Digital transformation has taken a giant leap during the past few years. The COVID-19 pandemic made cashless and contactless payments the need of the hour, resulting in the increased demand for digital payments and other fintech services.

The customers were happy to be able to make payments in the convenience of their homes. It improved their user experience and saved their time and effort at the same time. But, with the increased demand for digital payments, digital payments fraud increased copiously in the fintech sector.

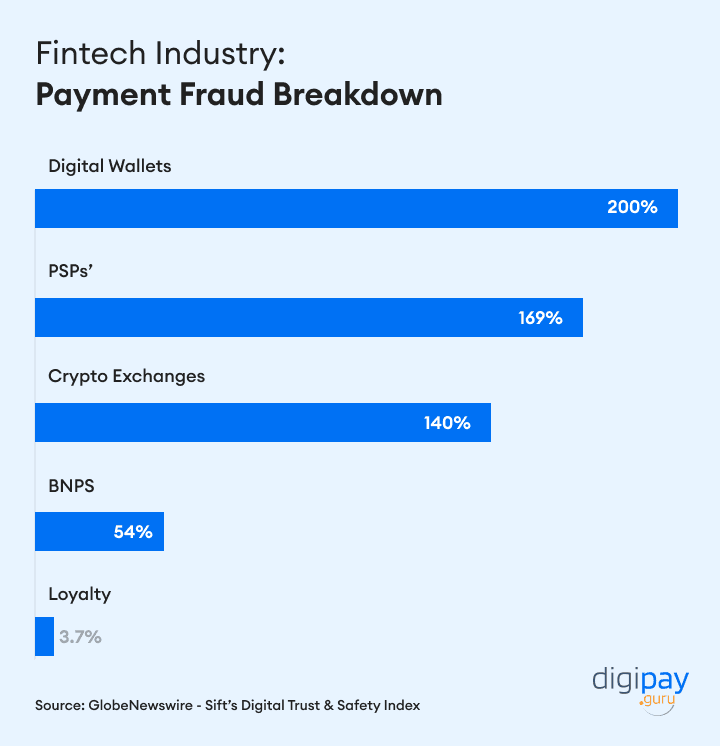

In fact, the latest study by Globe NewsWire suggests that, in the year 2021, the payment fraud attacks against fintech companies skyrocketed by a whopping 70 percent. Also, the study says that the continuous growth of the fintech industry is the main reason attracting cyber criminals and hackers to attack.

In the fintech industry, one of the most important things that keep kicking them toward success is user satisfaction. And it's undeniable that banks and financial institutions are transforming the customer experience in financial services.

The level of customer experience that fintech can provide is unparalleled as opposed to the traditional payment methods. Fintech can make customers reach the level of customer delight with its seamless solutions.

But, due to fraudulent activities and the risk of money laundering, user satisfaction may get hampered. So, in this blog, you’ll be learning about the importance of fraud prevention in fintech, how fraud prevention and user satisfaction depend on each other, and the best practices for fraud prevention.

Why is fraud prevention essential for fintech?

Fintech is the sector of innovation in banking, technology, and payments. It mainly focuses on making the users' lives easy by giving them the best customer experience at their fingertips with its advanced solutions. That's the main reason why people feel obliged to opt for fintech solutions.

As a result, the scenario for fintech adoption transformed, and people started using fintech solutions like mobile banking, digital wallet payments, mobile payment solutions, cross-border payments, agency banking, digital currencies, Buy Now Pay Later, and much more.

This transformation surged the use of fintech for payments and transactions. But, the surge in fintech also increased fraudulent activities, cyber-attacks, hacking, security and data breaches, and money laundering.

And when the fraud and cyberattacks along with other security breaches increased, the customers started feeling less secure and confident towards the fintech services. So for customers, their banking and finance experience was reduced, which ultimately will lead to a loss of customers and revenue for the fintech.

By implementing effective measures and fraud prevention tools, fintech companies can help protect themselves and their customers from financial loss and maintain the trust and confidence of their users.

For example, when the digital payments of the customers are processed with any fraud risk, they feel trust and confidence. Also, fraud prevention can help overcome the challenges in cross-border payments, such as fraud risks and security concerns.

Keeping in mind all the points discussed above, it is essential to have fraud prevention systems in place for fintech and its long-term success. So, it won't be wrong to say that fraud prevention is very crucial for a fintech company.

Prevent digital payments fraud with DigiPay’s secure payment systems

How fraud reduction helps in improving Customer Satisfaction?

It is pretty clear that fintech and its innovations are successful due to the customer experience they provide. Hence for that, preventing fraud is essential to keep their customers satisfied and retain them for the long run.

Effective fraud prevention measures can help earn users’ trust and make secure online transactions & payments for customers by making transactions more secure and reducing the risk of fraud. This can give users peace of mind and make them more confident using the fintech company's services.

Additionally, implementing fraud prevention measures in a way that doesn't negatively impact the user experience can also help in improving customer experience. For example, when a fintech company uses fraud prevention measures that are difficult for users to understand or make it difficult for them to complete transactions, it can create frustration and inconvenience for the user.

Therefore, fintech companies need to strike a balance between effective fraud prevention and a good user experience. By implementing fraud prevention solutions that can effectively reduce the risk of fraud, fintech companies can help ensure high levels of user satisfaction.

Here are five steps that fintech companies can take to prevent fraud:

1. Implement strong security measures: Use technologies like encryption and two-factor authentication to protect sensitive financial information and prevent unauthorized access to accounts.

