The coronavirus pandemic has impacted several facets of our lives like never before. The pandemic has literally halted most of the human activities for weeks. The current situation is unprecedented for a globalised world whose economy depends so much on the global collaborations.

With no international travel and lockdowns imposed in most parts of the world, the economy is suffering. According to some experts, we might be facing a recession worse than that of 2008. The exponential downfall in major industry vertical complies with the expert’s predictions.

Coronavirus pandemic is like a nightmare for most of the industry verticals and payments industry is no exception. Many of you might think that with digital and contactless payments, things won’t be that bad. However, it’s not that easy. In this article, we will discuss the impact of coronavirus on payment industry and will also focus on how it can recover from this pandemic.

Impact of CoronaVirus on the payment industry

As per the experience of the past crises, adjusted with means of payments and current mix in geographies suggest that there could be an economic contraction of around 1.5 per cent that would lead to a disproportionate reduction in payments of around 8 per cent. In the worst-case scenario, the drop in transaction volume could go up by 12 per cent.

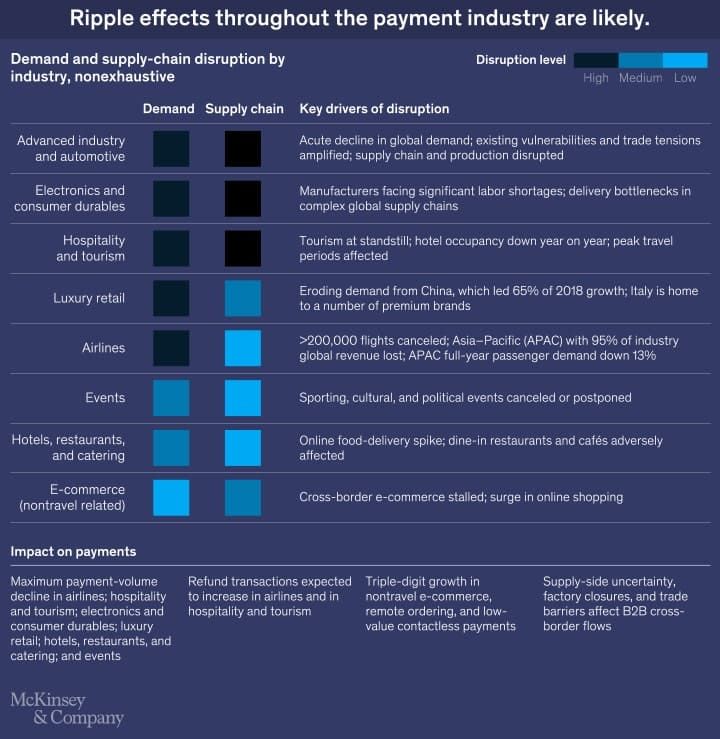

Much of the data is still unavailable, but the projections reveal the underlying realities of various segments in the payment arena

There’s likely going to be a drop in the cross-border consumers-to-business transactions. Almost a quarter of decline is caused by cross-border payments. Increasingly localized commerce ecosystems and disruptions caused in travel and tourism are some of the factors that help us understand this decline.

Cross-border business-to-business transactions are also meeting a similar fate. Since the month of January, container freight is down as compared to its level in Jan 2019.

Payments related to the securities transactions are at all-time highs which are the indicator of the market’s volatility and instability. This volatility is giving rise to a higher degree of risk for international securities.

Merchant-services and retail payments are also severely affected. Although online sales will be less affected, but the classic POS payments could drop by as much as 30-40 per cent in a very short period.

The FinTech wallets that are based on the gig economy are also going to suffer. Some of the leading wallets in Asia will experience a decline in the flow by 20-30 per cent despite of the growing user base. Ride-hailing and offline merchant payments are also one of the most affected.

As we saw above, some payment methods are more likely to suffer than the other. Cash and other paper payments methods are witnessing decline despite the sterilizing attempts made with heat treatment, ultraviolet rays, and ozone. The decline in cash and use ATMs has given rise to contactless payments all over the world.

Rise of Digital payment amid coronavirus Pandemic

The spread of the COVID-19 pandemic is drastically affecting the way we shop and make payments. Due to the highly contagious nature of the virus, people are avoiding shopping in the public places.

Moreover, work from home due to lockdown is also impacting the way people shop and make payments. Due to this, there has been a sudden spike in the payment processing needs which is posing challenges for payment processing as well as the merchants.

