Has payment fraud left you wary of digital transactions? You're not alone - Juniper Research study says that online payment fraud will exceed $362 billion globally between 2023 and 2028, with losses of $91 billion alone in 2028. Yet slow checkouts drive 70% of customers away. The solution? Optimized payment processes that balance speed and secure payment processing.

This article provides 10 tips for fast and secure payment processing to help you leverage the convenience of online payments while blocking cybercriminals. We'll cover expanding payment methods, streamlining checkout with one-click and guest options, PCI compliance standards, SSL encryption, avoiding data storage risks, software updates, and transaction monitoring.

Implement these best practices and watch sales surge. Frictionless successful payments mean higher conversion rates. Fraud prevention builds customer trust. Your business can have multiple benefits - faster checkouts plus complete protection of sensitive data!

You can provide a payment experience as smooth as Amazon's while blocking all potential criminals. With these tips, you can enable seamless transactions that convert more customers while preventing fraud. Say yes to digital growth and no to cyber threats. So, Let’s spill the beans.

Tip 1: Offer a Variety of Payment Methods

Give your customers options when it comes to paying for their purchases. Supporting multiple payment methods makes checkout faster, more convenient, and accessible to every shopper.

Popular Online Payment Methods

Credit and Debit Cards

Credit and debit cards are one of the most widely used online payment methods. You can accept all major card types like Visa, Mastercard, and American Express to maximize coverage. You should also use tools like card-type auto-detection for seamless checkouts.

Digital Wallets

Allow customers to easily pay with stored credentials via digital payment solutions like mobile wallets and e-wallets like PayPal, Apple Pay, and Google Pay. It not only reduces checkout fields but also enables successful payments in one-click for returning customers.

Read More: Understanding How Digital Wallet Online Payments Work

Bank Transfers

Support bank transfers and payment modes like ACH that directly integrate with bank accounts. It enables easy payouts & accounting and is useful for high-ticket purchases.

Payment Methods for Flexibility

COD/Pay on Delivery

Give customers the option to pay with cash at the time of product delivery. It becomes really useful for certain items like food delivery and in regions with cash preference.

Gift Cards

Let customers redeem gift cards from your brand or third parties like Amazon. It promotes loyalty and allows easy self-gifting.

Cryptocurrency

Consider accepting new-age digital currencies like Bitcoin and Ethereum to cater to tech-savvy and investment-oriented audiences.

Tip 2: Use a Payment Gateway with Fast Approval Times

Choose a digital platform payment gateway that seamlessly integrates with payment processors and card networks to enable near-instant and fast payment processing.

Why Payment Gateway Speed Matters?

A digital platform payment gateway with faster approval times means quicker checkout, fewer abandoned carts, and fast payment processing. Customers don't want to wait long for payments to process.

How to Pick a Fast Gateway?

- Integrations with Fast Processors: The gateway should connect to payment processors that use technology for fast payment processing approvals.

- Optimized Request Flows: It should have streamlined request flows of payment processes between the merchant website, gateway, and processors.

- Caching and Load Balancing: Features like response caching and load balancing prevent bottlenecks during traffic surges.

- Global Infrastructure: Digital platform payment gateways with globally distributed infrastructure reduce latency for international customers.

- Analytics and Monitoring: Robust analytics help identify and resolve bottlenecks to optimize speed and enable fast payment processing.

Tip 3: Enable One-Click Payments

Allow registered customers to check out in a single click for repeat purchases.

Benefits of One-Click Payments

- Fewer Abandoned Carts: Skipped checkout fields mean fewer chances for customers to abandon.

- Higher Conversion Rates: Removing friction with fast checkouts increases overall conversion rates.

- Improved Customer Experience: One-click buying evokes a seamless, "Amazon-like" purchasing experience.

Implementing One-Click Payments

- PCI Compliant Storage: Store customer payment credentials securely to enable fast checkouts.

- Streamlined Recheckout: Allow customers to breezily repopulate payment and shipping details.

- Guest User Support: Even guests should be able to easily re-enter details during repeat purchases.

- Post-Checkout Confirmations: Send purchase confirmations and reminders about easy future checkouts.

