The world of commerce is constantly evolving, and with it comes the need for innovative and efficient payment solutions. Merchant payment solutions play a vital role in facilitating transactions, improving the customer experience, and driving business growth. With the rapid pace of technological advancement, it's important to keep up with the latest trends and changes in the industry.

The next five years will bring major advancements in merchant payment solutions, making transactions faster, easier, and more secure. According to a study by the World Bank, in the Asia Pacific region alone there were around 82% of adults making digital merchant payments. So, get ready to be informed, inspired, and prepared for the changes ahead.

In this blog post, we'll take a closer look at what we can expect from merchant payment solutions in the next five years. We'll explore the trends shaping the industry, the impact these advancements will have on businesses, and the challenges that must be considered as we move toward a more technologically advanced future of merchant payment solutions.

Future Trends in Merchant Payment Solutions - A closer look at the next 5 years!

As technology continues to drive change in the payments landscape, we're seeing several key trends emerge in merchant payment solutions. From the increased use of mobile and contactless payments to the adoption of cryptocurrency and digital wallets, the industry is undergoing a major transformation with so many types of merchant payment solutions coming into the picture.

Here are some of the most notable trends shaping the future of merchant payments.

Increased Use of Mobile and Contactless Payments

With the widespread adoption of smartphones, it's no surprise that mobile payments are on the rise. In the next five years, we can expect to see a continued shift towards mobile and contactless payment solutions, as consumers seek out faster and more convenient payment options.

For example, Apple Pay and Google Pay have already made mobile payments a seamless and secure experience for millions of consumers.

Adoption of Cryptocurrency and Digital Wallets

Cryptocurrency wallet solution is making their way into the mainstream, and we can expect to see increased adoption of digital currencies in the coming years. This will bring new payment options to merchants, as well as a more secure and decentralized means of transaction processing.

Additionally, some digital wallet solution, such as PayPal and Venmo, are becoming increasingly popular, offering consumers a convenient and secure way to store and manage their funds.

Adopt a Robust Cryptocurrency Wallet System into Your Business.

Integration of AI and Machine Learning for Fraud Detection

As fraud and cybercrime continue to be major concerns in the payments industry, we can expect to see a greater emphasis on advanced technologies, such as AI and machine learning, for fraud detection.

These technologies will help to improve security and reduce the risk of fraud for both merchants and consumers. For example, payment processors like Stripe and Square already make use of AI and ML in financial service to detect and prevent fraudulent transactions.

Read more: Increasing Use of AI and ML in Financial Services

Expansion of Omnichannel Payment Options

In the next five years, we can expect to see a continued expansion of omnichannel payment options, making it easier for consumers to pay through their preferred channels. This could include everything from in-store purchases to online and mobile payments.

By offering a seamless and consistent payment experience across all channels, merchants will be able to better serve their customers and drive growth.

These trends in merchant payment solutions are just the tip of the iceberg, and we can expect to see even more exciting developments in the years to come. With the right strategies and preparations in place, businesses can take advantage of these changes to improve their bottom line and stay ahead of the competition.

Impact of future trends of merchant payment solutions on Businesses

The advanced merchant payment trends and solutions coming out of it are poised to have a major impact on businesses in the next five years. From improved customer experiences to enhanced security measures, the future of payments is looking bright for businesses that are prepared to adapt and evolve.

Here's a closer look at how these changes will impact businesses in the years to come.

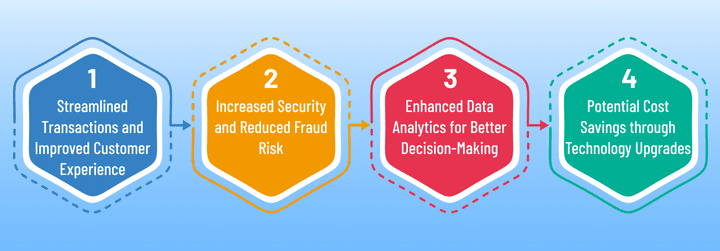

Streamlined Transactions and Improved Customer Experience

With faster, easier, and more secure payment options, businesses can expect to see an improvement in their transaction processing times. This will lead to a better customer experience, as consumers will be able to complete purchases quickly and with less friction.

Additionally, with the rise of mobile and contactless payments, customers will have more payment options to choose from, further enhancing their experience.

Increased Security and Reduced Fraud Risk

As fraud continues to be a major concern for businesses, the integration of AI and machine learning for fraud detection will bring much-needed improvements to security in merchant payment solutions. This will help to reduce the risk of fraud and cybercrime, providing peace of mind for merchants and consumers.

