Let’s be honest: for too long, opening a bank account has felt like a chore. Customers are stuck in queues, filling out paperwork, and jumping through the same tedious process at different counters, all before they even get to use your services.

That’s a problem. Not just for the customer, but for your bank too.

Because today, expectations have shifted. People expect onboarding to be fast, simple, and available at the palm of their hand. If you’re not delivering that kind of experience, chances are you’re losing prospects before they even become customers.

This is where digital onboarding in banking steps in. It eliminates friction from the bank onboarding process, modernizes compliance, and transforms how banks welcome new users, all while improving efficiency and reducing risk.

In this guide, you’ll discover:

-

How digital customer onboarding in banking works

-

Why it matters more than ever

-

What challenges should you look out for, and

-

Best practices for digital onboarding for a hassle-free banking experience

Let’s dive into what a better seamless customer onboarding looks like.

Why Customer Experience Matters in Digital Onboarding

Let’s face it. Customers expect the same smoothness from banks that they get from Netflix or Uber. If onboarding feels like a chore, they’ll bounce (and choose your competitors). Worse, they’ll tweet about it.

A long and complex onboarding process in banking isn’t just frustrating. It impacts your bottom line. And poor onboarding equals lost customers. On the flip side, a frictionless digital onboarding journey boosts trust, speed, and long-term loyalty.

According to a PwC report, 1 in 3 customers leave a financial institution (or bank) due to poor onboarding experiences. That’s a huge leak in your customer acquisition funnel.

All in all, the digital customer onboarding process in digital banking is your first impression. Nail it, and you’ve got a customer for life. Mess it up, and you’ll keep losing customers lightning-fast.

Traditional vs. Digital Customer Onboarding

Traditional onboarding means physical documents, multiple branch visits, and manual verification.

Digital onboarding simplifies the process for customers. No paperwork. No waiting. No frustration.

| Feature | Traditional Onboarding | Digital Onboarding |

|---|---|---|

| Time Taken to Open Account | Days to weeks | Minutes to hours |

| KYC Process | Manual, paper-based | Automated with eKYC |

| User Convenience | Low | High (mobile-first) |

| Error Rate | High due to manual entry | Low due to automation |

| Accessibility | Branch-limited | Anytime, anywhere |

It’s like comparing sending a fax versus sharing a Google Doc. One is outdated; the other is instant.

How Does Digital Onboarding for Banking Work?

Digital onboarding isn’t just a form on a website. It’s a carefully designed experience to enable customers to open accounts quickly, securely, and with minimal effort.

Let’s begin by understanding what digital onboarding is:

What is Digital Onboarding in Banking?

Digital onboarding in banking refers to the process of opening a bank account through an online platform or mobile application. It’s the use of digital channels and tools to onboard new customers. This process eliminates the need for in-person visits to a bank branch, minimizes paperwork, and maximizes speed.

Digital onboarding involves a series of steps that ensure the customer's identity is verified and their information is accurate.

The steps involved in digital onboarding for banking

Here’s how digital onboarding works:

Account Opening

Customers start the journey through a mobile app or website.

Customers are required to fill out an online application form that includes personal information such as name, address, and contact details. They may also be required to provide information on their employment status and income.

Identity Verification

To ensure the accuracy of the customer's information, digital onboarding in banking requires the verification of their identity. This is usually done through document scanning, selfie matching, and video KYC to verify identity. And then AI compares the selfie to ID proofs in real time.

In addition to that, it also involves a two-factor authentication process that may involve sending a code to the customer's phone or email.

KYC (Know Your Customer) Requirements

Banks like yours must comply with regulatory requirements, such as KYC regulations, to ensure that their customers are not involved in money laundering or terrorist financing.

For that, banks like yours use eKYC in banking to cross-verify documents with government databases in real-time. It also screens for anti-money laundering (AML) compliance.

Funding the Account

Once the customer's identity is verified, they can fund their account through online transfers or by linking their debit or credit card.