Tip 4: Offer Guest Checkout

Allow customers to check out quickly without creating an account for fast payment processing.

Why Offer Guest Checkout?

Removes Friction: Skipping account creation increases conversion rates.

- Accommodates Reluctant Shoppers: Guests may not want to share info or create yet another account.

- Enables Impulse Purchases: Guest checkout allows spur-of-the-moment buying decisions.

- Reduces Abandonment: Fewer fields and steps prevent customers from leaving.

Optimizing the Guest Experience

- Pre-populate Fields: Auto-fill shipping, billing, and payment details from previous purchases.

- Persistent Cart: Save their cart across sessions if they leave without finishing.

- Post-Purchase Surveys: Gather feedback from one-time shoppers to improve the experience.

- Remarketing: Retarget guests with ads and offers to drive repeat sales.

Tip 5: Optimize Your Checkout Page

Fine-tune your checkout page for maximum speed, conversion rates, and simple payment processes.

Elements of an Optimized Checkout

- Minimal Fields: Only ask for essential user and payment details to reduce abandonment.

- Auto-filled Information: Pre-populate info like shipping address and payment details to expedite checkout.

- Clear Messaging: Use microcopy to guide users and convey security and benefits.

- Mobile Responsiveness: Ensure the checkout page seamlessly adapts across the mobile, desktop, and tablet.

- Guest User Support: Allow guest checkout along with account creation for flexibility.

- Progress Tracker: Show checkout progress to set expectations and build trust.

Benefits of Checkout Optimization

- Higher conversion rates

- Reduced cart abandonment

- Improved page speed and UX

- Greater customer satisfaction

Tip 6: Follow PCI Compliance Standards

Adhere to industry rules for secure payment processing and cardholder data protection.

Importance of PCI Compliance

Builds Customer Trust: Shows you take payment security seriously by following standards.

- Reduces Fraud Risk: Minimizes vulnerabilities by requiring security best practices.

- Avoids Penalties: Non-compliance can lead to fines, higher processing fees, and revoked ability to accept cards.

Ways to Maintain Compliance

- Update Policies: Craft information security and cardholder data policies aligned with standards.

- Secure Cardholder Data: Safely handle storage, and transmission to enable secure payment processing of sensitive card data.

- IT Security Measures: Use firewalls, anti-virus, intrusion detection, and other security controls.

- Staff Training: Educate team members involved in payment processing on compliance.

- Annual Assessments: Do self-assessments and audits to identify and address gaps.

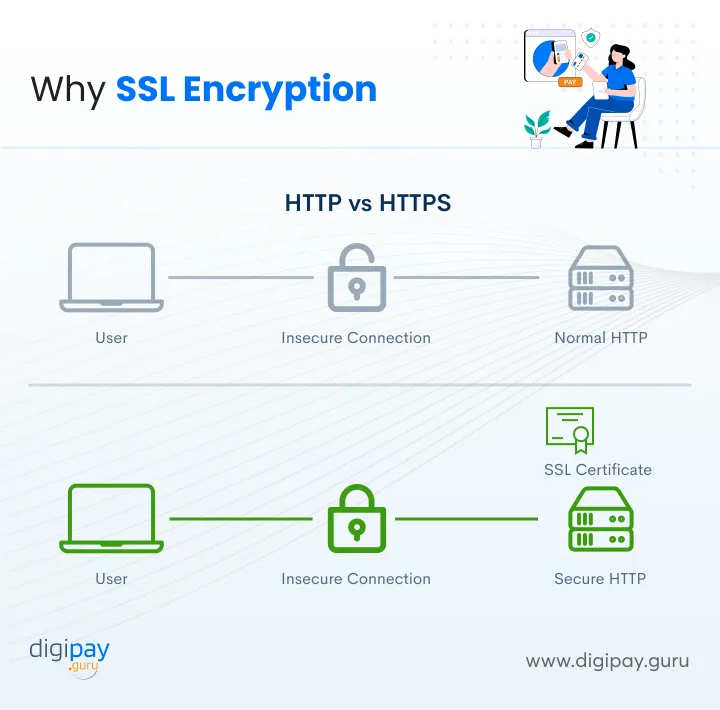

Tip 7: Use SSL Encryption

Implement SSL/TLS encryption to secure data transmission between customers and your servers.

