You’re not here to play it safe. You’re here to build something that moves the market. And in 2026, the timing couldn’t be better. Fintech isn’t just trending. Now it’s transforming. With over $340 billion in global investment projected this year, fintech is one of the fastest-moving industries. But speed alone isn’t the advantage. What matters is execution.

If you are someone who is struggling with starting your fintech in 2026, this guide is built for you. You're not looking for unnecessary details or confusion. You want real insight into how to pick the right niche, navigate compliance, secure funding, ship fast, and scale confidently.

At DigiPay.Guru, we’ve helped launch and scale digital wallets, remittance platforms, agency banking, and more across the globe. So, this isn't generic advice; it’s a refined playbook.

So if you're serious about starting a fintech start up in 2026 and want to avoid the usual risks and complexities, you’re in the right place.

In this blog, you will explore:

-

Why Start a FinTech Startup in 2026?

-

Step-by-Step Guide to Start a FinTech Startup in 2026

-

And How DigiPay.Guru Accelerates Your FinTech Launch

Let’s begin with what the whole point behind starting a FinTech company is.

Why Start a FinTech Venture in 2026?

2026 is a breakout year for fintech founders. Demand is high, the infrastructure is mature, and the funding is flowing.

Let’s unpack why you’re in the right place at the right time.

Consumer Demand Is Rising Across Every Region

In 2026, digital finance will become the ultimate expectation of your customers. Across the globe, consumers are demanding faster, safer, and more personalized financial services. The shift from branch-based to app-based engagement is accelerating.

-

Over 1.75 billion mobile money accounts are now active worldwide

-

Smartphone penetration and 4G/5G rollout are making real-time finance a standard

-

Younger users expect seamless financial experiences integrated into their digital lifestyle.

-

Fintech startups in India, Africa, and LATAM are surpassing traditional banks

Infrastructure and Regulation Are Founder-Friendly

Gone are the days when launching a fintech meant struggling with legacy systems and excessive costs. Unnecessary rules. Today’s ecosystem is built for innovation. Plus, governments and regulators are now partners, not blockers.

-

70+ countries offer regulatory sandboxes or fintech licenses

-

eKYC, digital ID, and AML frameworks are more developer-friendly

-

Cloud-native infrastructure and API-first design enable faster product rollout and easier scaling globally from day one

Investor Are Focused on Innovation

Investors are betting big on fintech, but not just any fintech. They want lean, compliance-ready startups with real monetization logic and strong product speed. So, if you’re building for speed and scale, capital will follow.

-

VCs and strategic funds are prioritizing B2B fintech and infrastructure players

-

Top fintech startups are raising faster rounds with less burn

-

Emerging markets like Africa and Southeast Asia are seeing 3X growth in fintech investment projections

-

Funding for fintech startup in Africa and APAC is projected to triple by 2027

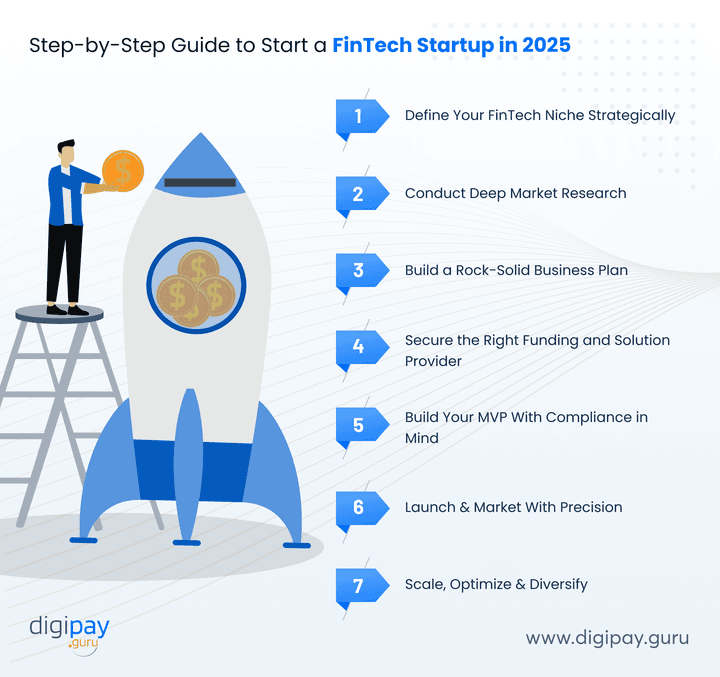

Step-by-Step Guide to Start a FinTech Startup in 2026

You don’t need a 200-page playbook to start. You need just the right steps in the right order.

