As digital payments evolve, customers now expect speed, flexibility, and convenience, even when it comes to shared transactions.

Whether it’s friends splitting a restaurant bill, riders sharing a fare, or families dividing household expenses, users want payment options that fit their real-world needs.

That’s exactly where split payments come in. It’s the process of dividing a single payment into two or more simultaneous transactions made by different users, instantly and automatically. It turns shared spending into a smooth and digital experience.

For businesses like yours, enabling this feature isn’t just about convenience; it’s about relevance.

Also, a Mastercard study revealed that over 45% of digital wallet users prefer payment apps with split or shared payment options, thereby proving how quickly user behavior is changing.

In this blog, we’ll explore

- What split payments mean and how they work

- Their common methods and benefits

- And where financial businesses like yours can leverage them to enhance customer experience.

Let’s begin by understanding the meaning of split payments.

What Is a Split Payment?

A split payment is a financial transaction where a single payment amount is divided into two or more portions, paid by different users or via multiple payment methods at the same time.

For example, imagine two customers shopping together. Their total bill at a retail store is $100. Instead of one person paying the entire amount, both can contribute $50 each using their digital wallets or debit cards while creating a single transaction with two payers.

This concept is also common in restaurants, ride-sharing, and peer-to-peer payment platforms. In these scenarios, users share expenses digitally, thereby removing the need for cash transfers or manual reimbursements.

It’s also important to distinguish split payments from partial payments:

| Criteria | Split Payment | Partial Payment |

|---|---|---|

| Purpose | Divides a full amount among multiple users | Allows one user to pay over time |

| Use Case | Shared bills, multi-payer transactions | Installments, EMIs |

| Timing | Simultaneous | Scheduled |

| Automation | Real-time via APIs | Often manual or scheduled |

In essence, split payments enable shared transactions, while partial payments manage deferred ones.

Split Payment Meaning: Beyond Simple Transactions

The split payment's meaning goes beyond its definition. It represents a new approach to digital collaboration in finance.

Modern users engage in shared consumption models, from shared rides to shared workspace subscriptions. And traditional payment systems weren’t designed for multi-user contributions, but modern APIs and wallet platforms have changed that.

With digital split payments, users can instantly divide one bill into several simultaneous payments. It simplifies expense management, improves transparency, and offers convenience across industries.

For businesses like yours, offering split payment features can:

- Boost user engagement and app retention.

- Strengthen trust through transparent digital settlements.

- Enable innovation in P2P and group transaction features.

In short, it’s not just about splitting money; it’s about building digital trust and convenience.

How Do Split Payments Work?

Split payments function through automation and real-time API integration. When a customer pays for a transaction, the system divides that payment according to pre-set logic, either equally or based on custom ratios.

Here’s a simple breakdown of how it works:

-

A transaction is initiated (e.g., a $100 restaurant bill).

-

The app identifies contributors (say, two users paying $50 each).

-

The system verifies payment methods (wallets, cards, or bank accounts).

-

The payment gateway processes both amounts within one transaction.

-

The ledger updates automatically, while ensuring instant settlement and record tracking.

And if you are still working out with manual settlements. You are losing customers.

How? Let's understand with a comparison between manual settlements vs API-based split payments:

| Step | Manual Payment Settlement | Split Payment via API |

|---|---|---|

| Processing | Manual calculation and entry | Automated rule-based distribution |

| Time Taken | Hours or days | Instant |

| Error Rate | High | Minimal |

| Visibility | Limited | Full real-time tracking |

This automation in split payment transactions ensures faster settlements, fewer errors, and a smoother customer experience, especially when dealing with multiple payers.

Read more - Product Update: Split & Schedule Payment, and Sub Wallets

Common Methods for Split Payments

Different platforms handle split payments differently based on flexibility, automation, and use case.

Here’s a quick breakdown of some of the most common methods for split payments:

| Method | Flexibility | Use Case | Automation Level |

|---|---|---|---|

| Static Percentage Split | Low | Fixed commissions or standard bill sharing | Basic |

| Dynamic Rule-Based Split | High | Variable amounts, multi-party transactions | Advanced |

| Smart Contract-Based Split | Medium-High | Blockchain and DeFi-based transactions | High |

Static percentage splits are ideal for predictable transactions like merchant commissions.

Dynamic rule-based splits are popular among fintechs because they adjust automatically depending on who’s involved.

Smart contract-based splits use blockchain for secure, transparent, and programmable transactions.

For banks and fintechs like yours that are building modern wallets, dynamic and smart contract approaches are key, because they balance flexibility and control.

