Behind every successful payment, QR code tap, or wallet recharge is an invisible but critical engine: the Transaction Processing Systems (TPS).

If you’re building digital banking, mobile money, or a fintech platform of any kind, you can’t afford to treat TPS as just a backend detail. When TPS works, your users get instant confirmation. When it fails, they get delays, errors, and a reason to switch to a competitor.

And to serve modern customers’ payment requirements, you need the transaction processing systems (TPS) that are fast, secure, and scalable.

Plus, you need a modern payment system that can support it. Because it’s about making sure every payment is validated, executed, and settled correctly, every single time.

This article will help you understand:

- What TPS means and how it works in modern fintech

- Why speed, security, and scalability matter in a transaction processing system

- How to evaluate a TPS that actually holds up in the real world, and more…

Let’s uncover what a transaction processing system actually is!

What Is a Transaction Processing System in Fintech?

The meaning of a transaction processing system is simple. A Transaction Processing System (TPS) is the core infrastructure in the digital payment system that handles financial transactions in digital environments. It's the silent operator that ensures every action from card swipes to fund transfers happens securely, accurately, and in real time.

The Function of a Transaction Processing System

A fintech TPS:

- Accepts a transaction request (like a payment or transfer)

- Validates the input (check balance, fraud detection, etc.)

- Executes and records the transaction

- Notifies both ends of success or failure

How Transaction Processing Works in Banks and Wallets

A Transaction Processing System (TPS) works as the engine behind your transaction flow. It processes each payment, transfer, or recharge by following a strict sequence of checks and operations in real time or batch, depending on your setup.

Here’s how it works, step by step:

-

Receives a transaction request: From a card swipe, mobile app, web API, POS device, or third-party service.

-

Validates the request: The validity checks include balance availability, transaction limits, KYC status, and fraud risk.

-

Authorizes and executes the transaction: Once cleared from the validation, it routes the transaction through internal rules or external networks.

-

Posts and records: Next, it updates user balances, sends notifications, and logs the transaction in ledgers or audit systems.

-

Responds in real time: At last, it sends confirmation or failure feedback to the user and downstream systems.

How it fits into a bank vs fintech environment

-

In banks, TPS often connects digital channels (apps, APIs, cards) to core banking and settlement systems. It ensures every transaction aligns with ledger integrity and compliance rules.

-

In fintechs, TPS is typically lighter, API-first, and modular, designed to plug into fraud engines, third-party gateways, and wallet services.

Despite the differences in architecture, the core functions remain the same: receive, verify, execute, record, and respond.

In short, TPS is the logic layer that makes your financial product operational, not just functional.

Understanding TPS Types: Real-Time vs Batch Processing

There are two core ways a transaction processing system (TPS) handles payment flows: real-time and batch. Both still exist in modern fintech and banking. The difference isn’t just technical → it’s operational and strategic.

If you're planning to scale or modernize your payment infrastructure, understanding these transaction processing system types helps you make better product, compliance, and architecture decisions:

What Is Real-Time Processing?

In a real-time TPS, every transaction is handled the moment it’s initiated. Here, there’s no delay, and the system checks, authorizes, and confirms the transaction, all within seconds.

When your customer scans a QR code at a store, real-time TPS makes sure:

- The money leaves the user's wallet

- The merchant gets a success message

- Both parties are notified instantly

This is the system behind:

- Mobile wallets (like GPay, bKash)

- Card payments

- Instant bank transfers (e.g., PIX)

- Buy Now Pay Later (BNPL) transactions

P.S. Real-time TPS is essential for any product that promises instant value movement and instant confirmation.

What Is Batch Processing?

Batch TPS works differently. It queues transactions and processes them together at scheduled intervals, often hourly, at the end of the day, or overnight.

It works like scheduled clearing:

- You collect all transactions during the day

- The system runs them in bulk

- The results are posted and reconciled later

You’ll see batch TPS used in:

- Payroll processing

- Utility payments aggregation

- Internal settlement between banks

- Cross-border remittance settlement

P.S. Batch TPS is not outdated, and it’s still the backbone of many large-scale & high-volume banking operations.

So Which TPS is Best For You?

For fintechs: You’ll likely lean heavily on real-time TPS as customers expect speed, and delays cost you trust.

