In African fintech, “buy vs build” is rarely about pride or engineering culture. It is about who carries regulatory exposure, settlement risk, and operational failure when volumes grow.

If your wallet, gateway, or payouts layer breaks, the impact is not only technical. It shows up as reversals, delayed settlements, support overload, and uncomfortable questions from partners.

This guide breaks down what actually worked across 12 teams, and what they stopped trying to own.

Who is this for?

- Banks and NBFCs: If you need a modern wallet, merchant acquiring, or agency layer without disturbing core systems.

- MTOs and remittance operators: If corridor expansion is blocked by compliance tooling, settlement complexity, or partner readiness.

- Fintech founders and PSP teams: If you are deciding whether to build a gateway, wallet ledger, or compliance stack in-house.

What “Build” “Buy” and “Hybrid” Really Mean in African FinTech (Not SaaS)

Building fintech software in Africa does not simply mean writing code. It often means direct exposure to regulatory scrutiny, bank dependencies, and local payment infrastructure limitations.

While making your “buy vs build” fintech software decision you need to understand the models and their digital payment solutions for fintech.

| Model | What It Means in African Fintech | What You’re Really Responsible For |

|---|---|---|

| Build | Creating and operating payment, wallet, or settlement systems | Central bank compliance, mobile money integrations, reconciliation, fraud liability |

| Buy | Integrating licensed, compliant payment infrastructure via APIs | Vendor governance, configuration, and oversight |

| Hybrid | Building product differentiation while leveraging compliant rails | Strategic control without full regulatory burden |

For example, integrating directly with mobile money operators often requires:

- Operator-specific certifications

- SLAs around uptime and reversals

- Custom reconciliation logic

- Regulatory reporting alignment

Buying or white-labeling regulated infrastructure does not mean losing ownership of your product. In many African markets, it is a viable way to move fast while staying compliant. A great white label payment platform provider can guide you with the buy vs build fintech software decision and can help you launch quickly.

The real question is not can we build this? It is - Should we be responsible for this layer of risk?

The 5-question framework was common in the 12 African teams, and used for Buy vs Build Fintech Software Decision

- Does this layer face direct regulator scrutiny?

- If it fails, do we lose trust instantly?

- Will it change country-to-country?

- Can we maintain it for 5 years, not 5 months?

- Can we explain it during an audit?

What Actually Worked Across 12 FinTech Teams?

After analyzing multiple fintech journeys—from early-stage wallets to regulated PSPs—one model consistently outperformed the rest:

Hybrid Build + Buy.

Not because it’s trendy—but because it aligns with how fintechs actually scale.

What Teams Chose to Build

The teams that succeeded built what made them unique:

- Customer experience and UX

- Vertical-specific logic (lending rules, merchant flows, pricing)

- Business intelligence and product differentiation

- Market-specific workflows

This is where control matters—and where differentiation lives.

What Teams Chose to Buy

They bought what creates hidden drag:

- Payment processing infrastructure

- Wallet ledger systems

- KYC, AML, and transaction monitoring

- Settlement, reconciliation, and reporting

- Cross-border and multi-rail payment access

These components are mission-critical but non-differentiating—and expensive to get wrong.

Why the Hybrid Model Wins?

Across teams, the hybrid approach delivered:

- Faster launches without compliance shortcuts

- Fewer re-engineering cycles during scale

- Better uptime and transaction success rates

- Lower long-term operational stress on engineering teams

One CTO summarized it simply: “We stopped rebuilding the plumbing and focused on building the house.”

Where Hybrid Fails (If Done Wrong)

Hybrid fails when your infrastructure partner cannot show:

- Clear audit trails and reconciliation visibility,

- Modular APIs without hidden dependencies,

- Transparent fintech compliance responsibilities (who owns what),

- Predictable exit options (data export, migration path),

- Operational controls for reversals, disputes, and incident response.

Rigid platforms with black-box logic break the hybrid promise.

What This Means for You -

The real decision isn’t buy vs build. It’s what should you own—and what should you never rebuild again.

Fintech teams that scale sustainably build differentiation and buy regulated infrastructure. They design for expansion and fintech compliance from day one.

In the next section, we’ll break down where teams miscalculate costs, timelines, and risk—and how those mistakes show up only after growth begins.

How Long It Takes to Build Fintech Software in Africa? (Timeline Reality)

African fintech teams often underestimate timelines—not because of engineering capability, but because of external dependencies.

