“Our checkout looked fine, but users were dropping quietly. At first, we thought it was a marketing issue. Turned out to be a payment issue.”

This is a common challenge for fintech founders. When payments fail silently, businesses lose revenue and customer trust.

This is where a fintech founder approached us with this issue. We provided a seamless white-label payment platform solution to them. They were convinced about how payment APIs can help them.

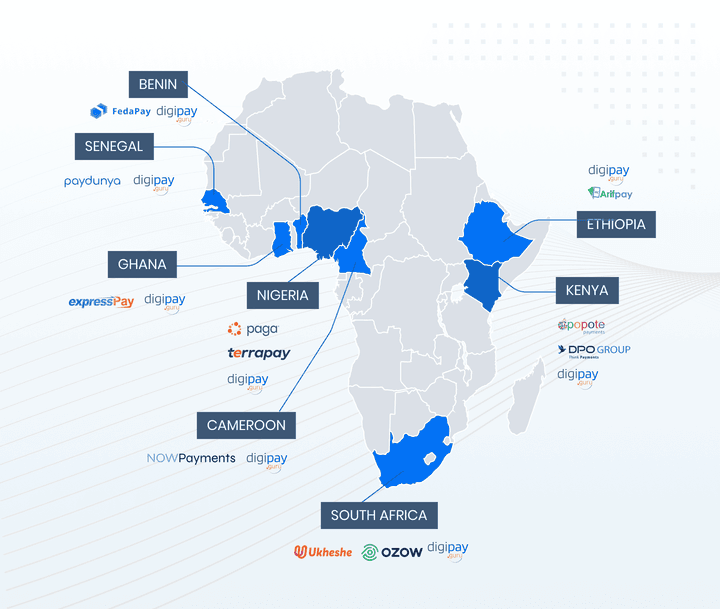

Africa is one of the fastest-growing digital payments markets in the world. The African mobile money market is projected to reach USD 3,655 million by 2033 in a report by Market Data Forecast.

Yet, payment fragmentation across cards, mobile money, bank transfers, and cross-border rails remains a major operational bottleneck for fintechs.

After reading 27 Payment API blogs this quarter—from banks, PSPs, fintech platforms, and developer docs—one thing became clear: most content explains what a Payment API is. Very few explain why it breaks growth when done wrong.

This guide explains what Payment APIs are, how they work, a comparison of payment API vs gateways, and how fintech companies can use them to build a reliable payment infrastructure across diverse markets.

What Every Blog Gets Right(And Misses)

Across the blogs, three themes showed up everywhere:

-

Payment APIs enable transactions

-

Security and compliance matter

-

APIs help scale globally

But what most blogs didn't explain clearly:

-

Why silent failures hurt more than visible declines

-

When APIs outperform gateways (and when they don’t)

-

How founders should sequence API complexity over time

What is a Payment API?

A payment API (Application Programming Interface) is the link between your online business or app and the payment processing network that allows transactions over different channels.

In simple words, it’s the interface that enables a customer to pay with a card or digital wallet and have the funds safely sent to the firm.

Founder takeaway:

If your payments logic lives outside your product (redirects, hosted flows), you don’t control conversion, retries, or recovery. A Payment API brings payments inside your product logic.

Different channels here refer to banks, card networks, or wallets. You can also use a digital payment platform for payment purposes.

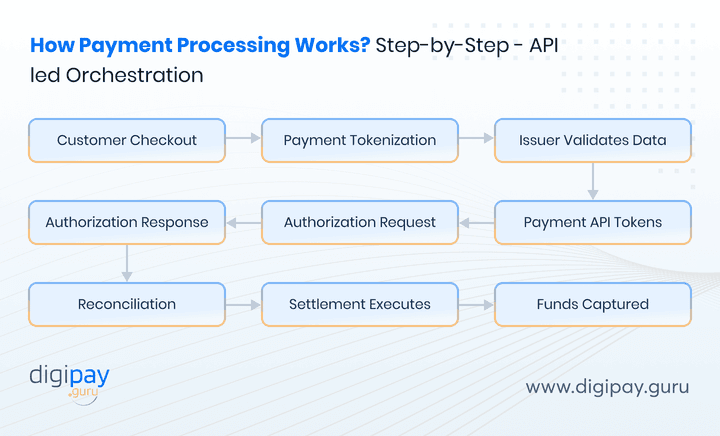

How Do Payment APIs Work? (Step by Step Guide)

Most blogs explain this technically. Here’s the version founders actually need.

