The integration of artificial intelligence (AI) and machine learning (ML) has been the driving force behind fintech innovation in recent years. From fraud detection to customer service, AI and ML have transformed the way financial institutions operate, making processes more efficient and customer experiences more personalized.

According to a recent report by PwC, AI could contribute $15.7 trillion to the global economy by 2030. In the financial industry alone, AI is projected to generate $1 trillion in cost savings and revenue by 2030, as per a report by Autonomous Research.

These statistics highlight the growing significance of AI and ML in the fintech landscape, and the potential benefits they can offer to banks, financial institutions, and fintech companies.

In this article, we will explore the various use cases of AI and ML in fintech, backed by real-world examples, the benefits and challenges of implementing AI and ML in financial services, and provide insights into the future of these technologies.

Artificial intelligence and machine learning in Fintech

The integration of artificial intelligence (AI) and machine learning (ML) has transformed the way financial institutions operate, making processes more efficient and customer experiences more personalized.

While these terms are often used interchangeably, they represent different technologies and have distinct applications of AI and ML in financial services. With the internet boom and technological advancements due to digitalization, there has been increasing use of artificial intelligence and machine learning in financial services.

Read More: Increasing use of AI and ML in financial services

In this section, we will explore the differences between AI and ML in fintech, and how they are being used to drive innovation and growth.

AI in Fintech

AI refers to computer systems that can perform tasks that typically require human intelligence, such as decision-making, language processing, and visual perception.

In fintech, AI is being used for fraud detection and prevention, customer service, risk assessment, investment management, and chatbots/virtual assistants.

For example, AI-powered chatbots can interact with customers and provide personalized financial advice, while fraud detection algorithms can analyze transaction patterns to identify potentially fraudulent activity.

ML in Fintech

In fintech, ML is being used for credit scoring and analysis, loan and mortgage processing, market analysis, algorithmic trading, and anti-money laundering (AML) compliance.

For example, ML algorithms can analyze credit history, income, and other factors to predict a borrower's creditworthiness, while AML algorithms can detect suspicious activity patterns in financial transactions.

The Difference between AI and ML for fintech

AI focuses on creating intelligent systems that can perform human-like tasks, while ML focuses on developing systems that can learn from data and improve their performance.

AI algorithms are designed to make decisions based on rules and logic, while ML algorithms can identify patterns and relationships in data to make predictions or classifications.

In fintech, AI is being used for more complex tasks that require decision-making and language processing, while ML is being used for data analysis and prediction.

Why should you use AI & ML in Fintech?

Artificial intelligence (AI) and machine learning (ML) have become essential tools in the fintech landscape, providing significant benefits to financial institutions and fintech companies.

These technologies can enhance decision-making processes, improve customer experiences, and increase operational efficiency.

So, now that we know how AI and ML are used in fintech, here we will explore the reasons why AI and ML are being used in fintech, and how they are transforming the digital payment system in the financial industry.

Enhanced Customer Experience

AI and ML can provide personalized financial advice and support to customers, improving their overall experience.

For example, chatbots and virtual assistants powered by AI can interact with customers in natural language, offering customized recommendations based on their preferences and financial history.

Improved Operational Efficiency

AI and ML can automate and streamline various financial processes, reducing costs and increasing efficiency.

For example, ML algorithms can analyze loan applications and identify patterns that indicate creditworthiness, streamlining the loan processing and approval process.

Fraud Detection and Prevention

AI and ML algorithms can analyze large volumes of data to identify suspicious patterns and prevent fraudulent activities, reducing financial losses and protecting customers' assets.

Better Investment Management

AI and ML can analyze market trends and make predictions about future performance, helping financial institutions and investors make informed investment decisions.

Compliance and Risk Management

AI and ML can assist with regulatory compliance and risk management, identifying potential compliance violations and assessing risks associated with various financial products and services.

Most Prominent use cases of AI and Machine learning in Fintech

The benefits of AI and ML in digital fintech solutions have been significantly appreciated across the financial and payment industry. So you might think, yes there are these benefits but does it really work practically? The answer is yes!

