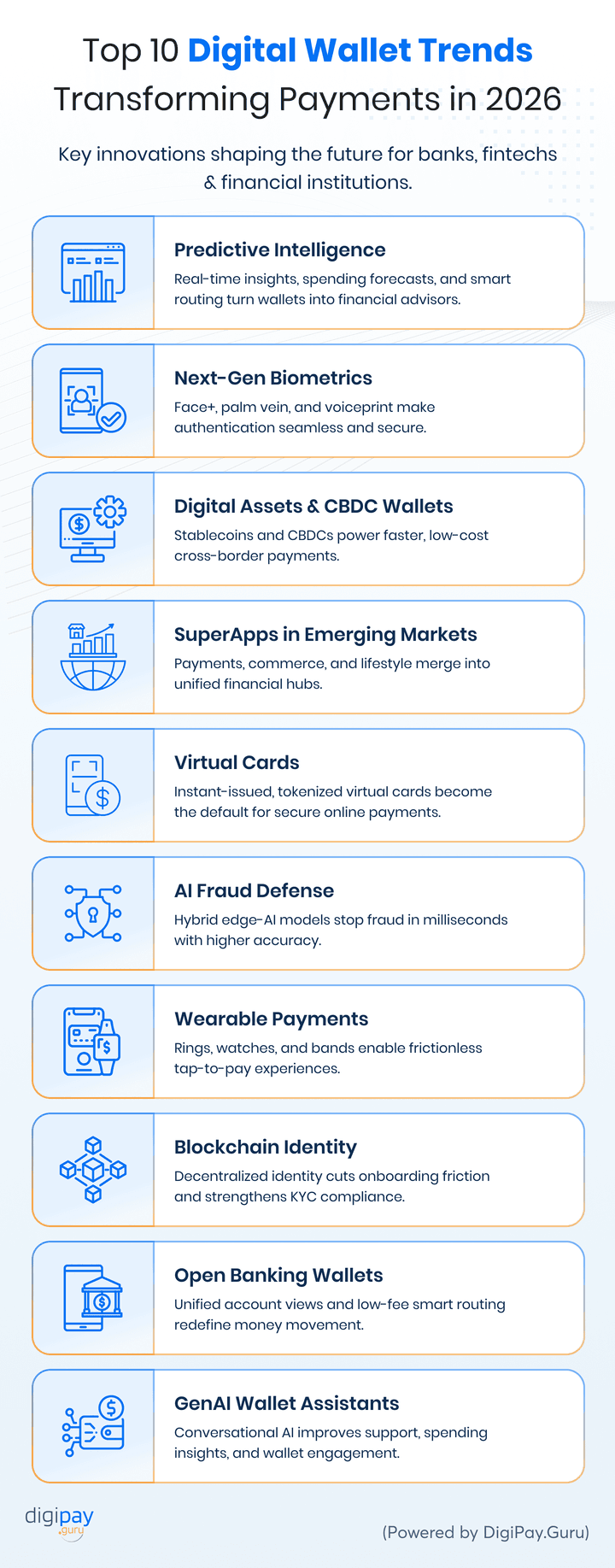

Trend 1: Predictive & Real-Time Insights Will Become a Core Wallet Feature

Predictive analytics is quickly becoming a must-have capability in digital wallets. And your customers want more than transaction history. They want clarity and guidance.

In 2026, digital wallet predictive analytics will help you offer personalized recommendations, prevent failed transactions, and support smarter financial decisions.

As mobile wallet trends evolve, the most successful products will use:

-

AI-driven payment recommendations

-

Real-time risk scoring

-

Automated triggers for savings

-

Spending alerts, and

-

Budgeting reminders

When you give users meaningful insights, you reduce friction, increase trust, and improve retention.

How Digital Wallets Can Apply Predictive Intelligence

Here are some practical applications that you can implement:

-

Real-time cashflow alerts that help customers avoid overdrafts

-

Instant payment routing that selects the lowest-fee corridor

-

Personalized micro-savings features based on spending behavior

-

AI-generated merchant offers that increase wallet engagement

Predictive intelligence turns your wallet into a financial guide rather than a transaction portal. It strengthens loyalty and improves user lifetime value.