-

Customer Action (Steps 1–2)

-

Authorization & Risk (Steps 3–4)

-

Money Movement (Steps 5–7)

-

Ops & Visibility (Steps 8–9)

Step 1 – Once the purchase is done, a user initiates a checkout, payment process through mobile money or a digital wallet. It can be either via app, web, or POS.

Step 2 – Then Payment API tokenizes card or wallet details via SDK or direct call. Tokenization makes the sensitive details secure.

Step 3 – Once the tokens are sent, an authorization request is sent to the processor/acquirer.

Step 4 - Issuer validates cardholder data like 3DS, CVV, and OTP, etc.

Step 5 – Once the information is confirmed, the authorization response is returned. After the response, i.e., approved or declined, comes the next step of funds capture.

Step 6 - Funds captured. This can be done immediately or later. Only when the funds are captured, the next step is executed.

Step 7 - Settlement executes per acquirer timelines.

Step 8 - Reconciliation occurs with payouts, fees, FX, or adjustments.

Step 9 - Webhooks notify merchant systems of status changes like refunds, chargebacks, or payouts.

In this way, the whole process of payment is carried out using a payment API. (Without redirecting the users)

Why are Founders Choosing Payment APIs?

Across nearly every high-performing fintech blog, one pattern stood out: founders didn't switch to Payment APIs for features—they switched after losing revenue. That is sad and late.

Every failed transaction, delayed payout, or compliance miss directly impacts trust, growth, and runway.

So, here are five benefits of Payment APIs -

1. Higher Conversion & Lower Drop-offs

Most founders learn this the hard way: every redirect loses users.

Redirect-based gateways break the user journey, especially on mobile. Payment APIs let you embed payments directly into your product, so users never feel like they're “leaving” your app.

What this means in practice:

-

Native checkout flows reduce friction and hesitation.

-

Saved cards, wallets, and one-click checkout improve repeat payments.

-

Higher authorization success rates translate directly into revenue.

For fintechs operating at scale, even a 1–2% improvement in success rate can mean millions in recovered GMV.

2. Faster Time-to-Market (and Fewer Engineering Bottlenecks)

Speed matters—especially when you're racing competitors or regulatory windows.

Believe us, every other person is building something in fintech, but the ones winning the market are those who know that speed is the real deal.

How can you get speed -

-

Use Plug-and-play SDKs. They reduce build time from months to weeks.

-

Adopting a unified API. It reduces integration complexity across multiple payment methods and processors.

-

Let your team spend more time on your product to make it fast.

For early and growth-stage fintechs, this often means shipping faster without over-engineering.

3. Lower Operational Costs as You Scale

Payments don't just fail at checkout—they fail in reconciliation, disputes, FX, and ops.

Payment APIs help founders move from manual firefighting to automation:

-

Automated reconciliation reduces finance and ops workload

-

Built-in fraud scoring lowers chargebacks and dispute costs

-

Smart routing and FX optimization reduce per-transaction leakage The result?

Lean teams can support higher volumes without linear increases in headcount or operational cost.

4. Better Global Reach Without Rebuilding Everything

Going global shouldn't mean rewriting your payments stack for every market.

Payment APIs expose local payment rails through a single integration, helping fintechs expand faster and with less risk-

-

UPI (India), or M-Pesa (Africa)

-

Multi-currency acceptance and localized settlement

-

Cross-border collections and payouts through a unified interface

For founders, this unlocks:

-

Faster market entry

-

Better local acceptance rates

-

Fewer dependencies on country-specific vendors

5. Compliance & Risk Reduction Built Into the Stack

Compliance is not optional. It's not something you want to add on a later stage.

A robust Payment API bakes regulatory and security requirements into the infrastructure, so founders can focus on growth without constant compliance anxiety.

