Quick Summary

This blog is for every remittance business that wants to increase revenue and boost customer satisfaction to become a preferred choice of their customers! And DigiPay.Guru’s cross border payment platform can do that for you. But the question is - how? That’s covered in this blog. Happy reading!

If you have a remittance business, you must be quite aware of the challenges that come with it. High fees, slow transfers, compliance issues, operational difficulties, and whatnot! You don’t want to face these challenges nor do you want your customers to be frustrated and unsatisfied with your services.

And despite all these challenges, the cross border remittance industry will not stop growing!

Know that, the global remittance market is expected to reach $990 bn by 2028.

But what if you can overcome all the challenges and focus solely on boosting revenue and customer satisfaction?

Yes, it's very much possible! All you have to do is switch to a robust and reliable international remittance solution - DigiPay.guru. Our cross border payment platform can boost your business revenue plus customer satisfaction with its API-driven advanced features.

This blog will help you understand:

- Challenges in boosting revenue and customer satisfaction

- How our cross border payment solution can increase your business revenue

- How you can gain more happy customers with our robust cross-border solution

- Other advanced features of our international payment solutions

Let’s get to it!

Challenges in increasing revenue and gaining happy customers

In increasing revenue:

| High fees | You may struggle to attract customers and grow revenue if your fees are significantly higher than competitors. |

| Slow transfer speeds | Customers expect fast cross border remittance transfers today. If your transfers take many days, customers may choose faster options. |

| Limited payout locations | Not having enough cash pickup locations can intimidate customers, ultimately opting for your competitors. |

| Compliance burdens | Meeting compliance requirements like KYC can be time-consuming and costly. |

| Lack of transparency | Customers want to clearly understand fees, exchange rates, & delivery times and easily track transfers! Offering all these under one roof can be difficult. |

| Security risks | Customers may be hesitant to use services prone to fraud or theft. Data breaches and stolen funds erode trust. |

| Limited market access | Tapping into lucrative new markets requires licenses and partnerships. |

In gaining happy customers:

| Long transfer times | Customers can get frustrated by the slow process like to send & receive international payment. |

| High and opaque fees | Hidden fees, excessive charges, or unclear cuts create dissatisfaction. |

| Inconvenient pickup | Limited payout locations & agent networks cause inconvenience to recipients. |

| Poor exchange rates | Uncompetitive exchange rates reduce the amount recipients get and customers feel dissatisfied. |

| Limited customer support | Not having a proper customer support system can lead to frustration for customers. |

| Security concerns | Customers worry about fraud and theft. Customers won't use your cross border payments services if they sense it insecure. |

| Compliance failures | Lapses in meeting regulations around anti-money laundering or counter-terrorism financing turn off customers. |

Nothing comes easy! And if you are still using the traditional remittance systems to offer cross border payments services to your customers, it will be hard for you to retain your customers. And you may fall behind your competitors. Sometimes, even the existing modern system can be unsatisfactory.

If any of that is the case for you, then there are high chances that you may be facing the below-mentioned challenges in boosting revenue and customer satisfaction.

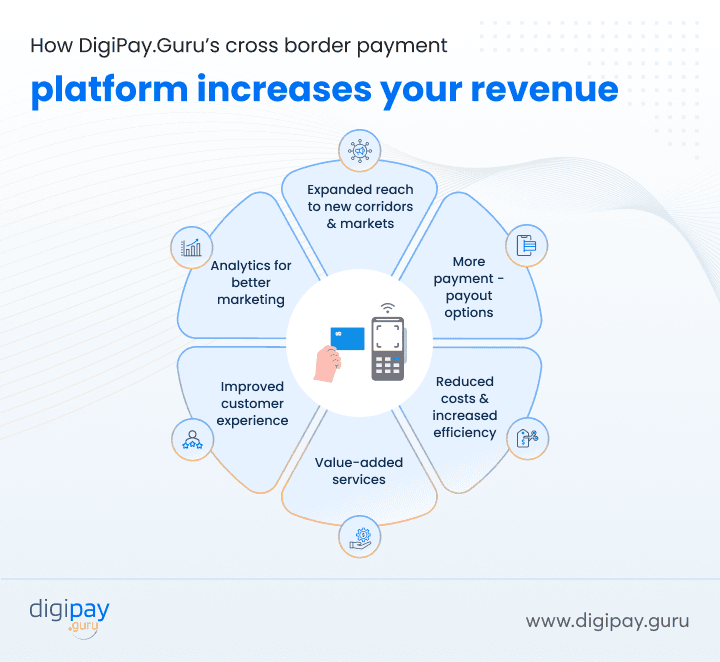

How DigiPay.Guru’s cross border payment platform can increase your business revenue?

Expand reach to new corridors and markets

With DigiPay.Guru, you can easily expand into new regions and corridors. Our platform connects you to an extensive network of partners and intermediaries globally. Plus, you can offer payout capabilities in many countries you may not serve today. Grow your customer base and ultimately revenue by tapping into new remittance markets.