Trend 2: Next-Generation Biometrics Will Reinforce Wallet Security

Security is a major factor in digital wallet adoption. With rising fraud attempts and stricter compliance requirements, the future of digital wallets depends on stronger, more reliable authentication. In 2026, multi-biometric authentication

will become the standard for secure digital payments.Instead of relying on a single method, you will combine facial recognition, palm vein scanning, and voiceprint verification.

This shift will help you

-

Reduce fraud and streamline onboarding

-

Increase trust among users who expect seamless yet secure experiences

Biometric Methods Comparison

| Method | Strength | Best Use Case |

|---|---|---|

| Face ID+ | High accuracy | Wallet access |

| Palm vein | Spoof-proof | High-value transactions |

| Voiceprint | Convenience | Wearable payments |

Each method serves a specific purpose:

-

Face ID+ is ideal for high-frequency access

-

Palm vein authentication is valuable for transactions that require stronger trust

-

And voiceprint works well for hands-free and wearable payment technology

Trend 3: Digital Assets Will Enter Everyday Payments

The conversation around digital assets is shifting from speculation to utility. Stablecoins and CBDCs will become part of daily financial activity, especially in regions with volatile currencies or high remittance flows.

With evolving digital payments trends 2026, CBDC-ready wallets and crypto and stablecoin wallets will become essential.

You will see hybrid systems where fiat and digital assets coexist. Plus, customers may hold a portion of their funds in stablecoins, use them for cross-border digital payments, or receive government service payments online through CBDC-ledgers.

To support this evolution, you will need a modular architecture that separates tokenized rails from fiat rails. This helps you maintain compliance while offering users fast, low-cost, digitally authenticated transactions.

Trend 4: Financial SuperApps Will Dominate Emerging Markets

SuperApp trends are accelerating across Africa, Asia, and LATAM. These markets already have strong mobile money ecosystems, which makes them a potential space for unified digital experiences.

In 2026, digital wallets will evolve into hubs that integrate payments, commerce, investments, remittances, and micro-services.

If you operate in these regions, you should think of your wallet as a platform, not just a payment service.

SuperApp Region Snapshot

| Region | Adoption Driver | SuperApp Opportunity |

|---|---|---|

| Africa | High mobile money use | Unified digital wallets |

| Asia | Lifestyle apps | Multi-service hubs |

| LATAM | Fintech boom | Cross-border money tools |

SuperApps create value by offering a unified commerce experience. They increase user stickiness and cross-sell potential.

If your wallet integrates well with other financial and lifestyle services, you will secure a stronger market position.

Trend 5: Virtual Cards Will Become a Default Payment Method

Virtual card payments are gaining traction because they offer security, control, and instant issuance. As digital wallet trends advance, virtual cards will become essential for e-commerce, subscriptions, corporate expenses, and merchant payments.

Plus, customers prefer virtual cards because they support secure tokenization methods, real-time card management, and seamless mobile-first experiences.

How to Implement Virtual Card Ecosystems

To support virtual cards efficiently, focus on:

-

BIN sponsorship and regulatory compliance

-

Instant issuance APIs built into your digital wallet

-

Spending controls that users can adjust

-

Merchant-specific tokenization and reconciliation

And virtual cards also reduce fraud because they limit exposure.

In 2026, virtual cards will be at the center of digital payment innovation, especially for online merchants and corporate clients seeking safer, more controlled payment options.

Trend 6: AI Fraud Defense Will Move to the Network Edge

Fraud attacks are becoming more sophisticated. And so, rules-based systems can no longer keep up with adaptive fraud patterns. This is why AI-powered edge detection is emerging as a crucial part of fraud management.

Edge AI models analyze transactions in milliseconds. They consider behavior, device signals, transaction history, and biometric cues. This allows you to block suspicious activity before the transaction is completed.

AI Fraud Model Comparison

| Model Type | Speed | Accuracy | Use Case |

|---|---|---|---|

| Rules-only | Fast | Low | Legacy systems |

| ML Models | High | Medium | Standard wallets |

| Hybrid AI | Real-time | High | 2026 intelligent wallets |

Hybrid AI will dominate fintech trends in 2026 because it combines the structure of rule engines with the adaptability of ML models. It allows your fraud system to evolve with emerging threats rather than react after the damage is done.

