If the past decade was about going digital, 2026 is about going contactless.

From cardholders to mobile wallet users, consumers across the world have made “tap and go” their default way to pay. According to Statista, the global contactless payment market is projected to surpass $12 trillion by 2027, growing at an annual rate of over 19%.

The U.S. alone has seen a fivefold increase in tap-to-pay transactions since 2020, with banks driving much of this transformation.

For financial institutions like yours, this isn’t just about offering faster checkouts or sleek cards, it’s about staying relevant in a payments ecosystem that’s evolving every quarter. Whether it’s NFC, mobile wallets, or biometric authentication, the contactless revolution is reshaping how banks deliver value, build trust, and retain customers.

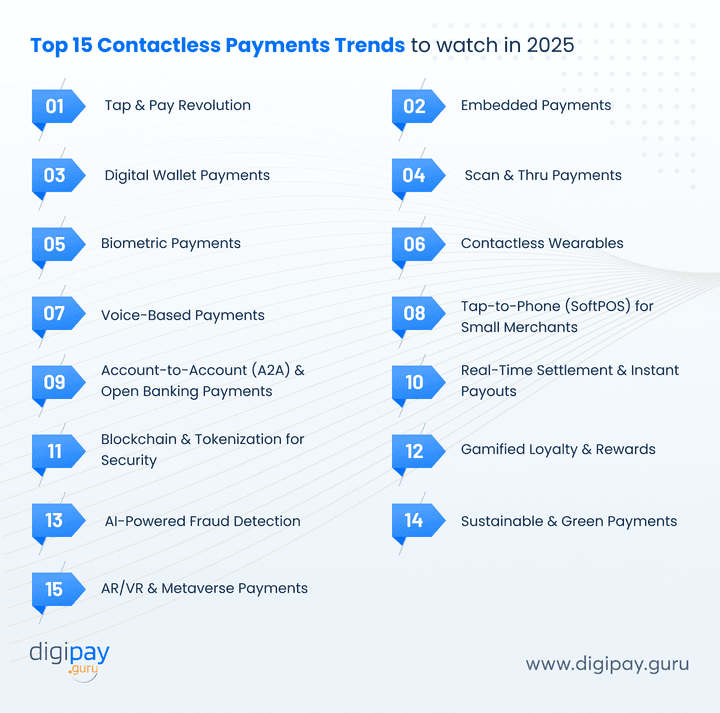

In this article, we’ll explore the top 15 contactless payments trends redefining financial experiences in 2026. Each trend is backed by market insight and practical context, so you can understand what’s changing, why it matters, and how your bank can prepare for it.

So, let’s get started with the basics.

What Are Contactless Payments?

Contactless payments are digital transactions that happen without physical contact between a payment device and a terminal. They rely on NFC (Near Field Communication) or RFID (Radio Frequency Identification) technology to securely transfer data.

It is used through a mobile contactless payment app, tap-to-pay card, or smartwatch. They’re faster, cleaner, and safer than cash or traditional swipes.

For you, this technology is the foundation of modern customer experiences where convenience meets compliance.

How Contactless Payments Work

When a user brings their card, phone, or wearable device close to a payment terminal, NFC chips exchange encrypted payment data within milliseconds. Each transaction generates a unique token, protecting sensitive account details.

It’s like handing over a one-time-use key instead of your whole wallet.

Banks that integrate NFC and contactless payments into their ecosystem not only ensure smoother customer journeys but also boost security through tokenization and multi-factor authentication.

Market Overview: Growth & Statistics

| Region | YoY Growth (2024–2025) | Key Driver | Adoption Rate |

|---|---|---|---|

| North America | 25% | Tap & Pay, Mobile Wallets | 70% |

| Europe | 28% | Wearables, Open Banking | 68% |

| APAC | 35% | QR & Super Apps | 82% |

| MENA | 20% | NFC & Account-to-Account | 56% |

Contactless payments aren’t a trend, they’re the market standard now. Here are the key contactless payment market trends and growth statistics:

The growth of contactless payments is fueled by consumer expectations, real-time rails, and open banking APIs.

For banks in the U.S. and Europe, the challenge is not adoption; it’s acceleration. The winners will be those who turn payment systems into value ecosystems with personalization, security, and rewards at their core.

Why Contactless Payments Are Rising

Speed, Security and Simplicity. That’s the trifecta driving global adoption.

Today’s consumers prefer tap-to-pay and mobile contactless payment apps because they eliminate friction. Merchants prefer them because they increase checkout speed by up to 40%.

For banks and fintechs like ours, contactless offers something more valuable: data and engagement. Each tap or scan tells a story about customer behavior, while enabling smarter offers, better risk models, and stronger loyalty programs.