For banks: You’re often managing both real-time as well as batch TPS. Real-time for digital channels. And batch for back-office processes, legacy integrations, and regulatory needs.

For any growing businesS: You need a hybrid TPS that is fast on the surface and structured underneath.

How They Work Together in Modern Systems

Let’s say you operate a mobile wallet:

- A user sends $100 to a friend → processed in real time

- Your platform settles funds with your partner bank → done in batch

This blended architecture gives you the best of both:

- Instant value movement

- And scheduled + reliable reconciliation

Why Speed Matters in Digital Transactions and How TPS Delivers It

Every digital transaction is a test of your system’s reliability. And the first thing users notice before security and design is how fast it responds.

A payment that takes too long feels like a failed transaction. And even if it goes through, slow processing breaks trust. Additionally, once users stop trusting your transaction speed, they start questioning everything else.

So speed is at the heart of payment processing. Here’s why speed matters:

Slow Transactions Create Friction and Risk

When your TPS lags, the effects ripple across your entire operation:

- Users retry payments, which leads to duplicates and reversals

- Your support team is flooded with “Did it go through?” requests

- You lose throughput, which directly limits revenue

- Manual intervention opens up security and compliance risks

All in all, every extra second a transaction takes is a moment of doubt in your customers. But TPS solves this problem. Here’s how!

TPS Is What Makes Instant Possible

A real-time TPS clears transactions within milliseconds. It takes a user-initiated request, validates it, routes it, posts it, and sends confirmation, often faster than the user can lock their phone.

This is what powers smooth user flows in:

- Wallet transfers

- QR-based merchant payments

- Card transactions, and

- API-triggered disbursements

Transaction speed builds confidence, confidence builds habit, and habit is what keeps users loyal.

How TPS Actually Delivers Speed

A fast transaction processing system (TPS) is possible with smart architecture. It comes with:

- In-memory processing so data doesn’t wait on disk

- Parallel execution, so multiple transactions can be processed simultaneously

- Asynchronous APIs to avoid blocking other requests during validation

- Low-latency data paths so that you can navigate from device to cloud to core in milliseconds

These architectural choices reduce drag at every layer, so you can move thousands of transactions per second without slowdown.

How TPS Ensures Secure Transactions

Every transaction carries risk when it comes to digital payments. Even a single fraud, misuse, error, or compliance gap can cost you money, credibility, and even your license.

That’s why a secure transaction processing system (TPS) is non-negotiable for your payment system

And another important thing about security is: It doesn’t live in one module. It needs to be embedded across your entire transaction flow, from the first request to the final ledger update.

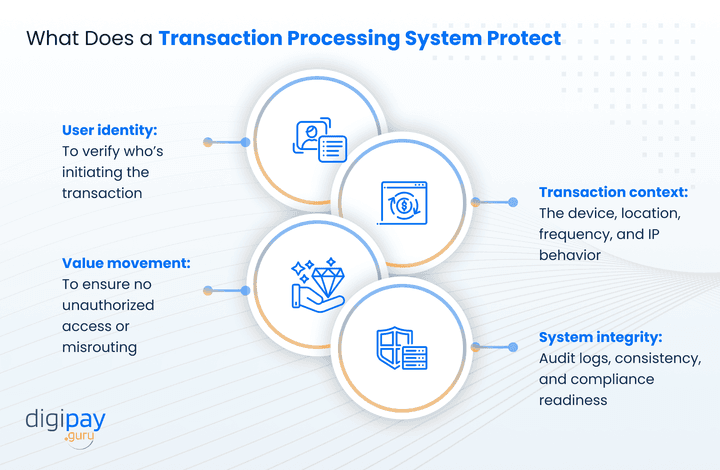

What TPS Secures (and Why It Matters)

A modern TPS protects:

- User identity: To verify who’s initiating the transaction

- Transaction context: The device, location, frequency, and IP behavior

- Value movement: To ensure no unauthorized access or misrouting

- System integrity: Audit logs, consistency, and compliance readiness

If any part of this chain breaks, you can face serious exposure to fraud, penalties, or operational failures. And in highly regulated markets of fintech, that can cost more than money.

