Money is running the world. But still using financial services is out of reach for many. Financial inclusion is important for decreasing poverty and driving economic growth.

"But 2 billion adults globally still lack access to basic financial services”

This is where cross-border payments come into play. According to Weforum, the cross-border payments sent home by migrant workers to support their families reached a whopping $800 billion in 2022.

The above stats indicate that international remittance solutions mixed with the right payment technologies can help to reduce costs and provide financial access to the underserved.

This blog discusses the importance of international remittance & financial inclusion, their connection, limitations and challenges that can come in the way and the future outlook of financial inclusion via cross-border remittance.

Let's dive in and explore how the flow of funds from migrants abroad is transforming financial services access for families back home.

Cross Border Payment Solution - The Key provider to Financial inclusion

Cross-border payments refers to cross-border money transfers by migrant workers to families back home. Remittances provide a vital capital inflow for developing nations. The World Bank estimates that low and middle-income countries received $630 billion in remittances in 2021.

By facilitating regular inbound cross-border payments, international remittances serve as the first entry point into formal financial services for millions of unbanked households.

Remittance service providers expand vital access points through networks of agents, branches, ATMs and mobile wallets. Senders abroad gain access to safe digital money transfer services, while recipients on the ground can leverage remittance touchpoints for broader inclusion.

Transaction records from remittance transfers and payments build financial histories that enable access to accounts, credit, savings, insurance, and more. With the right infrastructure, remittances provide the pathway to broader financial inclusion.

The Importance of Remittance For Financial Inclusion

Cross-border payments power financial inclusion through:

Expanding access points through remittance service providers

Remittance service providers (RSPs) that facilitate international remittance create vital financial access points for recipients in developing countries.

Whether through agents at retail stores, post office branches, ATMs, mobile wallets, or online channels, remittance recipients are interacting with formal financial systems. This helps overcome last-mile infrastructure challenges in reaching rural and remote communities.

For many families receiving digital money transfers, these transactions may represent the first entry point into the formal financial system.

Building savings and creditworthiness

The usage of cross border remittance solutions enables users to build financial histories and creditworthiness. Remittances received through bank accounts allow the accumulation of savings balances.

Transaction records associated with cross-border payments can form the foundation for alternative credit scoring mechanisms. This can help recipients gain access to much-needed financing for businesses and emergencies.

Cross-selling additional financial services

Remittance service touchpoints provide a platform for driving the adoption of other financial products. Many banks and fintech providers actively cross-sell savings accounts, insurance, loans, and other offerings to remittance users.

Migrant workers are also targeted with products like international remittance, bill pay, and multi-currency accounts. This allows providers to maximize their existing remittance customer base.

Fostering digital and mobile money ecosystems

Cross border remittance solutions have been a key driver of mobile money growth in many emerging markets. Digital cross border remittance solutions allow instant, affordable transfer of funds directly to a mobile wallet account.

The omnipresence of mobile devices has enabled remittance-linked mobile money accounts to spread rapidly across many countries. This builds digital finance ecosystems that can accelerate broader financial inclusion.

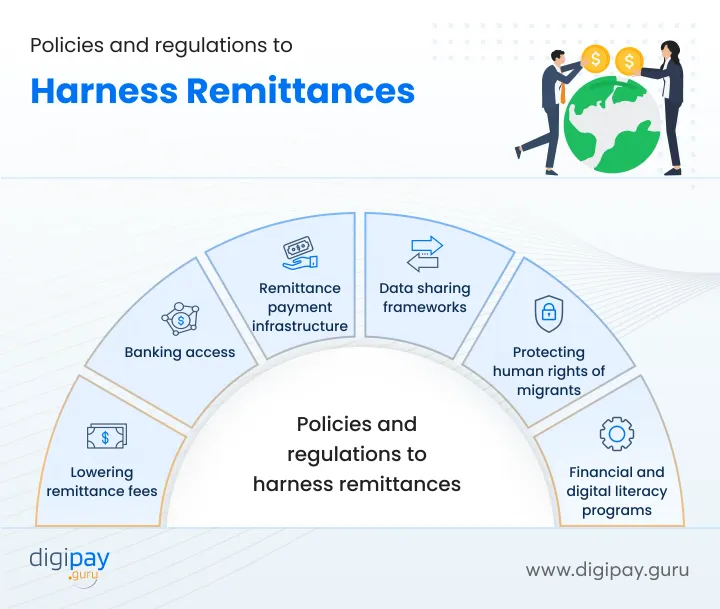

Policies and Regulations to harness remittances

Governments and regulators have an important role to play in implementing policies that maximize remittances for financial inclusion. Key measures include:

Lowering remittance fees: Remittance charges globally average over 6.25%, but costs across some corridors are much higher. Lowering fees encourages the use of formal remittance channels.

Banking access: Allowing basic bank accounts without minimum balances or relaxations on know-your-customer (KYC) norms can enable recipients to receive digital money transfers.