Now, let’s break down the top 15 contactless payment technology trends shaping the future of contactless payments in 2026.

Top 15 Contactless Payments Trends to Watch in 2026

1. Tap & Pay Revolution

Tapping is now the new swiping.

The tap-to-pay revolution continues to dominate payment behaviors globally. Visa’s 2025 report shows that tap payments now account for over 70% of all card transactions.

Banks are rapidly issuing dual-interface NFC cards and enabling mobile tap and pay through wallet integrations. The appeal is clear: faster checkouts, fewer touchpoints, and a cleaner customer experience.

For you, it’s time to integrate NFC and tokenized systems that make every tap not just seamless, but secure.

Also Read: All you need to know about NFC Payments

2. Embedded Payments

Embedded payments have quietly turned apps into banks.

Whether a user orders an Uber, book a hotel, or shop online, they have already used embedded finance. A simple example is a wallet app integrated into the Ola app to enable contactless payments for customers. This is not only convenient for customers but also for the drivers to keep track of their transactions.

Moreover, according to a 2025 Accenture study, the embedded payments market will exceed $360 billion in revenue by 2027.

Banks can lead this shift by powering contactless payment APIs and white-label infrastructure behind popular lifestyle apps.

Fintechs, on the other hand, can collaborate with banks to create invisible payment experiences that enhance loyalty while maintaining regulatory compliance.

The more invisible the payment, the more visible the customer engagement.

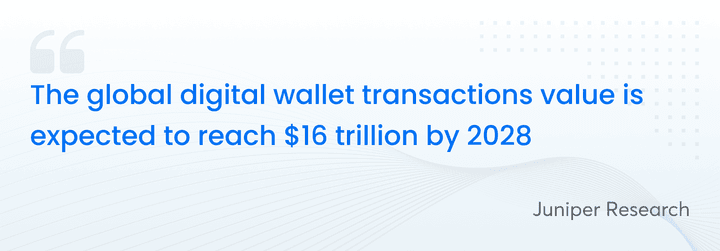

3. Digital Wallet Payments

Digital wallets have become the new banking front door.

As of 2025, more than 50% of global eCommerce payments happen through digital wallets like Apple Pay, Google Pay, or PayPal. Even traditional banks are launching their own white-label wallet ecosystems.

For financial institutions, wallets represent more than convenience; they’re data engines. They enable behavioral insights, rewards integration, and cross-border payment expansion. Plus, advanced digital wallet solutions are convenient & secure and enable rewards integration.

In short, owning the wallet means owning the customer relationship.

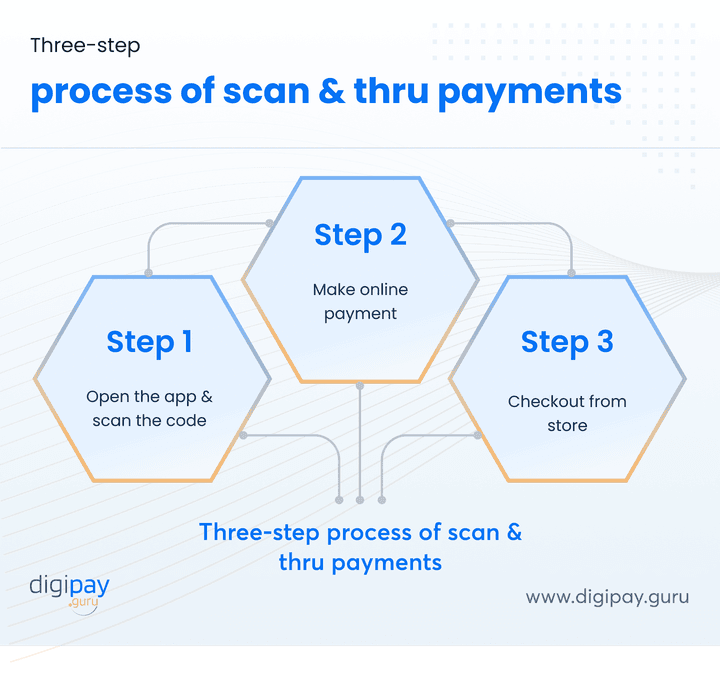

4. Scan & Thru Payments

The scan and thru solution has become one of the popular contactless payment trends! The main reason is its self-checkout and billing capabilities. A study by NRF mentions that 62% of people find self-checkout systems have improved their overall shopping experience.

Scan, & thru is important because it simplifies transactions and guarantees a lightning-fast, seamless checkout experience in just three simple steps.

5. Biometric Payments

Fingerprints, faces, and voices are replacing passwords.

A 2025 Juniper Research study shows that biometric payments will authenticate over $2.5 trillion in transactions this year. That’s because they combine the ultimate trio of convenience, speed, and security.