Built-In Protections of a Secure TPS

A high-trust TPS system will have:

- End-to-end encryption: So no one can intercept or tamper with transaction data

- Tokenization: Replaces sensitive user data with secure placeholders

- Real-time velocity and anomaly checks: Stops abuse before it escalates

- Access control: Role-based permissions and isolation of critical functions

- Audit trails: Every action is clearly logged, and every anomaly is trackable

Compliance is a Mandatory Requirement

For digital payment businesses like yours, regulators expect your platform to be secure by design. That’s where TPS can help you. A strong TPS helps you stay ready for audits, reduce false positives in fraud detection, and align with standards like:

- PCI-DSS

- GDPR

- PSD2

- AML / CFT directives

It’s not just about passing checks; it’s about proving that your system takes protection seriously, every second, every transaction.

Real Security Means Real-Time Protection

The threat surface is expanding with the increasing number of digital payments being processed every day. Your TPS needs to defend these threats in real time and not just report after it's all done & losses have been incurred.

That means:

- Scanning patterns across multiple transactions

- Blocking suspicious flows without stopping legit ones

- Enforcing business rules instantly, at scale

How a Good TPS Handles High Volumes and Future Growth

If you’re planning to scale, your transaction processing system has to support it rather than just trying to survive the growth.

Because volume is only part of the equation. And growth means more users, more products, more currencies, and more edge cases. If your TPS wasn’t built to scale as you grow, it’ll break down under the weight of your own progress.

What Growth Actually Looks Like in Fintech

- A festival campaign drives 10x the normal transaction traffic

- Your product goes live in a new region seamlessly with local settlement rules

- You onboard a new partner who needs hourly reconciliations

- A telecom client initiates 100K balance top-ups all at once

And the truth is: growth doesn’t wait for your infrastructure to catch up. So, your TPS needs to scale with you, not against you.

How a Scalable TPS Responds to Growth

A high-volume TPS should be able to:

- Auto-scale with transaction spikes

- Maintain consistent latency under load

- Handle multi-tenant environments (B2B2C use cases)

- Support regional failover for disaster recovery, and

- Enforce business logic without slowing throughput

How TPS is Architected for Scale from Day One

Scalability isn’t a feature you integrate later. You need to design it in-built from the very beginning.

That includes:

- Cloud-native deployment

- Stateless microservices that can spin up fast

- Distributed queues to manage large flows, and

- Load balancing that routes traffic intelligently

Without this, even a few months of successful growth can expose system limits you didn’t plan for. On the contrary, a good TPS doesn’t ask "how many users today?" It’s built for what you haven’t launched yet.

How to Choose the Right TPS for Your Bank or Fintech

All TPS software is not created equal. And your CTO shouldn’t rely on a provider’s marketing deck to figure it out. Here’s how you can choose the right TPS for your bank/fintech:

Questions to Ask Before You Commit to a TPS

- Can the system handle real-time loads beyond 10K TPS/sec?

- How does it handle fraud scenarios and suspicious patterns?

- Does it have built-in compliance support (PCI DSS, AML, PSD2)?

- What’s the fallback plan during an outage?

- Does it offer TPS visibility to product or ops teams?

If a TPS provider can’t give real-world proof and answers to these questions, you can safely assume they can’t deliver a reliable TPS at scale.

Top 5 Benefits of a Robust TPS

A transaction processing system directly affects how your platform performs, how your users feel, and how confidently you can scale.

If you're building for long-term impact, these are the transaction processing system benefits that separate a solid system from a fragile one.

1. Real-time speed

With TPS, transactions are processed, authorized, and confirmed in milliseconds. This improves your customer experience and reduces support tickets.

2. Security at every layer

From encryption to fraud detection, a secure TPS protects user data and transaction flows without slowing down your operations.

3. Compliance readiness

A well-structured TPS supports audit logs, KYC/AML rules, and global standards like PCI-DSS and PSD2 out of the box. This makes it compliance and regulatory-ready at all times.

4. Scalability under pressure

Whether you're onboarding 1,000 users or handling a national disbursement, a strong TPS keeps performance consistent. It scales as your transaction volumes increase without disrupting your operations.

5. Operational resilience

With TPS, you get built-in redundancy, auto-recovery, and monitoring, which ensures your platform stays up even when demand spikes or services fail.

These benefits don’t just improve your system; they protect your business, your users, and your ability to grow without friction.

Why TPS Is the Most Strategic Layer in Your Stack

You can launch new features, revamp your UI, and expand into new markets, but if your TPS isn’t solid, none of it scales safely.