Remittance payment infrastructure: Building real-time, interoperable cross border payment solutions and settlement facilitates mobile money and other digital remittance models.

Data sharing frameworks: Allowing access to telco and transaction data with appropriate consent mechanisms enables alternative credit scoring of remittance users.

Protecting human rights of migrants: Efforts to lower migration costs and prevent exploitation support remittance sending.

Financial and digital literacy programs: Equipping recipients with skills to access and gain the most from financial services is vital.

Harnessing technology and innovation

Technology and product innovation have been the lifeblood enabling b2b cross border payments to drive broader financial inclusion. Some key examples include:

Mobile money platforms: Mobile-based, low-cost digital wallets that allow instant account-to-account remittance transfers and payments. The money transfer app, M-Pesa in Kenya is a prime example.

Read more: Discover how Online Payments through Digital Wallets work

Micro-remittances: Platforms like WorldRemit facilitate small cross-border payments e.g. $10 at low cost using mobile money. This promotes regular cross-border remittance flow.

Remittance as a Service (RaaS): APIs that allow banks and remittance companies to easily integrate international remittance capabilities into their apps and services.

Payments infrastructure: Building real-time payment systems and interoperable switches across digital cash-in/cash-out networks. This enables omni-channel cross border remittance solutions and services.

Biometrics and eKYC: Money transfer software with secure biometric identity verification and electronic KYC to facilitate customer onboarding. This expands access for recipients lacking official documentation.

Alternative credit scoring: Using telco and payments data to underwrite and assess the creditworthiness of remittance users without formal credit profiles.

The role of mobile money in facilitating international remittance for inclusion

Mobile money platforms have revolutionized the application of remittances for financial inclusion in emerging economies. Popular international remittance solutions like M-Pesa allow remittances to be sent instantly and securely to a recipient's mobile money account. This provides several benefits:

Convenience and Accessibility

Recipients can access remittances easily via mobiles without visiting banks. Mobile agents provide cash-in/cash-out access.

Reduced Costs and Fees

Mobile cross border remittance solutions eliminate high fees charged by traditional money transfer operators (MTOs). This enables more frequent, smaller remittances.

Read more - Why cross border fee in remittance matters for market competitiveness?

Speed of Transactions

Funds are directly credited to mobile wallets in real-time rather than waiting days for bank transfers.

Security and Transparency

Cashless mobile remittances reduce risks associated with carrying/storing cash. Senders and recipients have transparent visibility into transactions.

Integration with International Money Transfer Services

MTOs like WorldRemit and Remitly have integrated with mobile operators to enable direct digital disbursement.

Financial Inclusion and Accessibility

Mobile remittances drive registration of recipient mobile wallets. These can then be used for other digital financial services like payments and micro-savings.

Read more: Financial Inclusion: Definition, examples, and why It's Important for your business

Challenges Associated with Financial Inclusion via Cross-border Payment

While the massive potential exists, some key challenges need resolution:

Regulatory Hurdles: Policy and regulatory roadblocks around KYC, licensing, and data protection in some countries inhibit remittance-linked offerings.

Limited Financial Literacy: Recipients may not fully understand how to optimally use remittance monies received for economic advancement.

Exchange Rate Fluctuations: Unexpected currency volatility impairs the sender's ability to meet financial goals for recipients consistently.

Limited Access to Banking Services: Where bank reach is limited, recipients struggle to convert mobile money to cash and leverage cross-border payments fully.

Dependence on Intermediaries: Reliance on large MTOs or mobile operators inhibits competition and user power.

Technological Barriers: Many recipients lack the digital skills and smartphone access needed to take advantage of mobile remittance capabilities.

Future opportunities and trends

Several promising opportunities exist to amplify the impact of remittances on financial inclusion:

- Integrating international money transfer services into government social support programs as complementary income sources.

- Linking remittance histories with telecom data to enable alternative credit scoring.

- Launching blended finance vehicles that match remittances with other development funds.

- Collaboration between fintech innovators and mobile operators to enable interoperable mobile wallets.

- Utilizing smart data analytics to customize remittance-linked financial product offerings.

- Digitizing backend payments infrastructure for faster processing and disbursements.

Conclusion

Cross-border payments play a vital role in boosting financial inclusion. International money transfer services touchpoints are expanding formal financial access, especially when integrated with mobile money platforms. Financial inclusion powered by international remittances can uplift millions out of poverty, driving greater equality and prosperity globally.

We at DigiPay.Guru, are armed with advanced international remittance solutions with the capability to seamlessly incorporate them into varied digital payment platforms in a convenient, simple, and quick manner to make financial services accessible and affordable.

We focus on empowering the B2B cross border payments landscape by simplifying global transactions to make them as easy as cash transactions. We are on a mission to provide businesses with safe, transparent, instant, and convenient cross border payment solutions all across the globe.