Artificial intelligence in fintech is no longer a forward-looking experiment. With the rapid integration of generative AI (GenAI) and the rise of Agentic AI systems, by 2026, it will become core infrastructure for digital financial services.

If you operate a digital payment service like a digital wallet, payment platform, card program, or remittance service, you already see the shift. Fraud patterns evolve daily.

Plus, compliance expectations move from periodic checks to continuous oversight. On top of that, customers expect instant, personalized responses across every channel.

This is exactly why AI in fintech 2026 is not about innovation alone. It is about survival, scale, and trust.

In this blog, you will understand

-

What is artificial intelligence in FinTech?

-

AI technologies used in FinTech

-

Why artificial intelligence matters in FinTech

-

Key applications of AI in FinTech, and

-

How can you adopt it responsibly inside modern digital payment platforms

Let’s begin by understanding what AI means to you in FinTech.

What is Artificial Intelligence in FinTech?

Artificial intelligence in fintech refers to AI systems that analyze financial data, learn from customer behavior, and make real-time decisions across financial services.

Unlike traditional automation, AI-driven fintech platforms do not rely on static rules.

-

They continuously improve as data grows.

-

Fraud models adjust dynamically.

-

Credit decisions evolve with usage behavior.

-

And customer support becomes context-aware instead of scripted.

In 2026, AI in fintech is not a separate layer. It is embedded intelligence within wallets, payment flows, onboarding journeys, and compliance systems.

If you serve end users through digital payments, AI directly influences speed, security, and experience.

Core AI Technologies Powering FinTech Platforms

Before looking at real-world use cases, it helps to understand the core technologies behind artificial intelligence in fintech.

These technologies do not work in isolation. They complement each other inside modern payment platforms, digital wallets, and compliance systems to support scale, security, and smarter decision-making.

AI Technologies Used in FinTech

| AI Technology | Description | FinTech Use Cases |

|---|---|---|

| Machine Learning | Learns from data patterns | Fraud detection, credit scoring |

| Natural Language Processing (NLP) | Understands human language | Chatbots, KYC document parsing |

| Computer Vision | Image and video analysis | ID verification, face match |

| Predictive Analytics | Forecasts outcomes | Risk scoring, churn prediction |

| RPA + AI | Intelligent task automation | Compliance reporting, operations workflows |

Now, let’s get a quick glimpse into each of these technologies:

Machine Learning

Machine learning analyzes large volumes of financial data to identify patterns that traditional systems miss. In machine learning in fintec, it continuously improves fraud detection and credit scoring as transaction behavior changes.

Natural Language Processing (NLP)

NLP enables AI systems to understand and respond to human language accurately. It powers chatbots, automates customer support, and helps extract data from KYC and compliance documents.

Computer Vision

Computer vision allows AI to verify identities by analyzing images and video inputs. It strengthens digital onboarding through face matching, liveness detection, and document verification.

Predictive Analytics

Predictive analytics uses historical and real-time data to forecast future outcomes. Financial institutions use it to assess risk, predict customer churn, and optimize decision-making.

RPA + AI

RPA combined with AI automates repetitive operational tasks while adding decision intelligence. It simplifies compliance reporting, reduces manual effort, and improves operational efficiency.

Why Artificial Intelligence Matters in FinTech

Traditional fintech systems were built for predictable environments. That assumption no longer holds.

You now operate in a world of:

-

High-volume digital transactions

-

Cross-border payment corridors

-

Sophisticated fraud networks

-

Real-time regulatory scrutiny

Rule-based systems struggle in this environment. They react late and overcorrect. AI systems, by contrast, adapt continuously.

For financial institutions, AI means managing risk proactively instead of responding after losses occur. It enables speed without giving up control.

Traditional FinTech vs AI-Driven FinTech

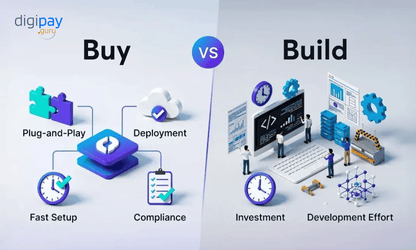

Most fintech platforms were originally built to automate known processes. They rely on predefined rules, fixed thresholds, and historical data.

This approach worked when transaction volumes were manageable and risk patterns were predictable. That is no longer the case.

Today, digital payments move in real time across channels, geographies, and devices.

-

Fraud patterns shift quickly.

-

Customer behavior changes without warning.

