Let’s face it. The traditional utility bill payment experience is a pain for your customers. Waiting in lines. Logging into outdated banking portals. Chasing due dates. For your customers, it becomes tiring, inconvenient, time-consuming, and complex. And for your business, it calls for missed engagement opportunities, limited transaction volumes, and a whole lot of operational inefficiency.

Utility bill payments typically cover essentials like electricity, gas, water, or broadband. These are high-frequency & non-negotiable expenses, which make them perfect for embedding into your wallet experience. When you simplify how users manage these, you shift from being optional to irreplaceable.

Plus, now the market has shifted. People expect to manage their financial lives in-app. That also includes their utility bill payments. As a business offering (or thinking of building) a digital wallet platform, enabling seamless utility wallet payment is a must-have.

And for that, this blog is your roadmap. We'll walk you through how to enable a utility bill payments solution that your customers will love and trust.

Let’s begin!

What Is a Digital Wallet in the Context of Utility Payments?

A digital wallet, in the context of utility payments, goes far beyond just storing money or sending peer-to-peer transfers. It's a command center for managing everyday financial tasks, and bill payments are at the heart of it.

With the right integrations, your digital wallet becomes a unified solution where users can:

-

View and receive real-time bills directly inside the app

-

Store funds or link preferred payment sources

-

Pay securely with just one tap

-

Access past payments with clear digital receipts

This transforms your digital wallet into more than just a utility tool. It becomes part of your users' monthly pattern. And when utility bill payments feel effortless, users stay engaged, build habits, and keep coming back.

The best part? They do it all within your ecosystem, not someone else's.

For your business, it builds engagement and trust.

Instead of bouncing between apps or physical bill payment centers, your customers get a seamless utility wallet payment experience without ever leaving your ecosystem (as an added feature).

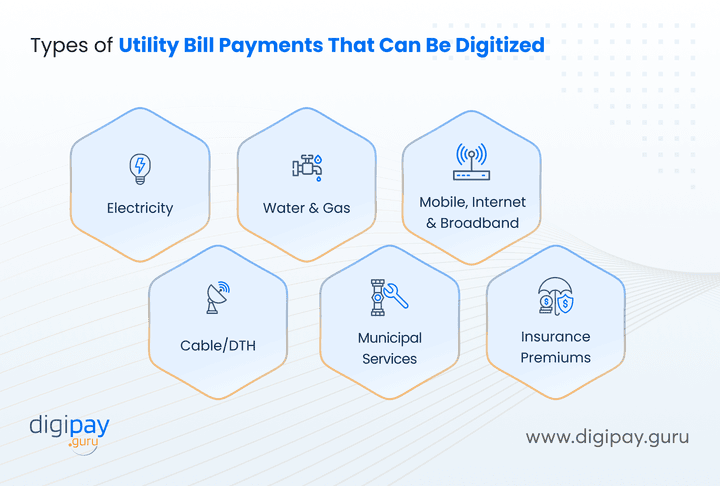

Types of Utility Bill Payments That Can Be Digitized

Utility bills come in many forms, and your digital wallet platform should be ready to handle all of them. Why? Because the more bill types you support, the more essential your wallet becomes in the daily lives of your users.

Here are the most common categories that your customers expect in a modern digital wallet:

-

Electricity: From city grids to regional providers, electricity bills are high-frequency and critical.

-

Water & Gas: Urban water boards, LPG cylinder bookings, or piped gas services.

-

Mobile, Internet & Broadband: Postpaid mobile bills and home Wi-Fi plans are non-negotiable for every user.

-

Cable/DTH: Subscription services like StarTimes, DSTV, or Tata Sky.

-

Municipal Services: Property taxes, garbage collection, or water drainage fees.

-

Insurance Premiums: Monthly or quarterly payments for health, life, or motor insurance.

Digitizing these payments through your wallet allows for automation, reduces human error, and boosts convenience. When users can settle all their essential bills in one app, your product becomes a utility in itself.

And the more integrated your utility bill payment offerings are, the more frequently users engage with your platform. And that directly results in long-term retention and increased revenue.

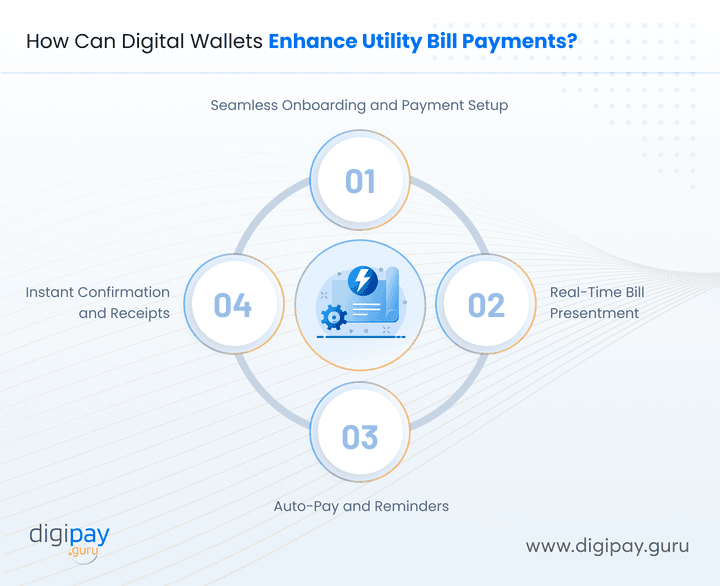

How Can Digital Wallets Enhance Utility Bill Payments?

