Let’s face it. The way financial institutions operate today is fundamentally different from even five years ago. Why? Because APIs have reshaped the rules of engagement.

The global API banking market was valued at $3.5 billion in 2023 and is projected to reach $17.5 billion by 2032. That’s not just growth; it’s a wake-up call for every bank and fintech leader looking to stay relevant.

As a bank or fintech, you’re likely struggling with one big question: How do we innovate faster, partner smarter, and meet customer expectations that shift by the quarter? The answer often starts with API banking.

Financial technology innovation doesn’t come from building everything in-house anymore. It comes from connecting the right dots securely, quickly, and intelligently.

This blog breaks down

-

The basics of banking and financial APIs

-

Types of banking and financial APIs

-

How Can Fintech Companies Use Banking APIs?

-

Benefits of Fintech APIs and Banking Sector, and

-

Challenges and use cases around it

Let’s begin with the basics of APIs in banking and finance!

Introduction to Banking and Financial APIs

Now, before we get deeper into banking and financial APIs, let's clear out the basics first.

What Does API Stand for in Banking?

API stands for Application Programming Interface. In banking, it’s a technology that allows different software systems to talk to each other in real-time. It’s like a secure translator between your bank’s core system and any external or internal app.

So when you hear "bank transfer API" or "bank account API," it’s not just tech lingo. It’s the infrastructure that lets a mobile wallet send money instantly or a budgeting app pulls live account balances.

What are Banking APIs?

Banking APIs help banks like yours to communicate (share the data) with third-party fintech companies. The main aim of these APIs is to make the baking process easy, seamless, and convenient for your users.

With the help of banking APIs, banks like you can improve their services & increase revenues. At the same time, third-party fintech companies can utilize the shared data for innovation & expansion of their services and improve the customer experience.

For example, a banking API is used to create a mobile banking fintech app for customers. This app allows them to enjoy various banking services, such as connecting their cards to the app, checking account balances, paying bills, transferring funds, and many more, at their fingertips.

How Do APIs Work in Banking and Finance?

At a technical level, APIs follow a request-response structure. A fintech app sends a request (e.g., "get account balance") to a bank’s API. If your customer has authorized access, the API responds with real-time data.

But you don’t need to code to understand the upside. APIs eliminate the old-school, costly spaghetti integrations and replace them with streamlined plug-and-play workflows. It’s API-driven innovation at its finest. Just connect → launch → scale.

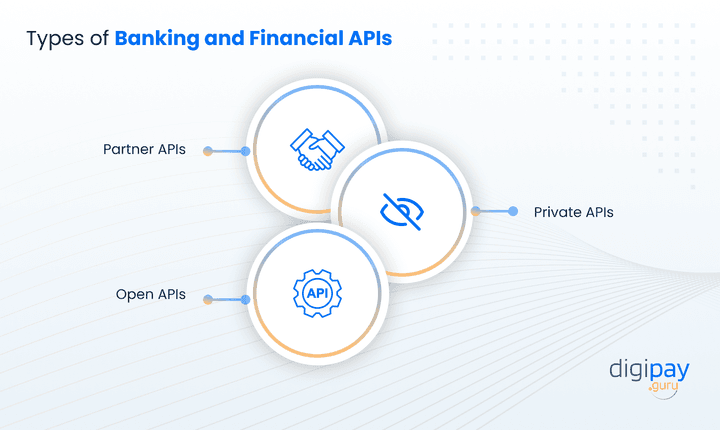

Types of Banking and Financial APIs

The banking and financial API helps various companies in creating seamless and innovative customer experiences.

There are 3 different types of banking and financial APIs. They are

1. Partner APIs

Here, the bank uses an API only for a specific set of third-party companies. And then the bank partners with these companies to solve a common problem. Partner APIs help banks like you to give exclusive access to their data to only these sets of companies.

For example, if a bank receives numerous applications for credit cards. In that case, the bank can partner with the desired third-party companies to automate the data collection process of credit card applications.

2. Private APIs

The banks create internal APIs for improving the operations of the banking services that they provide. These are the private APIs.

Used internally by a bank to connect legacy systems, CRMs, mobile apps, and more. These are the building blocks of digital transformation.

Banks create these APIs so that they do not need to make new systems and software every time they want to make enhancements to their services. This way, it becomes efficient and cost-effective for them.