-

Regulatory expectations demand continuous monitoring rather than periodic checks.

-

And traditional systems struggle because they react after an issue appears.

AI-driven fintech platforms operate differently. They learn from live financial data and adapt as conditions change. Instead of waiting for rules to fail, AI identifies early signals and adjusts decisions in real time.

This shift is not about replacing existing systems. It is about adding intelligence where speed and accuracy matter most.

Check out how this difference plays out across key operational areas:

Traditional Systems vs AI-Powered Systems

| Area | Traditional Systems | AI-Powered Systems |

|---|---|---|

| Fraud detection | Rule-based | Behavioral and adaptive |

| Credit decisions | Static scoring | Real-time dynamic scoring |

| Customer support | Manual or IVR | 24/7 AI chatbots |

| Compliance | Periodic audits | Continuous monitoring |

For banks and fintechs like yours, this transition enables faster decisions, stronger risk control, and more consistent customer experiences at scale.

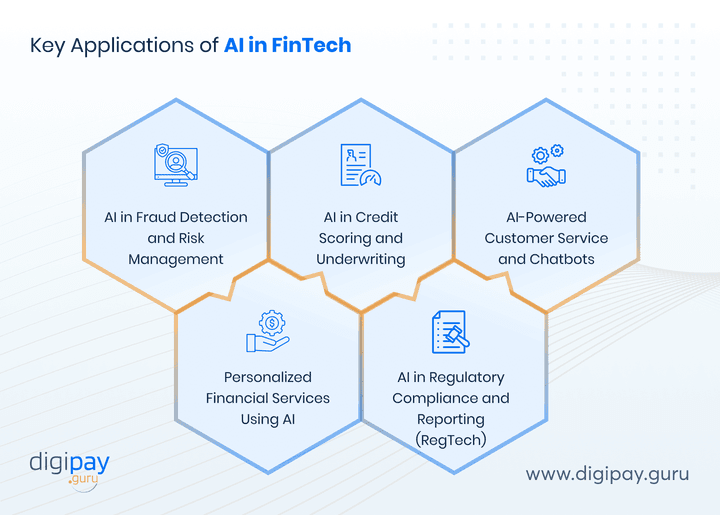

Key Applications of AI in FinTech

There is an application of every AI innovation in FinTech. This is where artificial intelligence use cases in banking move from theory to execution.

Each application below reflects how AI directly supports digital wallets, payment platforms, and financial services at scale.

Let’s explore:

AI in Fraud Detection and Risk Management

Fraud remains one of the most expensive challenges in fintech. And static rules fail against evolving attack patterns.

Whereas, AI systems analyze transaction velocity, device behavior, geolocation, and historical patterns in real time.

Here’s how each AI capability in fraud management impacts your business:

| AI Capability | Example Use Case | Business Impact |

|---|---|---|

| Anomaly detection | Card and wallet fraud | Reduced false positives |

| Behavioral analysis | Account takeover | Lower fraud losses |

-

For digital payment systems, this reduces unnecessary transaction declines.

-

For customers, it means fewer disruptions, and

-

For you, it means lower fraud losses without hurting user experience.

AI in Credit Scoring and Underwriting

Traditional credit scoring relies heavily on historical credit data. That approach excludes large segments of users, especially in emerging markets.

But fintech and machine learning enable alternative credit scoring by evaluating:

-

Transaction frequency

-

Wallet balances

-

Repayment behavior

-

Spending consistency

This allows businesses like yours to extend credit responsibly while maintaining strong risk controls. Decisions happen faster, with better accuracy.

AI-Powered Customer Service and Chatbots

In a traditional setting, the customer service costs rise quickly as transaction volumes grow. But, AI-powered customer support changes that equation.

AI chatbots handle:

-

Transaction queries

-

Dispute tracking

-

Payment status updates

-

Multilingual communication

More importantly, AI improves first-response time and consistency. And your customers get answers instantly. Plus, support teams focus on complex issues instead of repetitive tasks.

Personalized Financial Services Using AI

Generic financial experiences no longer retain users as they can’t keep the customers engaged.

And AI enables personalization based on real customer behavior, not assumptions.

With AI, you can deliver:

-

Smart spending insights

-

Context-aware notifications

-

Personalized offers inside wallets

-

Relevant loyalty rewards

This improves engagement without aggressive marketing, and personalization becomes helpful instead of intrusive.

AI in Regulatory Compliance and Reporting (RegTech)

Compliance pressure continues to increase across jurisdictions. And manual processes struggle to keep up with this regulatory pressure.