Banks are now integrating biometric authentication within mobile banking and contactless payment systems to prevent fraud and meet rising regulatory standards for strong customer authentication (SCA).

PS: Your identity is your new payment method.

Read More: Biometric technology - Enhancing security in digital payments

6. Contactless Wearables

What started with watches is now expanding to rings, bracelets, and even smart clothing.

According to Deloitte’s Fintech Review 2025, wearable payments grew 24% YoY, led by Europe and the U.S.

Banks partnering with wearable brands or offering co-branded NFC devices are gaining visibility and younger customers.

For fintechs, wearables are a gateway to lifestyle integration which makes payments that blend seamlessly with health, fitness, and entertainment apps.

7. Voice-Based Payments

“Alexa, pay my water bill.”

Voice commerce is no longer science fiction. It’s here. Voice-activated virtual assistants like Siri, Alexa, and Google Assistant enable hands-free payments. Users can make purchases simply by speaking requests.

By 2025, voice-based payments are projected to process over $20 billion annually. Banks integrating voice-activated payments through smart speakers and digital assistants are catering to a new kind of customer: one who values speed, convenience, and accessibility.

Voice adds a new dimension to “contactless”: it’s intuitive, inclusive, and instant.

8. Tap-to-Phone (SoftPOS) for Small Merchants

Small merchants are the next big opportunity.

SoftPOS, or Tap-to-Phone technology, lets merchants accept contactless payments on smartphones without extra hardware.

According to Mastercard, SoftPOS adoption grew by 44% in 2024, which makes it one of the most significant cashless payment technology trends for 2026.

For banks and fintechs, SoftPOS bridges the gap between digital inclusion and revenue while turning every smartphone into a contactless machine for small businesses.

9. Account-to-Account (A2A) & Open Banking Payments

A2A is rewriting the rules of payments.

Open banking APIs now allow customers to pay merchants directly from their bank accounts thereby skipping intermediaries.

According to the Open Banking Implementation Entity (OBIE), A2A payments in the UK alone grew 56% in 2024.

And for banks, A2A means faster settlements, lower costs, and greater control over the payment experience.

Hence we can say that A2A is not just innovation; it's the evolution of banking payments.

10. Real-Time Settlement & Instant Payouts

In 2026, waiting for settlements feels ancient.

However, with systems like FedNow (US) and SEPA Instant (EU), real-time payments are becoming the new norm.

McKinsey estimates that real-time settlement adoption has increased by 30% globally over the past year.

Banks can integrate instant settlement modules into their contactless systems, thereby improving liquidity and merchant trust. Because in payments, speed builds loyalty.

11. Blockchain & Tokenization for Security

Security isn’t optional; it’s the backbone in payments.

And blockchain and tokenization continue to redefine trust in contactless payment systems.

By tokenizing card credentials and recording transactions on distributed ledgers, banks can cut fraud by over 40% and reduce reconciliation time drastically.

It’s not about decentralization versus banks: it’s about decentralization with banks.

12. Gamified Loyalty & Rewards

Payments that feel like games drive loyalty that feels effortless.

Gamification in rewards like earning cashback for streaks or unlocking AR rewards is reshaping contactless payment systems with loyalty programs.

Plus, a recent PwC report showed that banks using gamified engagement saw a 22% rise in repeat transactions.

Fintechs can use AI to personalize rewards, while banks can integrate loyalty layers directly into their digital wallet ecosystems.

13. AI-Powered Fraud Detection

AI isn’t replacing fraud teams, it’s empowering them when utilised right.

Advanced machine learning models now come with the capabilities to detect suspicious behavior in real time, using context and transaction history.

In fact, a 2025 FIS Global report found that AI-based fraud detection reduced false positives by 30% across financial institutions.

So, by combining AI with behavioral authentication, banks can maintain a zero-friction, zero-fraud experience. This is a perfect balance between security and convenience.

14. Sustainable & Green Payments

Contactless payments can be climate-conscious too. As it's touch free and digital at the same time.

Banks worldwide are adopting eco-friendly NFC cards, paperless receipts, and carbon-tracked payment dashboards.

According to Mastercard’s 2025 Sustainability Index, 68% of consumers prefer banks that offer green payment options.

For financial institutions, sustainability isn’t just ethics;it’s economics. It builds trust, brand equity, and long-term customer value.

15. AR/VR & Metaverse Payments

The future of payments might not happen in the real world.

With AR shopping and metaverse banking, digital payments are moving into immersive experiences. IDC predicts that metaverse-related payments will exceed $15 billion by 2026.

And forward-looking banks are already experimenting with tokenized, avatar-driven payments by blending real and virtual economies into one financial continuum.

Why These Trends Matter for Banks & Fintechs

Every trend you just read points to one undeniable truth: contactless isn’t just about payments. It’s about possibilities.