Your TPS is more than just a backend service. It’s the foundation everything else relies on.

Here’s why TPS is strategic, not just technical:

-

It defines the customer experience - Users don’t blame the payment gateway when something’s slow; they blame your brand. TPS determines how fast, smooth, and reliable your app feels.

-

It enforces business rules - Whether it’s spend limits, tiered KYC, or partner commissions, your TPS governs the logic behind how money moves and how compliance is enforced.

-

It prevents risks and security issues - Fraud checks, velocity limits, and user behavior rules all live inside or alongside TPS logic. If it’s weak, your security is weak.

-

It sets the foundation for scale - When your transaction volume grows 10x, your TPS is either ready to scale seamlessly or it’s your failure point. A strong TPS allows your system to scale as you grow.

So, if you’re serious about scale, security, or seamless experience, TPS is where you start, and what you never outgrow.

See How DigiPay.Guru Powers Secure, Scalable Transactions With TPS

If you're building a wallet, card platform, remittance app, or digital banking system, the strength of your transaction processing system determines how far you can go and how fast you can get there.

At DigiPay.Guru, we don’t treat TPS as an add-on. It’s built into the core of every solution we offer, from mobile money platforms to agency banking and prepaid card systems. Our payment architecture is designed for real-time performance, multi-country compliance, and scalable transaction handling from day one.

Whether you're just launching or preparing to expand into high-volume markets, our payment systems are engineered to move with you: securely, quickly, and without compromise.

Opt for DigiPay.Guru today, and let’s lead your business towards success with speed, security & compliance, and scalability.

FAQs

A Transaction Processing System (TPS) in fintech is the backend engine that processes, validates, and records every financial transaction in real time or in batches. In fintech, it powers everything from wallet transfers and card payments to loan disbursements and merchant settlements while ensuring each transaction is secure, accurate, and traceable.

There are two main types:

- Real-Time TPS: Processes each transaction instantly (e.g., mobile payments, QR scans, P2P transfers)

- Batch TPS: Groups transactions and processes them at intervals (e.g., payroll, internal settlements)

Most modern fintech platforms use a hybrid approach to balance speed and operational efficiency.

A robust TPS helps you:

- Process high volumes of transactions with speed and reliability

- Enforce business rules and compliance checks automatically

- Prevent fraud through real-time monitoring

- Scale operations without compromising performance, and

- Maintain complete audit trails and reporting for regulators

If you leverage these key benefits, you can win the market strategically.

TPS security is embedded at every layer: encryption, user authentication, fraud detection, access control, and transaction logging. It ensures that only valid, compliant transactions are processed and blocks suspicious activity before it escalates.

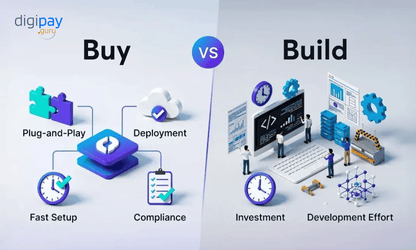

Technically, yes, fintech startups can build their own TPS. But it's resource-heavy and high-risk. Building a secure, scalable TPS in-house requires deep knowledge of real-time architecture, compliance, and risk management. Most startups partner with providers like DigiPay.Guru to leverage proven infrastructure and accelerate time-to-market.

To build one, you’ll need:

- A secure, low-latency architecture

- APIs for transaction intake and validation

- Business logic engines

- Real-time fraud detection layers

- Ledgering and reconciliation modules, and

- Regulatory compliance mechanisms

However, unless you’re a core banking company, building from scratch isn't recommended, and partnering is faster and safer.

- Bkash (Bangladesh): Mobile wallet TPS for millions of daily transfers

- Paytm / GPay (India): Real-time payment processing for consumers and merchants

- Visa/Mastercard networks: Card TPS platforms handling global transactions per second

- Digipay.Guru solutions: TPS built into prepaid card, agency banking, and mobile money platforms across emerging markets

Integrating the transaction processing system based on your business needs will make your business shine.

Look for a system that offers:

- Real-time and batch processing capabilities

- Built-in security and compliance features

- Scalability for high-volume growth

- Modular integration with your existing stack

- Transparent performance metrics and vendor support

If your TPS can’t handle your future load or regulatory demands, it will slow you down or, worse, expose you to risk.