The cross border payments market is expected to reach $345.42 Billion by 2033!

That growth will not go to the providers who simply process more transactions. It will go to the ones who deliver cross-border payments that feel reliable. Because reliability is what drives repeat usage, reduces disputes, and builds long-term trust.

And in the next phase of cross-border, your customers will not compare you against other remittance providers. They will compare you against the best payment experience they already know is fast, trackable, and predictable.

That is exactly where transparency, speed, and security become non-negotiable.

The good news is you don’t need to compromise one pillar for another.

With the right international remittance infrastructure, you can offer transparent, fast international payments, move closer to instant cross border payments, and strengthen compliance without slowing down operations.

In a market this competitive, that combination is what turns cross-border into a scalable growth channel.

In this blog, you’ll learn:

- What transparency, speed, and security look like in real cross-border operations

- Why they matter commercially, and

- How to deliver all three at scale without increasing complexity

Let’s begin.

What Are Cross-Border Payments?

Cross border payments meaning is simple:

It refers to any payment where the sender and recipient are in different countries. In most cases, currencies are different too.

But in operations, cross-border is never a straight road. It is more like a highway with toll gates, diversions, and multiple checkpoints.

A typical transfer may involve:

- The sending bank or wallet

- A remittance partner or settlement institution

- FX conversion providers

- Intermediary banks (sometimes multiple)

- Local payout banks or mobile money providers

- Compliance and regulatory verification

That is why cross border payment processing often feels unpredictable when legacy rails are involved.

Types of Cross-Border Payments

You will commonly see these types of cross border payments in the market:

-

B2C remittances: Individuals sending money to family abroad

-

B2B payments: Supplier payouts, international trade, gig payouts

-

Wholesale cross border payments: Large-value institutional transfers

-

Low value cross border payments: High-volume, small-ticket transactions

-

Cross border card payments: International card settlement and merchant acquiring

-

Cross border QR payment: QR-based acceptance across borders in select corridors

Each segment has different requirements. But one expectation stays the same: make it fast, clear, and safe.

This expectation is the reason many institutions are shifting towards a modern cross border payment system that supports automation, tracking, and stronger risk control.

Why Transparency, Speed, and Security Matter in Cross-Border Payments

If cross-border is part of your business model, these three pillars ( transparency, speed, security) decide whether you grow or plateau.

Here is what happens when one pillar breaks:

-

If transparency breaks → you get disputes and churn.

-

If speed breaks → customers lose confidence and switch.

-

If security breaks → you risk fines, shutdowns, and reputational damage.

So yes, these are not “service quality” features. These are survival features.

Moreover, the cross border payments industry is evolving fast. So, customers now compare cross-border experiences against local payments.

And nobody wants a black box transfer.

-

They want a clear timeline.

-

They want tracking.

-

They want visibility on cross border payments fees.

And when they do not get that, they blame you. Not the intermediary bank, FX layer, or the backend.

Your customers treat cross-border the same way they treat food delivery. If the tracking disappears, they assume something is wrong.

And transparency, speed, and security together solve this as they turn your service into a predictable product.

Importance of Transparency in Cross-Border Payments

Now you are clear on the meaning of cross border payments and why transparency, speed & security matter. Next, let’s begin by exploring the first important factor in cross border payments: Transparency:

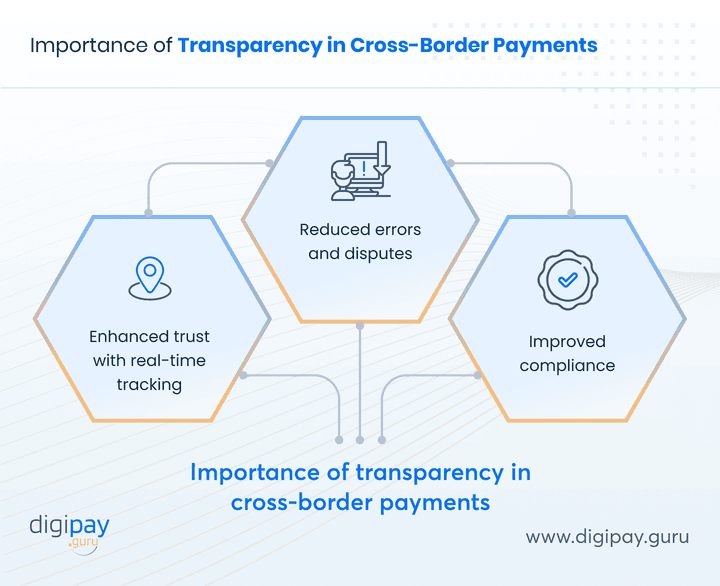

Here’s why transparency is important in cross border payments:

Enhancing Trust with Real-Time Tracking and Reporting

For your customers, tracing their international payments should be as easy as they can track their shipment on Amazon. This is possible with real-time tracking and reporting tools in your remittance system.