Banks and fintechs that lead in these innovations will:

- Expand financial inclusion with mobile-first ecosystems

- Reduce costs through automation and A2A networks

- Strengthen trust with blockchain, AI, and biometrics

- Increase engagement through gamification and loyalty tech

Hence, the future belongs to those who stop following payment trends and start creating them.

How DigiPay.Guru Helps You Lead the Contactless Future

At DigiPay.Guru, we empower banks, fintechs, and financial institutions to build smarter, faster, and more secure contactless payment ecosystems and not just digital payment solutions.

Our platform brings together NFC, QR, biometric, SoftPOS, and A2A capabilities under one white-label suite, thereby enabling seamless interoperability across wallets, merchant apps, and banking systems. And with built-in tokenization, eKYC, and AI-driven fraud detection, you get the speed of innovation without compromising on compliance or security.

So, whether you’re launching your first digital wallet, enabling tap-to-pay for merchants, or integrating real-time settlement and loyalty systems, DigiPay.Guru gives you the flexibility to innovate at your pace.

We don’t just help you keep up with payment trends; we help you set them,while transforming contactless technology into a growth engine for your business.

Conclusion

Contactless payments have become the foundation of modern finance. What began as a convenience has now evolved into the preferred way for people to transact, connect, and trust financial systems.

For banks and fintechs like yours, this transformation brings both responsibility and opportunity. It’s a call to create faster, safer, and more intuitive payment experiences that match the pace of today’s customers.

As technology continues to advance, the institutions that build adaptable, data-driven, and secure ecosystems will set the pace for the entire industry.

At DigiPay.Guru, we enable that leadership. Our advanced contactless and digital payment solutions help you strengthen your digital infrastructure, enhance compliance, and deliver the kind of seamless payment experiences that customers now expect.

The future of payments is clear: connected, secure, and contactless. And with DigiPay.Guru, you’re not just ready for that future; you’re leading it.

FAQs

The biggest contactless payment trends in 2026 include Tap-to-Pay, Digital Wallets, SoftPOS (Tap-to-Phone), Biometric Authentication, Voice-Based Payments, and Account-to-Account (A2A) transfers powered by open banking. These innovations are driving faster, more secure, and seamless transactions. Banks and fintechs are integrating these technologies into their ecosystems to enhance customer experience, reduce operational costs, and strengthen trust across digital channels.

Yes. Contactless payments are among the most secure digital payment methods available today. They use NFC encryption, EMV standards, and tokenization, ensuring each transaction generates a unique code that cannot be reused. When combined with biometric verification and real-time fraud monitoring, banks and fintechs can offer customers both convenience and top-tier security across mobile and wearable payment channels.

Tap-to-Phone (SoftPOS) is gaining traction because it lets merchants accept contactless payments using a smartphone and no additional hardware required. For banks and fintechs, it opens new revenue streams by enabling micro and small businesses to go digital instantly. It’s cost-effective, compliant with PCI DSS, and ideal for driving financial inclusion in both developed and emerging markets.

In 2026, digital wallets are transforming into full-service financial hubs. They’re not just storing cards; they’re enabling cross-border payments, loyalty rewards, tokenized security, and real-time settlements. For banks and fintechs, offering white-label wallet solutions helps strengthen customer engagement, improve retention, and create valuable data insights that drive smarter product personalization.

Absolutely. Real-time payments (RTP) are revolutionizing how contactless ecosystems operate. With instant settlement and 24/7 availability, banks can deliver faster fund access to both consumers and merchants. This shift improves liquidity, builds trust, and enhances the overall value of contactless payment systems, thereby making transactions truly seamless from tap to settlement.

Biometric authentication using fingerprints, facial recognition, or iris scans adds a personalized layer of protection to contactless payments. It ensures that only the authorized user can initiate a transaction, thereby reducing fraud and eliminating password or PIN dependency. For banks, integrating biometrics aligns with global regulatory mandates on strong customer authentication while improving convenience and trust.

Retail, transportation, and hospitality continue to lead in contactless payment adoption, but other sectors are catching up fast. Healthcare providers, entertainment venues, and even public sector services are now deploying NFC and QR-based systems for faster, safer transactions. Banks and fintechs that serve these industries are capitalizing on this growth through customized, sector-specific contactless solutions.

Businesses, especially banks and fintechs should focus on building scalable, API-driven, and interoperable payment ecosystems. This means investing in tokenization, SoftPOS, A2A infrastructure, and real-time settlement capabilities. Partnering with providers like DigiPay.Guru helps businesses deploy compliant, modular, and secure contactless systems that adapt easily to market shifts and customer expectations. The future belongs to institutions ready to evolve before the market demands it.