Furthermore, with the use of advanced encryption and security protocols, businesses can feel confident in the safety of their transactions.

Make Your Digital Payments Foolproof and Extra Secure With DigiPay.

Enhanced Data Analytics for Better Decision-Making

The advancement of payment technologies will also bring new opportunities for businesses to gather and analyze customer data. This will help businesses make more informed decisions and drive growth, as they'll have access to a wealth of information about consumer behavior and preferences.

With the right tools and strategies in place, businesses can turn this data into valuable insights that can be used to drive growth and improve their bottom line.

Potential Cost Savings through Technology Upgrades

One of the futuristic cases considered to be having necessary features of an ideal merchant payment solution is that businesses can also expect to see cost savings in the long run. This could include reduced processing fees, improved efficiency in transaction processing, and lower operational costs through automation and integration.

For example, the adoption of mobile and contactless payments can help to reduce the need for physical point-of-sale systems which was like a boon to Covid-19, while digital wallets can simplify the process of reconciling transactions and tracking payments.

Read More: How Contactless Payments Drove Digital Payments During COVID-19

Challenges and Considerations for businesses using merchant payment solutions

While the future of merchant payment solutions holds much promise, there are also several challenges and considerations for using merchant payment solutions for business.

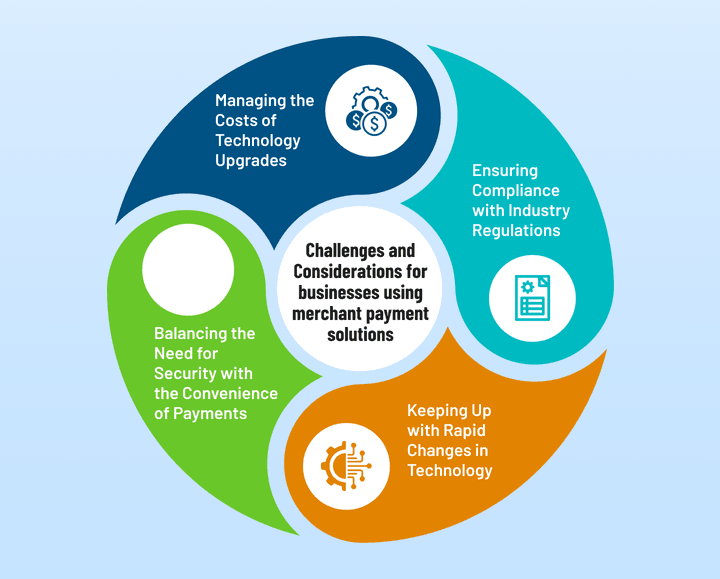

From managing the costs associated with technology upgrades to ensuring compliance with industry regulations, businesses must be prepared to address these challenges to take full advantage of the opportunities ahead.

Here are some of the key challenges and considerations to keep in mind.

Managing the Costs of Technology Upgrades

As new payment technologies are introduced, businesses will need to invest in upgrades and new systems to keep up. This can be a significant expense, and it's important for businesses to carefully consider the costs and benefits of each investment.

From hardware upgrades to software licenses, there are many factors to take into account when making technology decisions.

Ensuring Compliance with Industry Regulations

The payments industry is heavily regulated, and businesses must be prepared to comply with a wide range of rules and standards. This can be a complex and time-consuming process, and businesses must be proactive in staying up-to-date on the latest regulations and requirements.

Failing to comply with industry regulations can result in costly penalties and damage to a business's reputation.

Keeping Up with Rapid Changes in Technology

The pace of technological change in the payments industry is extremely fast, and businesses must be prepared to keep up. This requires a willingness to embrace change and a commitment to continuous learning and adaptation.

Whether it's attending industry events, following news and trends, or investing in professional development, businesses must be proactive in staying informed about the latest developments in the field.

Balancing the Need for Security with the Convenience of Payments

With the increasing number of payment options available, businesses must also find the right balance between security and convenience.

While it's important to protect against fraud and cybercrime, businesses must also ensure that their payment systems are fast and easy to use. Striking the right balance will be key to success in the competitive payments landscape.

Conclusion

The future of merchant payment solutions is shaping up to be more innovative, secure, and customer-focused than ever before. With a wide range of new technologies and solutions on the horizon, businesses of all sizes have the opportunity to streamline their payment processes and take their customer experiences to the next level.

As the payments industry continues to evolve, it's important for businesses to partner with a provider that has the expertise and experience to help them stay ahead of the curve. This is where DigiPay.Guru comes in.

At DigiPay.Guru, we understand the complexities of the payments landscape, and we're committed to delivering cutting-edge merchant payment solutions that help businesses succeed.