If you sit in leadership today, you’ve probably noticed something subtle but important.

Financial services are moving faster than the systems behind them.

Customers expect instant payments. Businesses want digital-first services. Cross-border transactions are becoming routine.

Many banks and financial institutions are still running on the age-old infrastructure built for a slower, branch-led world. The obvious result is friction, higher costs and longer timelines.

And the growing expectations from regulators, partners, and customers is on the next level.

With all these pressures, everyone is asking the same question how do we grow without breaking what already works?

This is where the conversation around fintech has changed.

Investing in fintech today is no longer about chasing the latest app or fintech technology trends. It is about understanding how tech is reshaping the foundations of financial services, from payments and digital wallets to compliance and cross-border operations.

For decision makers, the challenge is not whether fintech matters, but where to focus and what actually delivers long-term value.

This guide helps you step back and see the bigger picture like how fintech is transforming financial services, why investment patterns are shifting, and what this means for institutions operating in Africa’s fast-moving markets.

Just a heads up before starting -

What is Fintech Investment?

Fintech investment refers to allocating capital toward financial technology platforms, infrastructure, and systems that enable digital payments, banking, compliance, and financial services at scale.

Why Investing in Fintech Has Become a Strategic Necessity for Financial Services?

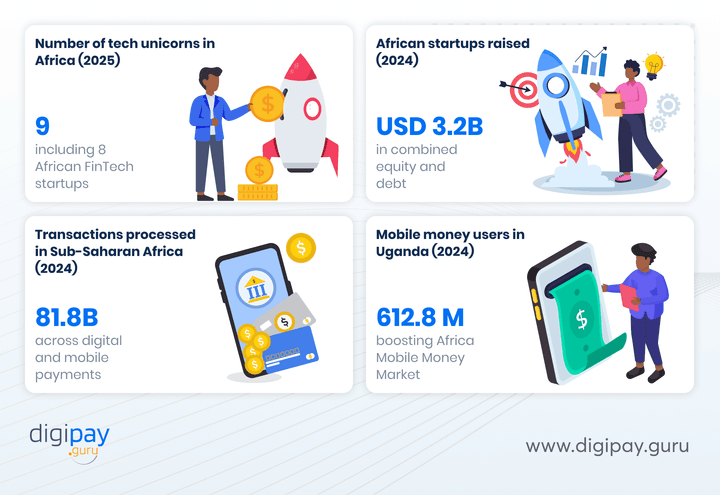

While looking for answers this question was pining in the mind again and again – “Why is investing in fintech important for Africa’s financial services sector?” Investing in fintech is important in Africa because financial demand is growing faster than traditional banking infrastructure. Fintech technology enables scalable, compliant, and mobile-first financial services that reach underserved markets efficiently.

And all this is changing the meaning of fintech investment in Africa.

A decade ago, investing in fintech largely meant funding startups or launching digital products at the edge of traditional banking. Today, the focus has shifted deeper. Institutions are investing in the systems that move money, manage risk, and enable compliance across markets.

Modern fintech investment includes:

-

Core payments, settlement infrastructure and digital fintech solutions

-

Digital wallet and mobile money platforms

-

Compliance, KYC, and monitoring systems

-

API-first platforms that integrate partners and services

-

Technology that supports expansion without constant re-engineering

For African banks and financial institutions, this shift is practical. Growth often happens market by market. Regulations differ by country. Payment rails vary. Investing in fintech infrastructure reduces friction across these realities and lowers the long-term cost of operating digital financial services.

In simple terms, fintech investment has moved from product bets to platform thinking.

The African Financial Technology Landscape: Opportunities and Constraints

Africa’s fintech story is often told through the lens of growth numbers and funding rounds.

But the more important story sits underneath.

The continent remains largely mobile-first. Major fintech growth opportunities are via mobile. Millions of users access financial services through phones, agents, and digital wallets rather than branches. Mobile money, agent networks, and informal channels play a central role in everyday transactions.

At the same time, African financial markets are not uniform. Each country has its own regulatory expectations, licensing regimes, and payment ecosystems. Expanding across borders requires more than ambition. It requires technology that can adapt without breaking.

Key realities shaping fintech adoption in Africa include:

-

Large unbanked and underbanked populations

-

Agent-led distribution models

-

Strong reliance on mobile money and wallets

-

Cross-border trade and remittance dependence

-

Market-specific regulatory oversight

These conditions create both complexity and opportunity. Institutions that invest in flexible, scalable fintech technology are better positioned to serve local markets while preparing for regional growth.