When you offer the feature of real-time cross-border payments tracking, your customers can:

-

Check exactly where their funds are at any moment

-

Monitor when payments are initiated, cleared, and received

-

Gain peace of mind about their international transfers

This kind of visibility eliminates the uncertainty in the process and helps you outperform your competitors in the market.

Reducing Errors and Disputes

Clear information means fewer mistakes and conflicts between the parties.

So, your customers must have clear information about:

-

How does your remittance service work?

-

How much time will it take to settle into the beneficiary account?

-

What are the fee structures and ongoing exchange rates?

-

How are you keeping their payment data and funds secure?

This clarity resolves problems faster and prevents minor hiccups from becoming major headaches. And you get happier customers and lower operational costs.

Role of Transparency in Regulatory Compliance

When we talk about finance and that too about moving money internationally, it goes without saying that compliance is integral.

When you keep all the compliance regulations in practice and maintain clear records of all cross-border transactions happening via your international remittance platform, you can:

-

Meet anti-money laundering (AML) requirements

-

Easily adhere to know-your-customer (KYC) regulations

-

And demonstrate due diligence to regulators

This way, transparency protects both your business from legal complications and your customers from hidden charges and the stress of delays.

Here’s a quick comparison at different levels of transparency:

| Aspect | Low Transparency | High Transparency |

|---|---|---|

| Fee visibility | Hidden charges | Upfront pricing |

| Tracking | Limited | Real-time |

| Trust | Low | High |

| Customer experience | Poor | Improved |

Takeaway: High transparency turns customer anxiety into confidence. And when your customer can track a payment, they stop panicking and calling support. Instead, they start trusting the platform.

💡Expert Tip

Role of Speed in Cross-Border Payments

Speed is not only about “fast settlement.” Speed is about certainty, predictability, and competitive advantage.

And legacy international payment flows often take 2–5 working days. Some corridors take longer (5-7 days). But customers today do not accept “working days” logic. They want speed because they have urgent needs and cash flow cycles.

That is why instant cross border payments are becoming a core requirement, not a premium add-on.

The points mentioned below explain the role of speed in cross-border payments. Let’s go through them one by one:

Meeting Customer Expectations

In 2026, your customers are used to instant domestic transfers with payment solutions like digital wallets and eWallets. Now, they want the same speed for international payment services.

Besides, there are apps in the market that already offer cross border instant payments. So you need to keep up with the competition and focus on outshining them.

Impact on Business Operations

Instant cross border payments are a big YES for customer satisfaction. But they are also important to improve your business operations.

With fast cross border money transfer, you can:

-

Improve cash flow management

-

Reduce foreign exchange rate risk

-

Use capital more efficiently

Plus, for your B2B customers, faster international payments mean better relationships with global partners and more business opportunities.

Technologies Enabling Faster Payments

Technological innovations are accelerating international transfers, thereby resulting in real time cross border payments for your customers.

Plus, real-time gross settlement (RTGS) systems, blockchain, and improved messaging standards like ISO 20022 are leading the charge. Hence, staying up-to-date with these technologies is crucial.

Remember, it's not about keeping up with competitors. It's about future-proofing your services and meeting evolving customer needs.

Here’s a quick comparison of cross-border payment speed: traditional vs modern payments

| Factor | Traditional Payments | Modern Payments |

|---|---|---|

| Settlement time | Days | Near real-time |

| Liquidity impact | High | Reduced |

| Customer satisfaction | Low | High |

Here is the real insight: Your competitor can match your FX rate. They can match your fees. But they will struggle to match your speed if your infrastructure is better.

Ensuring Security in Cross-Border Transactions

Speed and transparency are the two crucial pillars of cross-border payments, but they can not stand without the third pillar: “Security”.

Your customers trust you with their money, and so you need to protect it at all costs.

In cross border transactions, security goes far beyond “fraud detection.”