But, where is the evidence? Don’t worry, in the section below we will discuss. Some prominent use cases in both AI and ML in fintech.

Top Use cases of AI in Fintech

Artificial intelligence (AI) is being used in various ways in fintech, revolutionizing the way financial institutions operate and offering numerous benefits to customers.

From fraud detection and prevention to customer service and investment management, AI is transforming the financial industry.

In this section, we will explore some of the most significant use cases signifying the benefits of AI in fintech.

Fraud Detection and Prevention

AI algorithms can analyze transaction patterns and identify potential fraudulent activity, helping financial institutions prevent financial losses and protect customers' assets.

Read More : How FinTechs are combating fraud and enhancing their user satisfaction

Customer Service

AI-powered chatbots and virtual assistants can interact with customers in natural language, offering personalized financial advice and support, and enhancing customer experience.

Risk Assessment

AI algorithms can analyze customer data to assess creditworthiness and determine the level of risk associated with various financial products and services.

Investment Management

AI can analyze market trends and make predictions about future performance, helping investors and financial institutions make informed investment decisions.

Anti-Money Laundering (AML) Compliance

AI algorithms can detect suspicious activity patterns in financial transactions, helping financial institutions comply with AML regulations and prevent financial crime.

Loan Processing

AI can analyze credit history, income, and other factors to predict a borrower's creditworthiness, streamlining the loan processing and approval process.

Personalized Financial Planning

AI-powered financial planning tools can analyze customer data to provide personalized financial advice, helping customers make informed financial decisions.

Top Use cases of ML in Fintech

Machine learning (ML) is another powerful tool being used in fintech to improve operational efficiency, enhance customer experience, and prevent financial fraud.

ML algorithms can analyze vast amounts of data and make predictions based on patterns and fintech technology trends, offering numerous benefits to financial institutions and customers.

In this section, we will explore some of the most significant use cases of ML in fintech.

Fraud Detection and Prevention

ML algorithms can analyze transaction data and identify patterns that indicate fraudulent activity, helping financial institutions prevent financial losses and protect digital payment and its data for customers.

Prevent Fraud To Secure Your Digital Payment Solutions with DigiPay.Guru.

Credit Scoring

ML algorithms can analyze credit history, income, and other factors to predict a borrower's creditworthiness, improving the loan processing and approval process.

Trading and Portfolio Management

ML algorithms can analyze market trends and make predictions about future performance, helping investors and financial institutions make informed investment decisions.

Customer Segmentation

ML algorithms can analyze customer data to identify patterns and segment customers based on their behavior, preferences, and needs, offering personalized financial products and services.

Risk Management

ML algorithms can analyze data and assess risks associated with various financial products and services, helping financial institutions comply with regulations and avoid financial losses.

Chatbots and Virtual Assistants

ML algorithms can power chatbots and virtual assistants that can interact with customers in natural language, offering personalized financial advice and support, and enhancing customer experience.

Fraud Investigation

ML algorithms can analyze data to identify potential fraudulent activity and assist in the investigation process, improving fraud detection and prevention.

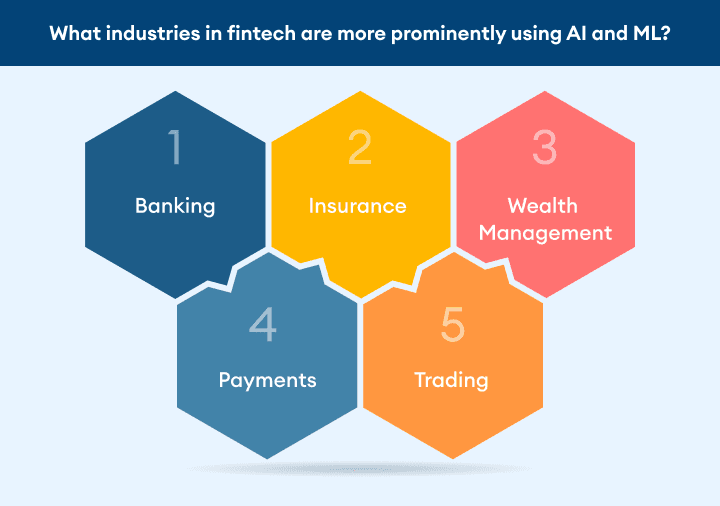

What industries in fintech are more prominently using AI and ML?

