Technological advancement and the availability of the Internet of Things have brought a revolution in the banking and finance sectors. As one-third of the world’s population is connected to the Internet with more than 700 million mobile connections, it is the ideal option to invest in mobile money.

Mobile money has been touted as the revolutionary tool for expanding financial services in low-resource countries like Egypt and Bahrain. With just a mobile phone, the users can quickly transfer money with a click and without needing any access to an existing bank account.

As of January 2022, two-thirds of the global mobile money business model were driven by users in the regions, with a value of 25 billion dollars.

What is mobile money?

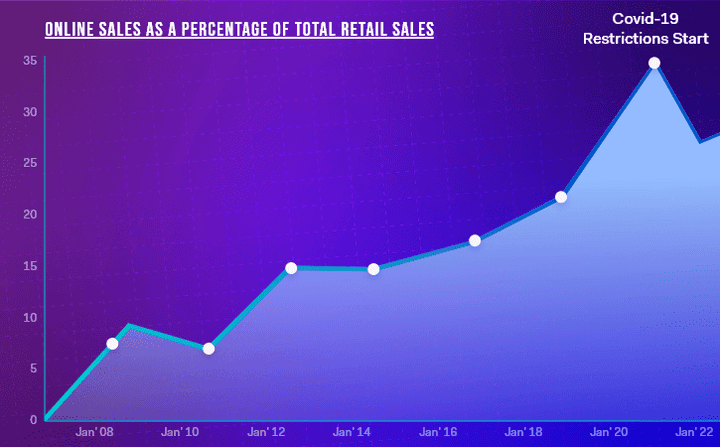

The Coronavirus Pandemic has enabled the banks and fintech industry to accept contactless payment to follow social distancing guidelines for stopping the spread of infection. This further encouraged the financial institutes to take advantage of the latest fintech trends to serve their customers the most productively and safely ever.

Mobile proximity payments are the future of a cashless world. In many countries, cash is already a thing of the past, but many nations are slower to transform their physical cash system to mobile for a number of reasons. However, experts have predicted $4.921 trillion retail ecommerce transactions through mobile payments.

When it comes to mobile money, MTN is the leading mobile money service provider with more than 24 million active MoMo users. The total value of mobile transactions of saharan countries was estimated to $456.3 billion in 2021, showing the importance of mobile money and the providers in the region.

Advanced Mobile Money solution for your day-to-day, digital transactions.

How does Coronavirus Pandemic has accelerate digital adoption for payments?

Even before the pandemic, mobile wallets were booming. The number of transactions conducted through smartphones has grown to 13% in the UAE, which is higher when compared to the annual growth of European countries. Besides, Saudi Arabia, Kuwait and Qatar have experienced an astronomical growth of 70% in contactless and digital fintech solutions, including,

- Scan&Thru payments

- Payment through QR codes

- Peer-to-peer payments

- Unified Payment methods

- Net Banking

The restrictions and social distancing have further fuelled these impressive growth rates. The contactless point of sale transactions has been doubled since January 2021.

Peer-to-peer payments have rapidly increased with promotional activities like cashback and scratch cards. Major Fintech players like Grey, Apple Pay and Samsung Pay have increased their customer base by quickly transferring the money in a single click. You don’t have to wait for days, unlike conventional banking transactions.

More and more banks, fintech organizations and financial institutes are switching to contactless digital wallet solutions. It’s high time for businesses to invest in digital wallets and contactless payment methods to facilitate their customers with point of sales transactions, online sales and hassle-free checkouts.

According to the World Banks’ global Findex, 46% of adults have an account with a reputed financial institute, encouraging evolution in the Middle East countries. However, the majority of the adults remain unbanked.

In UAE, Israel and Iran, more than 80% of adults have a banking account, comparatively higher than just 20% of adults in Iraq, Sudan and Egypt having an account in financial institutes. The account penetration is also increased by 10% in countries like Iran and Bahrain.

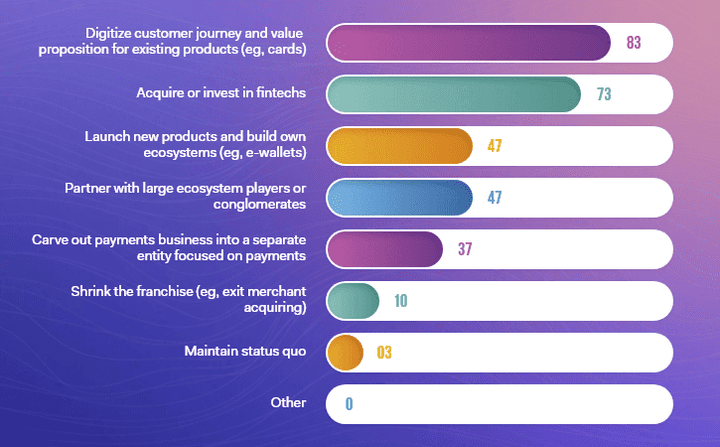

This reflects a promising opportunity for businesses and financial institutes to invest in digital wallet apps to win a competitive edge. Besides, customers also wanted banks and financial institutes to invest in digital customer journeys and value propositions.

The survey clearly shows consumers interest in digital payment solutions. Let’s check out the significant possibilities in the Middle East for mobile money.

Unleashing mobile money opportunities in the Middle East

Banking through mobile phones allows for the real-time transfer and the receipt of small amounts of funds at a low cost. They can reduce the costs of processing and administering small loans, thereby alleviating a significant disincentive for lenders to extend credit to MSEs. Businesses can experience a few possibilities by introducing digital payments through mobile phones.

Increasing focus and investment in mobile money

In many countries of the Middle East, businesses accept mobile money solutions and other digital payment solutions like GPay, mobile wallets, and credit cards. This shows their interest in investing in mobile money.