It includes the entire governance layer: onboarding verification, AML checks, sanctions screening, watchlist filtering, transaction monitoring, behavioural anomaly detection, plus audit trails, and reporting

Let’s first understand the security challenges in cross-border transactions:

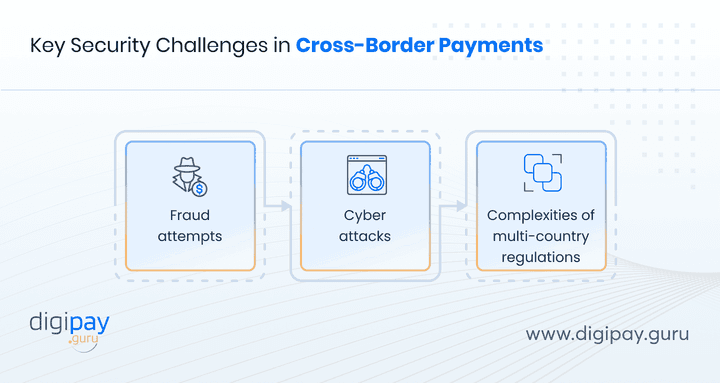

Key Security Challenges in Cross-Border Payments

Cross-border payments face unique security risks. These include:

Fraud Attempts

Cross-border corridors are a prime target for fraudsters because transactions are high-volume and often time-sensitive.

Fraud attempts typically show up as identity misuse, fake beneficiaries, mule accounts, or transaction manipulation to bypass controls.

Cyber Attacks

Cross-border payment systems connect multiple partners, APIs, and networks, so the attack surface becomes wider than domestic payments.

Cyber attacks can lead to data breaches, account takeovers, transaction tampering, and service downtime that directly impacts trust and compliance exposure.

Complexities of Multi-country Regulations

Every corridor involves different AML rules, sanctions requirements, reporting standards, and data privacy laws.

These regulatory mismatches can slow payouts, increase false positives, and create compliance risks if screening and monitoring are not corridor-aware.

As transactions cross borders, they often pass through several intermediaries. And each step is a potential vulnerability.

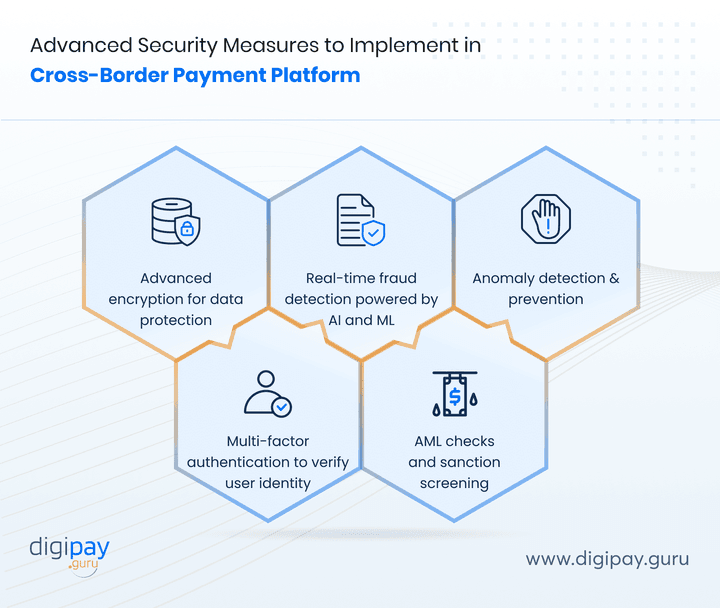

Implementing Advanced Security Measures

To overcome these security challenges, you need advanced security measures such as:

-

Advanced encryption for data protection

-

Multi-factor authentication to verify user identity

-

Real-time fraud detection powered by AI and ML

-

AML checks and sanction screening

-

Anomaly detection & prevention and more....

All the above security measures can make your cross border payment system extremely secure, effective, and reliable.

Regulatory Compliance and Security

Security in cross-border payments isn't just about stopping threats. It's about complying with global regulations. This includes regulatory requirements like AML and KYC requirements, as well as data protection laws like GDPR and CCPA.

Plus, robust security measures in cross-border payments help you avoid fines and reputational damage from breaches or non-compliance.

Major Challenges in Cross-Border Payments

Cross-border payments don’t fail because the intent is wrong. They fail because the ecosystem is complex.

But the complexity is not the problem. The unpredictability is.

Here are the biggest cross border payments challenges that directly impact your business:

Too Many Intermediaries

A single cross-border transfer may pass through multiple banks, processors, and settlement partners. This creates blind spots in tracking and increases the chance of delays, deductions, or routing failures.