Technologies Used in Digital Onboarding

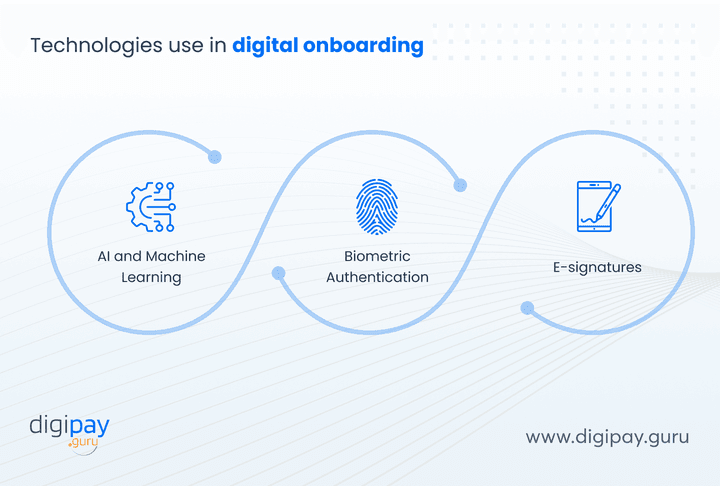

Several technologies are used in digital onboarding to ensure the process is secure and efficient. These technologies include:

AI and Machine Learning

These technologies can analyze large volumes of data to detect fraud and suspicious activity, which ensures that the customer's information is safe and secure.

It’s mainly used for real-time risk scoring, identity matching, fraud detection, and process automation. ML models also flag anomalies during onboarding.

Biometric Authentication

Biometric authentication uses physical characteristics such as fingerprints, voice recognition, or facial recognition to verify the customer's identity, which ensures that the person opening the account is who they claim to be.

This results in enhanced security and privacy of both digital onboarding processes and digital payments.

E-signatures

E-signatures allow customers to sign documents electronically, which eliminates the need for physical signatures and makes the process more convenient.

Bonus info: Even customers in rural areas or those with limited access to technology can use digital onboarding solutions. How? Well, banks have developed user-friendly platforms that can be accessed through a mobile phone or computer.

Plus, some banks have established partnerships with local agents, who can assist customers with the digital onboarding process. This makes it possible for customers in rural areas to access banking services without the need for physical branches.

Benefits of Digital Onboarding for Banks

Digital onboarding for banks offers several benefits for both customers and banks like yours. With the rise of digital transformation, banks have shifted towards digital onboarding to provide a seamless and efficient customer experience.

Here are some advantages of digital onboarding for banks:

Convenience and Speed

Access to Digital Services

Digital onboarding provides customers with access to a range of digital services such as online banking, mobile banking, loans, and e-statements right from the app without the need for a branch.

This allows customers to manage their accounts anytime and anywhere, without the need for physical branches.

Reduced Wait Times

Digital onboarding eliminates the need for in-person visits to a bank branch, which reduces wait times and makes the process faster and more convenient. This leads to happier and more loyal customers.

Enhanced Security

Verification and Authentication Processes

Digital onboarding uses advanced verification and authentication processes to ensure the customer's identity is verified and their information is secure. And automated ID checks reduce fraud and protect both the bank and the customer. Plus, AI-powered AML checks red flags proactively.

Document and Data Encryption

Digital onboarding uses encryption technology to protect customer data and documents, which ensures that they are safe from unauthorized access or theft. Plus, they are meeting regulatory compliance standards like KYC, AML, GDPR, or PCI DSS.

Better User Experience

Personalized Service and Support

Banks can offer tailored offers and in-app assistance based on user data. Digital onboarding provides customers with personalized service and support through chatbots, online support, and mobile applications. This improves the customer experience and reduces the need for in-person interactions.

Reduced Paperwork

Digital onboarding eliminates the need for physical paperwork, which reduces the administrative burden on banks and makes the process more efficient. That means lower cost and fewer human errors.

Bonus Benefit: In Africa, digital onboarding has become increasingly popular, with banks adopting technologies such as mobile apps and USSD codes to provide customers with a seamless and convenient banking experience.

For example, some African banks have developed advanced mobile money payment solutions like mobile apps that allow customers to open bank accounts, transfer money, and pay bills using their smartphones.

Additionally, USSD codes are being used to provide customers with access to banking services through their mobile phones, without the need for an internet connection. These technologies have made it possible for customers in rural areas or those with limited access to technology to access banking services conveniently and efficiently.

Challenges of Digital Onboarding in the Banking Landscape

Along with numerous benefits of digital onboarding to both customers and banks like yours, there are also challenges that you face when implementing digital onboarding processes.