Here’s a more realistic view:

| Phase | Typical Timeline | Africa-Specific Delays |

|---|---|---|

| Architecture & planning | 1–2 months | Regulatory interpretation varies by country |

| Core development | 4–6 months | Payment rail edge cases emerge late |

| Fintech Compliance Software (KYC,AML) & audits | 3–6 months | Central bank feedback cycles |

| Bank & MNO integrations | 3–9 months | Dependency on partner readiness |

| Testing & go-live | 2–3 months | Load, reversals, settlement validation |

In practice, many fintechs discover that regulatory alignment and partner approvals take longer than building the product itself.

This becomes especially complex when expanding across multiple African countries, each with:

- Different licensing regimes

- Local settlement rules

- Distinct mobile money ecosystems

Teams that rely solely on in-house builds often find themselves stuck—technically ready, but operationally blocked.

Cost Reality in African Fintech – Visible vs Hidden

Engineering cost is visible. Regulatory and operational costs are not.

In African markets, these hidden costs add up quickly:

| Cost Area | Why It’s Commonly Missed | Impact |

|---|---|---|

| Regulatory advisory | Required for each market | Delayed approvals |

| Compliance tooling | AML, transaction monitoring | Ongoing overhead |

| Bank & MNO onboarding | Non-standard processes | High dependency risk |

| Settlement & FX handling | Multi-currency realities | Reconciliation leakage |

| Operational staffing | Manual interventions | Higher long-term cost |

There is also a strategic cost that founders and bank innovation teams often underestimate: focus dilution.

For African fintechs, buying or hybridizing core fintech payment infrastructure is often less about saving money—and more about protecting institutional credibility and execution focus.

The Costs Teams See (and the Ones They Miss)

Most teams budget for:

- Engineers

- Cloud infrastructure

- Development time That’s only the visible part.

What shows up later—almost always:

- PCI or security audits before launch

- KYC/AML tooling once volumes grow

- Fraud monitoring after the first incident

- Reconciliation and reporting errors at scale

- Burnout from engineers maintaining non-core systems These costs don’t arrive as a big bill. They creep in quietly and compound.

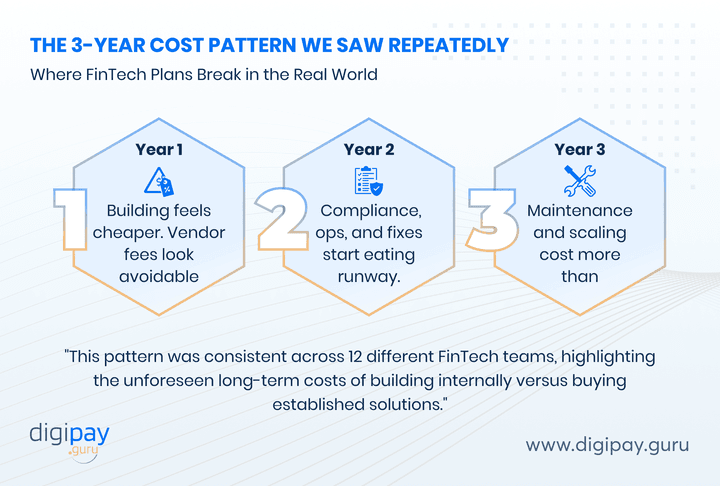

The 3-Year Cost Pattern We Saw Repeatedly

Here’s what actually happened across teams:

The “cheaper” path upfront often became the most expensive over time. So you need to think about the long-term costs before finalizing the cost.

Why the Hybrid Model Is Emerging as the Default in Africa

Across African markets, the Buy vs Build debate rarely ends in extremes.

Very few institutions fully build everything. Very few rely entirely on off-the-shelf tools long term.

Instead, the most resilient fintechs, banks, and payment institutions adopt a hybrid model—building what differentiates them, and buying what must be stable, compliant, and scalable from day one.

In Africa, the hybrid model typically looks like this:

-

Build: customer experience, workflows, pricing logic, business rules, integrations

-

Buy / White-label: payment processing, settlement, compliance tooling, orchestration, reporting

A hard-earned lesson across the continent

Innovation wins customers, but infrastructure keeps regulators, partners, and liquidity providers confident.

You need to choose wisely!

The hybrid model allows teams to move fast without carrying full regulatory and operational risk internally.

What a Strong Hybrid FinTech Architecture Looks Like in African Markets?

A well-designed hybrid architecture separates what changes often from what must never fail.