Unclear Fees and FX Margins

One of the biggest reasons customers lose trust is fee uncertainty. If the sender can’t see a clear breakdown of charges and exchange rates upfront, they assume hidden markups.

This is why cross border payments fees must be transparent from the start.

Slow Settlement and Unpredictable Timelines

Traditional payment rails often work in batch cycles, not in real-time. So even when the payment moves, the confirmation and settlement may take days.

For modern users, this feels outdated, especially when they expect instant cross border payments and trackable delivery.

Compliance Bottlenecks and False Positives

Cross-border transactions require stricter checks because they carry higher regulatory risk. But manual reviews and high false-positive rates can slow legitimate transactions.

This creates a tension:

-

Customers demand speed

-

Compliance demands controls

Fragmented Tracking and Poor Transaction Visibility

Many legacy setups do not support end-to-end tracking. So the sender sees generic statuses like “processing,” without knowing what’s happening.

This reduces trust and increases support tickets, like: “Where is my transfer?” and “Has the beneficiary received it?”

Security Threats Across Borders

Cross-border systems attract fraud attempts and cyber risks, especially when multiple APIs and partners are involved. Security also becomes harder due to varying regulatory rules across jurisdictions.

This includes:

-

Fraud and mule networks

-

Cyber attacks on payment infrastructure

-

Corridor-based sanctions and AML exposure

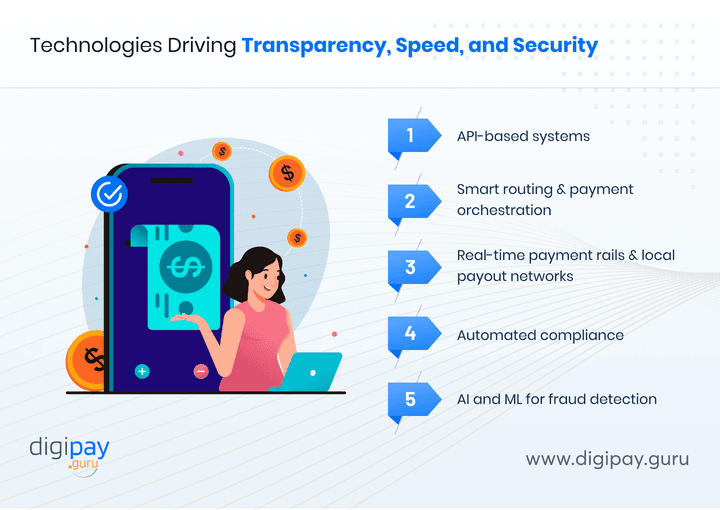

Technologies Driving Transparency, Speed, and Security

Cross-border payments don’t improve through “effort.” They improve through better infrastructure.

So, when the underlying system is modern, your payments become easier to track, faster to settle, and safer to run, without piling up operational workload.

Here are the key technologies that directly strengthen transparency, speed, and security in cross border payments:

API-based Systems

API-first platforms connect banks, payout partners, FX providers, and compliance tools through a single orchestrated layer. This improves cross border payment processing because statuses, fees, and confirmations can be updated in near real-time.

In turn, it leads to:

-

Faster partner integration

-

Real-time tracking + status updates

-

Automated payment flow handling

Smart Routing and Payment Orchestration

Smart routing automatically chooses the best payout route based on cost, speed, success rate, and corridor availability. This reduces failed transactions and improves straight-through processing (STP), which is essential for real time cross border payments.

Plus, it helps you:

-

Avoid unreliable intermediaries

-

Improve delivery predictability, and

-

Reduce unnecessary payout delays

Real-time Payment Rails and Local Payout Networks

Instead of relying only on traditional correspondent banking, modern cross-border platforms use local payout rails where possible. This is how institutions move closer to instant cross border payments and cross border instant payments in supported corridors.

Automated Compliance (AML Screening + Sanctions Checks)

Automation applies compliance controls at the right stage of the payment journey, without turning every transfer into a manual review. This makes it easier to scale secure cross border financial transactions without slowing legitimate transfers.

Key benefits include:

-

Faster AML screening

-

Lower false positives

-

Consistent checks across corridors

AI and ML For Fraud Detection

AI/ML models detect suspicious behaviour patterns that rule-based systems often miss. These systems strengthen security by identifying anomalies like mule accounts, repeated beneficiary manipulation, or abnormal corridor patterns.