Why SSL Encryption is Critical?

Prevents Data Interception: Encrypts data so it can't be read during transit by hackers.

- Provides Validity: SSL certificates verify business identity and website authenticity.

- Boosts Trust: SSL badges like green padlocks convey security to customers.

- Compliance Requirement: SSL is a PCI compliance prerequisite for securely accepting payments.

Implementing SSL

- Acquire Certificate: Obtain an SSL certificate from a trusted Certificate Authority.

- Install on Servers: Properly install the SSL certificate across websites and payment servers.

- Enable HTTPS: Redirect site pages to HTTPS and enable it on checkout/account pages at a minimum.

- Monitor Renewals: SSL certificates need to be renewed every 1-3 years for ongoing security.

Tip 8: Don't Store Sensitive Payment Data

Avoid storing full customer payment details like credit card numbers in your digital payment solution to minimize security risks.

Dangers of Storing Payment Data

Increased Attack Surface: Stored data makes your digital payment systems an attractive target for hackers.

- Costly Compliance: Storing data requires extensive security controls as per PCI DSS.

- Data Breach Impact: Stolen payment info damages the reputation and causes financial loss.

Safe Payment Data Practices

- Tokenization: Replace card numbers with tokens during storage and transactions.

- Truncation: Mask card numbers show only the last 4 digits.

- Minimize Storage: Only retain the bare minimum payment information needed for operations.

- Access Controls: Strictly limit and monitor data access to essential staff.

- Key Management: Securely manage encryption keys used to protect stored tokens/data.

Tip 9: Regularly Update Software

Installing the latest versions and patches is key for payment security.

Why Software Updates Matter?

- Fixes Vulnerabilities: Updates address weaknesses that hackers could exploit to breach systems.

- Enhances Functionality: New features improve secure payment processing speeds, convenience, and compliance.

- Optimizes Performance: Upgrades enhance stability, efficiency, and integration with other software.

- Reduces Support Issues: Outdated systems are prone to more problems and technical faults.

Best Practices

- Patch Frequently: Promptly install high-priority security and functional updates.

- Test Updates: Verify updates work as expected in staging environments before deployment.

- Automate Checks: Use tools to automatically check and install available updates.

- Include All Systems: Update digital payment systems, OS, and other software like browsers.

Tip 10: Monitor Transactions for Fraud

Actively monitor all payment transactions and card activity to detect and prevent fraud.

Why Transaction Monitoring is Vital?

- Early Fraud Detection: Identify suspicious transactions quickly before they are processed for a secure payment processing experience for the customers.

- Pattern Recognition: Detects organized attacks by analyzing transaction attributes for anomalies.

- Minimizes Losses: Blocking fraudulent transactions reduces financial risks and chargebacks.

- Improves Customer Trust: Proactive monitoring provides assurance you deeply care about security.

Effective Monitoring Practices

- Fraud Scoring Models: Assess transactions for signals like suspicious geolocation or purchases.

- Blocklists: Blacklist known threats identified by fraud filters and complaint analysis.

- Behavior Analytics: Scrutinize customer behavior before and during transactions for red flags.

- Back-end Checks: Scan for fraudulent activity even post-transaction e.g. during fulfillment.

Concluding Thoughts

Optimizing for speed and secure payment processing is critical in today's digital commerce landscape. Implementing these 10 tips will help your business provide fast and frictionless checkouts that maximize conversion rates.

Expanding payment methods, streamlining purchases, and enabling successful payments in one-click make it easy for customers to pay. At the same time, PCI compliance, encryption, access controls, and monitoring give customers confidence their data is protected.

Balancing convenience and safety in your payments facilitates business growth while preventing fraud. And We at DigiPay.Guru does the same for your business with our advanced international remittance solution. It is quick, secure, compliant, and reliable to gain an edge over competitors and boost revenue with secure payment processing and seamless transactions.