However, they failed to get enough focus or investment in mobile money as providers push multiple payment solutions.

Enabling non-banks to participate in the mobile payment sector

In many Middle East countries, the financial sector regulators haven’t introduced reforms allowing non-banks to participate in mobile money solutions. With money transfer solution, businesses can expand the availability of payment services and other financial services to foster efficient and inclusive fintech services.

Expansion of e-wallet usage

The Middle East payments market has recently expanded to include FinTechs, tech companies and telecoms companies alongside incumbent banks. It is a shift enabled by regulatory changes such as those introduced in Saudi Arabia in late 2019 and the UAE in 2021, as per McKinsey reports.

It also added that these reforms are expected to have broad ramifications for the payments business.

Encourage interoperability for better analysis

Mobile money promotes interoperability, enabling market-led solutions that brings value to their customers. A better analysis also helps businesses identify risks and get the right mitigation for a future prospectus.

Supporting international remittances

The labourers working in the construction companies in the Middle East tend to send money to their families out of the country. This international remittance promotes a powerful source of private capital and external funding.

Investing in an international money transfer solution can facilitate this international remittance and provide a secure source to send funds to family and friends without any hassle.

However, to conduct the above possibilities, the businesses have to overcome several challenges in implementing digital payment solutions in countries like Iran, Iraq, Jordan and other Middle Eastern countries.

Challenges of Mobile Money and how to conquer them in the Middle East

Challenges associated with digital payment solutions for businesses in the Middle East are endless. Here, we have discussed some of the major provocations that every business needs to address to succeed in Fintech.

Market research

The businesses should conduct thorough market research, including important data of prominent players in the payments, banking, commerce, and retail sectors. The data should provide detailed information about company profiles, key offerings, investment, funding, growth trends, and revenue.

This research can be helpful to explore the range of mobile money offerings and their value proposition in Middle east markets.

USP to launch

The Unique selling proposition to launch mobile money in the Middle East includes high-end and secured fintech technology, customized user experience, interactive user interface, omnichannel integration and seamless strategies that help you to win the competitive edge. Hiring the right digital wallet providers is the key to achieving the best USP according to your business brand.

Scalable software

Designing a scalable software can address the specific needs in the targeted country while investing in the right technology. A scalable digital payment solution can help businesses meet futuristic needs and digital payment trends for upcoming years.

Scalable software should be a key component of any financial institute’s digital strategy. And Chief Information Officer needs to innovate scalable solutions that can deliver value to the businesses in terms of future growth and consistent profit margins.

The CIO must act as the technology product manager, possessing expansive knowledge of digital payment landscape, combing with skills like digital payment infrastructure and digital payment solution provider.

Infrastructure A scalable infrastructure is necessary for mobile money that supports the future growth of your business. Infrastructure works by hosting the digital payment solutions, including cloud computing, on-site database, and on-premise content management. Only the best digital money-transfer operators can help you select the best infrastructure for your business requirements.

Team building Hiring the right talent is necessary for building a scalable mobile money service. Check out the experience of the mobile money app developers and their expertise in the latest fintech trends.

An experienced mobile app developer updated with the latest Fintech trends is a game changer for your business. Only an experienced mobile app developer can help you to conquer challenges arises in future for running a seamless business software.

Thus, infrastructure and team building are the key components when it comes to build a scalable digital payment software that is flexible to adjust according to your business needs.

Innovate scalable digital payment solutions that support your business growth.

Merchant acquisition

To capture emerging opportunities in the growing merchant digital-payments business, incumbent businesses and financial institutes must design a thoughtful merchant payment solution strategy to reach the targeted segments.

Licensing

The prime provocation for businesses for obtaining a license will be building trust in their services. The business can achieve this by designing a solution that addresses the specific pain points in the targeted country.

The business can select versatile digital payment solutions, including merchant payments, B2B payments, peer-to-peer payments to work in specific characteristics.

Cyber security

It is no surprise that financial institutes are spending more on cyber security than any other businesses and corporate organizations. The number of mobile money accounts reached 146 million with transaction value growing 26% to $10.5 billion.

The number of registered mobile money accounts grew 9% to 56 million, enabling the Arab banks to face challenges when it comes to cyber theft and malware. The Arab banks have invested in disruptive technologies, followed by strict measurements to combat financial crimes and compliances.

Agent networking

Agent networking is the most crucial aspect for mobile money companies in Middle Eastern countries. The agents can help preserve the vital asset by converting physical cash into digital money. The businesses must focus on agent on-boarding, agent training, liquidity management and agent monitoring.

3rd party partnership

The key to success for any mobile money service depends on the number and variety of 3rd party partnerships, which help them build a diverse and engaged user base.

For a seamless transition to a digital payment platform, they should build on their strengths through a wide distribution network and trusted brands while also capitalizing on innovation.

Branch operations

A scalable digital payment solution can help you manage different branches in multiple countries. You must invest in the latest technology and user-friendly portals to manage multiple branches simultaneously. The best digital payment solution will enable you to view all the mobile money branches from one dashboard.

Marketing

Marketing is a great means for expanding your user base. By analyzing the data, you can encourage your customers for contactless transactions by offering lucrative discounts, cash backs, scratch cards and many other benefits.

Final thoughts

While digital financial services have undoubtedly supported many households during the pandemic, they still do not reach many households, especially the poorest, even in the countries with the highest rates of penetration.

Mobile money offers a safer alternative to cash and governments of Middle Eastern countries are turning towards digital solutions to distribute cash relief. The creative solutions offered by the digital solution providers are laudable and perhaps mos digital services are born from an opportunity to improve the system.