(We have covered compliance and security in the section “Compliance and security”)

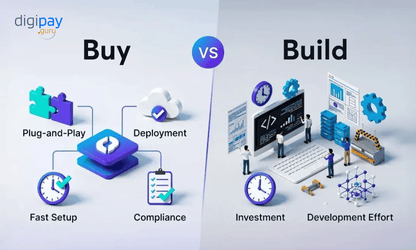

Payment APIs vs Payment Gateways

Now, many companies confuse the two. But they are different. Their rules and roles differ. Here is a comparison table for payment API vs gateway to give you a quick look at the basic differences -

| Criteria | Payment API | Payment Gateway |

|---|---|---|

| What it is | A programmable interface to initiate and manage digital payments. | A payment facilitator that securely transmits transaction data between merchants & processors. |

| Integration Type | High | Limited |

| Use Cases | Marketplaces, SaaS, fintechs, super apps, wallets. | Small businesses, low dev resources. |

| Scalability | High | Moderate |

| Developer Friendly | Yes | No |

| Automation | Native | Partial |

Payment APIs work best for enterprises needing flexibility, global payout rails, and white label payment platform providers.

Payment Gateways are best for merchants who want a fast setup with less development involved.

Features You Should Look for in a Payment API

Features help you make the payment API more convenient for the user.

Every founder doesn't need everything on day one. Based on what we saw across fintech case studies, here's how teams usually sequence features.

Core = “Day 1”

Advanced = “Scale phase”

Top 5 core features

| Core Features | What It Does | Why It Matters for Businesses |

|---|---|---|

| Payment Authorization & Capture | Processes real-time transaction approvals and fund captures from different channels. | fast checkout, higher authorization rates |

| Tokenization & Secure Data Vaulting | Replaces sensitive payment data with non-exploitable tokens. | Improves data security |

| Refunds, Voids & Chargeback Handling | Manages post-transaction events via API calls and webhooks. | Simplifies dispute resolution and automates customer refunds. |

| Multi-Currency & FX Processing | Supports payments in multiple currencies with dynamic FX conversion. | cross-border commerce and improves international CX. |

| Webhooks & Event Notifications | Sends real-time payment status updates to merchant systems. | Keeps systems synchronized |

Payment API is evolving with time. What started as a simple transaction enabler has now transformed into a full-scale financial infrastructure layer. Here are the top 5 advanced features that you can integrate into your fintech solution.

Top 5 advanced features

| Advanced Features | What It Does | Enterprise Use Case |

|---|---|---|

| Recurring Billing & Subscription Management | Automates recurring charges | SaaS platforms, subscription services |

| Payouts & Mass Disbursements API | Enables instant or scheduled payouts to channels. | Marketplaces, gig platforms, loan disbursements, remittances. |

| Fraud Prevention & Risk Scoring APIs | Integrates AML, velocity checks, and fraud detection tools. | Reduced chargebacks |

| Payment Orchestration & Smart Routing | Routes transactions across multiple processors for cost. | Enterprises requiring redundancy, cost control, and high uptime SLAs. |

| eKYC & Compliance Integrations | Connects identity verification, AML screening, and regulatory reporting tools. | Fintechs, banks, wallets, and regulated financial institutions. |

With these core and advanced features, you can kickstart your project. Then, gradually add the features that are needed. This will help you in reducing the time-to-market.