When you embed utility bill payments into your digital wallet, you’re not just adding another feature; you’re transforming the user experience.

Here's how a modern digital wallet solution simplifies utility bill management, increases app stickiness, and delivers value to both users and your business.

Seamless Onboarding and Payment Setup

With a digital wallet, you can make it easy for users to link their billers once and then pay with a tap. No need for your users to add details every month. This one-time setup reduces friction and boosts repeat usage. This is exactly what your product team wants to see in the analytics.

Real-Time Bill Presentment

By integrating directly with utility providers or aggregators, your digital wallet can fetch due bills in real time. This means that the users know what they owe, when it’s due, and how much to pay without jumping between apps or checking emails.

Auto-Pay and Reminders

Let users schedule automatic utility bill payments or get notified before the due date. This helps them avoid late fees while giving your app recurring visibility and habitual engagement, built-in retention, without needing a loyalty program.

Instant Confirmation and Receipts

Your customers don’t like to keep wondering if a payment went through. When your digital wallet platform offers instant receipts and status confirmations, it gives users peace of mind. And when your platform builds that kind of trust, it increases both satisfaction and daily active usage.

Is It Safe to Use a Digital Wallet for Utility Payments?

It’s a fair question and a critical one. As a business in the financial sector, your credibility depends on how safe your platform feels. When users trust your digital wallet with their utility payments, it’s not just about functionality; it’s about security and peace of mind.

To deliver secure utility bill payments, your solution must be built on industry-leading standards:

-

PCI-SSF compliance ensures sensitive cardholder data is always protected.

-

End-to-end encryption shields transactions from potential threats.

-

Biometric login and OTP verification add layers of real-time user authentication.

-

AI-driven fraud detection helps identify suspicious patterns before they escalate.

These are must-haves for your customers, your partners, and your regulators.

When your bill payment stack in a digital wallet is secure by design, you boost user confidence and regulatory alignment. That’s the foundation of a digital finance experience people can trust and come back to every month.

Bottom line? Yes, utility bill payment online is safe, as long as your wallet is built the right way.

Read more - Digital Wallet Security:Best Practices for keeping your funds safe & secure

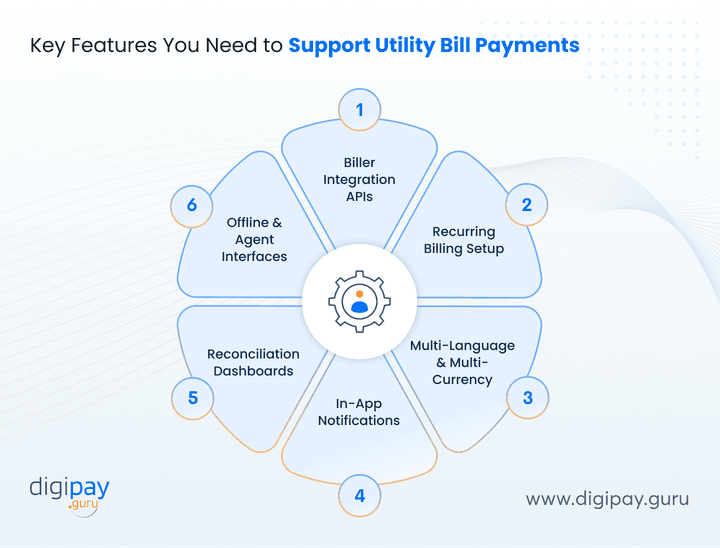

Key Features You Need to Support Utility Bill Payments

Now let's get into the nitty-gritty. What should your platform actually include to enable seamless utility payments automation? The key features to support utility bill payments include:

Biller Integration APIs

Connect directly with utility companies or third-party bill aggregators. This enables real-time bill fetching and automatic due amount syncing. This allows users to get up-to-date billing info without manual input, and you avoid data errors and support headaches.

Recurring Billing Setup

Let users automate payments with options like monthly auto-pay, scheduled payments, or one-time setups. This increases convenience and reduces missed deadlines, which makes your digital wallet a part of their daily routine.

Multi-Language & Multi-Currency

Support users across regions by enabling billing in their local language and currency. This is essential for cross-border offerings, diaspora markets, and inclusive financial products.

In-App Notifications

Keep users informed with real-time alerts for due bills, payment confirmations, and failed transactions. These notifications boost user confidence and reduce churn by ensuring no payment goes unnoticed.

Reconciliation Dashboards

With the help of a digital wallet platform, give your internal teams and utility partners access to payment histories, settlement statuses, and transaction logs. This transparency improves trust, compliance, and reporting efficiency.

Offline & Agent Interfaces

Extend utility payments to low-connectivity regions through USSD, SMS, or agent-assisted models. This is perfect for reaching rural users or cash-dependent populations with digital reliability.

