The number of global digital buyers is increasing continuously. Nowadays, people tend to spend more time looking for products online than before. By comparing different products or services, they select the best for them to make the purchases irrespective of the boundaries.

With this, cross-border payments are also increasing. “A Cross-border payment is a payment transfer between the payer and the recipient who are respectively based in two different countries.” These transfers are generally wholesale/retail but also include education, medical treatments, living expenses, and gifts.

According to a study by PRNewswire, the value of global remittance and cross-border payments transactions is predicted to increase from US$ 37.15 trillion in 2020 to US$ 39.9 trillion by 2026.

Still, cross-border payments face various in-transit issues before reaching the end payee and the process of cross-border payments remains slow and expensive. In this international market with digital advances, the delays and high costs in transfers can hinder growth and waste resources.

The networks like SWIFT have somewhat facilitated international payments but not every country can adopt them. So, there still isn’t any foolproof international payment transfer solution available globally.

Fintech startups with advanced digital technologies are aiming to change the scenario of cross-border payments. For that, they are working on creating the best international money transfer system as an alternative to the current process causing inconvenience to the banks and financial institutions.

Want to improve your Cross-Border Payment process with tech.

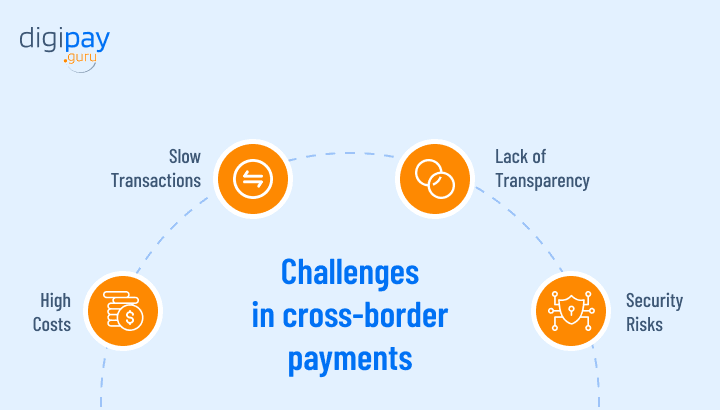

Major challenges in cross-border payments

We live in a fast-paced global economy where the need for making international transactions is of utmost importance for consumers, businesses, as well as the banks and financial institutes that serve consumers.

Yet, when cross-border payments are very essential for financial inclusion, there is a pool of challenges in both retail and wholesale markets for cross-border payments.

The major challenges in cross-border payments are:

High costs

In cross-border payments, there are so many intermediaries involved in the process of making the payment reach the end payee. The intermediaries generally involve the payer, the payer’s payment service provider, the payment infrastructure, and the corresponding bank.

Passing through all these intermediaries consists of their respective fees which make cross-border payments ridiculously costly.

Apart from that, there are regulatory costs, compliance costs, and currency exchange costs involved. This makes it difficult for banks and financial institutions to retain customers until and unless they can provide a competitive rate to businesses and individual customers.

Slow transactions

Generally, any cross-border payment transfer takes a time of one to five business days. This is a prolonged process compared to instant domestic transactions.

As there are too many intermediaries involved in a single transaction, the turnaround time for the transactions remains slow.

Because of this, many businesses may experience burdens of cash flow which in turn can be a threat to their survival in the market.

In addition, this process remains slow because of the lack of automation and standardization among various banking networks and payment infrastructures.

Also, there are instances when the banks in both countries do not have any cross-border payment system (Such as CHIPS) available, which can indeed make the payment process even more vague and slow.

As a result, many cross-border payment transfers take days to process, which the businesses worldwide currently operating on tighter margins and often with a smaller workforce, cannot afford to waste.

Read More: Cross-border transactions and international payment solution

Lack of transparency

Cross-border payments can have transparency issues with so many intermediaries involved in the process. The SMEs may have to go through a lack of transparency in terms of the costs, speed, and arrival of payments while doing business with different intermediaries.