3. Open APIs

The APIs through which banks can share their user data with third-party companies have become more prevalent nowadays. These are the open APIs. Through this API, the data can be granted to any third-party company, irrespective of any prior formal relationship with the bank.

Read More: Mobile banking: Transforming banks across the globe

Security in Financial APIs

You might wonder, "If we open up APIs, aren’t we also opening ourselves to risk?"

Not if it’s done right.

Leading fintech APIs providers and banks use tokenization, encryption, OAuth2, mutual TLS, and rate limiting to ensure airtight security. APIs often improve security by replacing fragile screen scraping or batch file transfers.

In fact, API integration in banking often becomes the most traceable, auditable, and secure method of data exchange.

How Can Banking APIs Be Used by Fintech Companies?

For fintech companies, the process remains the same as the third-party company and bank relations. Here, the banks and fintech companies communicate or share data and services through an API.

To understand it better, let's break it down into three simple steps:

-

The fintech companies contact a financial institution or bank for the user data they need and pay a fee attached to it.

-

The financial institution or bank shares (opens) an API for them to grant access to their user data (sensitive or non-sensitive)

-

The fintech companies utilize these data to improve their application processes, expand their customer base, and bring new innovative services to users.

APIs help them get to the same page and interpret each other’s functioning, programming languages, and various other technical aspects. It enables safe communication of data between both parties and keeps financial security in check.

Read More: Impact of fintech in banking sectors

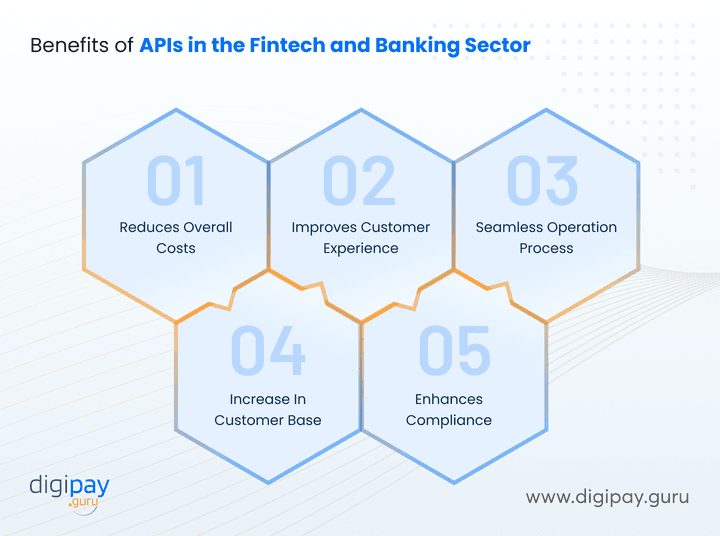

Benefits of APIs in the Fintech and Banking Sector

APIs have created an uplifting environment for both banks and fintech companies. The API benefits for banks and fintechs are

Reduces Overall Costs

A single API can help in developing multiple products and services. It means that the costs involved in creating various features and functionalities all from scratch will drop significantly.

And even if the usage of an API may have a certain fee, it is still less costly than maintaining your own infrastructure and fintech integrations of complex functionalities needed in the fintech application

Improves Customer Experience

Sharing user information is always a sensitive topic, and in the past, banks didn’t feel comfortable sharing customer data. But now, with fintech API and its more secure frameworks, banks feel safer sharing the information. As a result, the customers can ask for their data for any third-party fintech apps that they want to use.

The fintech apps mainly work on making the customer experience better and more innovative. APIs enable slick user journeys through capabilities like real-time payments, instant onboarding, personalized dashboards, or budget tracking.

Seamless Operation Process

The fintech apps provide mobile banking, online banking, wallet services, and much more. APIs allow fintech and banks to provide banking services quickly and efficiently.

Internal APIs make data flow smooth across departments. External APIs reduce back-and-forth with partners. This creates a seamless operation process for the customers.

APIs enable users to manage their banking operations directly through their mobile devices. Plus, it is safe and can be done from anywhere and at any time. This way, the customers can save so much of their time and effort.

Increase In Customer Base

As discussed, the web service API connects the banks and fintech to communicate the data of the customer onboarding in banks and related services with each other via the APIs. It happens because of the increase in demand for third-party applications in the current digital scenario.