Here's your roadmap.

Step 1: Define Your FinTech Niche Strategically

Before building your product, you need to pinpoint your purpose. Your niche isn’t just the market you enter, it’s the core problem you solve. It shapes your technology, licensing, monetization, and your brand’s reason to exist.

Start With a Real Problem That Needs Solving

The strongest fintechs solve real pain problems users already experience and want to fix. Not hypotheticals. Such as:

-

Delayed cross-border payments with high fees

-

Informal merchants without banking or POS access

-

Low credit access for gig workers or first-time borrowers and more…

Use interviews, search data, and reviews to validate that people want this solved and would pay for it.

Explore Proven Ideas and Untapped Opportunities

You don’t need to reinvent fintech. You need to adapt what works or innovate where others are slow. Such as:

-

eWallets with offline access or USSD (great for Africa)

-

Micro-lending with alternative credit scoring

-

BNPL or micro-insurance for underserved consumers

-

Merchant acquiring tools for informal or rural economies and so on..

Look at what’s scaling globally and localize it for your region.

Balance Ambition With Practicality

Choose a niche that lets you go live fast, stay compliant, and make revenue.

-

Digital wallets → quick MVP, light licensing

-

Lending → more regulation, bigger upside

-

Embedded finance → partner-led growth, lower CAC

Ask yourself: Can we build this fast? Can we get licensed? Can we monetize in Year 1?

Your niche isn’t a guess; it’s a decision with downstream impact. Choose it wisely.

Step 2: Conduct Deep Market Research

Great fintech startups don’t just disrupt; they fit the current market and customer needs. And that's possible with research. Research helps you find your market fit, compliance path, and competitive edge.

Analyze Competitor Strengths and Gaps:

-

Study apps in your niche (reviews, ratings, UX)

-

Use tools like SimilarWeb and AppAnnie

-

Benchmark licensing and go-to-market models

Mapping competitors is beyond just copying them. It's about knowing where they're weak and where you can win.

Understand Regional Regulations and Licensing. For example:

-

Africa: EMI licenses and partnerships with local telcos

-

MENA: Central bank licensing, especially in UAE and Saudi

-

Europe: PSD2, GDPR, passporting via Lithuania or Estonia

Every region has its gatekeepers. Learning to navigate them is a startup moat.

Explore Technology Expectations by Region. For instance:

-

Africa: USSD & agency banking still dominate

-

Europe: Open banking integrations and SEPA

-

Asia: QR codes, super-app integrations, multi-language support

Step 3: Build a Rock-Solid Business Plan

Investors and partners want confidence, not code. Your business plan proves you know the road ahead. Here’s how you can build a solid business plan:

Define Your Business Model and Pricing Strategy

-

Transaction fees, interchange, float revenue, or tiered SaaS pricing

-

API monetization or white-label offerings for B2B fintech

Fintech business models are more flexible than ever. But clarity = confidence.

Include Compliance, Ops, and Customer Support Plans

-

Who handles KYC? What’s your fraud detection protocol?

-

How do you support users across languages, time zones, or platforms?

This is where a lot of new fintech companies fall short. Operational blind spots kill great ideas.

Map Product Roadmap and Go-To-Market Timeline

-

Create a MVP vs. future features timeline

-

Set 6-, 12-, and 24-month targets

Break your roadmap into outcomes, not just sprints. Investors love to see execution clarity.

Step 4: Secure the Right Funding and Solution Provider

You don’t just need funding. You need the firepower of capital and capability working in sync. In 2026, fintech founders who win aren’t just raising money; they’re raising smart money and backing it up with solution partners who de-risk execution.

Here’s how you can secure the right funding & solution provider:

Explore Funding Routes: Equity, Debt, Grants

Your capital strategy should fit your growth phase. Are you pre-revenue or post-MVP? Regional or global?