So, tracking the payments and getting a clear picture of the entire process is very difficult and may have hidden costs associated with it. This can severely affect the profits of the business.

Security risks

It is quite obvious that all businesses and financial institutes certainly want to make secured digital transactions in cross-border payments. But, there is always the risk of cyberattacks in international payment processes.

A single weak spot in any of the countries involved in the transactions can be used for stealing money even before it enters the payee country.

The regulations of security for every country can be different. There is no guarantee that both the countries involved in the transaction use the same security standards.

So, if the receiving country’s bank has weaker security regulations in place, there are chances that the transaction may suffer from a high-security breach and the money may never reach the receiver’s account. This can ultimately lead to losses.

How fintech can help overcome the challenges in cross-border payments

The fintech industry has always strived to work on advanced payment systems. These technologies can act as a driver for improving speed, security, and transparency in cross-border payments. Fintech can help overcome the challenges involved in these payments in the following ways:

Cost cutting

The businesses have to keep tight control on the cash flow management and the costs involved in cross-border payments are not affordable to incur. Hence, businesses need to reduce their reliance on banks for conducting such international transactions and opt for the better options available in today’s market.

FinTech can be a suitable alternative as they have begun working on the incorporation of all the required features into their online payment solutions. Many of the fintech even offer for cross-border payment, making them more valuable. This allows SMEs to manage and reduce their costs in a better way.

Faster setup

The setup for international bank accounts may take longer. It could be a week or in some cases 2-3 weeks. It’s a prolonged process that has become unnecessarily more complicated for businesses with limited resources.

And for cross-border payments, it has become essential to have a different bank account for each country or currency, which then functions in silos, where information sharing is limited. These limitations become an obstacle to the flexibility and growth of businesses.

But, with Fintech’s advanced remittance and money transfer apps, the process of setup can be sped up, with some solutions which can reduce the time of processing to less than 48 hours. It is possible to avoid different accounts for different countries or currencies and get a single accumulated view of the entire payments and cash flow activities.

Improving payment speed

It is a known fact that cross-border payments take up to one to five business days to process which is considered a long period. And with intermediaries, the process becomes even slower. This hinders the management of the cash flow.

But, with the emergence of fintech and its digital money transfer software, it becomes possible to make user-friendly payments on the same day. These help the businesses to manage their cash flow and keep a storage of different currencies, for making speedy payments.

Better transparency

Due to the involvement of many intermediaries in cross-border transactions, the transparency of information such as payments, time, fees, and the arrival of payment is not available. Sometimes, because of the lack of transparency, there may be hidden costs incurred.

Many fintech companies can provide transparency about the pricing and fees. With its international money transfer software, it can also track payments and their history. If SMEs could set up their international account with multi-currency International Bank Account Number (IBAN) in their firm’s name, they can view the market data, statistics, and history through a single platform.

Fraud protection

International transactions are most likely to be at risk of digital payment fraud and cyberattacks because of the involvement of too many parties in it in comparison to domestic ones.

With fintech startups having security standards like ISO 27001 Certificate, complex passwords, two-factor authentication, monitor, alert, block, secured coding, infrastructure security, and data encryption, they can tackle security risks and protect against the possibilities of fraud.

Prevent digital payment frauds with DigiPay’s secure payment solution

User-friendliness

The process of cross-border payments remains complex for businesses and customers. But, fintech can improvise the existing payment system with its advanced technological approaches.

With the help of simple API integration, they can create a solution that can provide a seamless user-friendly experience and tracking functions in the existing payment system for cross-border payments.

Read More: International Money Transfer Dominates the Digital Landscape.

Conclusion

In a nutshell, cross-border payments still face a lot of challenges like high costs, lack of transparency, slow transactions, and security concerns. But fintech has made the cross-border payment system simpler, effective, and efficient, with its advanced artificial intelligence & machine learning integrated solutions and its user-friendly infrastructures.

Also, if the banks and PSPs involved in international payments adopt the tech-friendly innovations of the fintech industry, they can help businesses and customers minimize the challenges of cross-border payments. This will help them to retain customers and stay in the market for a long time.