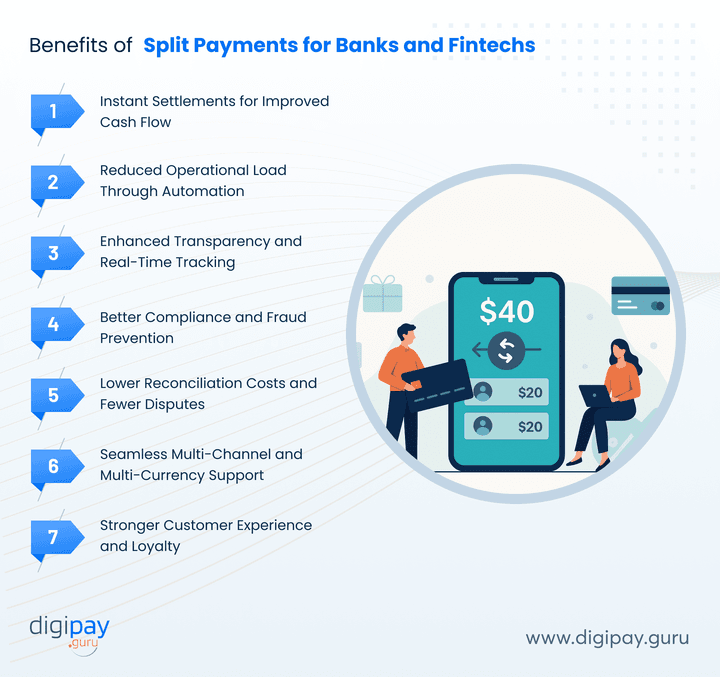

Benefits of Split Payments for Banks and Fintechs

For financial businesses like yours, split payments go far beyond convenience. They reshape the way digital ecosystems operate.

By automating how shared transactions are processed, they simplify settlements, improve transparency, and reduce operational risk.

Here’s a closer look at the key split payment benefits:

1. Instant Settlements for Improved Cash Flow

Split payments eliminate the long settlement delays that come with manual fund distribution.

When multiple users contribute to a single payment, each share is processed and credited in real time, while ensuring faster access to funds for merchants, service providers, and platform owners.

2. Reduced Operational Load Through Automation

Manual reconciliation often consumes time and creates friction. With split payments, automated APIs manage all calculations and allocations, thereby freeing up your staff resources and minimizing the risk of human error during transaction processing.

3. Enhanced Transparency and Real-Time Tracking

Every transaction is fully traceable in split payments. Banks and fintechs like you can:

- Track each payer’s contribution

- Monitor settlements instantly, and

- Maintain a clear digital audit trail.

This not only builds customer trust but also streamlines internal reporting.

4. Better Compliance and Fraud Prevention

Regulatory compliance becomes simpler when every split is recorded in detail.

Split payment systems maintain AML-ready logs, ensure accurate KYC verification, and prevent unauthorized transfers. This helps you stay compliant without extra manual oversight.

5. Lower Reconciliation Costs and Fewer Disputes

Automated allocation rules drastically cut down reconciliation time and cost.

Since each contributor’s share is instantly logged and confirmed, disputes about “who paid what” virtually disappear. This makes settlements more reliable and error-free.

6. Seamless Multi-Channel and Multi-Currency Support

Modern split payment platforms can handle multiple currencies, regions, and payment methods, whether debit cards, credit cards, or digital wallets.

This flexibility makes it easier for global banks and fintechs to offer inclusive, borderless payment options.

7. Stronger Customer Experience and Loyalty

When users can split bills easily within the same app or wallet, it reinforces convenience and reliability. Plus, it turns an everyday need of sharing expenses into a smooth digital interaction that keeps users engaged and loyal to the platform.

All in all, offering split payments delivers more than convenience; it creates operational efficiency and stronger customer relationships.

This is why, without adding the feature of split payments to your payment system, your business is lacking. Let’s understand it with a quick:

| Metric | Before Split Payments | After Split Payments |

|---|---|---|

| Settlement Time | 2–3 days | Instant or same-day |

| Manual Errors | 10–15% | <1% |

| Operational Cost | High | Reduced by 30–40% |

Split Payment Use Cases Across the Fintech Ecosystem

Split payments have versatile applications across industries. Check them out below:

| Industry | Split Payment Example | Key Benefit |

|---|---|---|

| Restaurants & Retail | Friends splitting a $100 bill into $25 each | Easy shared billing |

| Ride-Sharing Platforms | Fare split between passengers | Transparent cost-sharing |

| Fintech Wallets | Multiple users contributing to one transaction | Simplifies shared expenses |

| Marketplaces | One order, multiple vendor payouts | Instant and fair distribution |

| Cross-Border Payments | Family members contributing to one remittance | Multi-currency flexibility |

For businesses like yours, enabling these experiences through eWallets not only simplifies payment processing but also creates new engagement models that turn users into active digital participants.

Split Payment Users and Tools: How Platforms Differ

Do you know if the specific tools for split payment work better for specific users?