-

Angels and VCs bring mentorship, networks, and credibility

-

Strategic investors (like banks or payment companies) can open partner channels

-

Grants from DFIs, NGOs, or local regulators offer non-dilutive cash to build MVPs

Yet, many fintechs ignore grant opportunities, thereby missing free capital designed to foster innovation.

Investors Look for Speed, Scalability, and Risk Reduction

-

A working MVP or live pilot says more than a pitch deck

-

Monetization clarity and compliance readiness move deals faster

-

One of the top reasons investors pass? No clear execution path

That’s why your solution provider has to be part of your pitch.

Choose a Solution Provider That De-Risks Your Journey

To be the best pick of your investor, your platform should be built via a best-in-class solution provider

This is where DigiPay.Guru steps in.

-

Building from scratch? You’ll need 12–18 months and a full-stack team

-

Using DigiPay.Guru? You’ll go live in 90–120 days with proven modules

-

Built-in eKYC, agency banking, remittance, cards, fraud tools, and compliance baked in

We’ve seen startups burn $500K+ on basic infrastructure. You can spend less, move faster, and stay investor-ready from day one.

Step 5: Build Your MVP With Compliance in Mind

Your MVP is the proof of your product quality, concept, and vision. Investors, regulators, and customers will judge your entire business by it. So while you shouldn’t build everything, what you do build must be airtight.

Many fintech startups fall into the trap of overbuilding early. Months go into features users don’t need, while compliance, scalability, and performance take a backseat. The result? A flashy app that can’t survive a stress test, or worse, a compliance audit.

Key Features to Include in a FinTech MVP

-

Secure onboarding with eKYC and basic AML checks

-

Wallet engine with real-time ledgering and transaction history, and

-

Admin dashboard with reporting and user management tools

Your MVP should feel lean but perform like infrastructure. Prioritize stability, trust, and clarity over bells and whistles.

Don’t Reinvent, Leverage Prebuilt APIs

-

Plug into trusted APIs for KYC, AML, fraud detection, and currency conversion

-

Use proven gateways for card processing, mobile money, and crypto ramps

Building from scratch might seem like control, but in fintech, speed and credibility win.

Test for Security, UX, and Stress Load

-

Simulate user spikes, large transaction volumes, and system downtimes

-

Run audits against PCI DSS, GDPR, or relevant local data laws

Step 6: Launch & Market With Precision

Launching is not just about pushing your app live. It’s about earning trust, sparking traction, and laying a foundation for long-term growth.

Many startups launch with technical readiness but forget market readiness. The result? A beautiful product no one uses, or worse, no one trusts. You need both visibility and credibility from day one.

Focus First on Earning Trust

In fintech, trust = currency. Before you acquire users, earn their confidence.

-

Display regulatory licenses clearly

-

Communicate fee structures with zero ambiguity

-

Offer visible and responsive customer support channels

-

Include guided walkthroughs or explainer videos for onboarding

Think like a user: would you hand your money to a new app without these?

Choose Your Distribution Channels Strategically

Different markets require different strategies. So, you need to choose the channels that already hold your audience’s attention. For instance:

-

Africa: Leverage USSD codes, agent networks, and telco integrations

-

MENA: Partner with logistics providers and use regional influencer campaigns

-

Europe: Optimize app store listings, collaborate with digital banks, and run Google UACs

Find out where your users spend time and make your fintech unavoidable there.

Double Down on Customer Support Early

Support is a very big growth aspect in your fintech success.

-

Offer multilingual live chat or WhatsApp support

-

Automate FAQs but always provide a human fallback and

-

Train agents to treat every ticket as a retention opportunity

We’ve seen fintechs 3x their user retention by solving onboarding issues within 5 minutes. That’s not support, it’s strategy.

Step 7: Scale, Optimize & Diversify

You’ve launched. Now it’s time to lead. Scaling is more than just growth on an increasing trend. It’s about refining what works, fixing what doesn’t, and layering on new monetization streams that make sense for your users and business model.

The post-launch stage is where great fintechs separate themselves. While some stall after launch due to lack of iteration or weak data tracking, others scale smartly by going modular and compliant from the start.

Here are a few steps to work it out:

Track the Right Metrics Early

Your metrics contribute to the scalability of your business. Your key metrics can drive investor interest, user retention, and operational clarity, such as

-

CAC (Customer Acquisition Cost)

-

LTV (Lifetime Value)

-

MAU (Monthly Active Users)

-

Fraud incidents & chargeback rates

-

Conversion across onboarding and key features

Start tracking these from week one. They’ll guide your roadmap and growth levers.