Fintech Technology Trends Reshaping Financial Services in Africa

Several fintech technology trends are driving the transformation in East and West African markets. What matters is not the technology itself, but how it enables scale, control, and efficiency.

| Technology | Impact on Financial Services |

|---|---|

| APIs | Faster product launches |

| AI & ML | Fraud & risk automation |

| Mobile wallets | Financial inclusion |

| Cloud | Cost efficiency |

| Payment orchestration | Reliability & scale |

API-First Fintech Platforms

API-first architecture allows institutions to connect services, partners, and channels without rigid integrations. For banks, this means faster product launches and easier collaboration with fintech partners.

Real-Time Payments and Orchestration

Customers expect instant transactions. Real-time payment infrastructure and intelligent routing across rails improve success rates and reduce settlement risk.

Embedded Finance Platforms

Financial services are increasingly embedded inside non-financial platforms, from marketplaces to logistics providers. This expands reach without requiring customers to enter traditional banking environments.

Scalable Compliance Tooling

As transaction volumes grow, manual compliance processes become unsustainable. Automated KYC, monitoring, and reporting are now core infrastructure requirements.

Together, these trends are shifting financial services from static systems to dynamic, connected platforms. You can read more such fintech trends that are making a positive impact on the fintech market in 2026.

Also read - Top 15 fintech trends in 2026 that you can’t miss.

Fintech Investment Trends in Africa: Where Capital Is Flowing?

Fintech investment across Africa is becoming more focused. Capital is flowing toward areas that support volume, resilience, and regulatory confidence.

Key areas attracting sustained investment include:

-

Digital payments and mobile wallets

-

Remittance and cross-border payments infrastructure

-

Agency banking and merchant acquiring platforms

-

RegTech and compliance automation

-

Core fintech infrastructure that supports multiple use cases

Rather than chasing niche applications, institutions are prioritizing technologies that can support multiple business lines and adapt as markets evolve.

Why Fintech Infrastructure Investment Delivers Long-Term Value?

Fintech is already offering great value to the sub Saharan and African market.

So you need to know which investments can prove beneficial for you in long term?

What types of fintech investments offer long-term value?

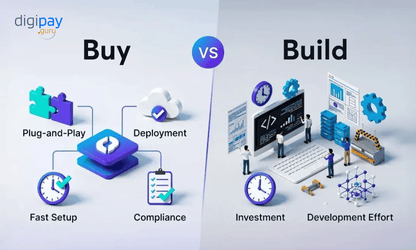

Fintech investments focused on infrastructure, such as payment platforms, API-first systems, and compliance technology, offer longer-term value than standalone applications because they support scale, regulation, and multi-market expansion.

Now you would be thinking that you can use applications.

Yes, ofcourse you can. But with time applications can be replaced but infrastructure compounds with time. This explains why infrastructure-led fintech is attracting long-term investment.

Payment engines, ledger systems, compliance frameworks, and payment API platforms form the backbone of digital finance. Once established, they support multiple products, markets, and revenue streams.

Infrastructure-focused investment offers:

-

Better scalability across countries

-

Lower marginal cost as volumes grow

-

Stronger regulatory alignment

-

Reduced operational complexity

For African institutions navigating diverse markets, infrastructure investment is less risky than repeatedly rebuilding solutions for each expansion.

The Fintech Regulatory Environment and Its Impact on Investment Decisions

Regulation is often viewed as a constraint in emerging African financial ecosystems.

In reality, it shapes smarter investment decisions.

| Compliance Area | Why It Matters |

|---|---|

| KYC | User onboarding |

| AML | Risk mitigation |

| Reporting | Regulatory trust |

| Monitoring | Scalability |

Across Africa, central banks and regulators are closely involved in supervising payment systems, wallets, and digital financial services. Technology choices directly affect licensing timelines, reporting obligations, and audit outcomes.

Institutions that invest in compliant, transparent fintech platforms benefit from:

-

Faster regulatory approvals

-

Clearer audit trails

-

Greater trust with partners and authorities

In this environment, regulation rewards preparation. Fintech investment aligned with regulatory expectations creates long-term stability rather than short-term acceleration.

How Banks and Financial Institutions Approach Fintech Investment?

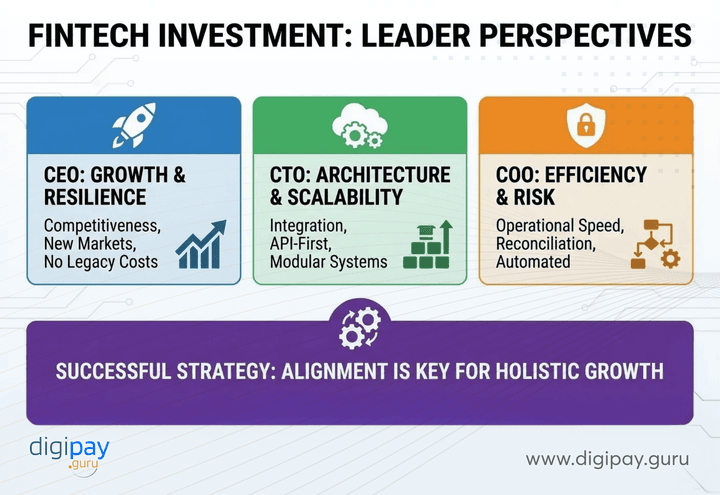

Different leadership roles view fintech investment through different lenses.