Here are some of the challenges of digital onboarding in the bank:

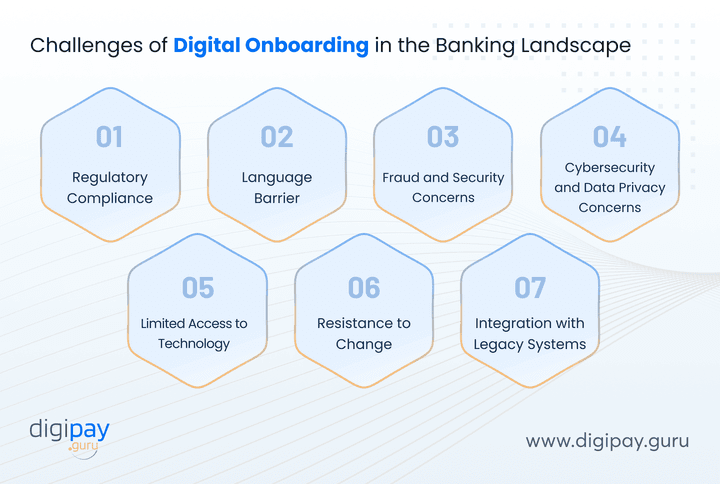

Regulatory Compliance

Banks must comply with various regulations and laws when onboarding customers digitally. These regulations may vary depending on the jurisdiction, which makes it challenging for banks to keep up with the constantly evolving compliance requirements.

Language Barrier

Digital onboarding may be challenging for customers who are not fluent in the language used in the digital process. This can create a barrier for customers who may struggle to understand the information required or the steps involved in the onboarding process.

Fraud and Security Concerns

Digital onboarding poses security risks, including the risk of identity theft, fraud, and data breaches. Your bank must implement adequate security measures to protect customer data and prevent unauthorized access.

Cybersecurity and Data Privacy Concerns

Handling sensitive data demands robust adherence to international privacy standards, including encryption, role-based access, and secure APIs. A single breach can damage your institution’s reputation, lead to regulatory penalties, erode customer trust, and result in costly legal battles. The stakes are high, security can’t be optional.

Limited Access to Technology

Not all customers have access to technology or the Internet, particularly in rural areas or developing countries. This can make it difficult for banks to onboard customers digitally and may exclude certain segments of the population from accessing banking services.

Resistance to Change

Some customers may be resistant to change and prefer traditional methods of onboarding, such as visiting a physical branch. Your bank must find ways to educate customers on the benefits of digital onboarding and ensure that the process is easy to use and understand.

Integration with Legacy Systems

Many banks continue to operate on outdated legacy systems that lack the flexibility and compatibility to integrate with modern digital platforms. These core systems, often built decades ago, are not designed for API connectivity or cloud-native functionality. This disconnect creates friction, delays, and high IT overhead during the digital onboarding process.

Best Practices in Digital Onboarding for a Hassle-Free Banking Experience

Digital onboarding has become an essential part of the banking landscape as it provides customers with a hassle-free and convenient banking experience.

However, to ensure the success of customer digital onboarding, banks must implement best practices that promote ease of use, security, and customer satisfaction.

Here are the best practices for digital customer onboarding:

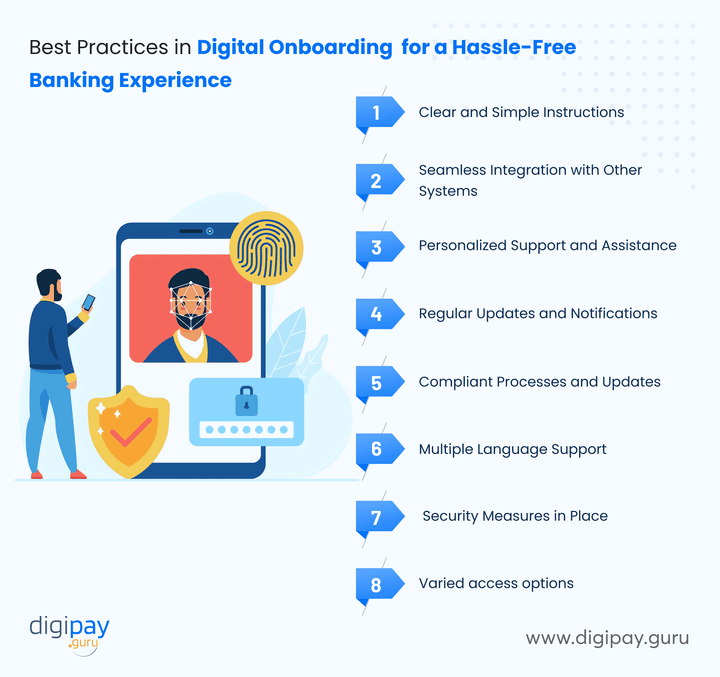

Clear and Simple Instructions

Digital onboarding processes should be easy to understand and follow, with clear instructions that guide customers through each step of the process. Guide users step-by-step with plain language and visuals. Banks like yours should also provide customers with support and assistance if they encounter any issues or have questions

Seamless Integration with Other Systems

Digital onboarding should be seamlessly integrated with other banking systems, such as online banking, mobile banking, CRMs, KYC tools, and core banking. This ensures that customers can access all their banking services through one platform, without the need to switch between different systems.

Personalized Support and Assistance

Your bank should provide personalized support and assistance to customers during the onboarding process. This can include chatbots, online support, and customer service representatives who can assist in multiple languages. This helps to prevent drop-offs.

Regular Updates and Notifications

Customers should receive regular updates and notifications during the onboarding process via SMS or app about progress and next steps to keep them informed at all times. This helps to reduce customer anxiety and ensures that the onboarding process is completed smoothly.

Compliant Processes and Updates

Your bank must ensure that its digital onboarding processes comply with regulatory requirements and regularly update its systems to reflect any changes in the regulations. So you must run regular compliance audits to stay updated and trusted.

Multiple Language Support

Banks should offer onboarding instructions and support in multiple languages to cater to customers who may not be fluent in the primary language. Support vernacular languages to improve accessibility and reach.

Security Measures in Place

Your bank must implement robust security measures and advanced fraud detection, such as biometric authentication, MFA, and data encryption, to protect customer data and prevent fraud.

Varied access options

You should provide alternative options to customers who do not have access to technology or the Internet, such as phone-based onboarding or USSD for onboarding flexibility. More channels = more conversions.

Mobile‑First Design and Easy Navigation

Design your onboarding flow for smartphones first, not desktops. Use clean layouts, large touchpoints, and intuitive steps to guide users easily. A mobile-first approach ensures accessibility, reduces friction, and delivers a smooth, seamless banking experience that aligns with how customers engage today.

Backend Integration with Core Systems

Seamlessly connect your digital onboarding process with existing core banking, CRM, and compliance systems. This integration eliminates data silos, reduces manual entry, and improves efficiency. It enables real-time verification, faster processing, and consistent customer data across your entire bank onboarding process.

Customer Education Initiatives

Educate users through simple guides, FAQs, or explainer videos during onboarding. Clear communication helps build trust, reduces drop-offs, and empowers customers. When people understand the steps and why they matter, they feel confident and are more likely to complete the digital onboarding journey.

Popular Case Studies of Successful Digital Onboarding in Banking

As the banking industry moves towards digital transformation, digital onboarding has become an essential part of the customer journey.

In recent years, many banks have successfully implemented digital onboarding strategies to improve the customer experience, reduce costs, and increase operational efficiency.

Here are some popular case studies of successful digital customer onboarding in banking:

JPMorgan Chase

JPMorgan Chase launched a fully digital account opening flow that allows customers to open an account within minutes via mobile.

The bank uses facial recognition technology and mobile check deposit to verify customer identities and fund accounts. The result has been a significant increase in new accounts and customer satisfaction.

DBS Bank

DBS Bank implemented a digital onboarding process which allows customers to open an account using their mobile devices. Here, DBS uses a paper‑free, step-by‑step flow with eKYC checks and instant approval.

Plus, the bank uses biometric authentication and facial recognition technology to verify customer identities. The result has been a 75% reduction in the time it takes to open an account and a significant increase in customer satisfaction.

BBVA

This Spanish bank shifted to digital by merging biometric eKYC, AI‑powered fraud systems, and a slick app interface. It allows customers to open accounts using their mobile devices or the bank's website. The result has been a significant increase in new accounts, and their customer satisfaction scores have gone up fast.