AI and ML are being adopted by various industries in fintech, ranging from banking and insurance to wealth management and payments.

These technologies are enabling financial institutions to improve their operations, enhance customer experience, and make better decisions based on data insights.

In this section, we will explore some of the industries in fintech that are more prominently using AI and ML, along with real-life examples.

Banking

AI and ML are being used to reduce operational costs, prevent fraud, and to improve overall customer experience in banking.

For example, JPMorgan Chase is using AI to analyze customer data and provide personalized investment advice, while Wells Fargo is using ML to detect fraudulent transactions and prevent financial losses.*

Insurance

AI and ML are being used by insurance companies to improve underwriting accuracy, customer service, and claims processing.

For example, Allstate is using ML to improve risk assessment and pricing, while Lemonade is using AI to provide personalized insurance policies and claims processing.

Wealth Management

AI and ML are being used by wealth management firms to provide personalized investment advice, portfolio management, and risk analysis.

For example, Betterment is using AI to provide personalized investment advice and portfolio management, while Wealthfront is using ML to optimize investment portfolios and tax strategies.

Payments

AI and ML are being used by payment processors to improve fraud detection and prevention, customer experience, and transaction processing speed.

For example, PayPal is one of the digital payment solutions that use ML to prevent fraudulent transactions and provide personalized customer support, while Square is using AI to improve transaction processing speed and enhance user experience.

Trading

AI and ML are being used by trading firms to improve investment decision-making, risk management, and trade execution.

For example, Renaissance Technologies is using ML to analyze market trends and make investment decisions, while Two Sigma is using AI to optimize trading strategies and reduce risk.

Future of AI & ML in Fintech

With so many fintech industry trends surrounding AI and ML, they have been able to gradually transform the fintech landscape, and the future holds even more possibilities.

As technology advances and more data becomes available, AI and ML will play an even more critical role in improving financial services' efficiency, accessibility, and security.

In this section, we will explore the future of AI and ML in fintech and some of the potential applications that are being developed by companies in the industry.

Personalized Financial Products and Services

Companies like Wealthfront and Betterment are already providing personalized investment advice and portfolio management services using AI and ML. In the future, we can expect to see more personalized financial products and services that are tailored to customers' needs, preferences, and behavior.

Hyper-Personalization

AI and ML can analyze vast amounts of data to provide hyper-personalized financial advice and support, leading to better customer experience and engagement. Companies like Capital One and Chase are already using AI to provide personalized offers and rewards to customers.

Fraud Detection and Prevention

AI and ML are already being used to detect and prevent fraud in the financial industry. In the future, we can expect to see more advanced fraud detection techniques that use AI and ML to analyze complex data patterns and prevent financial losses.

Predictive Analytics

AI and ML can be used to analyze vast amounts of data and make predictions about future trends, performance, and risks. Companies like BlackRock and Vanguard are already using ML to make investment decisions based on data insights.

Autonomous Finance

AI and ML can automate financial decision-making and reduce the need for human intervention, leading to faster, more efficient, and more accurate financial services. Companies like Ant Financial and N26 are already using AI to provide autonomous financial services, such as loan approvals and investment recommendations.

Conclusion

In conclusion, AI and ML have tremendous potential to transform the fintech industry and create more efficient, secure, and personalized financial services. From fraud detection and prevention to predictive analytics and autonomous finance, the use cases of AI and ML in fintech are numerous and growing.

We, at DigiPay.Guru, value AI and ML in finance and strive to offer innovative and secure digital payment solutions that leverage these technologies. Our commitment to staying ahead in this fast-changing industry ensures customers benefit from the latest advancements.