What Are the Benefits of Offering Utility Bill Payment Services?

Utility payments are an essential feature of a digital wallet platform. In addition to that, it’s also a revenue lever, retention engine, and market differentiator. Here’s what’s in it for you and your business:

For Wallet Providers & Fintechs

-

Embedding utility bill payments increases transaction volume and daily active usage.

-

It creates habit loops where users return monthly without a reminder.

-

You also gain new monetization paths through convenience fees or commissions, which give your wallet both purpose and profit.

It’s a smart step from transaction tool to ecosystem.

For Banks & Financial Institutions

-

Utility payments modernize outdated bill pay infrastructure and bring routine transactions inside your digital banking experience.

-

You gain more touchpoints with customers, reduce foot traffic in branches, and foster loyalty through convenience.

-

It also supports financial inclusion by digitizing services for underserved or rural users.

For Utility Providers

-

Partnering with digital wallets simplifies collection, shortens billing cycles, and reduces late payments.

-

Real-time reconciliation improves operational accuracy, while automated flows reduce manual errors.

-

Wallet platforms also open up access to newer segments like urban youth, gig workers, and digital-first consumers who avoid traditional bill pay channels.

How Is the Demand Growing in Emerging Markets?

Emerging markets are witnessing a sharp rise in demand for utility bill payment through digital wallets. This is driven by infrastructure improvements, mobile adoption, and policy reform.

-

In Kenya, over 90% of utility bill payments for services like electricity (via KPLC) and water are now processed through mobile wallets such as M-Pesa.

-

Similarly, Ghana’s ECG Mobile App and third-party wallets are processing more than 2 million transactions monthly, supported by the Bank of Ghana's push for cashless utilities.

-

In Nigeria, digital bill payments are growing at a CAGR of 35%, with wallets and fintech apps leading adoption. The Central Bank's Payment Systems Vision 2025 highlights utility payments as a key use case for expanding digital finance.

-

Across MENA, government-led platforms like Egypt’s Meeza and Saudi Arabia’s SADAD are driving wallet adoption, while fintechs integrate billers to increase wallet usage frequency.

This surge is not driven by consumer behavior alone. It’s being reinforced by national utility agencies going digital, telecom-wallet partnerships, and an ecosystem shift toward interoperability.

For financial institutions and fintechs in these regions, embedding utility bill payment services into digital wallets is a basic need of the hour now.

How DigiPay.Guru Helps You Build Your Utility Bill Payment Ecosystem

Here’s the part you’ve been waiting for.

When you choose DigiPay.Guru, you don’t just get software. You get a customizable, white-label-ready platform with:

-

Real-time payment gateways for utilities

-

Built-in bill payment integration services

-

Pre-configured utility billers across regions

-

PCI-DSS and regulator-ready security layers

-

Agent banking modules for hybrid offline/online access

Our clients deploy in weeks, not months, with full scalability. Whether you're building a standalone digital wallet or embedding it into an existing mobile app, we’ve got your back.

Conclusion

Utility bill payments have evolved from a back-office function to a front-facing opportunity for user engagement. In emerging markets, especially, wallets that offer bill payments are quickly becoming default platforms for daily financial tasks. This shift has a real impact on retention, monetization, and product relevance.

When your users can manage electricity, gas, broadband, and insurance payments within your app, it eliminates friction and creates habit loops. More importantly, it signals trust. You’re not just helping them pay a bill; you’re helping them stay organized, save time, and avoid missed deadlines.

As regulators push for digitization and utility providers embrace APIs, this space is moving fast. Businesses that act now can position themselves as category leaders, while those that delay risk losing user engagement to faster-moving fintechs.

But there’s good news for you.

DigiPay.Guru helps you bridge that gap. We provide a secure, white-label digital wallet solution with built-in utility integrations, biller APIs, and proven deployment experience. Whether you're launching or upgrading, we help you build a digital wallet your users will rely on monthly, without hesitation.

FAQ's

Our platform allows you to offer automatic, scheduled, and one-time payment flows. Users can set up auto-pay instructions for any registered biller, which helps reduce late payments and improve retention through monthly engagement.

Yes. DigiPay.Guru’s digital wallet solution is built on PCI-SSF standards. Every utility transaction is encrypted, tokenized, and authenticated with OTPs or biometrics to ensure full regulatory compliance and user trust.

Absolutely. Our system supports API-based and aggregator-led integrations with utility companies across regions. You get access to ready-to-plug modules for electricity, water, telecom, and more.

Electricity, water, gas, broadband, mobile, DTH, municipal taxes, and even insurance premiums. DigiPay.Guru enables full flexibility to onboard any biller relevant to your region or customer base.

With pre-integrated modules and configurable architecture, clients typically go live within 4–8 weeks. Deployment timelines may vary slightly based on local biller APIs and compliance reviews.

Yes. You can fully brand the utility bill payment flow within your own wallet interface—from UI components to notifications and receipts, which ensures a seamless customer experience.

Yes. You get a dedicated dashboard for internal teams or biller partners to view transactions, track settlements, and download custom reports for compliance or audit purposes.