Offer more payment and payout options

Give your customers flexible ways to send and receive funds. Through our cross border payment solution, you can offer bank transfers, digital wallets, cash pick-up, and more. Providing multiple payout methods makes you more attractive to customers. They can choose what works best for them on the receiving end.

Reduce costs and increase efficiency

Our cutting-edge cross border payment platform optimizes transactions and settlements to reduce your costs.

Features like automation, straight-through cross border payment process flow, and real-time cross border transactions tracking provide significant operational efficiencies. This reduces your overheads and passes savings to customers through competitive exchange rates and fees.

Provide value-added services

Leverage our API-driven efficiency to integrate value-added services like loyalty programs, cashback offers, alerts & transaction thresholds.

Also, data-rich reporting and analytics give insights to provide spending notifications and financial planning tools. These features improve user experience and engagement.

Improve customer experience

Deliver seamless omnichannel banking experiences with our unified cross border payment platform. It provides easy integrations across various platforms such as the web, mobile apps, and in-person services.

This ensures consistent user experience and accessibility regardless of the preferred channel used by your customers. Moreover, you can offer fast settlement times to your customers and provide full transparency into their transaction status.

Analytics for better marketing

Get a 360-degree view of your business and customer behavior with our comprehensive dashboard and its business intelligence. Identify growth opportunities, optimize conversion funnels, target high-value segments, and more. These data-driven insights help you acquire and retain your customers more effectively.

Gain more happy customers with DigiPay.Guru’s international payment solution

Faster transfer speeds

DigiPay.Guru’s cross border payment platform offers faster and near-real-time money transfers. Your customers get their funds right when they need them. With faster transfers happening in seconds or minutes instead of days, your customers will feel happy with the speed and convenience it offers.

Convenient digital access

Offer your customers 24/7 access through our user-friendly online and mobile platforms. They can securely send money on the go whenever and wherever they want.

With just a few taps, funds can be sent internationally without visiting a physical location. Digital access makes remittances easier and more convenient.

Low and transparent fees

With our cross border payment platform, you can offer low and transparent fees to streamline cross border payment process flow. This reduces overhead costs.

You can also offer clear and upfront fees with no hidden charges to ensure affordability and transparency. This will ultimately build trust and happy customers.

Multiple payout options

Provide flexibility with payout options including bank deposit, cash pickup, mobile wallet transfer, prepaid cards, and more. Your customers can choose how to receive their funds in the destination country. With multiple disbursement methods, you can cater to individual preferences ensuring convenience and customer satisfaction.

Better customer support

Our platform enhances customer support by providing multilingual assistance, real-time chat support, dedicated customer service lines, and comprehensive FAQs.

Your customers can get quick help with any questions or issues. With our teams available 24/7 across multiple channels like phone, email, live chat, and social media, your customers have a great experience, always!

User-friendly interface

You can make cross border money transfer easy for your customers by offering a user-friendly web and mobile interface along with intuitive navigation, clear instructions, and multi-language support.

Moreover, sending money abroad is simplified through logical menus, payment flows, and cross border transactions tracking. This further enhances user experience and ensures a better experience for your customers.

Enhanced security

With our cross border payment platform, you can protect every transaction by leveraging all leading security technologies and protocols. With advanced features like encryption, biometric authentication, fraud monitoring, AML screening, PCI SSF compliance, and more, your customers gain peace of mind.

What more do DigiPay.Guru’s cross border payment platform have in store for you?

Digipay.Guru cross border remittance solution is not limited to increasing your business revenue and customer satisfaction. DigiPay.Guru offers multiple other advanced features to help you grow your business:

Multi-currency corridors & exchange rates: Offer your customers more flexible and cost-effective cross border money transfer with multi-currency corridors and competitive exchange rates.

Cross-border bill payments: Offer a convenient way to pay bills in another country by integrating cross-border bill payments into your solution.

AML sanction screening: Make your cross-border remittance service more compliant and secure with AML sanction screening

Loyalty & rewards: Offer tailored loyalty programs and rewards to customers to keep them engaged with your solution

Alert & transaction thresholds: Set up customizable alerts and transaction thresholds to monitor & manage remittance activities effectively.

Comprehensive admin dashboard: Manage and access all critical remittance operations via a centralized admin dashboard.

Data-rich reporting & analytics: Access comprehensive reporting and analytics capabilities to identify trends, optimize strategies, and drive growth.

Conclusion

DigiPay.Guru’s cross border payment platform is the perfect solution for remittance businesses, banks, and fintech looking to increase their revenue and gain more happy customers by offering remittance services. Our advanced features and functionalities are designed just for you and offer everything you need to offer a perfect experience to your customers.

Moreover, our cross border payment system comes in two different models so that you can scale and multiply profits irrespective of your business stage. If you are a small business or a startup, we have a SaaS-based remittance solution for you. And if you are an established business, we have a license model for you.