Core principles of an Africa-ready hybrid stack:

- API-first payment infrastructure that supports local rails

- Configurable compliance modules aligned with central bank expectations

- Country-level flexibility without duplicating core systems

- Clear audit trails and reconciliation visibility Below is how responsibilities are typically split:

| Layer | Responsibility | Ownership |

|---|---|---|

| Customer experience | Apps, portals, onboarding flows | Internal team |

| Business logic | Fees, limits, routing rules | Internal team |

| Payments & settlement | Processing, clearing, payouts | White-label platform |

| Compliance & monitoring | AML, KYC, reporting | Shared / Platform-led |

| Infrastructure scalability | Uptime, redundancy, routing | Platform-led |

This structure allows African institutions to:

- Expand into new markets without re-architecting

- Adjust to regulatory changes without system rewrites

- Maintain operational control without compliance overload

FinTech Software in Africa Is 50% Regulation (100 % Liability)

In African markets, regulation is not a one-time hurdle to cross before launch. It is a continuous operating condition.

Central banks across Africa are deeply involved in supervising payment systems, wallets, remittance flows, and digital lending. Whether you are a fintech startup, a bank-led digital unit, or an MTO expanding corridors, your software choices directly affect licensing, reporting, and supervision.

Key regulatory realities African institutions face include:

- Central bank licensing and approvals tied to system architecture

- Ongoing AML, KYC, and transaction monitoring requirements

- Local payment rail mandates, especially for mobile money and bank transfers

- Data protection and residency obligations that vary by country

Buying or white-labeling regulated infrastructure does not eliminate compliance responsibilities but it significantly reduces regulatory exposure at the infrastructure layer. For many African fintechs, this difference determines whether they launch on time or spend months navigating approvals.

💡Key takeaway

FinTech in Africa Often Fails Quietly—Until It Becomes a Public Issue

African fintech failures rarely begin with a major outage. They usually start quietly.

A small delay in settlements. A reconciliation mismatch that grows over weeks. An increase in reversals that customer support struggles to manage.

Because many African payment ecosystems rely on batch settlements, multi-party flows, and manual interventions, issues can remain hidden until volumes increase or regulators step in.

| Risk Area | What Happens in Practice | Why It’s Dangerous |

|---|---|---|

| Settlement delays | Funds don’t arrive on time | Liquidity and trust issues |

| Reconciliation gaps | Balances drift over time | Financial exposure |

| Reversals & disputes | Manual handling increases | Operational strain |

| Reporting errors | Inaccurate regulatory submissions | Regulatory scrutiny |

In close-knit markets, where banks, regulators, and partners communicate frequently, reputational damage spreads fast. A single operational failure can affect partnerships, approvals, and future growth opportunities.

💡Expert insight

Can Your Infrastructure Survive Success Across African Markets?

Growth in African fintech often comes faster—and less predictably—than teams expect.

A wallet gains traction through mobile money. An MTO opens a new corridor. A bank launches a digital channel that suddenly scales nationwide. Infrastructure that works at low volumes often struggles when:

- Transaction volumes spike

- New payment methods are added

- Additional countries come online Scaling in Africa is not just about traffic—it is about complexity.

Growth introduces:

- Multiple settlement timelines

- Different currency controls

- Local payment rail nuances

- New regulatory expectations

Teams that fully build their infrastructure often face a painful reality: every new market behaves differently. API-first, white-label, or hybrid models allow institutions to scale gradually—adding rails, countries, and capabilities without rebuilding core systems each time.

💡Key insight

What FinTech Software Really Needs in African Markets?

African fintech software must do more than process transactions. It must operate reliably across diverse financial ecosystems.

Here are the capabilities that matter most:

| Capability | Why It Matters in Africa |

|---|---|

| Local payment rail support | Mobile money, bank transfers, cards |

| Strong reconciliation & reporting | Multi-party settlement environments |

| Built-in compliance tooling | AML, KYC, transaction monitoring |

| Payment orchestration | Routing across providers for reliability |

| Observability & controls | Real-time visibility for ops teams |

Features alone are not enough. Institutions need operational confidence—the ability to explain transactions to regulators, partners, and customers at any time.