AI-driven compliance systems enable:

-

Continuous transaction monitoring

-

Automated suspicious activity detection

-

Real-time AML screening

-

Faster regulatory reporting

So, instead of preparing for audits, you stay audit-ready at all times. That reduces regulatory risk and operational stress.

Business Benefits of Artificial Intelligence in FinTech

Artificial intelligence in fintech delivers value only when it improves daily operations and decision-making.

For financial businesses like yours, the benefits are not theoretical. They show up in faster processes, lower risk exposure, and more consistent customer experiences across digital channels.

The key benefits of AI in FinTech market include:

| Benefit | Business Outcome |

|---|---|

| Faster decisions | Improved customer experience |

| Fraud reduction | Lower operational losses |

| Automation | Scalable growth |

| Compliance accuracy | Reduced regulatory exposure |

| Personalization | Higher retention |

Let’s look at these benefits quickly:

Faster Decisions

AI processes financial data in real time, which enables instant approvals, alerts, and transaction validations. This reduces customer wait times and supports smoother digital payment and wallet experiences.

Fraud Reduction

AI systems detect abnormal behavior early by analyzing patterns across transactions and devices. This lowers fraud losses while minimizing false declines that frustrate genuine users.

Automation

AI-driven automation removes repetitive manual tasks from operations and support teams. As volumes grow, platforms scale without a proportional increase in cost or staffing.

Compliance Accuracy

AI continuously monitors transactions against regulatory requirements. This improves audit readiness and reduces the risk of missed or delayed compliance actions.

Personalization

AI analyzes customer behavior to tailor offers, insights, and interactions. Personalized experiences increase engagement and long-term customer retention.

Challenges of Artificial Intelligence in FinTech

While artificial intelligence delivers measurable value, adopting it in financial services comes with real challenges that need careful planning.

Ignoring these risks can weaken trust, slow adoption, and create regulatory exposure. They are:

-

Data quality and bias: AI systems depend on accurate and representative financial data. And poor data quality or biased inputs can lead to unfair credit decisions and unreliable risk assessments.

-

Explainability and transparency: Regulators and auditors expect clear reasoning behind automated decisions. Black-box AI models can create compliance challenges if outcomes cannot be explained.

-

Regulatory alignment: AI must operate within evolving local and global regulations. Maintaining consistency across multiple jurisdictions adds complexity.

-

Integration with legacy systems: Many financial institutions run on legacy infrastructure. Integrating AI without disrupting existing workflows requires careful architecture planning.

Addressing these challenges early ensures AI adoption remains secure, compliant, and scalable.

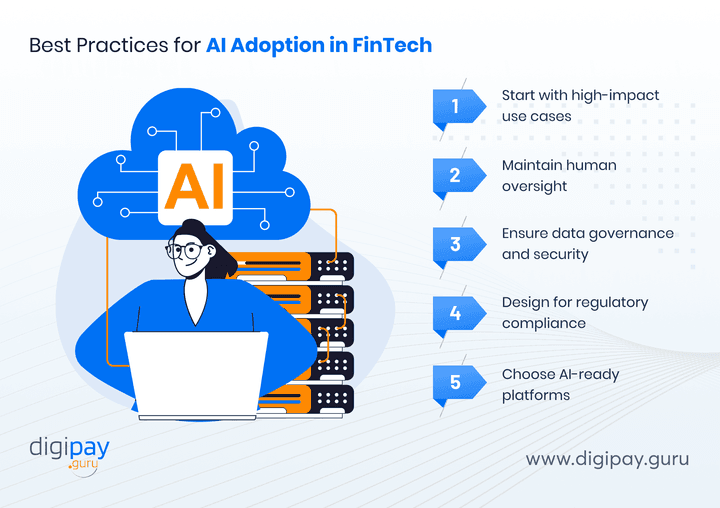

Best Practices for AI Adoption in FinTech

Adopting artificial intelligence in fintech works best when it follows a structured, risk-aware approach. Financial businesses that plan early avoid costly rework and compliance issues later.

The best practices for AI adoption in fintech are:

-

Start with high-impact use cases: Focus on areas like fraud detection, customer support, and compliance monitoring where AI delivers quick, measurable value.

-

Maintain human oversight: Keep humans in the loop for critical decisions such as credit approvals and fraud escalation to ensure accountability.

-

Ensure data governance and security: Establish strong controls around data quality, access, and privacy before training AI models on financial data.