It ultimately benefits banks and fintech companies to enhance their services and bring the latest innovations into the market. It drives your users to keep using the services and converts non-users into users. Hence, the customer base increases automatically.

Helps With Compliance

Open Banking APIs ensure data sharing is consent-based and traceable. Banks with APIs can also share their user data with the government and security regulators. So various security standards like GDPR and PCI DSS are also kept in check.

This way, the security risks while sharing sensitive information with third-party companies are resolved. APIs also help in complex security compliances such as KYC, data encryption, and security authentication to make digital fintech solutions more secure.

Challenges and Considerations

APIs are powerful, but they aren’t a silver bullet. Here’s what to plan for:

Security Lapses Without Proper Governance: Unmonitored APIs are like unlocked doors. Implement API gateways, role-based access, and regular audits.

Compliance Complexity Across Regions: Europe’s PSD2 isn’t the same as Brazil’s Open Finance or India’s Account Aggregator framework. Hence, local expertise matters.

Vendor Lock-In or Over-Dependence: Using a single API banking platform for everything? That’s a risk. Build with modularity and exit options in mind.

Internal Resistance to API-First Transformation: Change towards an API-first environment can be a problem. Success depends on executive buy-in, agile teams, and cross-functional collaboration.

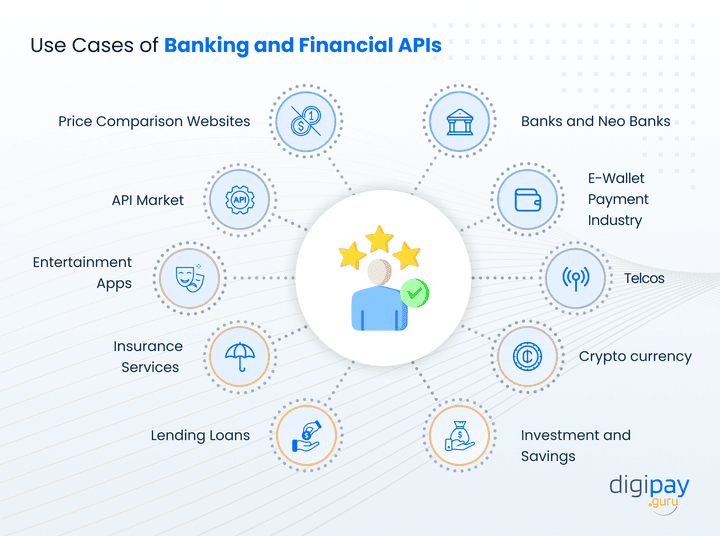

Use Cases of Banking and Financial APIs

This is where theory becomes reality. Here’s how APIs in fintech and banking shine in practice:

Empowering Banks and Neo Banks

Banks often have their own APIs that they usually provide to non-banking businesses. It allows them to offer various banking and financial services to their customers. This helps banks to expand their service horizons.

Similarly, neobanks (digital banks with no branches) are backed by various banks (having multiple physical branches) and integrate the banking APIs to provide major banking services in digital form.

Now, the neobanks are able to offer services like personal checking accounts, money transfers, loans, and savings accounts without any physical branch. Some popular API-enabled neobanks are Chime, Monzo, Varo, and Revolut.

E-Wallet Payment Industry

With digitalization, the use of online wallet apps has increased significantly. These apps aim to provide innovative and seamless payment services to their users by integrating banking APIs.

For instance, apps like Google Pay, PayPal, Venmo, Square, and Stripe allow users to send money domestically and internationally directly through their bank accounts.

Telcos

Want to add lending, micro-insurance, or top-ups into mobile apps? Telcos do it via fintech APIs and companies that offer plug-and-play services.

Plus, telecom companies integrate banking APIs to provide their customers with multiple payment options. Verizon is one example of a telecom company using APIs.

Also, there are various payment apps that integrate telecom APIs with their app to enable users to make their recharges and bills through one single app only.

For example, Ding is a mobile recharge app that helps customers make recharge payments for friends and family in almost 150+ countries and with more than 500+ telecom operators integrated into the app.

Cryptocurrency

Various cryptocurrency apps, like Binance, Coinmama, Zebpay, and WazirX, allow users to add their bank details and debit/credit cards, deposit funds, make investments, and withdraw money in the accepted currency. This is possible due to banking APIs integrated into these apps.

