About

Coincidently, our client has the same name as ours. The only similarity that he lacks in the name is “.guru”. Our client “DigiPay” is a leading e-wallet service provider in Ivory Coast backed by Digital Afrique Telecom (DAT).

DAT has launched a subdomain “DigiPay” intending to provide a transaction processing platform for the people of Ivory Coast to easily send-receive money and boost cashless payments in the country.

DigiPay is a payment and money transfer service provider approved by the Central Bank of West African States (BCEAO). Moreover, along with allowing to send-receive, deposit-withdraw funds, our client connects its customers to various users communities and offers a comprehensive suite of smart, simple, and secure solutions for your financing and budget management needs at a lower cost.

The application is more than what other e-wallet applications are available in the market. It has unique features, an extra layer of security to protect its customers, an intuitive user interface to provide an unforgettable experience. Adding on, it is offered by Africa Digital Finance (ADF), an electronic money institution approved by the BCEAO.

Challenges

To make the app compatible with Multi-languages

Our client was aware of not everyone on the earth is well-versed with the English language. He knows his target audience and wanted to give them a personalized experience incorporating native language in the app.

Our client was clear with his vision. He wanted the app with the ability to introduce new languages in the application as and when required. He wanted functionality in the backend, where he simply wanted the automation of the backend.

He wanted a solution where he can operate for adding and updating any new language in the future without the help of a developer. In a nutshell, he wanted a complex process to be simplified.

Top-Up and Bill Payment Middleware Integration

The client wanted to allow his customers to enjoy more services rather than just sending and receiving money. He wanted his users to use his app for any kind of financial transaction. One of the financial transaction that every working human do is Top-up and Bill Payment.

Our client wanted his customers to pay their bills using his application. Moreover, he had a long roadmap with many more 3rd party tools to be integrated in the future. He wanted a one-time solution to add new vendors of his choice as and when required. In short, he wanted access to the driving seat of the admin panel and add new vendors by himself without the help of an expert.

Payment Gateway Middleware Integration

Another challenge client had was to eliminate the dependency of the developer whenever it is about adding the payment gateway into his application. The client wanted to offer his users multiple payment options within his app.

He wanted us to integrate payment gateway middleware to make the admin panel able enough that can allow him to remove & add new payment gateways whenever needed at his fingertips.

Solutions

Made the App multilingual

Instead of using the old school method of using Google Translate. We leveraged our expertise and made an extension in the admin panel. As Google Translate does not provide accurate translations, we built a smart extension for the app.

The extension has the entire content file. The client can download and save it offline. He can write manually the translation, make changes or addition to the content offline. And then upload the same updated file.

This simple 3 step process of download, amendments, and upload has saved client time consumption, helped him in killing the developer’s dependency, and saved costs that he would have to pay in the future without incorporating this innovative extension.

Made the admin and the app Able

Leveraging our decades of experience in development, migration, and integration. We successfully integrated the top-up and bill payment middleware making sure the structure of the app remains untouched.

Simplified the complexity of adding new vendors for the client by giving more power to the admin. Made the app and the admin both able. Now, they can dynamically integrate any 3rd party Top-up & Bill Payment APIs without the need to come to us.

This solution not only empowered the client but also has added wings that will help him reach new heights of success offering new solutions to the users.

Integrated Payment Gateway Middleware

We fulfilled our client’s requirement of integrating Payment Gateway Middleware. Our team of expert developers used a standard integration method to successfully integrate the Payment Gateway Middleware.

After integrating, our team performed a testing session to ensure that the integration is successful. Our aim was not just to integrate but to provide a seamless experience to our client’s end users.

This integration made our client receive a lifetime solution. Now, he can add any new vendor of his choice without the need for a developer in the future. The solution is not just making the client receive integration but eliminating the need for developers in the future for any Payment gateway Integration. This saved his time, energy, and money.

Features

Self Onboarding

The application allows users to onboard themselves. Users just have to fill in the required information, confirm the filled details, allow the app to save detail, and register themselves to start using the application.

KYC

Know your customer. Here, the user has to upload all the required documents to get verified and use the service without any hassle. The documents requirement is different for merchant and customer that can be managed and configured by the Admin.

P2P

This feature enables a user to seamlessly receive and send money to their contact list, friends, and family via phone number & QR code.

Load Money

With this feature in the app, user can link their bank account or debit card and load money into the digital wallet with a single click.

Merchant Payments

This feature gives an added option to merchants and users. Using this feature, users can pay money to merchants simply by scanning the QR code.

Utility Bill Payments

This feature in the app allows users to pay their utility bills like mobile recharge, electricity, gas, cable, water, etc. at their fingertips without having to visit any other page.

Agent to Agent transfer

This feature enables the parent agent to transfer money to the child agent. This easy transfer loads the money to the child agent’s account and allows them to operate the app, enjoy the benefits and make a profit serving their end-users.

Merchant Settlements & Refunds

This feature enables merchants to manually choose to settle funds into their bank accounts as and when required. When they choose the manual option, they can transfer the funds instantly by simply filling in their choice of bank account details.

Merchants can refund the money back to the customer in case of any incorrect transaction. If the funds are deducted from the account but the payment has not been received by the receiver, in this case also, the refund will be issued to the account owner.

Referral and rewards

This feature enables the client to offer various referrals & rewards to the users like cashbacks, discounts, redeemable points, referral bonuses, and many more.

Transfer to Non-Registered Users

Incorporating this unique feature, the client allows its users to send money to non-registered users also. To receive money, the non-registered user will have to download the app, register, verify doing KYC, and become a registered user.

If the non-registered user does not download the app, the sent money request will get automatically canceled at a specific period and money will be credited back to the sender’s account.

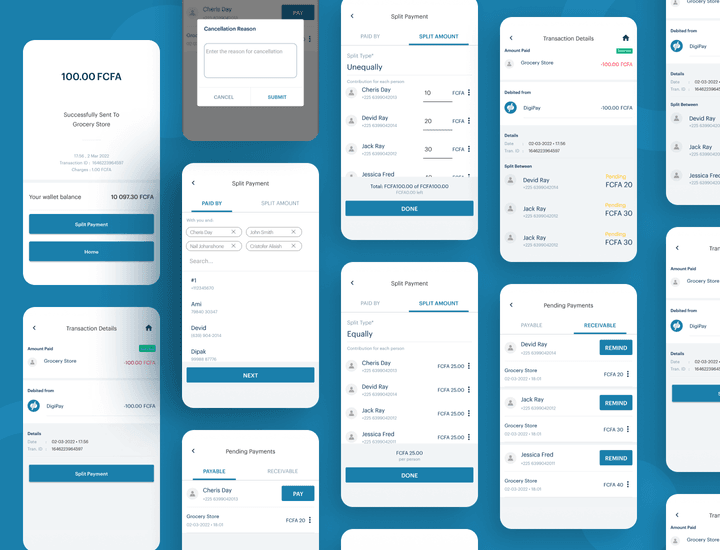

Split Payment

Split Payment allows individuals to easily calculate and split their bills for restaurants or other shared purchases. Thereby, it easily keeps a track of all the pending requests.

Conclusion

The overall performance of the app is now better. The owner has experienced a huge welcome and a large number of app downloads. The app now stands on the list of leading companies providing digital payment solutions in Africa. African people prefer doing digital payments over cash transactions these days. They have replaced cash with their mobile phones and e-wallets.