Barclays Bank

Barclays Bank executed a digital onboarding process that allows customers to open an account online in under ten minutes. They rolled out facial recognition and chat‑based onboarding in the UK.

Customers get updates by SMS, email, or in‑app prompts, which keeps them in the loop. The result has been a significant increase in new accounts and enhanced customer satisfaction.

Wells Fargo

Wells Fargo’s digital onboarding process allows customers to open an account online or via the bank's mobile app using automated ID and AML checks. Because of this, they saw fewer drop-offs and faster account openings.

Bank of America

Bank of America executed a digital onboarding process that enables customers to open an account online or via the bank's mobile app. The bank uses digital signatures and biometric authentication to verify customer identities. The result has been a significant increase in new accounts and customer satisfaction.

Also, with push notifications and guided account creation, they embedded compliance checks invisibly. It’s a textbook online banking onboarding flow now.

Conclusion

In banking, the onboarding experience says a lot about your brand. If it’s quick, secure, and easy, customers feel confident from the start. But if it’s slow or complicated, they’ll likely look elsewhere.

Digital onboarding helps you fix that. It removes paperwork, speeds up account opening, and makes compliance part of the process, not a hurdle. More importantly, it gives your customers the smooth, mobile-first experience they expect.

If you're serious about improving customer onboarding, DigiPay.Guru is the partner you’ve been looking for.

Our eKYC solution goes beyond the basics. It combines real-time identity verification, biometric security, and smooth backend integration to deliver a faster, safer, and more reliable onboarding experience.

Plus, it offers advanced features like face verification, document verification, address verification, and AML screening to make your onboarding process smooth and fast.

It’s built for scale, tailored for banks and fintechs, and designed to reduce drop-offs from day one.

FAQ's

Digital onboarding is the process of acquiring and verifying new banking customers through digital channels, such as mobile apps or web platforms, without requiring physical paperwork or branch visits. It includes data capture, identity verification, electronic KYC (eKYC), compliance checks (like AML), and account setup, all streamlined into a smooth, paperless experience. For banks, it’s not just a convenience feature; it’s a critical lever for acquisition, compliance, and customer experience.

Traditional onboarding relies on manual steps, filling physical forms, in-person visits, photocopying documents, and delayed account activation. It’s time-consuming and error-prone.

Digital onboarding, by contrast, eliminates physical friction. It automates KYC, supports remote verification, and speeds up account creation, often in minutes. It meets modern user expectations and significantly reduces operational costs for banks.

Yes. When implemented correctly, digital onboarding is extremely secure and often more reliable than manual processes. It uses advanced safeguards like biometric authentication, AI-driven fraud detection, encrypted data transmission, and multi-factor verification.

Furthermore, leading platforms comply with regulations like GDPR, RBI, PCI DSS, and FATF guidelines, ensuring high standards of regulatory compliance and data privacy

A typical digital onboarding journey includes the following stages:

-

Account initiation via app or website

-

Customer data entry (personal, financial, or business details)

-

Identity verification using documents, biometrics, or video KYC

-

eKYC and AML screening via government/API databases

-

Funding the account through linked sources (bank, wallet, UPI)

-

Final confirmation & digital signature to activate the account

Each step is designed to balance user ease with compliance rigor.

Key challenges for banks include:

-

Regulatory complexity across countries and jurisdictions

-

Cybersecurity threats, such as identity theft or phishing

-

Resistance to change among internal teams or legacy customers

-

Technology gaps, especially integrating with outdated core systems

-

Access inequality, particularly in regions with poor connectivity or device penetration

-

Language and UX mismatches, which can alienate diverse user groups

Addressing these requires a mix of technology, process maturity, and customer education.

Leading digital onboarding solutions leverage:

-

AI & Machine Learning: For fraud detection, risk scoring, and OCR

-

Biometrics: Face, fingerprint, or iris recognition for secure logins

-

eKYC platforms: Connected to government or telecom databases

-

Video verification: For real-time agent-assisted onboarding

-

Digital signatures: Legally binding e-signatures for documents

-

Cloud-native infrastructure & APIs: For scalability and integrations

-

Encryption & secure storage: To protect sensitive data end-to-end

These technologies not only automate workflows but also enhance the overall customer experience while ensuring compliance and speed.