Investment and Savings

Fintech has brought a revolution in the investment and savings industry. There are numerous apps in the market that enable users to invest their money. APIs make these apps so smooth to use that even beginners can invest and save their hard-earned money with ease.

Some of the best examples of investment and savings apps using banking APIs are Stash and Betterment.

For Lending Loans

APIs help banks/fintechs like you streamline and simplify the loan process for customers based on their earnings and credit scores. It makes the process of lending money quick and easy for both the banks and customers. Also, it helps loan providers to expand their boundaries of availing credit for the underserved population.

Examples of API-backed loan apps are Brigit, Bankrate, and Aella Credit.

For Insurance Services

Insurance companies use banking APIs to provide insurance services quickly and effortlessly. Also, certain InsurTech companies collaborate with insurance companies and banking institutions through APIs to expand their services and boost automatic insurance processing.

Some of the best examples of companies providing API-integrated insurance services are Lemonade and PolicyGenius.

Entertainment Apps

Nowadays, online entertainment is increasing. So, people prefer watching TV shows and movies on their mobile devices only. OTT platforms like Netflix, PrimeVideo, and Hulu come with subscription plans.

A user can use the OTT platform by paying a certain amount of subscription fee. These platforms integrate various banking APIs to allow users to make payments from various cards and enjoy the platform's services.

API Market

The increased demand for APIs encouraged banks like BBVA to create a fintech API marketplace. This platform was created for developers to find various banking and financial APIs in one place and avoid the hassles of creating APIs from scratch.

Another leading company in this field is TrueLayer, which provides the best APIs for fintech developments.

Price Comparison Websites

There are price comparison websites like GoCompare that compare prices of various products like insurance, loans, mortgages, rent, broadband, travel, and mobiles through some of the best fintech APIs.

Here the API performs the analysis of the products listed on the website and provides the best prices to the customers. Various other examples of these kinds of websites are BizRate, PriceGrabber, and Pronto.

Conclusion

The future of financial technology is API-first. The global shift is clear: banking APIs have gone from an emerging concept to an essential infrastructure. With nearly every fintech platform now demanding API integration, the adoption curve is only getting steeper.

As the demand for fintech apps grows, so does the competition. You can't afford to look and feel like everyone else. To win, your platform needs to offer smarter features, faster experiences, and more connected ecosystems. That's exactly what APIs enable.

Banking APIs aren't just about efficiency. They're the engines behind innovation, customer expansion, and new revenue models. The fintechs and banks that leverage them well won't just keep up. They'll lead.

FAQ's

An API (Application Programming Interface) in banking is a secure software interface that allows external applications or systems to access banking data or services. For example, it can let a fintech app check account balances, initiate payments, or verify identities in real time, with the customer’s consent.

Banking APIs help fintechs integrate with licensed financial institutions without building infrastructure from scratch. They enable faster go-to-market, real-time access to data, and regulatory compliance. Popular use cases include KYC, payments, digital lending, account aggregation, and embedded finance.

The main types of banking APIs are

Private APIs: Used within the bank to connect internal systems.

Partner APIs: Shared with trusted external partners for co-branded services.

Open APIs: Publicly accessible APIs under regulatory frameworks like PSD2 or Open Banking, which allow third-party developers to build new financial products.

Yes, when implemented correctly. Most financial APIs use industry-standard security protocols like OAuth 2.0, mutual TLS encryption, tokenization, and rate limiting. APIs often offer better security than legacy integration methods like screen scraping or FTP.

API banking is the broader concept of using APIs to access banking functionality. Open Banking is a regulatory-driven initiative (e.g. in the UK, EU, and Australia) that mandates banks to open APIs for data sharing, with user consent. All open banking is API banking. But not all API banking is open banking.

Fintech APIs are enabling faster product innovation, personalized services, and embedded finance. They help banks and fintechs collaborate better, reach new customer segments, and launch services like real-time payments, credit scoring, robo-advisory, and more, all with reduced operational costs.

DigiPay.Guru provides robust, modular, API-based solutions for banks, fintechs, and financial institutions. From e-wallets to international remittance APIs and eKYC, our platforms help you build, scale, and comply faster than legacy approaches. Get in touch to learn more.