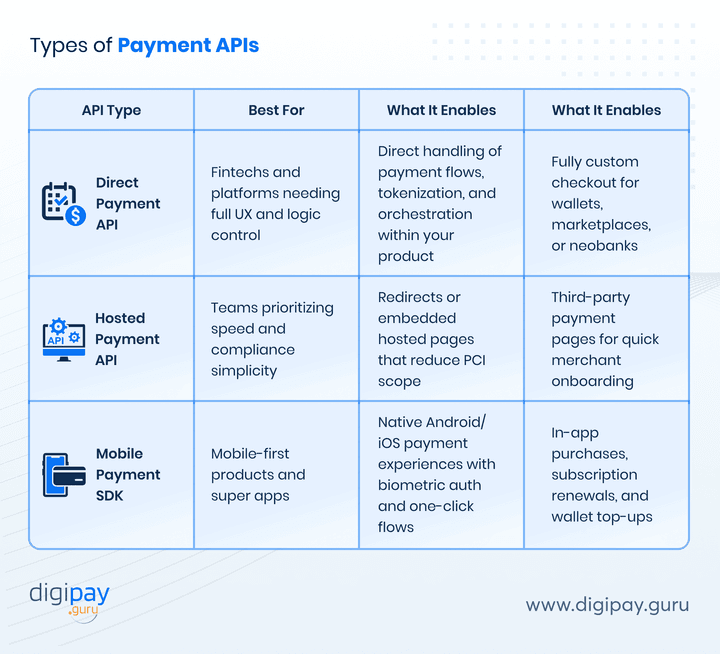

Types of Payment APIs

The type of payment API you need to choose depends on how much speed, control, and compliance responsibility your team is ready to take.

Here is a basic payment API classification that you can refer to for your product.

Generally, founders start from simple models and gradually switch to more complex models. Choosing an API depends on answering some basic questions about your product

-

What is your product?

-

Which functionality does it provide?

-

How do you want to integrate it?

The Decision Tree You Need to Know Before Making Any Decision

This is the framework founders kept asking for—but rarely found.

Use this quick decision tree to identify the right Payment API type based on your product stage, team capability, and compliance readiness.

Step 1: How much control do you need over the checkout experience?

➡️ I need full control over UX, flows, and logic

→ Go to Step 2

➡️ I'm okay with redirects or hosted pages to launch faster

→ Choose a Hosted Payment API

Step 2: Is your product mobile-first or web-first?

➡️ Mobile-first (Android / iOS apps)

→ Choose a Mobile Payment SDK

(Often combined with a Direct API for backend orchestration)

➡️ Web-first or platform-based (SaaS, marketplace, admin panels)

→ Go to Step 3

Step 3: Are you ready to manage PCI and compliance responsibilities?

➡️ Yes, we can handle PCI-DSS, tokenization, and audits

→ Choose a Direct Payment API

➡️ Not yet, we want lower compliance overhead

→ Start with a Hosted Payment API and plan migration later

Step 4: Are you planning to scale across markets or payment methods?

➡️ Yes, multi-country, multi-rail expansion is on our roadmap

→ Choose a Direct Payment API with orchestration and local rail support

➡️ No, single market or MVP stage

→ Hosted API or Mobile SDK is sufficient for now

We wish more blogs included this kind of framework.

Key Considerations When Choosing a Payment Processing API

You need to know which areas require your focus when working on the Payment processing API.

| Consideration | Why It Matters | What to Ask |

|---|---|---|

| Security & compliance | Risk mitigation | How is data protected? |

| Scalability | Future-proofing | Can it handle peak load? |

| Cost & pricing model | Budget clarity | Any hidden fees? |

| Global support | Expansion readiness | Multi-currency / local methods |

| Documentation & support | Speed of implementation | What resources exist? |

Most fintech delays don’t happen at code review—they happen at compliance review.

Payment APIs that bake compliance early remove weeks from launch cycles.

We are going to talk about the areas that you should focus on from day 1.

-

Security and Compliance

-

Cost and pricing model

Security, Compliance & Regulatory Factors

For fintech founders and decision-makers, compliance and security are a go-to-market requirement, not a backend task. Enterprises must evaluate compliance from day one.

Must know regulations -

PCI-DSS (Card Security)

Mandatory across both regions for any card-based payments.

API-led processing increases PCI scope unless tokenization and encryption are used.

Most banks and card networks require PCI-DSS Level 1 for scaled fintech platforms.

Key takeaway: Choose a Payment API with built-in tokenization and certified PCI infrastructure to reduce audit effort and risk.

Data Protection & Privacy

Governed by state-level laws like CCPA/CPRA and financial data safeguards like GLBA.

SOC 2 compliance is often required by banks and enterprise partners.

Strong encryption, access controls, and audit logs are critical.

Rapidly evolving data protection laws

- POPIA - South Africa

- NDPR - Nigeria

- Kenya - DPA

Increasing focus on data residency, consent management, and cross-border controls.