-

Design for regulatory compliance: Align AI workflows with local and global regulations from the beginning, not after deployment.

-

Choose AI-ready platforms: Adopt payment and wallet platforms built to support AI integration without disrupting existing operations.

Following these practices helps you scale AI safely while maintaining trust and regulatory confidence.

Future of Artificial Intelligence in FinTech

As artificial intelligence becomes more mature, its role in fintech shifts from experimentation to infrastructure.

The focus moves away from standalone AI tools toward intelligence that is embedded directly into payment flows, digital wallets, and compliance systems.

By 2026, financial businesses like yours will rely less on visible dashboards and more on AI working quietly in the background, thereby supporting faster decisions, reducing operational risk, and improving user experiences at scale.

Below are the key trends highlighting how artificial intelligence in fintech is shaping the next phase of digital financial services:

| Trend | Impact |

|---|---|

| Generative AI | Smarter financial operations |

| Real-time AI | Instant risk and payment decisions |

| Embedded AI | Invisible finance experiences |

All in all, AI shifts from dashboards to background intelligence, while guiding every transaction.

How DigiPay.Guru Helps You Build AI-Driven Digital Payments

DigiPay.Guru helps you launch and scale AI-ready digital payment solutions without rebuilding your core systems. Our modular platform is designed for banks, fintechs, and financial institutions that need speed, security, and regulatory confidence.

You can offer intelligent digital payment services across multiple AI use cases in financial services, while keeping full control over compliance and customer experience.

With DigiPay.Guru, you can deploy:

-

Digital wallet solutions with AI-supported fraud monitoring and personalized user experiences

-

Mobile money platforms built for high-volume, real-time transactions

-

International remittance solutions with smart routing, risk monitoring, and transparency

-

Prepaid card issuing solutions for physical and virtual cards

-

Merchant acquiring and payment solutions with intelligent transaction insights

-

eKYC, AML, and fraud prevention tools aligned with regulatory requirements

Our platform lets you embed AI where it matters, across payments, onboarding, risk, and compliance, so you can scale securely and confidently.

Conclusion

Artificial intelligence in fintech is steadily becoming part of how modern financial services operate.

According to industry research, over 70% of financial institutions are expected to use AI for fraud detection and compliance by 2026, which reflects a clear shift toward data-driven decision-making. For banks and fintechs like you, this is less about adopting new technology and more about strengthening everyday operations.

When applied thoughtfully, AI helps improve risk management, streamline compliance, and deliver more consistent digital payment experiences.

It supports faster decisions without compromising control and enables personalization without increasing operational complexity. At the same time, successful adoption depends on governance, transparency, and platforms designed to scale responsibly.

This is where choosing the right digital payment partner matters. DigiPay.Guru’s advanced digital payment solutions help banks, fintechs, and financial institutions deliver secure, compliant, and future-ready services across wallets, payments, cards, and remittances.

With the right foundation in place, AI becomes a practical advantage and not a leap of faith.

FAQs

Artificial Intelligence in FinTech refers to the use of AI systems to analyze financial data and support decision-making across payments, compliance, fraud prevention, credit scoring, and customer service.

Instead of relying only on fixed rules, AI learns from transaction patterns and customer behavior to improve accuracy and speed. For financial businesses like yours, AI acts as an intelligence layer that strengthens existing digital payment and banking systems.

AI is used in FinTech apps to detect fraudulent transactions, automate customer support through chatbots, improve digital onboarding with eKYC, and personalize user experiences. It also supports real-time risk monitoring and transaction validation, helping payment and wallet platforms operate securely at scale.

AI helps financial institutions make faster decisions, reduce fraud losses, and improve operational efficiency. It enables continuous compliance monitoring, lowers manual workload, and supports personalized financial services. These benefits allow fintech platforms to scale without compromising security or customer trust.

AI is safe for financial decision-making when implemented with proper governance, transparency, and human oversight. Most regulated institutions use AI to support decisions rather than fully automate them. Clear audit trails, explainable models, and compliance controls ensure responsible use.

AI is more likely to change roles than replace them. It reduces repetitive manual tasks and allows teams to focus on higher-value activities such as risk review, customer engagement, and strategy. Human judgment remains essential in regulated financial services.

Key risks include data bias, lack of explainability, regulatory misalignment, and integration challenges with legacy systems. These risks can be managed through strong data governance, transparent AI models, and platforms designed for compliant AI adoption.