This is why many African fintechs and banks increasingly separate:

- Product innovation layers (UX, customer journeys, business logic) from

- Regulated infrastructure layers (payments, settlement, compliance)

Buy vs Build Fintech Software by Institution Type and Growth Stage in Africa

The right approach depends on who you are and where you are in your journey.

| Institution / Stage | Recommended Approach | Why |

|---|---|---|

| Early-stage fintech | Buy or Hybrid | Faster licensing, lower risk |

| Scaling fintech | Hybrid | Control without full compliance burden |

| Banks & NBFCs | Hybrid | Modernization without disrupting core systems |

| MTOs | Buy or Hybrid | Corridor expansion and compliance |

| Pan-African platforms | Hybrid | Market-by-market adaptability |

Across Africa, the dominant pattern is clear: very few institutions fully build everything—and even fewer succeed long-term doing so. Hybrid architectures allow institutions to:

- Innovate responsibly

- Scale across markets

- Maintain regulatory confidence

With these realities in mind, the conversation naturally shifts toward the hybrid fintech architecture model—and why it has become the preferred path for African fintechs, banks, and payment institutions looking to grow sustainably.

Where DigiPay Guru Fits in the Hybrid Model?

DigiPay Guru is built for institutions that understand a simple truth:

Fintech payments infrastructure should accelerate growth not become a long-term liability.

Rather than replacing your product or brand, DigiPay Guru operates as a white-label, API-driven payment infrastructure layer beneath your fintech, bank, or MTO.

What DigiPay Guru typically supports?

- Multi-rail payment processing (cards, mobile money, bank transfers)

- Unified APIs for collections, payouts, and reconciliation

- Built-in compliance readiness aligned with regulated environments

- Configurable workflows to match country-level requirements

- White-label deployment that preserves your brand and customer trust

For African institutions, this means:

- Faster regulatory alignment

- Reduced dependency on fragmented local integrations

- Lower operational and reconciliation risk

- A foundation designed to scale across borders responsibly

DigiPay Guru does not dictate your business model. It supports it quietly, reliably, and compliantly.

The Real Question Is Not About Buy vs Build Fintech Software Decision

The Real Question You Should Ask

It’s not:

“Can we build this?”

It’s:

“Do we want to own this for the next five years?”

Now the ball is in your court.

We know the Buy vs Build fintech software decision is not theoretical—it is operational. Ask the questions that matter:

- Does this component differentiate us in the market?

- Will regulators expect deeper scrutiny here?

- Can we afford failures in this layer?

- Will this slow expansion into new countries?

In most cases:

- Product experience deserves internal focus

- Buy vs build fintech software decision demands proven stability

The institutions winning across Africa are not the ones building the most code or secure or most compliant.

They are the ones making the clearest architectural choices early.

Platforms like DigiPay Guru support this approach by providing white-label, API-first payment infrastructure designed for African realities so institutions can focus on growth, not payment complexity.

The real question is no longer Buy vs Build. It’s whether your payments stack is ready for Africa’s scale and scrutiny.

FAQs

“Buy vs build” in fintech means choosing between developing financial software internally or using an existing fintech platform or white-label solution. Building gives control but increases regulatory and operational risk. Buying reduces time-to-market and compliance complexity, especially in African markets.

Building fintech software in-house is usually more expensive long-term. Costs include compliance, security audits, infrastructure scaling, and ongoing regulatory updates. In Africa, buying or using a hybrid model often results in a lower total cost of ownership.

Building a compliant fintech payment or wallet platform typically takes 9 to 18 months. This includes development, regulatory approvals, integrations, and testing. Buying or white-labeling can reduce this to weeks or a few months.

The main risks are regulatory delays, security vulnerabilities, scalability limitations, and operational failures. In Africa, additional risks come from fragmented payment rails, settlement delays, and evolving central bank requirements.

Organizations should avoid building payment processing engines, settlement systems, compliance tooling, and reconciliation layers. These systems are complex, highly regulated, and costly to maintain across multiple African markets.

It makes sense to build in-house when the software directly differentiates the product, such as unique customer experiences, pricing logic, or proprietary workflows. Infrastructure that must remain stable and compliant is better bought or white-labeled.

The hybrid model combines building product and experience layers with buying or white-labeling core fintech infrastructure. It is popular in Africa because it balances innovation, compliance readiness, and scalability without increasing risk.

Compliance significantly affects the build vs buy decision. Building requires managing PCI-DSS, AML, KYC, reporting, and audits internally. Buying or using a hybrid model reduces compliance effort by relying on platforms designed for regulated financial environments.

No. Modern API-first fintech platform and white-label fintech platforms allow custom flows, pricing rules, and user experiences. They handle infrastructure and compliance in the background without limiting product differentiation.

DigiPay Guru provides a white-label, API-first fintech payments platform that supports collections, payouts, compliance, and reconciliation across African markets. This enables organizations to scale without rebuilding core payment infrastructure.