Key takeaway: Payment APIs must support encryption, configurable data retention, and regional data residency.

Payments & Financial Regulations

Real-time transaction monitoring and SAR reporting.

Central bank licensing for PSPs and wallets.

Mandatory two-factor authentication(2FA) or OTP, transaction caps, and AML checks.

Strong reliance on local rails (mobile money, bank transfers).

Key takeaway: APIs should embed KYC, AML, authentication, and local payment rail support. These measures make sure that the underdeveloped population with no or limited bank access can work through a secure system.

Why It Matters to Founders?

Non-compliance can lead to -

- License delays or revocation

- Account freezing and settlement blocks

- Regulatory fines and reputational damage

Local Regulations

Examples:

UPI (India): API velocity limits, issuer/PSP compliance, and mandatory 2FA.

MENA: SAMA & CBUAE compliance for wallets and merchant acquiring.

EU: PSD2 SCA rules mandate dynamic authentication.

Africa: Central bank licensing + KYC/AML enforcement are mandatory across most African markets, with transaction limits, wallet tiering, and real-time monitoring.

Data protection, PCI-DSS, and strong customer authentication (OTP/2FA) are increasingly enforced, especially for mobile money and cross-border payments.

Read More about Payment Processing and Compliancing here

Pricing Models for Payment APIs

It is imperative for you to know the price and cost models in the beginning for a smooth flow. Understanding cost structure ensures accurate TCO projections.

| Pricing Component | Description |

|---|---|

| MDR / Per-Transaction Fees | Percentage + fixed fee on every payment. |

| FX Markups | For cross-border or multi-currency transactions. |

| Payout & Settlement Fees | Fees for transferring funds to bank accounts. |

| Chargeback Fees | Fixed fee per dispute. |

| Platform Fees | Monthly minimums or platform access charges. |

This table gives you a basic overview of the pricing component involved.

Payment APIs transform payments from a backend function into a programmable foundation for innovation.

By embedding payments directly into products, businesses can

-

design seamless checkout and payout experiences,

-

launch faster across markets, and

-

support new business models such as subscriptions, marketplaces, and instant disbursements.

Instead of managing multiple integrations and manual processes, teams gain a unified interface that improves conversion rates, reduces operational friction, and enables data-driven optimization across regions and payment methods.

Innovation Starts with the Right Payment Foundation

Payments don't break because of bad code. They break because of early decisions.

The right API doesn't just process payments—it protects growth, trust, and time.

Payment platform providers like DigiPay.Guru is built with this reality in mind - offering a payment API-first, white-label payment infrastructure designed for scalability and regional adaptability.

For founders and decision-makers, this means focusing less on payment complexity and more on building products that move markets.

FAQs

A payment API is a software interface that allows businesses to accept, process, and manage digital payments directly within their applications. It connects merchants to payment networks, banks, wallets, and processors through secure, programmable endpoints.

A payment API works by securely transmitting payment data from the customer to the payment processor for authorization and settlement. It handles steps like tokenization, authentication, approval or decline, and sends real-time status updates back to the business via webhooks.

Payment APIs improve checkout conversion, reduce payment failures, enable faster market launches, and support multiple payment methods through a single integration. They also automate reconciliation, enhance security, and help businesses scale efficiently.

Payment API flexibility refers to the ability to customize payment flows, add or remove payment methods, route transactions intelligently, and adapt to different markets or regulations without rebuilding the entire payment infrastructure.

Yes, modern payment APIs are highly secure. They use encryption, tokenization, and authentication standards like PCI-DSS and 3D Secure to protect sensitive payment data and reduce fraud risk.

Yes, small businesses can use payment APIs. Many providers offer hosted APIs and SDKs that simplify integration, lower compliance overhead, and allow small teams to accept digital payments without deep technical expertise.

Payment APIs can support cards, mobile money, bank transfers, wallets, QR payments, BNPL, and cross-border payment methods. Supported options vary by provider and region.

Payment API integration typically takes a few days to a few weeks, depending on complexity, payment methods, compliance requirements, and internal testing cycles.