There’s still a doubt whether COVID-19 virus could survive onto the currency the same way it does on metal surfaces of doorknobs and handrails. However, people are not taking any chances and are readily embracing the digital and contactless modes of payment.

According to new research, American users, which were sceptical of contactless payments, are now becoming more interested in it. Currently, in Germany, more than half of the payments made by cards are contactless. This number was 35% before the Coronavirus outbreak.

People are adopting contactless and digital payment methods as they involve less physical interaction making them more secure.

This massive adoption is also reflecting in the sudden surge of digital payments across the world. For example, FinTech major Paytm said that there was a 15% increase in the number of incoming requests from the offline merchants for partnering with Paytm.

Similarly, Razorpay announced that the unified payment interface (UPI), internet banking, e-wallets were the top three modes of payments post the COVID-19 pandemic. They also witnessed a surge in all three modes of payments with a 19.6% hike in UPI followed by a hike of 11.5% and 10.3% in internet banking and e-wallets respectively. Along with that Razorpay’s report also suggests a 10% hike in the digital transactions in terms of value.

What payment companies must do from here?

With time, we’ll slowly get clarity as to how long this situation will persist and how deeply will it impact us. However, one thing is pretty clear that the economy won’t return to the norms of 2019 that quickly and easily. The impact of this pandemic will go beyond customer behaviour and expectation as it will affect the entire fabric of the economy.

That’s why it’s imperative for not only the payments ecosystem but also for the entire economy to develop as a whole. Today, we can leverage payment solutions which allow our economies to emerge stronger in this crisis situation and thus establish a post-COVID-19 future.

Below we have highlighted the top 7 fundamental changes that all payment companies must implement if they want to emerge strongly in this crisis situation.

Leverage digital options

Due to the way that COVID-19 spreads, businesses and consumers are moving away from using cash and checks for payments. Banks are also closing their branches and urging their users to use banking services from their phones. At this juncture, payment players have to come forward to promote and design more number of digital payment options for their customers.

Financial inclusion

Even though many countries have contributed heavily for financial inclusion and cashless economy, the truth is that even today there’s a massive proportion of the human population that is unbanked. Due to this, not all people get access to the necessary digital tools and technologies. Now is the time for the payment companies to come up with more inclusive setups where all the consumers and merchants can access the tools irrespective of the education and finances.

Reliable digital currencies

The current crisis has highlighted the fact what major role do governments play when it comes to maintaining the global financing system. Digital currencies can emerge as an efficient means of moving money; however, they need to be reliable in this time of crisis.

Both Wells Fargo and JP Morgan came up with their digital currencies that would quickly move money in and out of the client’s accounts. However, it’s also important to note that both the banks have pegged their digital coins at 1:1 to the reserve of US dollars thus rendering their value as static.

Build omnichannel payment solutions

By building omnichannel payment platforms, you can accommodate various ways of shopping. The omnichannel approach can also bridge the gap between in-store and online spending. For example, Square has launched a suite of online payments products that support all the merchants’ eCommerce efforts.

Bridging physical payments with that of digital payment is crucial for all the eCommerce players as they have started closing their brick-and-mortar stores amid of the coronavirus pandemic.

Establish touchless payments

Contactless payments have taken its share of time to gain traction in the US. However, in the UK and most parts of Europe, digital wallets and tap-to-pay technologies are very common. Now responding to the current situation, merchants and consumers are limiting the amount of contact with contactless payments. Payment companies must adopt this mode of payment quickly and offer it to all their users ensuring safe payment practices.

Offer more for digital wallets

Digital wallets have been disrupting the payment industry since the very beginning of the decade. Nowadays, it’s available on various popular devices like smartphones and watches. However, there’s still a huge scale of adoption which is required. Digital wallet companies can boost digital wallet adoption by offering features like digital IDs, alerting users when the store is overcrowded, etc.

Payments-as-a-service partnerships with banks

Payments constituents as a major cost for the majority of the banks. Moreover, tech budgets are primarily used for maintaining outdated systems rather than building the new one. With the help of tools like cloud-based tech and automation, banks can cut their long term processing payments costs.

Payments-as-a-service FinTechs can also see a surge, especially with reduced IT budgets due to market conditions caused by the coronavirus pandemic.

Conclusion

In this article, we discussed everything from COVID-19’s impact on payment industry, increase in the usage of digital payment modes, to the top steps that all the payment companies must take to ensure a stronger comeback for the post-COVID era.

We all know that these are tough times for everyone as we don’t know how long this situation continues. However, by adopting contactless and digital payment modes and following the steps mentioned above, one can manage to emerge victorious against all odds.