About

DigiPay helped its client based in South Africa to come up with their own digital payment application. In recent years, the mobile payment industry in South Africa has boomed.

According to a study, it’s estimated that the mobile payment industry in South Africa is expected to record a CAGR of 12.9 % by the year 2025 with an evaluation of US$ 29,424.4 million. This was one of the biggest motivation for our client to enter this industry.

Our client had a vision of making payments extremely easy and simple for the people of South Africa. We fulfilled their vision by providing them with a top-notch mobile wallet solution. An application that a common man can easily download and register without hassles.

This application is also user-friendly and has an easy to understand KYC and the onboarding process. With this app, merchants can easily register themselves on the platform and begin accepting payments. This app allows merchants to manage payments and arrange change without any hassle.

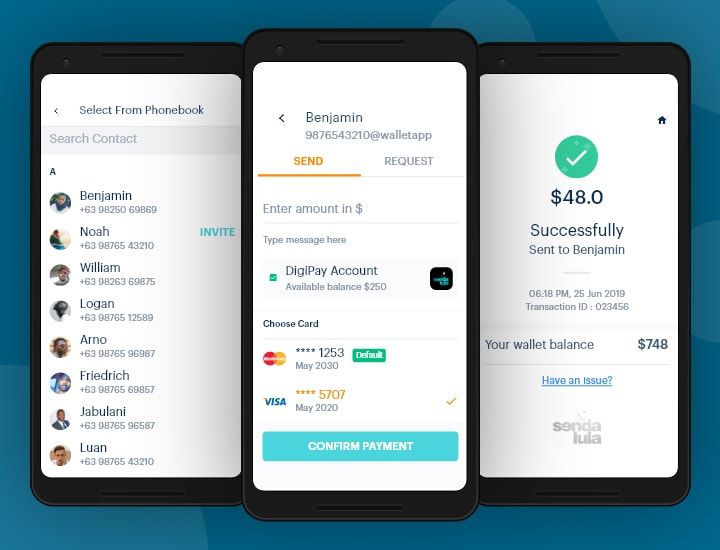

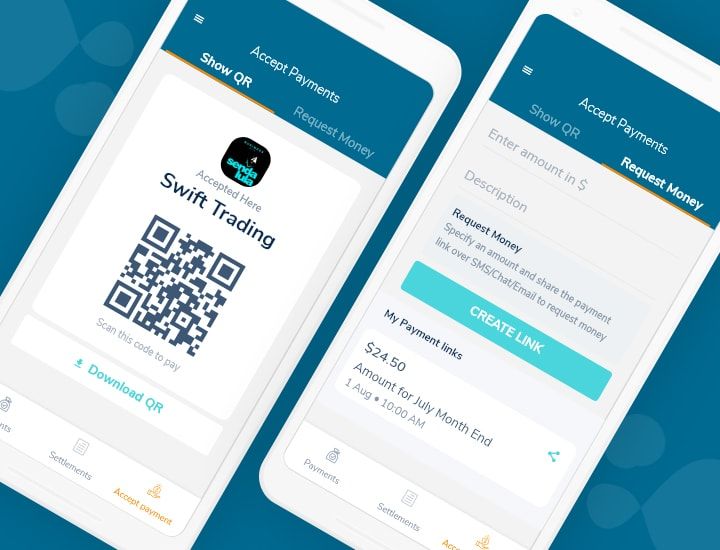

With this application, the users can transfer money to other registered users via a phone number or QR code. Users can also view all the details of their past transactions.

Challenges

App size

The client wanted to ensure that people can easily download the application without any hassles. That’s why they wanted the application’s size to be small.

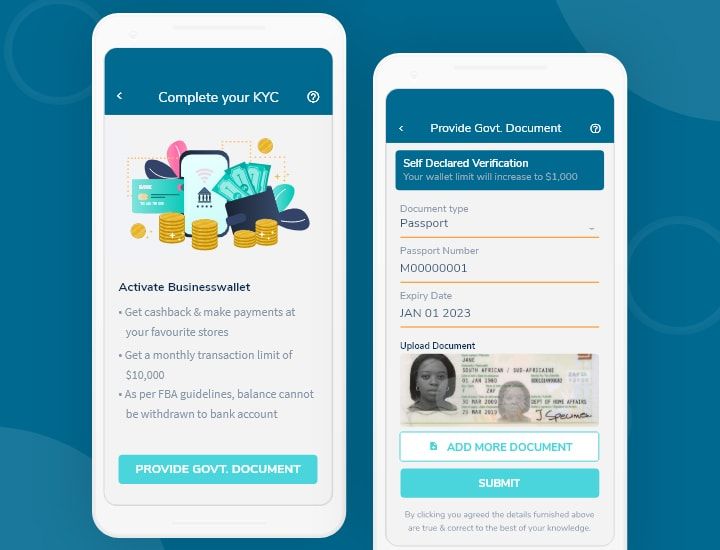

Onboarding and KYC

The client wanted the onboarding and KYC process to be as simple as possible for the users. Moreover, the client wanted this process can accommodate further additions so that it can comply with the government’s new regulations in the future.