2. Monitor Transactions: Use data analytics and other tools to monitor transactions for suspicious activity and flag potential fraud.

3. Verify user identities: Use methods like identity verification and biometric authentication to confirm the identity of users before allowing them to access accounts or complete transactions.

4. Educate the employees: Train employees on the importance of fraud prevention and how to detect and prevent frauds. This can help ensure that there is a primary importance on fraud prevention in the entire company.

5. Stay up-to-date on the latest fraud prevention techniques: Fraudsters are constantly finding new ways to commit fraud, so fintech companies need to stay on top of the latest digital payment trends and techniques in fraud prevention to stay one step ahead.

These techniques may involve regularly reviewing and updating the company's fraud prevention policies and procedures and staying informed about new technologies and best practices in the fintech field.

Read More: Digital payment trends in upcoming years

Best fraud prevention strategies for enhancing customer experience

Fraud prevention benefits businesses especially fintech in myriad ways. The five steps of fraud prevention mentioned above are imperative. Yet, there is a need to stay fully prepared, come what may. Here are the best fraud prevention strategies for enhancing the customer experience for fintech.

A deterrence for avoiding fraudsters

Deterrence is a fraud prevention strategy often used to discourage potential fraudsters from attempting to commit fraud. Deterrence is an effective way to prevent fraud because it sends a strong message to potential fraudsters that the company is serious about protecting the customers and their financial information.

For example, a fintech company can market its strong tracking and security monitoring systems. This can help deter fraudsters from attempting to commit fraud against the company or its customers, reducing the overall risk of financial fraud and loss.

Get fool-proof security for digital payment transactions

Risk assessment to mitigate risks

Risk assessment is the process of identifying and evaluating the potential risks that a fintech company may face, including the risk of fraud. By conducting a thorough risk assessment, fintech can better understand the potential threats that they may face and develop strategies to mitigate those risks.

Also, they can find specific types of fraud that they are most likely to encounter. For example, a fintech company dealing in digital payments may be at a higher risk of experiencing payment fraud. It could be a different scenario for other companies.

Once the higher risks are identified, the company can develop strategies to mitigate those risks. For example, the fintech company with a payment fraud risk may implement measures, such as two-factor authentication and transaction monitoring to help prevent fraudulent payments.

Limiting control and strategizing user restrictions

A control and usage strategy is a set of policies and procedures that fintech can use to control and monitor the use of their services. These policies and procedures can include measures like setting limits on the amount of money & the volume of transactions and mandating additional authentication for high-value transactions.

For instance, by setting limits on the amount of money that can be transferred or spent, fintech can prevent fraudsters from making large, unauthorized transactions. And with additional authentication for high-value transactions, fintech can make it more difficult for fraudsters to access sensitive financial information.

Authentication of identities for secure transactions

Authentication is the process of verifying the identity of a user to ensure that they are who they claim to be. It is a vital part of digital payment fraud prevention because it helps to prevent fraudsters from accessing sensitive financial information or making unauthorized transactions. It also ensures that terrorists and blacklisted users cannot access the payment system in any way.

Through identity authentication to access accounts, fintech can ensure that only authorized users can access sensitive financial information. This can prevent fraudsters from gaining access to the account or making unauthorized transactions.

Also, by using strong authentication methods, such as two-factor authentication or biometrics, fintech can make it difficult for fraudsters to evade authentication and gain access to sensitive information.

Detecting the fraud

Fraud detection in fintech is essential for fraud prevention because it helps quickly identify and respond to potential fraud, thereby reducing the financial loss for both the company and its customers.

There are various tools, techniques, and solutions to prevent fraud, that can be utilized to detect fraud activities in fintech, such as data analytics and transaction monitoring. These tools can help them identify patterns and irregularities in user behavior that may indicate suspicion of fraudulent activity.

Investigating for proof of fraud

The investigation is an integral part of the fraud prevention process because it helps to gather proof and determine the details of a possible instance of fraud. By conducting a detailed investigation, fintech can gather the details of a possible event of fraud, such as the parties involved, the methods used, and the financial losses.

The details collected during the investigation will act as evidence to support the legal action taken against fraudsters or cybercriminals. This evidence will also prevent any future fraud events.

Customer dispute handling

Payment fraud can cause disputes between the customer and fintech. Dispute handling can help fintech prevent and mitigate the effects of fraud by addressing any issues or concerns that customers may have about fraudulent activity.

So, fintech can cooperate with the customers and work on any issues they face because of fraudulent activities. The dispute-handling process will rebuild a sense of trust and confidence among the customers.

Concluding Thoughts

The way fintech innovations improve the customer experience is unparalleled. But the success of Fintech, from account opening to unshakable loyalty, and customer experience to user satisfaction essentially depends on fraud prevention. So, combating all the necessary frauds in the fintech system is a must.

For improving fraud prevention, the company can implement the best fraud prevention strategies like deterrence, authentication, risk assessment, controls and usage, fraud detection, dispute resolution, and investigations. Moreover, they can also use advanced AI & ML algorithms to detect and prevent fraudulent activities in real time.

Thus, fraud prevention and user satisfaction go hand in hand for the long-run success of fintech. Effective fraud prevention can help to enhance user satisfaction, while poor fraud prevention can lead to user dissatisfaction and a huge amount of penalties and fines along with a risk of losing the license and shutting the company down. So, successful fraud prevention can help build trust and confidence among customers.