CEOs focus on growth, competitiveness, and long-term resilience. Fintech technology enables expansion into new segments and markets without relying on legacy cost structures.

CTOs evaluate architecture, integration complexity, and scalability. API-first platforms and modular systems reduce technical debt and improve adaptability.

COOs prioritize operational efficiency, reconciliation accuracy, and risk management. Unified platforms simplify operations and reduce manual intervention.

Successful fintech investment aligns these perspectives rather than optimizing for one at the expense of others.

Common Mistakes Leaders Make When Investing in Fintech

Despite growing experience, some mistakes appear repeatedly.

Institutions often:

-

Overinvest in customer-facing applications while neglecting infrastructure

-

Underestimate the cost and effort of compliance at scale

-

Launch pilots without a clear path to production and expansion

-

Rely on fragmented systems that increase operational risk

These missteps slow progress and erode confidence. Strong fintech investment starts with clarity on long-term operating realities.

Where DigiPay Guru Fits in the Fintech Investment Landscape?

As fintech investment shifts toward platforms and infrastructure, DigiPay Guru represents this new direction.

Rather than focusing on standalone products, DigiPay Guru provides a unified, white-label fintech infrastructure designed for regulated, multi-market environments.

| Requirement | Legacy Systems | DigiPay Guru |

|---|---|---|

| API readiness | Limited | Native |

| Multi-rail payments | Fragmented | Unified |

| Compliance tooling | Manual | Embedded |

| Expansion readiness | Slow | Fast |

By supporting payments, wallets, compliance, and reconciliation through a single platform, DigiPay Guru enables institutions to invest once and scale across use cases and markets.

This approach aligns with how African financial services are evolving: platform-led, compliant, and expansion-ready.

The Future of Financial Services: Platform-Led Fintech Models

The future of financial services in Africa will be shaped by platforms rather than isolated systems.

Institutions are moving toward:

-

Interoperable ecosystems

-

Real-time monitoring and reporting

-

Embedded compliance

-

Infrastructure consolidation

Fintech investment decisions made today will determine how easily institutions adapt to these shifts.

Key Takeaways for Decision Makers

We will sum up the whole guide to give you bite-sized information -

-

Investing in fintech is now a strategic infrastructure decision

-

Africa’s financial growth requires scalable, compliant platforms

-

Technology choices shape regulatory confidence and operational efficiency

-

Infrastructure-led fintech delivers long-term value

-

Platforms outperform fragmented systems over time

Across Africa, financial institutions that invest thoughtfully in fintech technology are not just digitizing existing services. They are reshaping how finance is delivered, regulated, and scaled.

While going forward if you find an experienced infrastructure led payment platform provider like Digipay Guru, it is a wise and logical next step to partner with them for your future products.

FAQs

Investing in fintech means allocating capital to financial technology platforms, infrastructure, and systems that enable digital payments, banking, compliance, and scalable financial services, not just consumer-facing apps.

Fintech is transforming financial services by replacing manual, branch-led processes with digital, API-driven platforms that deliver faster transactions, broader access, and more efficient operations.

The most investment flows into payment infrastructure, digital wallets, API-first platforms, embedded finance systems, and compliance technology that supports regulated financial services at scale.

Fintech reduces operational costs for banks by automating onboarding, payments, reconciliation, and compliance, which lowers manual processing, reduces errors, and improves efficiency across operations.

Fintech infrastructure is more attractive than consumer apps because it supports multiple products, scales across markets, aligns with regulation, and delivers long-term value beyond short-term user growth.

Compliance is critical in fintech investing because regulatory alignment determines whether financial platforms can scale, operate across markets, and maintain trust with regulators and institutional partners.

Regions with large underbanked populations, mobile-first adoption, and growing digital economies, particularly across Africa and emerging markets, offer the highest fintech growth potential.

Embedded finance expands financial services by integrating payments, lending, and wallets directly into non-financial platforms, increasing reach and improving customer access without traditional banking channels.

Investors should consider regulatory risk, scalability challenges, integration complexity, security exposure, and long-term operational costs when evaluating fintech investments.

Fintech platforms support banks and enterprises by providing unified infrastructure for payments, compliance, APIs, and digital services, enabling faster innovation while maintaining regulatory control.