This improves fraud prevention, risk scoring accuracy, and security without friction

Here’s a quick table to understand the technology impact on the 3 pillars: Transparency, speed, and security:

| Technology | Transparency | Speed | Security |

|---|---|---|---|

| AI & ML | High | Medium | High |

| Blockchain | High | High | High |

| Fintech platforms | Medium | High | High |

| API-based systems | Medium | High | Medium |

What this means in practice:

-

AI improves security and reduces fraud losses.

-

Blockchain can improve traceability and settlement, but corridor adoption varies.

-

Fintech platforms enable scale through pre-built networks.

-

API systems allow automation, orchestration, and faster processing.

So the real message is this: Technology is useful, but architecture decides outcomes.

💡Expert Tip

How DigiPay.Guru Enables Transparent, Fast, and Secure Cross-Border Payments

DigiPay.Guru is a leading cross border payment provider that enables you to offer faster, secure, affordable, interoperable, and transparent cross-border payments to your customers with our end-to-end international remittance solution.

We are fast

-

We offer real-time cross-border payments by streamlining the processes that traditionally involved multiple banks, intermediaries, and currencies.

-

Our system connects directly to various global payment networks, which allows for real-time or near-instant transfers.

We are transparent

-

We offer real-time tracking of transactions from initiation to completion

-

We ensure a transparent fee structure and exchange rates

-

We clearly inform how we can keep funds and data secure

We are secure

-

We offer robust security features like biometric authentication, advanced encryption algorithms, AML screening, and more

-

Plus, we are PCI SSF compliant. Along with it, we are ISO27001 and SOC Type II certified.

-

We also offer anomaly detection & prevention, periodic web pen-testing, periodic SAST, DAST, SCA scans, and straightforward authorization rules

Read More: Glimpse into Digipay.Guru's Cross-Border Payment Platform

Conclusion

Cross-border payments are no longer judged only by whether money reaches the destination. They are judged by how confidently you deliver the entire experience.

When customers can clearly see fees and FX rates, track the payment status in real time, and receive funds without uncertainty, trust builds automatically. And trust is what drives repeat usage, higher transaction volume, and long-term corridor growth.

For your business, this shift creates a clear priority: you need cross-border infrastructure that consistently delivers transparency, speed, and security together.

That is exactly where a modern remittance platform makes a difference. DigiPay.Guru’s advanced international remittance solution helps you offer transparent, fast international payments, move closer to instant cross border payments, and strengthen compliance with built-in controls.

So you can expand your business operations effectively, increase customer retention, boost revenue by 10X, and achieve long-term success.

FAQs

Cross-border payments are transactions where the sender and receiver are in different countries, often involving currency conversion. These payments may pass through multiple banks or payout partners, which can impact fees, speed, and tracking.

Transparency builds trust by clearly showing fees, FX rates, and transaction status end-to-end. It reduces disputes, prevents “hidden charge” complaints, and improves repeat usage, especially in remittance and high-volume payout corridors.

Speed directly impacts customer satisfaction and business cash flow. And faster settlement reduces payout anxiety, improves retention, and supports time-sensitive use cases like salary remittances, emergency transfers, and supplier payments.

Cross-border payments face risks like fraud, mule accounts, identity misuse, sanctions exposure, and AML violations. Since multiple jurisdictions and partners are involved, stronger monitoring and controls are essential to prevent losses and compliance breaches.

Fintech platforms provide real-time tracking, clear fee/FX disclosure, and structured status updates across payment stages. This gives customers and operations teams better visibility and reduces support tickets caused by tracking gaps.

API-based orchestration, smart routing, and local payout rails are key enablers of faster cross-border payments. These reduce dependency on slow correspondent banking flows and improve straight-through processing (STP) across corridors.

AI detects unusual patterns and suspicious behaviour that traditional rules may miss, like mule networks or repeated beneficiary manipulation. It also improves risk scoring and reduces false positives, thereby helping security without slowing genuine transfers.

Common challenges include unclear fees, delayed settlement, failed payouts, limited tracking, reconciliation complexity, and compliance bottlenecks. These issues increase operational cost and reduce customer trust if not handled through modern infrastructure.

Cross-border payment systems are shifting toward real-time tracking, multi-rail routing, and automated compliance. The market is moving from batch-based processing to smarter orchestration that delivers speed, transparency, and stronger control.

DigiPay.Guru’s advanced international payments solutions help you deliver transparent, faster, and secure cross-border payments through smart routing, real-time tracking, and built-in AML/compliance controls. This allows banks, fintechs, and remittance businesses to scale corridors without increasing operational complexity.