Rest API security

Security was on one of the biggest challenges as it was a digital wallet solution. We had to ensure that all the functionalities of the solution are secure. We also had to ensure that it’s secure across the platforms. Apart from this securing REST API was a challenge, as most of the solutions provide REST API without encryption.

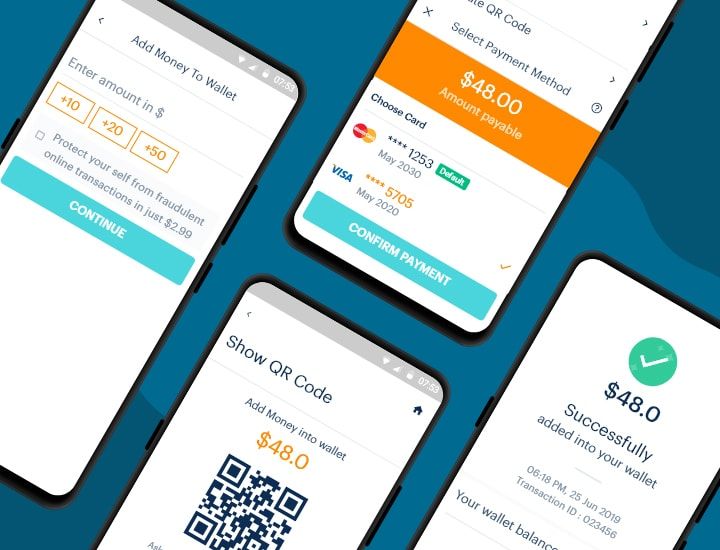

QR scanner

Another client requirement was that they wanted an optimized QR scanner which has a faster scanning ability as compared to the other QR scanners.

Solution

Reduced app’s download size

Earlier the expected size of the app was around 50 MBs. We reduced the application’s download size by up to 50% by using the app bundle feature.

Made the onboarding and KYC process easier

We fulfilled our client’s requirements of on-boarding and KYC process by implementing a simple step-by-step process for the end-user and the admin. Moreover, we ensured that the admin could easily make changes in the onboarding procedure directly from the backend.

REST API security

We achieved the REST API security by encrypting all payload data of each API calls. Moreover, we ensured the application’s security with the help of biometric verification and two-factor authentication with a PIN.

Optimized QR scanner

We enhanced the QR scanner’s ability by increasing its scanning speed. For this, we introduced modifications in the QR scanner’s library.

Features

Easy onboarding

The application has a simple self onboarding process in which the users can fill the required details and register themselves to start using the application.

KYC

The user has to submit various documents for the KYC process. The types of documents required for the merchants and the users are different. These documents are then verified by the verifier and approved by the approver. The KYC process concludes only when the approver approves the submitted documents.

Add money to the wallet

Adding money to the wallet is very simple. All users have to do is add money into their wallet by either using their cards or bank account.

P2P transfers

With the help of this application, users can send money to their friends and family via a phone number or QR codes.

Merchant payments

With this application, users can make merchant payments by simply scanning the QR code.

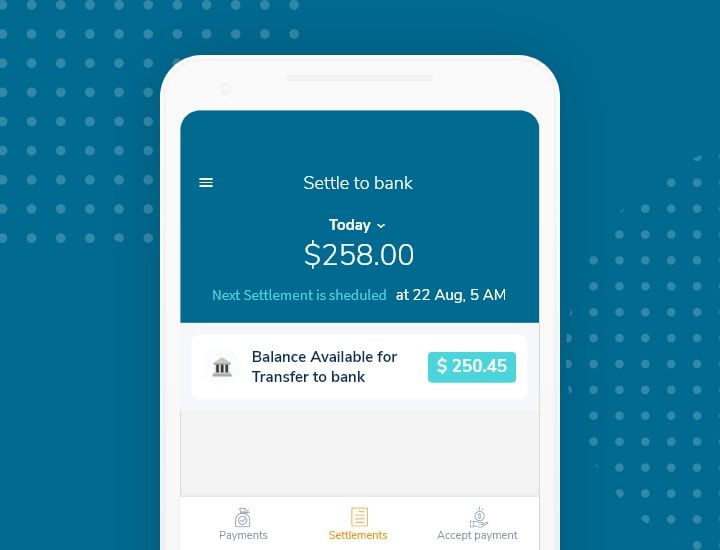

Merchant settlements

Merchant can make settlements either automatically or manually. In automatic mode, the merchant can define a schedule as to when they want to transfer money from the wallet to their bank account. They can define a merchant settlements schedule on a daily, weekly, or monthly basis. Similarly, in the manual mode, the merchant can make settlements at any instant by simply filling his bank account details.

Admin control panel

Admin can perform various actions from the control panel such as user management, merchant management, staff management; view transactions, reports & analytics, etc.

Threshold management

In threshold management, the admin can define the total amount of money that a user can send in a defined period. The admin can also define different threshold limits for merchants and users based on their KYC status or any other criteria.

Revenue management

Admin can manage revenue by defining commissions and charges for different users and merchants. Admin can also define various government charges on the platform like taxes or any other charge.

Aftermath

The application has received a huge reception in South Africa due to its user-friendly nature and top-notch performance