Let’s look at how different platforms handle split payments:

| Platform | Target Users | Split Type | Settlement Time | White-Label Ready |

|---|---|---|---|---|

| Stripe Connect | Marketplaces | Static + Dynamic | Instant | ❌ |

| PayPal | Merchants | Limited | 1–2 days | ❌ |

| DigiPay.Guru | Banks, Fintechs, FIs | API-based, rule-driven | Instant | ✅ |

Global payment platforms like Stripe and PayPal provide limited flexibility for multi-party transactions.

However, businesses like yours require white-label-ready solutions that integrate with their core systems to ensure full ownership, compliance, and scalability.

Real-World Examples of Split Payments in Action

To understand how powerful split payments can be, let’s look at a few real-world scenarios where this feature is transforming how people and platforms handle money.

Restaurants and Cafés

Split payments make dining out easier for groups. Instead of one person paying the entire bill and chasing others later, each diner can instantly contribute their share through their digital wallet or card, all in a single transaction.

Ride-Sharing Platforms

When multiple passengers share a ride, split payments ensure each person pays their part automatically. It removes awkward fare-splitting at the end and helps platforms credit drivers accurately and instantly.

Fintech Wallets and P2P Apps

Digital wallets are using split payment features to enhance the user experience. Whether friends share subscription costs or chip in for an online purchase, each person’s share is deducted seamlessly, improving engagement and retention.

Online Marketplaces

In multi-vendor marketplaces, split payments help distribute funds instantly between sellers, delivery partners, and the platform itself. This automation reduces manual settlements, improves trust, and supports transparent vendor management.

Cross-Border Transactions

Families sending remittances can now divide one transaction across multiple recipients in different countries. Split payments make multi-beneficiary transfers easier, thereby ensuring each share reaches the right account instantly, even across currencies.

How DigiPay.Guru Enables Split Payments

At DigiPay.Guru, we help banks, fintechs, and financial institutions like yours empower their customers with smarter, faster, and more transparent payment experiences.

Our white-label eWallet solution lets you offer split payment functionality directly within your ecosystem, branded as your own, powered by us.

Here’s how DigiPay.Guru makes it simple:

- Rule-Based Automation: Define equal or custom splits for any transaction with API-driven precision.

- Instant Settlements: Distribute funds to multiple recipients in seconds, not days.

- Multi-Currency Ready: Seamlessly handle domestic and cross-border splits across currencies.

- Compliance-First: Stay fully aligned with PCI-SSF, AML, and KYC standards.

- White-Label Control: Deliver a secure, branded experience while retaining full ownership of your platform.

With DigiPay.Guru, you don’t just process payments; you transform them into seamless, shared digital experiences that build loyalty, trust, and long-term growth.

Conclusion

Split payments redefine how people and platforms handle money together. They simplify shared spending, enhance transparency, and align perfectly with how digital customers live and pay today.

For banks, fintechs, and financial institutions like yours, enabling this feature means delivering convenience, control, and confidence: three pillars of modern digital finance.

With DigiPay.Guru’s white-label eWallet solution, you can offer your customers seamless split payment experiences: automated, compliant, and instant. It’s not just about splitting bills; it’s about empowering users with smarter financial interactions.

FAQs

A split payment is the process of dividing a single transaction into multiple payments made by different users or contributors. It allows each participant to pay their share instantly and transparently within one digital transaction.

Banks and fintechs like you use APIs to automate the distribution of funds across multiple payers or recipients in real time. This ensures accurate settlements, faster processing, and full visibility across every transaction

They simplify shared spending and vendor payouts by removing manual settlements. For wallets and marketplaces, split payments enhance customer convenience, improve transparency, and strengthen user engagement.

Split payments divide one transaction among multiple contributors, while partial payments allow a single payer to pay over time or in installments. The key difference lies in who pays and when the payment occurs

Yes. DigiPay.Guru’s platform supports multi-recipient and cross-border remittances, while allowing your users to split one transfer across several beneficiaries instantly and securely.

Industries like digital wallets, e-commerce marketplaces, ride-sharing, travel, and hospitality gain the most. They rely on shared transactions, multi-party settlements, and transparent real-time distribution.

Split payments improve cash flow, reduce manual workload, and enhance transaction transparency. They also strengthen compliance and create smoother customer experiences through automation and instant settlements.

Common methods include static percentage splits, dynamic rule-based splits, and blockchain-based smart contract splits. Each method offers varying levels of flexibility and automation based on the business model.

Fintech startups can integrate DigiPay.Guru’s modular APIs to automate how funds are divided and settled. The integration is simple, scalable, and designed for real-time processing within existing platforms.

Yes. When implemented through PCI-SSF and AML-compliant systems like DigiPay.Guru’s, split payments adhere to global standards for data security, traceability, and financial transparency.

Absolutely. DigiPay.Guru’s eWallet solution supports cross-currency and multi-region transactions, thereby ensuring accurate conversions, compliant settlements, and seamless fund distribution across global corridors.

DigiPay.Guru integrates split payments directly into its white-label eWallet platform through rule-based APIs. Financial institutions can offer this feature under their own brand, with full control, automation, and compliance built in.