Trend 7: Wearable Payments Will Reach Mass Adoption

Wearable payment technology is expanding rapidly due to smartwatches, fitness bands, and smart rings. Plus, your customers prefer these devices for their speed and convenience, especially in high-frequency environments like transit, retail, and events.

To stay competitive, you need to support token provisioning for wearable devices and offer lightweight, secure payment flows.

Wearable Types

| Device | Payment Fit | 2026 Upgrade |

|---|---|---|

| Smartwatch | Mature | AI-based prompts |

| Fitness band | High adoption | Continuous authentication |

| Smart ring | Rising | Ultra-fast NFC |

Wearables also support continuous authentication, which minimizes false declines. As contactless payment adoption grows, wearables will become an important loyalty driver and a differentiator for wallet providers.

Trend 8: Blockchain Identity Will Strengthen Trust and Compliance

Decentralized identity verification is gaining momentum because it reduces friction and minimizes data exposure. Instead of collecting raw documents repeatedly, you will rely on verifiable credentials stored on a blockchain layer.

This shift reduces onboarding time and lowers operational costs. It also improves compliance because users maintain control over their information while you verify authenticity through secure, tamper-proof signatures.

Blockchain also enhances settlement security. You can use smart contracts for

-

Automated transfers

-

Merchant splits, and

-

Cross-border settlement workflows

All in all, this trend will play a major role in the future digital payments infrastructure.

Trend 9: Open Banking Will Turn Wallets into Universal Accounts

Open banking digital wallets will give users a unified view of all their financial accounts. They will no longer switch between apps to check balances or transfer funds. Instead, your wallet will sit at the center of their financial life.

Let's look at the quick comparison of the open banking vs pre-banking wallet to get a clear idea of the effectiveness of the open banking wallet.

Open Banking Wallet Comparison

| Feature | Pre-Open Banking | Open Banking Wallet |

|---|---|---|

| Account view | Fragmented | Unified |

| Payment routing | Standard | Smart, low-fee routing |

| Personal insights | Generic | Bank-level intelligence |

Open banking also improves cross-border digital payments, reduces transaction costs, and supports unified commerce experiences. When you integrate open banking APIs, your wallet becomes the user's primary financial interface.

Trend 10: Generative AI Assistants Will Transform Wallet Engagement

A major shift in 2026 will be the rise of GenAI-powered financial assistants inside digital wallets. These assistants will help users manage money, understand spending patterns, resolve disputes, and plan budgets, all through natural conversation.

GenAI enhances digital wallet loyalty programs by personalizing rewards and offering more intuitive support. It also helps you reduce customer service workload by automating routine queries.

GenAI Trend Impact Table

| Trend | Core Impact in 2026 |

|---|---|

| Predictive insights | Smarter spending habits |

| Multi-biometric security | Stronger protection |

| Digital asset payments | Broader adoption |

| SuperApps | Unified financial journeys |

| Virtual cards | Safer online spending |

| AI fraud detection | Pre-emptive security |

| Wearables | Frictionless payments |

| Blockchain security | Reliable identity |

| Open banking | Single financial view |

| Online-offline blend | Seamless commerce |

| GenAI assistants | Interactive money management |

As users demand simplicity, a conversational interface will become a major differentiator.

What These Trends Mean for Banks, Fintechs & Wallet Operators

Together, these trends signal a shift toward intelligence, interoperability, and security. To stay ahead, you need to adopt a modular architecture that supports new technologies without disrupting the core. Invest in hybrid rails, open banking APIs, and AI-powered decision systems.

Your next steps should include:

-

Strengthening compliance through decentralized identity verification

-

Expanding your payment rails with virtual cards and digital assets

-

Enhancing user engagement with predictive insights and GenAI

-

Supporting quick commerce, wearable payments, and omnichannel experiences

2026 will reward businesses that invest in scalable, smart, and secure digital wallet infrastructure.

How DigiPay.Guru Helps You Prepare for 2026

At DigiPay.Guru, our digital wallet solution, is designed for banks, fintechs, telcos, and financial institutions that want to offer secure and reliable digital payment services to their customers.