Add Revenue Streams via Modular Add-ons

Once your core product is stable, layer on high-margin, compliant add-ons that align with your market and monetization plan. For example:

-

Merchant acquiring to tap B2B fintech flows

-

Prepaid card issuance for new payment use cases

-

Remittance modules for cross-border transactions

-

Embedded finance for platforms or ecosystem plays

With DigiPay.Guru, these aren’t new builds. They’re plug-and-play extensions you can activate.

Go Regional or Global with Regulatory Strategy

Scaling across geographies means scaling compliance. But it's true only when you:

-

Use passporting or regulatory umbrella partnerships

-

Leverage DigiPay.Guru’s licensing-ready infrastructure

-

Keep real-time audit trails and automate policy updates

Scaling is not about pushing products. It’s about replicating trust, market by market.

How DigiPay.Guru Accelerates Your FinTech Launch

Building a fintech startup is hard enough; you shouldn’t also have to build your infrastructure from scratch. At DigiPay.Guru, we’ve engineered a fintech platform that cuts months off your launch timeline and eliminates the guesswork of compliance, scalability, and reliability.

Whether you're launching a digital wallet in Nairobi, a remittance service in Dubai, or a business banking app in London, our platform equips you with ready-to-use, fully compliant building blocks designed for real-world needs.

We’ve partnered with fintech startups and financial institutions across the globe to help them:

-

Launch faster with modular, pre-tested fintech stacks

-

Operate compliantly with built-in KYC, AML, and fraud detection

-

Scale smarter with flexible APIs, real-time analytics, and multilingual capabilities

Pre-Built FinTech Modules for Every Stage

You don’t need 18 months of development time to get to market. When you plan to launch a fintech startup with DigiPay.Guru, you plug in and launch:

-

Multi-currency digital wallets, agent networks, and agency banking tools

-

Card issuance, merchant acquiring, and real-time remittance engines

-

eKYC, onboarding workflows, and automated transaction monitoring

Launch Faster, Stay Compliant, and Scale on Day One

DigiPay.Guru cuts through the complexities so you can focus on what really matters: user adoption, monetization, and market share. With our digital fintech solutions, you can:

-

Save 6–9 months of backend development

-

Start with compliance-ready workflows from day one

-

Grow confidently with enterprise-grade stability

Your fintech deserves a partner that’s built for your successful journey. So, don’t get left behind; choose smarter, choose DigiPay.Guru.

FAQ's

A fintech startup is a technology-driven company that builds financial products or services like digital wallets, lending platforms, or cross-border remittance apps. These businesses leverage software to make financial services faster, more inclusive, and often more affordable. Whether you’re targeting consumers or businesses, if your product improves the way money is stored, moved, borrowed, or managed, you’re in fintech.

There’s never been a better time. In 2026, the market is hot, the tools are mature, and digital financial behavior is the norm. With innovation-friendly compliance environments, investor interest in B2B fintech, and modular solutions like DigiPay.Guru available, launching a fintech startup today takes less time, less capital, and unlocks global scale faster than ever.

Some of the best fintech startups are solving hyper-local problems or scaling globally. Examples include:

-

Chipper Cash (Africa): cross-border payments

-

Razorpay (India): merchant payments and neobanking

-

Wise (UK): international money transfers

-

Aspire (APAC): SME banking and finance management

-

Flutterwave (Africa): online payment infrastructure for merchants

Each of these started with a single use case and scaled with a focused product strategy.

Start by identifying a pain point in the market that’s underserved or poorly solved. Validate it with real users. Then evaluate feasibility: regulation, monetization, and time-to-market. For example, eWallets or agency banking are great in Africa and MENA due to infrastructure gaps. Use this blog’s Step 1 section to walk through the full decision-making framework.

You’ll need a secure backend, wallet infrastructure, APIs for KYC and payments, admin dashboards, and mobile/web interfaces. Depending on your niche, you may also need modules for card issuing, agent management, or remittance.

The good news? Solutions like DigiPay.Guru offers these as plug-and-play modules, so you can skip building from scratch and launch faster with compliance built in.