Our platform helps you launch advanced wallet experiences with strong security, modular flexibility, and rapid go-to-market execution.

With DigiPay.Guru, you gain:

-

Predictive analytics and real-time payment insights

-

Multi-biometric onboarding and identity verification

-

Instant virtual card issuance and secure tokenization

-

Fiat, stablecoin, and CBDC-ready wallet rails

-

AI-powered fraud detection at the network edge

-

Decentralized identity verification modules

-

Open banking APIs with unified financial views

-

Wearable payment integration and merchant wallet solutions

We help you align your strategy with payments industry trends and future-ready architecture. You can launch fast, scale confidently, and offer experiences that your customers trust.

Conclusion

The future of digital wallets is intelligent, secure, and deeply interconnected. As you prepare for 2026, these ten trends will help you understand where the industry is heading and how your institution can adapt. The next generation of ewallet trends will reward providers who focus on innovation, interoperability, and user-centric design.

If you take action now, even with two or three high-impact features such as virtual cards or predictive insights, you will position your wallet for long-term relevance and growth.

However, preparing for this shift requires a clear strategy and the right technology foundation. You can start by:

-

Reviewing your current wallet capabilities

-

Identifying gaps in fraud controls

-

Evaluating your readiness for open banking, and

-

Exploring opportunities in predictive insights, biometrics, & hybrid payment rails

Each step positions you to offer a more secure, intelligent, and future-ready experience.

Our digital wallet solution gives you a modular, scalable, and secure platform designed for businesses like yours. Plus, it helps you launch advanced wallet capabilities faster and stay competitive as the industry evolves.

So when you're ready to build, refine, or scale your digital wallet solution, DigiPay.Guru is here to support you every step of the way.

FAQs

Prioritize predictive analytics, AI-driven fraud defense, and open banking.

-

Predictive analytics raises engagement and reduces churn.

-

Edge AI cuts fraud losses and false declines.

-

Open banking turns your wallet into a single financial view that improves routing, lowers costs, and boosts retention.

And virtual cards and CBDC/stablecoin readiness are next-tier but quickly become table stakes for international products.

You gain higher transaction throughput, lower operational costs, and new revenue lines. Micro-savings, loyalty programs, and merchant wallet solutions increase ARPU. Edge AI and multi-biometric onboarding reduce fraud and cut KYC costs. Supporting hybrid rails (fiat + tokenized assets) opens cheaper cross-border corridors and faster payouts.

Expect the fastest growth in Africa, Southeast Asia, and LATAM. These regions combine rising smartphone penetration, strong mobile money adoption, and regulatory openness for fintech pilots. Growth is driven by everyday use cases (remittances, bill pay, merchant acceptance) rather than niche crypto use.

Start small and modular: pilot verifiable credentials (VCs) and a Decentralized Identity (DID) adapter that plugs into your onboarding flow. Use DID for cross-border KYC portability, not as a replacement for regulated AML checks. Validate interoperability with regional identity frameworks, and build governance for consent, revocation, and data minimization before wide rollout.

SuperApps bundle finance with daily services, increasing user stickiness and lifetime value. If your wallet integrates into a SuperApp, or you add complementary services, you tap commerce, lending, and utility flows that boost frequency and revenue per user. In short, SuperApps turn payments into a platform for broader monetization.

Not necessarily, but wearables can be a differentiator in fast-commerce and transit use cases. Prioritize core features first (security, virtual cards, open banking, predictive insights). Add wearable payments when your customer journeys show high-frequency, low-latency transactions, or you need a convenience play to win a specific segment.

DigiPay.Guru provides a modular, API-first wallet platform that includes predictive analytics, edge-AI fraud engines, multi-biometric onboarding, virtual card issuance, open banking connectors, and hybrid rail support (fiat + tokenized assets). You can deploy incrementally or opt for end-to-end implementation to accelerate time to market while keeping compliance and UX priorities intact.

Technically possible, but not advisable. Launch in phases: secure the core (wallet, KYC, fraud), add high-impact features (virtual cards, predictive insights, open banking), then expand into wearables, decentralized identity, and GenAI assistants. Use a modular platform to parallelize development and iterate based on real user metrics. That approach balances speed, risk, and ROI.